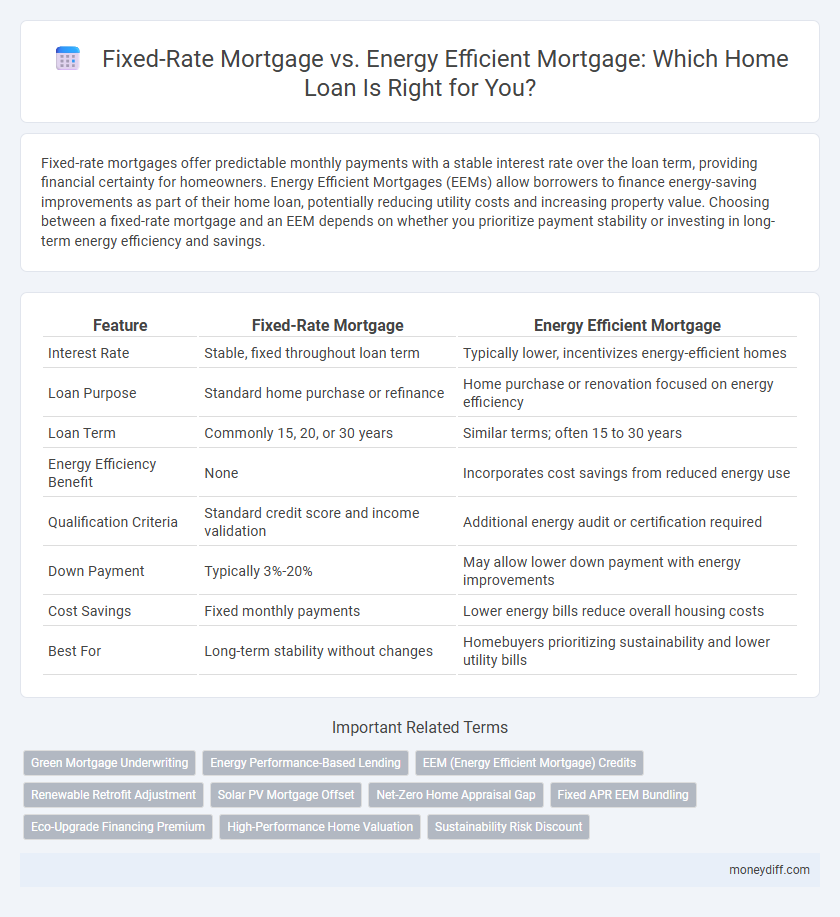

Fixed-rate mortgages offer predictable monthly payments with a stable interest rate over the loan term, providing financial certainty for homeowners. Energy Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements as part of their home loan, potentially reducing utility costs and increasing property value. Choosing between a fixed-rate mortgage and an EEM depends on whether you prioritize payment stability or investing in long-term energy efficiency and savings.

Table of Comparison

| Feature | Fixed-Rate Mortgage | Energy Efficient Mortgage |

|---|---|---|

| Interest Rate | Stable, fixed throughout loan term | Typically lower, incentivizes energy-efficient homes |

| Loan Purpose | Standard home purchase or refinance | Home purchase or renovation focused on energy efficiency |

| Loan Term | Commonly 15, 20, or 30 years | Similar terms; often 15 to 30 years |

| Energy Efficiency Benefit | None | Incorporates cost savings from reduced energy use |

| Qualification Criteria | Standard credit score and income validation | Additional energy audit or certification required |

| Down Payment | Typically 3%-20% | May allow lower down payment with energy improvements |

| Cost Savings | Fixed monthly payments | Lower energy bills reduce overall housing costs |

| Best For | Long-term stability without changes | Homebuyers prioritizing sustainability and lower utility bills |

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage offers a consistent interest rate and monthly payment throughout the loan term, providing financial stability and ease of budgeting for homeowners. Unlike energy efficient mortgages, which incorporate additional funds for energy-saving home improvements, fixed-rate mortgages focus solely on the property's purchase price and standard loan repayment. Understanding the predictability and straightforward nature of fixed-rate mortgages helps borrowers evaluate their long-term affordability without the variable factors tied to energy efficiency investments.

