Jumbo mortgages are designed for high-value homes exceeding conforming loan limits, offering flexibility in loan amounts but often requiring higher credit scores and larger down payments. Community Land Trust loans provide an affordable alternative by separating the land cost from the home price, lowering upfront costs and preserving long-term affordability. Choosing between these options depends on upfront financial capacity, desired homeownership equity, and long-term investment goals.

Table of Comparison

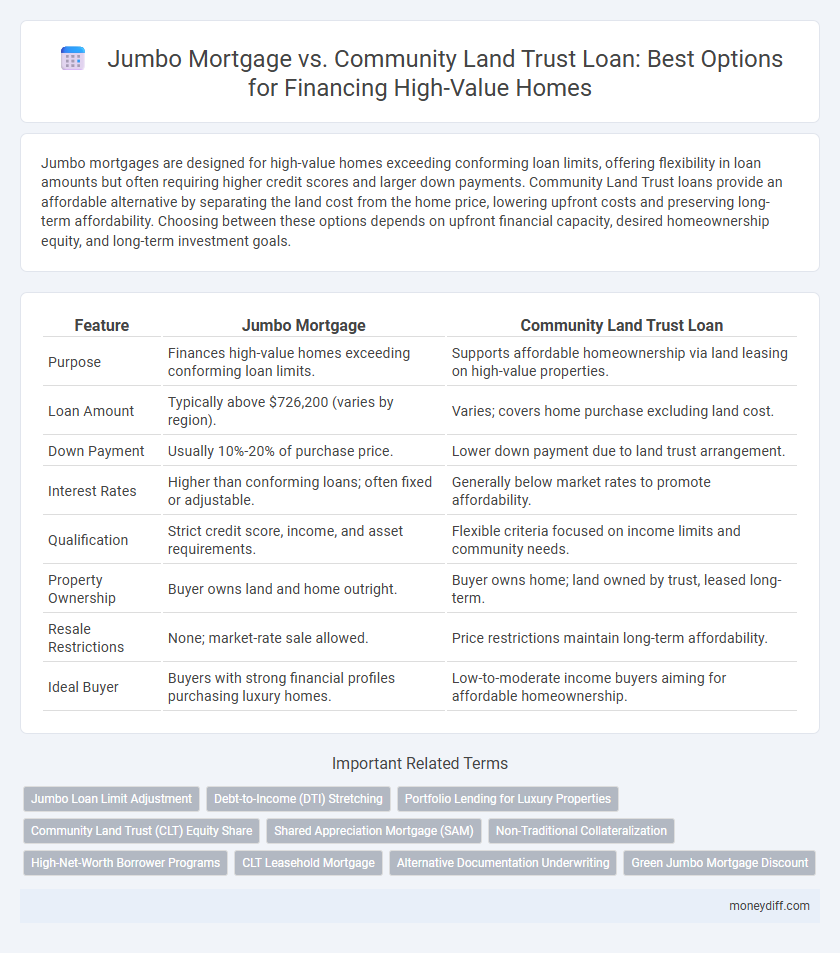

| Feature | Jumbo Mortgage | Community Land Trust Loan |

|---|---|---|

| Purpose | Finances high-value homes exceeding conforming loan limits. | Supports affordable homeownership via land leasing on high-value properties. |

| Loan Amount | Typically above $726,200 (varies by region). | Varies; covers home purchase excluding land cost. |

| Down Payment | Usually 10%-20% of purchase price. | Lower down payment due to land trust arrangement. |

| Interest Rates | Higher than conforming loans; often fixed or adjustable. | Generally below market rates to promote affordability. |

| Qualification | Strict credit score, income, and asset requirements. | Flexible criteria focused on income limits and community needs. |

| Property Ownership | Buyer owns land and home outright. | Buyer owns home; land owned by trust, leased long-term. |

| Resale Restrictions | None; market-rate sale allowed. | Price restrictions maintain long-term affordability. |

| Ideal Buyer | Buyers with strong financial profiles purchasing luxury homes. | Low-to-moderate income buyers aiming for affordable homeownership. |

Understanding Jumbo Mortgages: Key Features and Requirements

Jumbo mortgages are specialized home loans designed for properties that exceed conforming loan limits set by the Federal Housing Finance Agency, often surpassing $726,200 in most U.S. regions. These loans typically require higher credit scores, larger down payments--usually around 20% or more--and stringent financial documentation due to the increased lending risk. Borrowers opting for jumbo mortgages benefit from competitive interest rates but must demonstrate strong income verification, low debt-to-income ratios, and substantial reserves to qualify.

