Owner-occupied loans offer lower interest rates and more favorable terms because the borrower lives in the property, making them ideal for primary residences. Buy-to-let mortgages are designed for rental properties and typically come with higher rates and stricter lending criteria due to increased investment risk. Investors should weigh the cost differences and intended property use when choosing between these mortgage options for property investment.

Table of Comparison

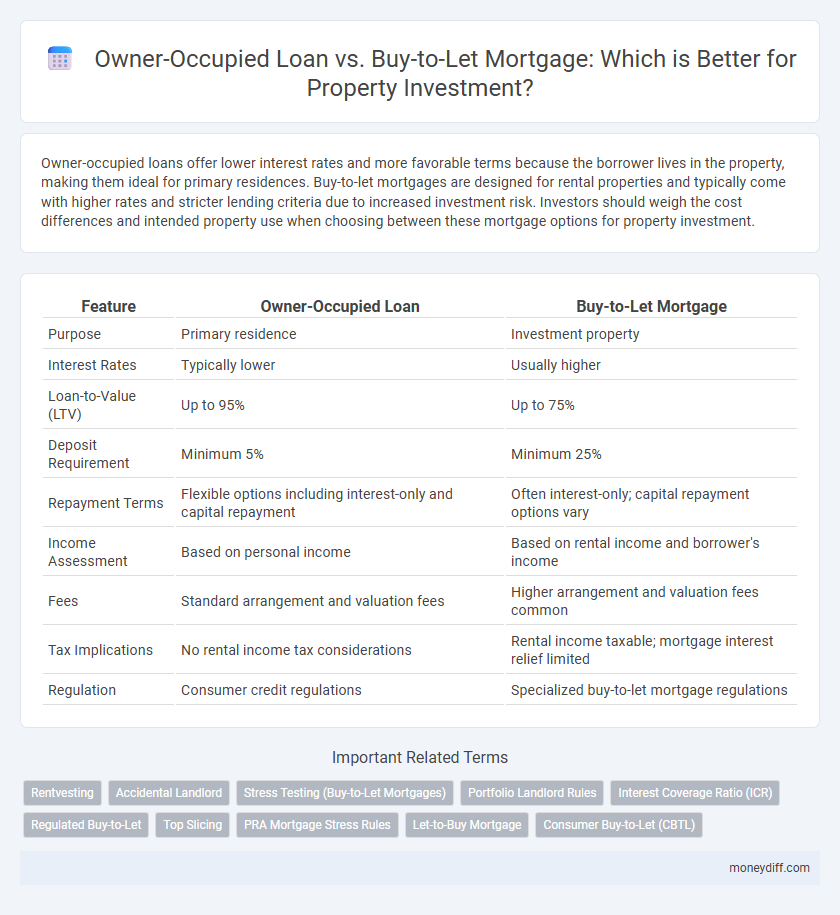

| Feature | Owner-Occupied Loan | Buy-to-Let Mortgage |

|---|---|---|

| Purpose | Primary residence | Investment property |

| Interest Rates | Typically lower | Usually higher |

| Loan-to-Value (LTV) | Up to 95% | Up to 75% |

| Deposit Requirement | Minimum 5% | Minimum 25% |

| Repayment Terms | Flexible options including interest-only and capital repayment | Often interest-only; capital repayment options vary |

| Income Assessment | Based on personal income | Based on rental income and borrower's income |

| Fees | Standard arrangement and valuation fees | Higher arrangement and valuation fees common |

| Tax Implications | No rental income tax considerations | Rental income taxable; mortgage interest relief limited |

| Regulation | Consumer credit regulations | Specialized buy-to-let mortgage regulations |

Understanding Owner-Occupied Loans and Buy-to-Let Mortgages

Owner-occupied loans are designed for borrowers who intend to live in the property as their primary residence, typically offering lower interest rates and more favorable terms due to reduced lender risk. Buy-to-let mortgages target investors purchasing properties specifically for rental income, often requiring higher deposits and featuring higher interest rates to account for the increased risk profile. Understanding the distinctions between these mortgage types is essential for optimizing property investment strategies and ensuring compliance with lender criteria.

