Amortizing loans provide a structured repayment plan where principal and interest are paid down evenly over the loan term, resulting in full loan payoff by maturity. Balloon mortgages require smaller periodic payments with a large lump-sum payment due at the end, which can offer lower initial monthly costs but involve refinancing risk. Choosing between these options depends on your financial stability, long-term plans, and ability to manage potential large payments.

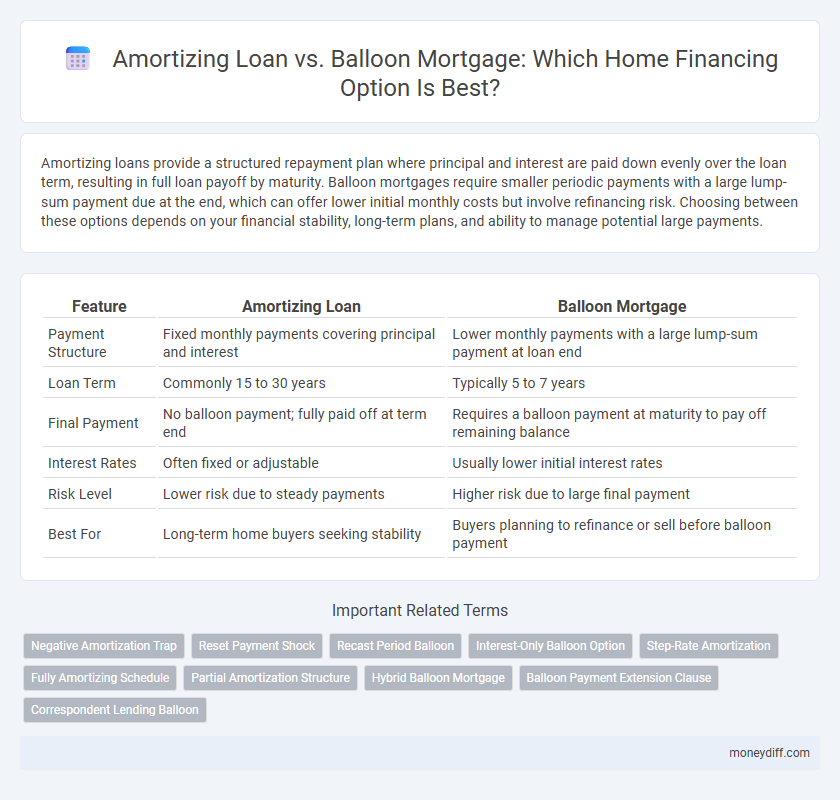

Table of Comparison

| Feature | Amortizing Loan | Balloon Mortgage |

|---|---|---|

| Payment Structure | Fixed monthly payments covering principal and interest | Lower monthly payments with a large lump-sum payment at loan end |

| Loan Term | Commonly 15 to 30 years | Typically 5 to 7 years |

| Final Payment | No balloon payment; fully paid off at term end | Requires a balloon payment at maturity to pay off remaining balance |

| Interest Rates | Often fixed or adjustable | Usually lower initial interest rates |

| Risk Level | Lower risk due to steady payments | Higher risk due to large final payment |

| Best For | Long-term home buyers seeking stability | Buyers planning to refinance or sell before balloon payment |

Understanding Amortizing Loans: Key Features

Amortizing loans for home financing involve scheduled monthly payments that cover both principal and interest, ensuring the loan balance decreases steadily over time. These loans provide predictability in budgeting by maintaining consistent payment amounts throughout the loan term, typically 15 or 30 years. The key feature of amortizing loans is full repayment by the end of the term, eliminating large lump-sum payments often required by balloon mortgages.

What Is a Balloon Mortgage?

A balloon mortgage is a type of home loan that requires smaller monthly payments during the term, followed by a large lump-sum payment called a balloon payment at the end. Unlike an amortizing loan, which spreads payments evenly over the loan term, a balloon mortgage typically has a shorter period before the full balance is due, often five to seven years. Borrowers use balloon mortgages to benefit from lower initial payments but must prepare for refinancing or paying the substantial final balance.

Monthly Payment Comparison: Amortizing vs Balloon

Amortizing loans feature consistent monthly payments that cover both principal and interest, allowing homeowners to gradually build equity over time. Balloon mortgages typically offer lower initial monthly payments since only interest or minimal principal is paid, but they require a large lump-sum payment at the end of the term. Comparing monthly payments, amortizing loans provide steady budgeting and predictable costs, while balloon mortgages may appeal to borrowers seeking lower short-term payments but carry the risk of significant refinancing or payoff demands later.

Interest Costs Over Time

Amortizing loans spread interest payments evenly across the loan term, resulting in gradually decreasing interest costs as the principal balance reduces with each payment. Balloon mortgages feature lower initial interest payments but require a large lump-sum payment at the end, which can lead to higher overall interest costs if the balloon payment is refinanced at less favorable rates. Understanding the difference in interest cost accumulation over time is crucial for optimizing long-term home financing expenses.

Risks Associated with Balloon Mortgages

Balloon mortgages carry significant risks due to the large lump-sum payment required at the loan's maturity, which can lead to refinancing challenges if the borrower's financial situation changes or property values decline. Unlike amortizing loans that gradually reduce principal, balloon loans impose payment uncertainty, increasing the risk of default or foreclosure. Borrowers should carefully assess their ability to repay or refinance the balloon amount to avoid financial strain.