What Is a Community Land Trust Loan?

A Community Land Trust (CLT) loan provides financing for homebuyers through a nonprofit organization that retains ownership of the land while the buyer owns the home, reducing overall housing costs and promoting long-term affordability. Unlike Jumbo mortgages, which require high credit scores and large down payments for luxury homes, CLT loans offer lower interest rates and down payment assistance tailored to income-qualified buyers in high-cost areas. This model limits resale prices to ensure sustainable homeownership and community stability, making it an effective option for purchasing high-value homes with more accessible financing terms.

Minimum Down Payments: Comparing Options

Jumbo mortgages typically require a minimum down payment ranging from 10% to 20%, depending on lender guidelines and borrower credit profiles, reflecting the high loan amount exceeding conforming loan limits. Community Land Trust (CLT) loans for high-value homes often offer lower down payment options, sometimes as low as 3% to 5%, due to shared equity models and nonprofit involvement, reducing upfront buyer costs. Comparing minimum down payments between jumbo loans and CLT loans highlights significant financial accessibility differences for purchasing high-value properties.

Credit Score Criteria for Jumbo vs. CLT Loans

Jumbo mortgages typically require a higher credit score, often above 700, due to the larger loan amounts involved in high-value home purchases. Community Land Trust (CLT) loans generally have more flexible credit score criteria to increase affordability and accessibility, sometimes accepting scores as low as 620. Borrowers with excellent credit profiles tend to qualify better for jumbo loans, while CLT loans provide an alternative for those with moderate credit scores seeking homeownership in high-cost areas.

Interest Rates: Which Loan Offers Better Terms?

Jumbo mortgages typically have higher interest rates compared to Community Land Trust (CLT) loans due to the increased risk associated with larger loan amounts. CLT loans often provide more favorable interest rates as they are designed to support affordable homeownership through subsidized terms and community-focused financing. Homebuyers looking for cost-effective financing on high-value homes should carefully compare the current rate spreads, loan eligibility criteria, and long-term cost implications of both options.

Ownership Structures: Individual vs. Community Land Trust

Jumbo mortgages provide individual ownership of high-value homes, offering full property rights and the ability to build equity independently. In contrast, Community Land Trust loans involve a shared ownership structure where the land is owned collectively by the trust, while the homeowner holds a leasehold interest, promoting long-term affordability and community stewardship. This distinction impacts asset control, resale restrictions, and financial benefits tied to property ownership.

Pros and Cons of Jumbo Mortgages

Jumbo mortgages offer financing for high-value homes exceeding conforming loan limits, enabling buyers to purchase luxury properties without multiple loans. Pros include competitive interest rates compared to alternative financing and no restriction on property type, while cons involve stricter credit score requirements, larger down payments typically 20% or more, and higher sensitivity to market fluctuations. Borrowers should weigh the benefits of higher loan amounts against the risks of increased financial burden and potential difficulties in refinancing.

Benefits and Drawbacks of Community Land Trust Loans

Community Land Trust (CLT) loans for high-value homes offer significant benefits, including lower down payment requirements and stabilization of housing costs through shared equity models, making homeownership more accessible in expensive markets. However, CLT loans often come with limitations such as resale restrictions and income eligibility criteria, which can reduce property appreciation potential and complicate financing options. Compared to jumbo mortgages, CLT loans prioritize affordability and community stability over investment returns, appealing to buyers focused on long-term housing security rather than market value growth.

Which Loan Suits High-Value Homebuyers?

Jumbo mortgages cater to high-value homebuyers seeking loans that exceed conforming limits, offering flexible terms but often requiring higher credit scores and larger down payments. Community Land Trust (CLT) loans provide an alternative by promoting affordability through shared equity models, ideal for buyers prioritizing long-term community stability over maximum home equity. High-value homebuyers focused on immediate luxury and investment potential typically prefer jumbo loans, while those valuing affordability and community engagement lean toward CLT loans.

Making the Right Choice: Factors to Consider

When selecting between a Jumbo Mortgage and a Community Land Trust Loan for purchasing high-value homes, evaluate the loan limits, interest rates, and eligibility criteria closely. Jumbo Mortgages typically offer higher borrowing limits but require stronger credit scores and larger down payments, whereas Community Land Trust Loans may provide more affordable options with shared equity but often come with property use restrictions. Assessing your financial stability, long-term homeownership goals, and the specific terms of each loan type will help ensure the most suitable mortgage choice.