Key Differences Between Owner-Occupied and Buy-to-Let Mortgages

Owner-occupied mortgages typically offer lower interest rates and require smaller deposits, as lenders consider the borrower's primary residence less risky compared to buy-to-let properties. Buy-to-let mortgages often demand higher interest rates, larger deposits of around 25%, and proof of rental income to cover repayments. Tax implications vary significantly, with buy-to-let investors facing income tax on rental earnings and potential capital gains tax, unlike owner-occupiers.

Eligibility Criteria for Each Mortgage Type

Owner-occupied loans require applicants to intend to live in the property as their primary residence, often mandating proof of occupancy and income stability. Buy-to-let mortgages cater to investors who rent out properties, demanding higher deposit amounts, demonstrable rental income projections, and stricter credit assessments. Understanding these eligibility criteria ensures borrowers choose the appropriate mortgage that aligns with their investment strategy and financial profile.

Interest Rate Variations: Owner-Occupied vs Buy-to-Let

Owner-occupied loans typically offer lower interest rates compared to buy-to-let mortgages due to reduced risk for lenders, as the borrower lives in the property. Buy-to-let mortgages carry higher interest rates to compensate for the increased risk of rental income variability and potential tenant vacancies. Investors must carefully assess the impact of these interest rate differences on overall investment returns and cash flow projections.

Deposit Requirements for Property Investors

Buy-to-let mortgages typically require a larger deposit, often between 25% and 40% of the property value, compared to owner-occupied loans which usually demand deposits as low as 5% to 20%. This higher deposit requirement for buy-to-let loans reflects the increased risk lenders associate with property investment. Investors should prepare for these significant upfront costs to secure favorable loan terms and optimize rental returns.

Tax Implications of Owner-Occupied and Buy-to-Let Mortgages

Tax implications of owner-occupied loans typically include eligibility for mortgage interest tax relief limited to personal income, whereas buy-to-let mortgages allow landlords to deduct full mortgage interest from rental income before tax. Owner-occupiers cannot claim rental income deductions, impacting net returns on investment properties. Buy-to-let investors must also consider capital gains tax upon sale, which differs significantly from owner-occupiers' primary residence exemption rules.

Rental Income Potential and Investment Returns

Owner-Occupied Loans typically offer lower interest rates and require smaller down payments but restrict rental income potential as the property must be the borrower's primary residence. Buy-to-Let Mortgages are designed for investment properties, allowing landlords to maximize rental income and achieve higher investment returns, though they often come with higher interest rates and larger deposit requirements. Evaluating rental yield, tax implications, and market demand is crucial in deciding between these mortgage types to optimize long-term profitability.

Regulatory and Legal Considerations

Owner-occupied loans require borrowers to live in the property as their primary residence, complying with strict occupancy verification and borrower disclosure regulations. Buy-to-let mortgages are subject to additional regulatory requirements including rental income assessments, landlord licensing laws, and tenancy deposit protection under housing legislation. Failure to adhere to these legal considerations can result in loan defaults, penalties, or mortgage invalidation, emphasizing the importance of selecting the appropriate mortgage type for property investment.

Risks and Challenges in Property Financing

Owner-occupied loans typically offer lower interest rates and require smaller deposits but restrict rental income potential, presenting a risk if plans change from living in the property to renting it out. Buy-to-let mortgages cater to property investors by allowing rental income to cover repayments, though they often come with higher interest rates, larger down payment requirements, and stricter lending criteria. The challenges of buy-to-let financing include vulnerability to rental voids, maintenance costs, and changing regulations such as tax relief limits and mortgage interest deductions.

Choosing the Right Mortgage for Your Investment Goals

Owner-occupied loans typically offer lower interest rates and more favorable repayment terms compared to buy-to-let mortgages, making them suitable for investors planning to live in the property or use it as a primary residence. Buy-to-let mortgages cater specifically to landlords, often requiring a larger deposit and factoring rental income into affordability assessments, aligning with strategies for generating rental yield. Understanding key differences in loan-to-value ratios, interest rates, and eligibility criteria is essential for selecting the mortgage that best supports your property investment objectives.

