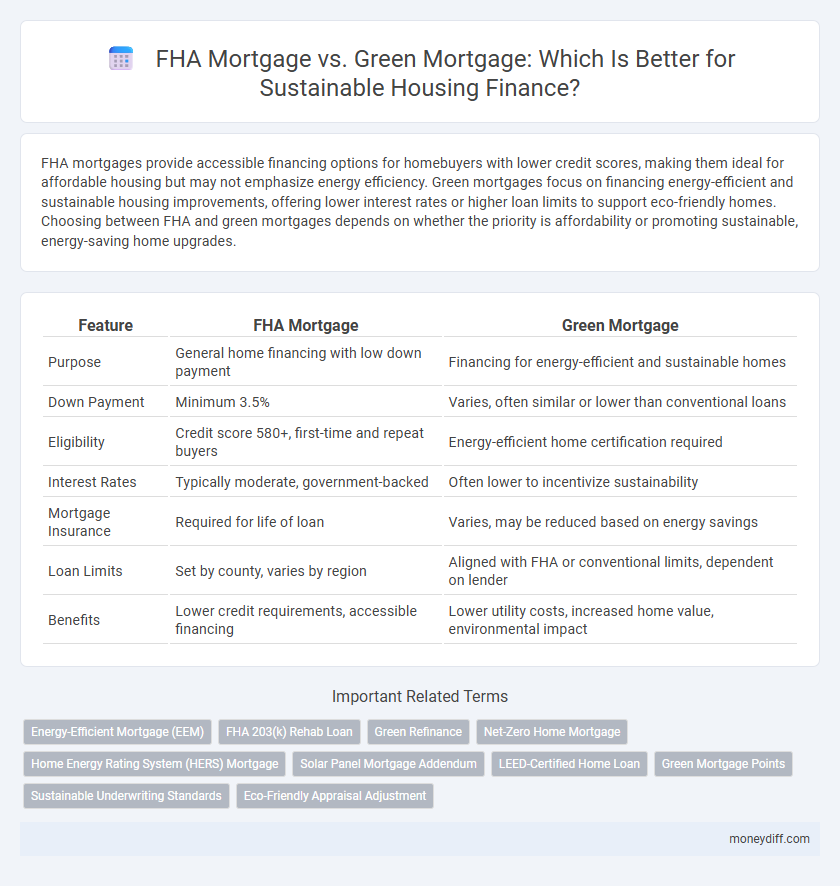

FHA mortgages provide accessible financing options for homebuyers with lower credit scores, making them ideal for affordable housing but may not emphasize energy efficiency. Green mortgages focus on financing energy-efficient and sustainable housing improvements, offering lower interest rates or higher loan limits to support eco-friendly homes. Choosing between FHA and green mortgages depends on whether the priority is affordability or promoting sustainable, energy-saving home upgrades.

Table of Comparison

| Feature | FHA Mortgage | Green Mortgage |

|---|---|---|

| Purpose | General home financing with low down payment | Financing for energy-efficient and sustainable homes |

| Down Payment | Minimum 3.5% | Varies, often similar or lower than conventional loans |

| Eligibility | Credit score 580+, first-time and repeat buyers | Energy-efficient home certification required |

| Interest Rates | Typically moderate, government-backed | Often lower to incentivize sustainability |

| Mortgage Insurance | Required for life of loan | Varies, may be reduced based on energy savings |

| Loan Limits | Set by county, varies by region | Aligned with FHA or conventional limits, dependent on lender |

| Benefits | Lower credit requirements, accessible financing | Lower utility costs, increased home value, environmental impact |

Understanding FHA Mortgages: Basics and Benefits

FHA mortgages, insured by the Federal Housing Administration, offer low down payment options and more flexible credit requirements, making homeownership accessible for many buyers. They support sustainable housing by allowing borrowers to finance energy-efficient improvements within their mortgage. These benefits make FHA loans a practical choice for those seeking affordable, eco-friendly home financing solutions.