Overview of Energy Efficient Mortgages

Energy Efficient Mortgages (EEMs) enable homebuyers to finance energy-saving improvements as part of their home loan, reducing utility costs and increasing property value. Unlike Fixed-Rate Mortgages, which maintain a consistent interest rate over the loan term, EEMs specifically support the purchase or refinancing of homes with energy-efficient features or the cost of adding such upgrades. EEM programs, backed by agencies like FHA, VA, and Fannie Mae, often offer favorable terms that incentivize sustainable homeownership.

Key Differences Between Fixed-Rate and Energy Efficient Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payment over the loan term, providing stability and predictability for homeowners. Energy Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements by integrating the cost into the mortgage, potentially lowering utility expenses and increasing property value. The key difference lies in EEMs' focus on promoting energy efficiency, while fixed-rate mortgages prioritize fixed payment stability without additional funding for green upgrades.

Interest Rates: Fixed-Rate vs. Energy Efficient Options

Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing predictable monthly payments and stability for borrowers. Energy Efficient Mortgages (EEMs) often have slightly lower interest rates or favorable terms compared to traditional fixed-rate loans, as they incentivize energy-saving home improvements that reduce overall utility costs. Comparing these options, borrowers may benefit from EEMs' potential financial incentives while balancing the reliable predictability of fixed-rate mortgage payments.

Eligibility Requirements for Each Mortgage Type

Fixed-rate mortgages require strong credit scores, stable income documentation, and a minimum down payment typically ranging from 3% to 20%. Energy Efficient Mortgages (EEMs) demand similar financial qualifications but also require an energy audit or home assessment to verify energy-saving improvements or projects. Borrowers seeking EEMs must provide evidence of planned or completed energy-efficient upgrades to qualify for the additional loan amount.

Long-Term Savings and Costs Comparison

Fixed-rate mortgages offer predictable monthly payments with stable interest rates, providing financial security over the loan term. Energy Efficient Mortgages (EEMs) typically include lower interest rates or additional funds for energy-saving improvements, leading to reduced utility bills and long-term operating costs. Homebuyers can achieve significant savings by combining EEM benefits with fixed-rate terms, balancing upfront costs and ongoing energy expenses for enhanced affordability.

Upfront Costs and Financial Considerations

Fixed-rate mortgages typically require a standard upfront down payment ranging from 3% to 20% of the home purchase price, offering predictable monthly payments over the loan term. Energy Efficient Mortgages (EEMs) may allow borrowers to finance energy-saving improvements within the loan amount, potentially reducing initial out-of-pocket expenses but possibly increasing overall debt. Evaluating these options involves comparing the upfront costs against long-term financial benefits, including energy savings and interest rates.

Impact on Monthly Payments

Fixed-rate mortgages provide predictable monthly payments with a stable interest rate over the loan term, ensuring budget consistency for homeowners. Energy Efficient Mortgages (EEMs) incorporate financing for energy-saving improvements, potentially raising the loan amount but lowering utility costs, which can offset higher payments. The impact on monthly payments depends on energy savings and loan structure, often resulting in manageable payments and long-term financial benefits.

Pros and Cons: Fixed-Rate vs. Energy Efficient Mortgages

Fixed-rate mortgages offer predictable monthly payments and protection against interest rate fluctuations, making budgeting easier for homeowners but often come with slightly higher initial interest rates. Energy efficient mortgages (EEMs) enable borrowers to finance energy-saving improvements within the loan, potentially reducing utility costs and increasing property value, though they may require additional qualification criteria and appraisal processes. Choosing between fixed-rate and energy efficient mortgages depends on priorities such as payment stability versus long-term savings on energy expenses.

Which Mortgage is Best for Your Financial Goals?

Fixed-rate mortgages provide predictable monthly payments with stable interest rates, ideal for buyers seeking long-term financial certainty. Energy Efficient Mortgages (EEMs) offer benefits by rolling the cost of home energy improvements into the loan, potentially lowering utility bills and increasing property value. Choosing the best mortgage depends on whether your priority is straightforward budgeting with a fixed rate or leveraging energy savings and eco-friendly upgrades to meet your financial goals.