Related Important Terms

Rentvesting

Rentvesting leverages an owner-occupied loan to purchase an affordable property for living while simultaneously investing in a buy-to-let mortgage for a rental property, maximizing financial benefits through lower interest rates and tax deductions on investment properties. This strategy enables investors to build equity in both their primary residence and investment property, optimizing wealth creation in property investment.

Accidental Landlord

An Owner-Occupied Loan typically offers lower interest rates and more favorable terms, designed for those living in the property, but using it as an Accidental Landlord by renting it out can breach mortgage conditions and lead to penalties. Buy-to-Let Mortgages are specifically structured for property investment, allowing landlords to rent out properties legally with interest rates based on potential rental income rather than personal income.

Stress Testing (Buy-to-Let Mortgages)

Stress testing for buy-to-let mortgages evaluates a landlord's ability to cover mortgage payments under varying interest rates and rental income scenarios, ensuring financial resilience against market fluctuations. Lenders typically require higher interest coverage ratios and impose stricter affordability criteria compared to owner-occupied loans to mitigate default risks.

Portfolio Landlord Rules

Portfolio landlord rules limit the number of buy-to-let mortgages an investor can hold, often capping it at four to six properties before stricter lending criteria and higher interest rates apply. Owner-occupied loans typically offer lower rates and deposit requirements but exclude properties intended solely for rental investment, affecting portfolio landlords' financing strategies.

Interest Coverage Ratio (ICR)

Owner-Occupied Loans typically require less stringent Interest Coverage Ratio (ICR) calculations compared to Buy-to-Let Mortgages, which demand a higher ICR to ensure rental income sufficiently covers mortgage payments. Lenders often set Buy-to-Let ICR thresholds at 125% to 145% of the mortgage interest payments, emphasizing risk management in property investment.

Regulated Buy-to-Let

Regulated Buy-to-Let mortgages are designed for landlords who have a personal connection to the tenant, such as a child or elderly parent, offering more stringent eligibility criteria and higher interest rates compared to standard Buy-to-Let loans. Owner-Occupied loans differ by requiring the borrower to live in the property, typically providing lower rates and more flexible terms, but are not suitable for pure investment purposes.

Top Slicing

Top slicing is a rental income tax relief method primarily relevant to buy-to-let mortgages, allowing property investors to calculate tax based on income divided over multiple years, reducing taxable liability from profits. Owner-occupied loans do not qualify for top slicing, as they are intended for primary residences rather than income generation, making buy-to-let mortgages more advantageous for leveraging rental income tax benefits.

PRA Mortgage Stress Rules

PRA Mortgage Stress Testing applies higher interest rate buffers on buy-to-let mortgages compared to owner-occupied loans, reflecting increased risk and ensuring borrowers can withstand potential rate rises. Owner-occupied loans typically undergo lower stress rate assessments, making them comparatively easier to qualify for under PRA regulations.

Let-to-Buy Mortgage

Let-to-Buy mortgages allow homeowners to rent out their current property while purchasing a new one to occupy, combining elements of owner-occupied and buy-to-let loans. This specialized mortgage requires meeting stricter lender criteria, such as higher credit scores and rental income assessments, offering strategic flexibility for investors transitioning between residences.

Consumer Buy-to-Let (CBTL)

Consumer Buy-to-Let (CBTL) mortgages offer property investors a tailored financing option that differs from owner-occupied loans by accommodating rental income projections and higher loan-to-value ratios, optimizing cash flow and investment returns. These mortgages typically feature stricter affordability criteria and specialized underwriting to assess rental income reliability, distinguishing them from standard residential loans designed for owner-occupied properties.

Owner-Occupied Loan vs Buy-to-Let Mortgage for property investment. Infographic

moneydiff.com

moneydiff.com