Jumbo mortgages are designed for high-value property purchases exceeding conforming loan limits, offering competitive interest rates but requiring stringent credit and down payment qualifications. Community Land Trust mortgages focus on affordability by separating land ownership from the property, often providing below-market interest rates and shared equity arrangements to reduce upfront costs. Choosing between these options depends on the buyer's financial profile and long-term investment goals in the housing market.

Table of Comparison

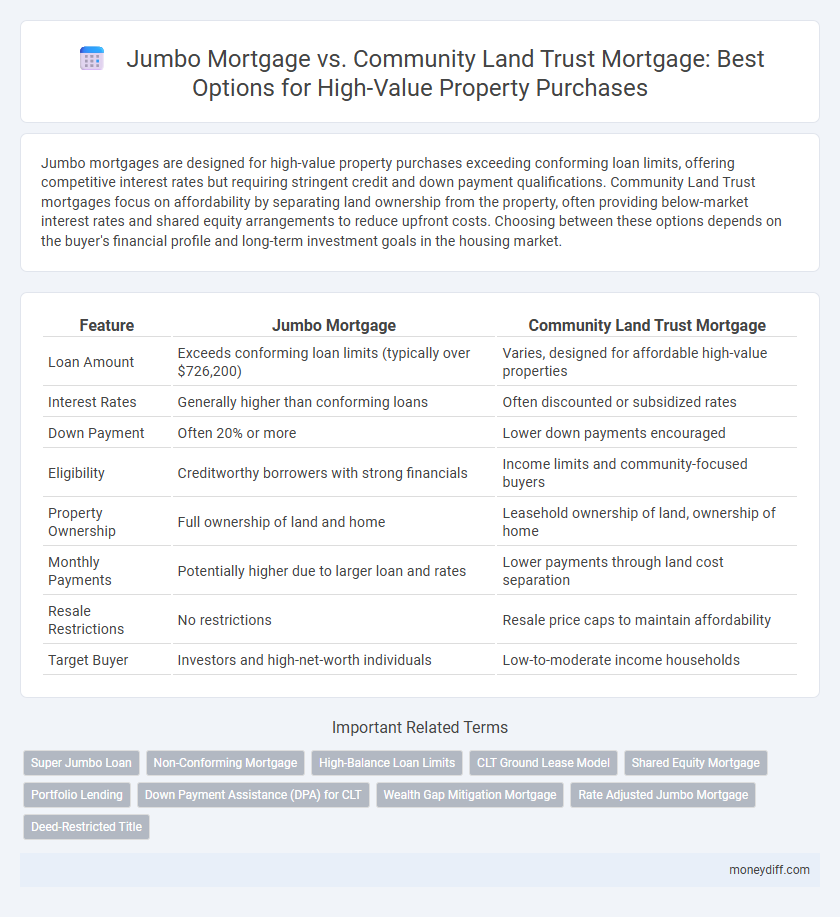

| Feature | Jumbo Mortgage | Community Land Trust Mortgage |

|---|---|---|

| Loan Amount | Exceeds conforming loan limits (typically over $726,200) | Varies, designed for affordable high-value properties |

| Interest Rates | Generally higher than conforming loans | Often discounted or subsidized rates |

| Down Payment | Often 20% or more | Lower down payments encouraged |

| Eligibility | Creditworthy borrowers with strong financials | Income limits and community-focused buyers |

| Property Ownership | Full ownership of land and home | Leasehold ownership of land, ownership of home |

| Monthly Payments | Potentially higher due to larger loan and rates | Lower payments through land cost separation |

| Resale Restrictions | No restrictions | Resale price caps to maintain affordability |

| Target Buyer | Investors and high-net-worth individuals | Low-to-moderate income households |

Understanding Jumbo Mortgages: Key Features and Requirements

Jumbo mortgages are loans that exceed conforming loan limits set by Fannie Mae and Freddie Mac, often used for high-value property purchases exceeding $726,200 in most U.S. counties. These loans typically require higher credit scores, lower debt-to-income ratios, and larger down payments, often around 20% or more, due to the increased lender risk associated with larger loan amounts. Borrowers must provide extensive documentation, including detailed income verification and asset statements, to qualify for jumbo mortgages that offer competitive interest rates despite stricter underwriting standards.

What Is a Community Land Trust Mortgage?