Related Important Terms

Jumbo Loan Limit Adjustment

The Jumbo Loan Limit Adjustment allows borrowers to finance high-value homes above conforming loan limits, often exceeding $726,200 in high-cost areas, providing flexibility beyond standard mortgages. Community Land Trust Loans, while offering affordable homeownership through shared equity, typically impose restrictions that limit financing options for luxury properties, making jumbo loans more suitable for buyers seeking greater loan amounts and property value.

Debt-to-Income (DTI) Stretching

Jumbo mortgages typically allow higher debt-to-income (DTI) ratios, enabling buyers to finance luxury properties beyond conventional loan limits, whereas Community Land Trust loans often impose stricter DTI caps to maintain affordability and reduce borrower risk. Stretching DTI with a Jumbo loan increases purchasing power but carries higher risk and potentially higher interest rates compared to the more conservative, income-focused underwriting criteria of Community Land Trust loans.

Portfolio Lending for Luxury Properties

Jumbo mortgages provide tailored portfolio lending solutions for luxury properties, enabling borrowers to finance high-value homes exceeding conforming loan limits with flexible underwriting criteria and competitive rates. Community Land Trust loans, while geared towards affordable housing, typically do not cater to luxury property purchases due to income restrictions and resale price limits inherent in their financing structure.

Community Land Trust (CLT) Equity Share

Community Land Trust (CLT) Equity Share loans provide an innovative financing solution for high-value homes by allowing buyers to purchase a home at a reduced price through shared equity with the trust, thereby lowering monthly mortgage payments compared to Jumbo Mortgages that require higher credit scores and larger down payments. This shared equity model helps maintain long-term housing affordability while enabling access to the luxury market without the financial strain of traditional jumbo loan requirements.

Shared Appreciation Mortgage (SAM)

Shared Appreciation Mortgage (SAM) offers a unique advantage for buyers of high-value homes by allowing them to share the property's appreciation with the lender, reducing initial loan costs compared to traditional Jumbo Mortgages. Community Land Trust Loans paired with SAM enable homeowners to access affordable financing while preserving community equity, contrasting with the higher down payments and stricter qualifying criteria typical of Jumbo Mortgages.

Non-Traditional Collateralization

Jumbo mortgages typically require extensive traditional collateral and higher credit standards to secure financing for high-value homes, while Community Land Trust loans utilize non-traditional collateralization by separating land ownership from home ownership, lowering entry barriers for buyers. This alternative approach enables access to affordable financing by reducing loan risk through shared land ownership and community-backed equity rather than solely relying on property value.

High-Net-Worth Borrower Programs

Jumbo mortgages cater to high-net-worth borrowers seeking financing for luxury properties exceeding conforming loan limits, offering competitive rates and flexible terms. In contrast, Community Land Trust loans provide affordable homeownership options with shared equity models, primarily targeting income-qualified buyers and often including resale restrictions to maintain long-term housing affordability.

CLT Leasehold Mortgage

Community Land Trust (CLT) Leasehold Mortgages offer a unique financing option for high-value homes by allowing buyers to lease the land while owning the home, significantly reducing upfront costs compared to traditional jumbo mortgages. These mortgages often provide more flexible underwriting criteria and lower interest rates, making homeownership accessible within high-cost markets where jumbo loans may have stringent requirements and higher financial burdens.

Alternative Documentation Underwriting

Jumbo mortgages typically require extensive traditional documentation including detailed income verification, credit history, and asset statements, while Community Land Trust (CLT) loans offer alternative documentation underwriting by prioritizing borrower stability and community impact over conventional financial metrics. This flexibility in CLT loans can make high-value homeownership more accessible for buyers who may not meet standard jumbo loan criteria but demonstrate strong repayment potential through non-traditional evidence.

Green Jumbo Mortgage Discount

Green Jumbo Mortgages offer competitive interest rate discounts for high-value homebuyers who meet energy efficiency criteria, making them more cost-effective compared to traditional Jumbo Mortgages. In contrast, Community Land Trust Loans provide affordable homeownership opportunities through land ownership separation but typically lack specific green incentives or rate reductions for energy-efficient features.

Jumbo Mortgage vs Community Land Trust Loan for buying high-value homes. Infographic

moneydiff.com

moneydiff.com