Long-Term Financial Planning and Predictability

Amortizing loans provide consistent monthly payments that gradually reduce the principal balance, offering long-term financial predictability and ease in budgeting for homeowners. Balloon mortgages feature lower initial payments but require a large lump-sum payment at the end, posing risks for those without a clear refinancing plan or sufficient funds. Choosing an amortizing loan supports stable financial planning, while balloon mortgages may benefit borrowers confident in future market conditions or income growth.

Best Situations for Choosing an Amortizing Loan

An amortizing loan is best suited for borrowers seeking predictable monthly payments and long-term financial stability, as it gradually reduces both principal and interest over the loan term. Homebuyers planning to stay in their property for several years benefit from the steady equity buildup and full repayment by the end of the mortgage term. This option is ideal for those who prefer consistent budgeting without the risk of a large final payment, unlike balloon mortgages that require refinancing or lump-sum payoff.

When Does a Balloon Mortgage Make Sense?

A balloon mortgage makes sense when a borrower expects a significant increase in income or plans to refinance before the large final payment is due, often within five to seven years. This type of loan offers lower initial monthly payments compared to a fully amortizing loan, making it suitable for short-term homeownership or investors aiming to sell or refinance before the balloon payment. Borrowers should carefully assess their financial stability and market conditions to avoid refinancing risks tied to balloon mortgages.

Impact on Home Equity Build-Up

Amortizing loans steadily build home equity by requiring regular principal and interest payments that gradually reduce the loan balance over time. Balloon mortgages maintain lower payments initially but demand a large lump-sum payment at the end of the term, which delays significant equity accumulation. Borrowers seeking consistent equity growth often prefer amortizing loans due to their predictable payoff schedule and gradual home ownership increase.

Making the Right Choice for Your Home Financing

Choosing between an amortizing loan and a balloon mortgage depends on your financial stability and long-term plans. An amortizing loan offers predictable monthly payments by spreading principal and interest over the loan term, reducing the risk of a large payout at the end. A balloon mortgage provides lower initial payments but requires a lump-sum payment or refinancing after a short period, which may pose a risk if property values or personal finances change unexpectedly.

Related Important Terms

Negative Amortization Trap

Amortizing loans ensure consistent principal and interest payments, preventing negative amortization by fully paying down the loan over time, while balloon mortgages risk plunging borrowers into the negative amortization trap if large final payments can't be met, causing unpaid interest to accumulate. Negative amortization in balloon mortgages can lead to increased loan balances and potential foreclosure, highlighting the importance of understanding payment structures in home financing.

Reset Payment Shock

Amortizing loans provide consistent monthly payments gradually reducing the principal, minimizing payment shock by maintaining predictable budgeting throughout the loan term. Balloon mortgages, while offering lower initial payments, can cause significant payment shock at the reset date, requiring a large lump sum or refinancing under potentially higher interest rates.

Recast Period Balloon

A recast period balloon mortgage combines a lump-sum payment at the end of a fixed term with subsequent amortizing payments recalculated over the remaining loan balance, offering borrowers lower initial monthly payments and potential flexibility. Unlike traditional amortizing loans with consistent payments, the recast period balloon requires careful planning for the balloon payment or refinancing to avoid financial strain.

Interest-Only Balloon Option

Interest-only balloon mortgages offer lower initial monthly payments by requiring only interest payments before a large lump-sum principal is due at loan maturity, contrasting with amortizing loans that spread both principal and interest payments evenly over the loan term. This option can improve short-term cash flow but carries the risk of refinancing challenges or large payment obligations at the balloon date.

Step-Rate Amortization

Step-rate amortization in mortgage financing gradually increases monthly payments at predetermined intervals, balancing initial affordability with faster principal reduction over time. Unlike balloon mortgages, which require a large lump-sum payment at the end of the term, step-rate amortizing loans provide a clear amortization schedule that reduces mortgage risk and improves budget predictability.

Fully Amortizing Schedule

A fully amortizing loan ensures the principal and interest are paid off through consistent monthly payments over the loan term, eliminating any remaining balance at maturity. This contrasts with a balloon mortgage, which requires a large final payment after lower periodic payments, increasing refinancing risk.

Partial Amortization Structure

Partial amortization structure in a balloon mortgage combines regular payments that cover both principal and interest with a large final lump-sum payment, contrasting with a fully amortizing loan that spreads payments evenly over the term until the balance reaches zero. This hybrid approach offers lower monthly payments but requires borrowers to plan for the significant balloon payment at maturity or refinance to avoid default.

Hybrid Balloon Mortgage

Hybrid balloon mortgages combine the benefits of amortizing loans with a balloon payment feature, offering lower initial monthly payments by amortizing the principal over a longer period while requiring a lump-sum payment at the end of the term. This financing option appeals to homebuyers seeking short-term lower payments but who plan to refinance or sell before the balloon payment due date.

Balloon Payment Extension Clause

A Balloon Payment Extension Clause allows borrowers with balloon mortgages to defer the large final payment by extending the loan term under specified conditions, reducing the immediate financial burden. Unlike amortizing loans with fixed, equal payments over time, balloon mortgages require managing this lump-sum payment risk, making the extension clause crucial for improved cash flow flexibility.

Correspondent Lending Balloon

Correspondent lending balloon mortgages offer shorter-term financing with lower initial payments and a large final balloon payment, appealing to borrowers seeking flexibility and potentially lower interest rates compared to standard amortizing loans that spread payments evenly over the loan term. These balloon loans require careful planning for the lump-sum payoff or refinance at term-end, especially in fluctuating real estate markets.

Amortizing Loan vs Balloon Mortgage for home financing. Infographic

moneydiff.com

moneydiff.com