A Community Land Trust (CLT) mortgage involves financing where the homeowner purchases the building but leases the land from a nonprofit trust, significantly reducing upfront costs for high-value properties. Unlike a jumbo mortgage, which requires large loan amounts often exceeding conforming loan limits and carries higher interest rates, a CLT mortgage offers affordable homeownership with shared equity and long-term community stewardship. This model promotes sustainable housing by separating land ownership from property ownership, making luxury homes more accessible while preserving community affordability.

Eligibility Criteria: Jumbo vs Community Land Trust Mortgages

Jumbo mortgages require borrowers to meet higher credit score thresholds, typically above 700, and demonstrate substantial income and assets due to the large loan amounts exceeding conforming loan limits. Community Land Trust (CLT) mortgages focus on affordability and require eligibility based on income limits, community residency, and commitment to preserving affordable housing rather than high credit scores or large assets. While jumbo loan borrowers must prove financial capacity for luxury property purchases, CLT mortgage candidates prioritize income qualifications and community engagement for ownership within controlled land trusts.

Down Payment Requirements Compared

Jumbo mortgages typically require down payments of at least 20% to qualify for high-value property purchases, reflecting the increased loan amounts above conforming limits. Community Land Trust (CLT) mortgages often have more flexible down payment requirements, sometimes as low as 3-5%, as they focus on affordable homeownership within a shared equity model. The lower down payment threshold in CLT mortgages alleviates upfront financial barriers for buyers but may come with resale restrictions tied to affordability goals.

Interest Rates: Jumbo Mortgage vs CLT Mortgage

Jumbo mortgages generally carry higher interest rates due to the larger loan amounts exceeding conforming loan limits, resulting in increased risk for lenders. Community Land Trust (CLT) mortgages typically offer more favorable interest rates through partnerships with nonprofit organizations and local governments focused on affordable housing. Borrowers seeking high-value properties may find CLT mortgages advantageous for lower rates, though availability and property eligibility criteria can vary significantly.

Loan Limits and Flexibility for High-Value Purchases

Jumbo mortgages exceed conventional loan limits, enabling high-value property purchases with loan amounts typically above $647,200 in most U.S. regions, offering flexibility in property type and loan terms. Community Land Trust (CLT) mortgages, while generally designed for affordable housing, impose stricter loan limits tied to local affordability standards, limiting their use for luxury or high-value homes. Borrowers seeking substantial financing and broader property options should consider jumbo loans for greater flexibility and higher loan ceilings.

Credit Score Impact in Jumbo and CLT Mortgage Approval

Jumbo mortgage approvals typically require a higher credit score, often above 700, due to the increased loan amount and risk associated with high-value property purchases. Community Land Trust (CLT) mortgages may have more flexible credit score requirements, emphasizing income stability and community engagement over a perfect credit history. Borrowers with strong credit profiles benefit from lower interest rates on jumbo loans, while CLT mortgages provide an alternative route for those with moderate scores seeking affordable homeownership within trust communities.

Ownership Structure: Full vs Shared Equity Models

Jumbo mortgages provide full ownership of high-value properties with straightforward financing but often require higher credit scores and larger down payments. Community Land Trust (CLT) mortgages operate on a shared equity model, where homeowners own the building but lease the land, reducing upfront costs and preserving long-term affordability. This shared ownership structure in CLTs limits property appreciation gains compared to jumbo loans, which allow owners to benefit fully from market appreciation.

Pros and Cons of Jumbo and Community Land Trust Mortgages

Jumbo mortgages offer high loan amounts above conforming limits, enabling buyers to finance luxury properties, but they often come with higher interest rates and stricter credit requirements that can limit borrower accessibility. Community Land Trust mortgages provide affordable homeownership options by separating land ownership from the property, reducing upfront costs and promoting long-term affordability, though they typically impose resale restrictions that may limit the property's market value appreciation. Choosing between these mortgage types depends on prioritizing either flexible financing for high-value purchases or sustainable affordability with community-focused benefits.

Choosing the Right Mortgage for High-Value Property Buyers

High-value property buyers must evaluate Jumbo Mortgages for their higher loan limits and conventional lending terms against Community Land Trust Mortgages, which offer affordability and long-term land stewardship but may restrict property resale value. Jumbo Mortgages typically require stronger credit profiles and higher down payments, making them suitable for buyers seeking full ownership on multi-million-dollar homes. Community Land Trust Mortgages emphasize shared equity and community benefits, ideal for those prioritizing affordable homeownership within regulated price appreciation frameworks.