Related Important Terms

Green Mortgage Underwriting

Fixed-rate mortgages offer consistent monthly payments with stable interest rates, while energy efficient mortgages (EEMs) incorporate the cost of home energy improvements into the loan amount, supporting environmentally friendly upgrades. Green mortgage underwriting evaluates energy savings and home efficiency to determine loan eligibility and potential interest rate benefits, promoting sustainable homeownership.

Energy Performance-Based Lending

Energy Efficient Mortgages (EEMs) integrate energy performance-based lending by allowing borrowers to finance energy-saving improvements within their home loan, reducing utility costs and increasing property value. Unlike fixed-rate mortgages with stable interest rates, EEMs incentivize energy efficiency, helping homeowners lower long-term expenses and promote sustainability through targeted upgrades.

EEM (Energy Efficient Mortgage) Credits

Energy Efficient Mortgages (EEM) offer homebuyers the ability to finance energy-saving improvements by incorporating the cost into the overall loan, often resulting in lower utility bills and increased property value. These loans provide credits and incentives that reduce monthly payments compared to traditional fixed-rate mortgages by leveraging anticipated energy savings.

Renewable Retrofit Adjustment

Fixed-rate mortgages provide stable interest rates over the loan term, while energy efficient mortgages incorporate a Renewable Retrofit Adjustment that increases borrowing capacity based on projected savings from energy-efficient home improvements. This adjustment encourages investment in renewable retrofits by factoring reduced utility costs into loan qualification, enabling homeowners to finance green upgrades without increasing monthly payments.

Solar PV Mortgage Offset

A Fixed-Rate Mortgage offers predictable monthly payments with a stable interest rate, while an Energy Efficient Mortgage (EEM) incorporates the cost of solar PV installations into the loan, enabling borrowers to finance eco-friendly upgrades without increasing upfront expenses. The Solar PV Mortgage Offset in an EEM reduces energy bills, effectively lowering overall housing costs and increasing long-term savings.

Net-Zero Home Appraisal Gap

Fixed-rate mortgages provide consistent monthly payments, while energy efficient mortgages (EEMs) incorporate improvements that reduce utility costs, potentially closing the net-zero home appraisal gap by increasing property value through enhanced energy performance. EEMs support investments in energy-efficient upgrades that appraisers may recognize, leading to higher home valuations compared to properties with traditional fixed-rate financing.

Fixed APR EEM Bundling

Fixed-rate mortgages offer predictable monthly payments with a stable APR, making budgeting easier over the loan term. Energy Efficient Mortgages (EEM) allow borrowers to finance energy-saving home improvements by bundling these costs with the fixed-rate loan, maximizing affordability and long-term savings through reduced utility bills.

Eco-Upgrade Financing Premium

Fixed-rate mortgages offer consistent monthly payments with stable interest rates, ideal for budgeting, while energy efficient mortgages (EEMs) provide specialized financing that includes an eco-upgrade financing premium, enabling borrowers to incorporate energy-saving improvements into their home loans and reduce long-term utility costs. The eco-upgrade financing premium in EEMs often increases loan limits or offers lower interest rates, making sustainable home enhancements more affordable and attractive to environmentally conscious homeowners.

High-Performance Home Valuation

Fixed-rate mortgages provide consistent interest rates and predictable payments over the loan term, while Energy Efficient Mortgages (EEMs) offer financing incentives by incorporating the value of energy-efficient improvements into the loan amount, enhancing high-performance home valuation. Lenders recognize that EEMs increase a home's market value and reduce utility costs, making these loans attractive for buyers investing in eco-friendly upgrades.

Sustainability Risk Discount

Fixed-rate mortgages offer consistent interest rates and payments over the loan term, while energy-efficient mortgages provide borrowers with financing tailored for sustainable home improvements that can reduce utility costs and environmental impact. The sustainability risk discount in energy-efficient mortgages incentivizes eco-friendly upgrades by lowering interest rates or offering better loan terms based on the home's energy performance and reduced carbon footprint.

Fixed-Rate Mortgage vs Energy Efficient Mortgage for home loans. Infographic

moneydiff.com

moneydiff.com