What Is a Green Mortgage? Key Features Explained

A green mortgage is a specialized loan designed to finance energy-efficient homes or improvements that reduce a property's environmental impact and lower utility costs. Key features include incentives such as lower interest rates, higher loan limits, or the ability to finance energy-saving upgrades within the mortgage itself, which encourages sustainable housing development. Unlike FHA mortgages that primarily focus on affordability and creditworthiness, green mortgages prioritize environmental sustainability and long-term savings through eco-friendly home investments.

Eligibility Criteria: FHA vs Green Mortgage

FHA mortgages require borrowers to meet credit score minimums typically around 580 with a 3.5% down payment, focusing on standard residential properties eligible under FHA guidelines. Green Mortgages often demand additional eligibility criteria tied to the energy efficiency of the home, such as meeting ENERGY STAR certification or similar sustainable standards, with incentives for improvements that reduce environmental impact. Borrowers must prove property compliance with green building standards for Green Mortgages, whereas FHA loans emphasize borrower credit qualifications and property eligibility without specific sustainability requirements.

Down Payments and Interest Rates Compared

FHA mortgages typically require down payments as low as 3.5%, offering accessible financing for first-time homebuyers, while green mortgages often feature similar or lower down payment options to incentivize energy-efficient home purchases. Interest rates on FHA loans are generally competitive but may be higher than some green mortgage programs, which can provide reduced rates or rebates tied to sustainable housing improvements. Evaluating down payments and interest costs highlights how green mortgages align financial savings with environmental benefits compared to traditional FHA loans.

Sustainable Home Requirements for Green Mortgages

Green mortgages prioritize energy-efficient features such as solar panels, high-performance windows, and improved insulation to qualify for sustainable home financing. FHA mortgages focus primarily on affordability and creditworthiness without specific mandates for sustainability upgrades. Meeting sustainable home requirements for green mortgages typically involves third-party energy assessments and verification of reduced environmental impact through certifications like LEED or ENERGY STAR.

FHA Mortgage Pros and Cons for Homebuyers

FHA mortgages offer lower down payment requirements and more flexible credit score criteria, making homeownership accessible for first-time buyers and those with limited credit history. However, FHA loans require mortgage insurance premiums that increase overall loan costs, potentially making monthly payments higher than conventional alternatives. While FHA loans provide stability and government backing, they may limit borrowers seeking to combine sustainable home improvements with financing, unlike Green Mortgages designed specifically for energy-efficient upgrades.

Environmental Impact: Green Mortgage Advantages

Green mortgages provide significant environmental benefits by incentivizing energy-efficient home improvements that reduce carbon emissions and lower utility costs. Unlike FHA mortgages, which primarily focus on loan accessibility, green mortgages promote sustainable building practices and integration of renewable energy technologies. These eco-friendly loans contribute to long-term environmental sustainability by encouraging the construction and renovation of homes with reduced ecological footprints.

Cost Comparison: FHA vs Green Mortgage Over Time

FHA mortgages typically offer lower upfront costs with competitive interest rates and down payment requirements, making initial affordability more accessible for borrowers. Green mortgages, while sometimes featuring slightly higher fees, provide long-term savings through energy-efficient upgrades that reduce utility expenses and may include incentives or reduced interest rates specifically for sustainable housing. Over time, the total cost of ownership with a Green mortgage can be lower than an FHA loan due to these operational savings and potential tax benefits related to energy-efficient improvements.

Government Incentives for Sustainable Housing Finance

Government incentives for sustainable housing finance include FHA mortgages that offer lower down payments and more flexible credit requirements, promoting affordability for first-time homebuyers. Green mortgages provide additional benefits by incorporating energy-efficient upgrades, often including reduced interest rates or rebates tied directly to sustainability improvements. By combining FHA programs with green financing options, borrowers can access government-backed loans that support environmentally responsible homeownership while easing financial barriers.