Related Important Terms

Super Jumbo Loan

Super jumbo loans exceed standard jumbo mortgage limits, typically surpassing $1.5 million, offering tailored financing for luxury or high-value properties requiring loan amounts above typical jumbo thresholds. Community Land Trust mortgages provide an alternative by enabling homeownership in affordable housing models, though they often have loan limits unsuitable for super jumbo purchases, making traditional super jumbo loans preferable for acquiring premium real estate assets.

Non-Conforming Mortgage

Jumbo mortgages are non-conforming loans that exceed conforming loan limits, offering high-value property buyers competitive interest rates but often requiring stringent credit and income qualifications. Community Land Trust mortgages, also non-conforming, provide affordable pathways for purchasing expensive homes by separating land ownership from property ownership, reducing loan amounts and monthly payments for buyers.

High-Balance Loan Limits

High-balance loan limits in jumbo mortgages often exceed conforming loan limits, enabling the financing of luxury properties typically over $1 million, while community land trust mortgages usually enforce stricter caps aligned with affordable housing goals. Jumbo loans provide flexibility for high-value property purchases without the income or geographic restrictions commonly imposed by community land trust mortgage programs.

CLT Ground Lease Model

Jumbo mortgages provide traditional financing for high-value properties but often require higher credit scores and larger down payments, while Community Land Trust (CLT) mortgages utilize a ground lease model where homeowners lease the land from the trust, reducing upfront costs and preserving long-term affordability. The CLT ground lease separates land ownership from the property, enabling sustainable homeownership by limiting resale prices and maintaining community control over land use.

Shared Equity Mortgage

A Jumbo Mortgage typically requires higher credit scores and larger down payments for high-value properties, while a Community Land Trust Mortgage offers Shared Equity options that reduce the borrower's upfront costs by splitting property appreciation with the trust. Shared Equity Mortgages facilitate affordability by allowing buyers to invest less capital initially, benefiting from lower monthly payments and community stewardship of the property's long-term value.

Portfolio Lending

Jumbo mortgages are tailored for high-value property purchases exceeding conforming loan limits, often requiring strict credit criteria and higher down payments, while community land trust (CLT) mortgages offer affordable homeownership by separating land ownership from the property, typically supported by portfolio lenders with flexible underwriting. Portfolio lending plays a crucial role by allowing lenders to retain these loans on their books, enabling customized terms and accommodating non-traditional borrower profiles for both jumbo and CLT mortgage programs.

Down Payment Assistance (DPA) for CLT

Jumbo mortgages require higher down payments, typically 20% or more, making them less accessible for many buyers of high-value properties. Community Land Trust (CLT) mortgages often include Down Payment Assistance (DPA) programs that reduce upfront costs and increase affordability by separating land ownership from housing, providing significant financial support for buyers in high-value markets.

Wealth Gap Mitigation Mortgage

Jumbo mortgages cater to high-value property purchases with loan amounts exceeding conforming limits, often requiring stringent credit and income qualifications, while community land trust mortgages promote wealth gap mitigation by enabling affordable homeownership through shared equity models and reduced land costs. Community land trust mortgages support long-term affordability and neighborhood stability, making them a critical tool in addressing wealth disparities compared to conventional jumbo loans.

Rate Adjusted Jumbo Mortgage

Rate Adjusted Jumbo Mortgages offer competitive interest rates tailored for high-value properties exceeding conforming loan limits, making them a preferred option over Community Land Trust Mortgages, which often have restrictions and lower loan amounts due to their focus on affordable housing. Borrowers seeking flexibility and market-rate pricing for luxury real estate typically benefit from the customized rate adjustments in Jumbo Mortgages.

Deed-Restricted Title

Jumbo mortgages finance high-value properties without price limits, offering flexible terms but typically requiring substantial down payments and strict credit criteria. In contrast, Community Land Trust mortgages involve deed-restricted titles that limit resale prices to maintain affordability, prioritizing long-term community equity over market-driven appreciation.

Jumbo Mortgage vs Community Land Trust Mortgage for high-value property purchase. Infographic

moneydiff.com

moneydiff.com