Choosing the Right Mortgage: Factors to Consider

When choosing between an FHA mortgage and a Green mortgage for sustainable housing finance, consider eligibility criteria, interest rates, and potential savings on energy-efficient upgrades. FHA loans offer lower down payments and flexible credit scores, making them accessible, while Green mortgages provide incentives for energy-efficient home improvements and reduced utility costs. Evaluating your financial profile, long-term energy savings, and environmental impact helps determine the best option for sustainable homeownership.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs), often offered under FHA programs, provide borrowers with additional funds to purchase or refinance homes with energy-saving features, reducing utility costs and environmental impact. These loans incentivize sustainable housing finance by integrating energy efficiency improvements into the mortgage, promoting green living while maintaining affordability.

FHA 203(k) Rehab Loan

The FHA 203(k) Rehab Loan enables homebuyers and homeowners to finance both the purchase and rehabilitation of a property, making it a viable option for sustainable housing improvements under FHA Mortgage programs. Unlike Green Mortgages that typically prioritize energy-efficient upgrades, the FHA 203(k) focuses on overall home rehabilitation, including structural repairs and modernization, while supporting affordability and rehabilitation flexibility.

Green Refinance

FHA Green Refinance Mortgage enables homeowners to reduce energy costs and improve home efficiency by refinancing existing FHA-insured loans with added funds for energy upgrades. This sustainable housing finance option supports energy-efficient improvements while maintaining favorable loan terms and federal backing compared to traditional FHA mortgages.

Net-Zero Home Mortgage

The FHA Mortgage provides government-backed financing with lower down payment requirements, ideal for traditional homebuyers, while the Green Mortgage, particularly the Net-Zero Home Mortgage, offers specialized incentives and reduced interest rates for energy-efficient, sustainable housing. Net-Zero Home Mortgages facilitate financing for homes designed to produce as much energy as they consume, promoting long-term savings and environmental benefits.

Home Energy Rating System (HERS) Mortgage

The Home Energy Rating System (HERS) Mortgage incentivizes energy-efficient home improvements by integrating HERS index scores into loan qualification, offering lower interest rates and increased borrowing power compared to traditional FHA Mortgages. This green mortgage supports sustainable housing finance by reducing utility costs and carbon footprints, aligning with government initiatives for energy conservation and long-term homeowner savings.

Solar Panel Mortgage Addendum

The FHA Mortgage offers accessible financing with government backing but lacks specific provisions for integrating sustainable technologies like solar panels, whereas Green Mortgages often include a Solar Panel Mortgage Addendum that enables borrowers to finance solar panel installations directly into their home loan. This addendum facilitates energy-efficient upgrades, reduces upfront costs, and supports sustainable housing finance by leveraging incentives and energy savings to lower overall mortgage payments.

LEED-Certified Home Loan

FHA Mortgages offer accessible financing with lower down payments and credit requirements, while Green Mortgages, such as LEED-Certified Home Loans, provide incentives for energy-efficient, sustainable housing with reduced utility costs and increased property value. LEED-certified financing supports eco-friendly construction by rewarding buyers with lower interest rates and down payment assistance tailored for environmentally responsible properties.

Green Mortgage Points

Green Mortgage Points provide borrowers with financial incentives such as lower interest rates and reduced closing costs to promote sustainable housing practices, making them a strategic advantage in eco-friendly home financing. FHA Mortgages offer government-backed support with lower down payments but typically lack specific benefits linked to energy-efficient upgrades compared to specialized green loans designed to reward sustainable building and renovation.

Sustainable Underwriting Standards

FHA mortgages provide accessible financing with standardized credit criteria, while green mortgages emphasize sustainable underwriting standards by incorporating energy efficiency assessments and environmental impact into loan eligibility. Sustainable underwriting in green mortgages prioritizes reduced carbon footprints and lower utility costs, supporting long-term affordability and environmental responsibility.

Eco-Friendly Appraisal Adjustment

FHA mortgages offer lower down payments and government-backed security designed primarily for first-time homebuyers, while Green Mortgages provide eco-friendly appraisal adjustments that increase property value based on energy efficiency improvements, incentivizing sustainable housing finance. These appraisal adjustments can lead to higher loan amounts by reflecting reduced utility costs and environmental impact, promoting energy-conscious investments in residential real estate.

FHA Mortgage vs Green Mortgage for sustainable housing finance. Infographic

moneydiff.com

moneydiff.com