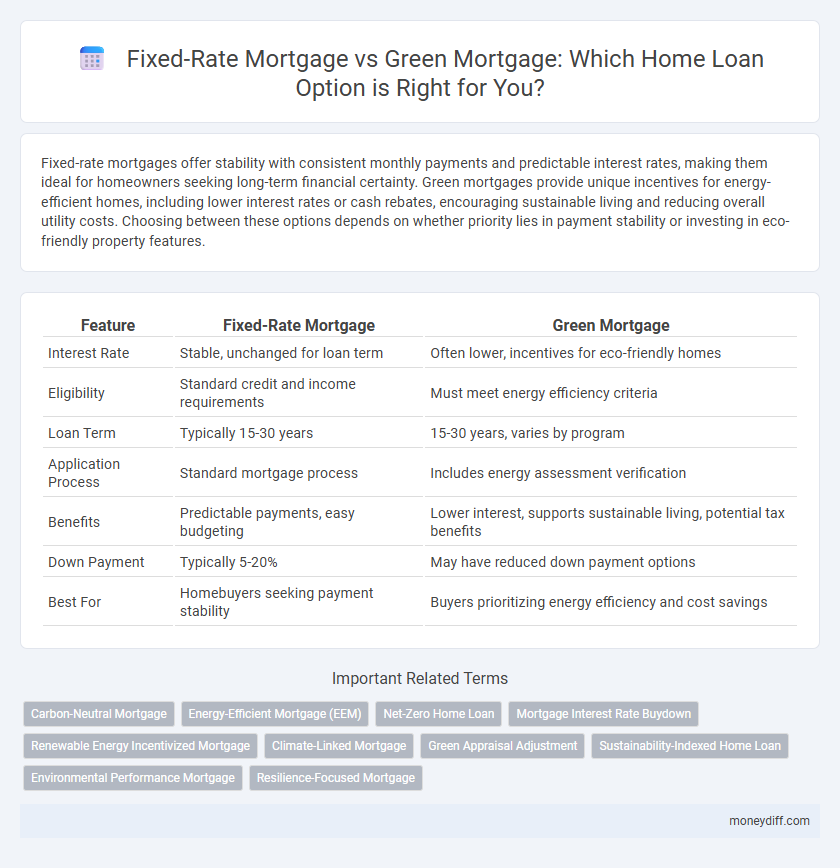

Fixed-rate mortgages offer stability with consistent monthly payments and predictable interest rates, making them ideal for homeowners seeking long-term financial certainty. Green mortgages provide unique incentives for energy-efficient homes, including lower interest rates or cash rebates, encouraging sustainable living and reducing overall utility costs. Choosing between these options depends on whether priority lies in payment stability or investing in eco-friendly property features.

Table of Comparison

| Feature | Fixed-Rate Mortgage | Green Mortgage |

|---|---|---|

| Interest Rate | Stable, unchanged for loan term | Often lower, incentives for eco-friendly homes |

| Eligibility | Standard credit and income requirements | Must meet energy efficiency criteria |

| Loan Term | Typically 15-30 years | 15-30 years, varies by program |

| Application Process | Standard mortgage process | Includes energy assessment verification |

| Benefits | Predictable payments, easy budgeting | Lower interest, supports sustainable living, potential tax benefits |

| Down Payment | Typically 5-20% | May have reduced down payment options |

| Best For | Homebuyers seeking payment stability | Buyers prioritizing energy efficiency and cost savings |

Understanding Fixed-Rate Mortgages

Fixed-rate mortgages offer homeowners predictable monthly payments with a consistent interest rate throughout the loan term, typically 15 to 30 years. This stability helps borrowers budget effectively without the risk of rising interest rates, making it ideal for long-term financial planning. Unlike green mortgages, which often include incentives for energy-efficient homes, fixed-rate loans emphasize payment certainty over environmental benefits.

What Is a Green Mortgage?

A green mortgage is a home loan designed to finance energy-efficient properties or improvements, offering lower interest rates or down payment incentives. These loans encourage sustainable building practices by reducing overall energy costs and environmental impact. Fixed-rate mortgages provide consistent payments over time, while green mortgages combine financial benefits with eco-friendly homeownership.

Interest Rate Comparison: Fixed-Rate vs Green Mortgage

Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Green mortgages often include lower interest rates or incentives tied to energy-efficient home improvements, potentially reducing overall borrowing costs. Comparing typical fixed-rate mortgage rates averaging 3-4% against discounted green mortgage rates, often 0.25-0.5% below market standard, highlights cost-saving opportunities linked to sustainability investments.

Eligibility Criteria for Each Mortgage Type

Eligibility for a fixed-rate mortgage typically requires a stable credit score above 620, steady income documentation, and a down payment of at least 3% to 20%. Green mortgage eligibility often demands property certification such as LEED or ENERGY STAR and may require higher energy efficiency standards compliance. Borrowers must provide documentation proving the home's sustainable features to qualify for a green mortgage, which can include appraisals verifying energy savings.

Upfront Costs and Fees

Fixed-rate mortgages typically involve standard upfront costs such as appraisal fees, origination fees, and closing costs, which remain consistent regardless of the loan term. Green mortgages often offer lower upfront fees or incentives like reduced origination charges to promote energy-efficient home improvements and sustainable building practices. Borrowers should compare these upfront costs carefully, as green mortgages might require additional expenses related to home energy assessments or certifications, impacting the overall loan expense.

Long-Term Savings Potential

Fixed-rate mortgages offer stable monthly payments and predictable interest costs over the loan term, making long-term financial planning straightforward. Green mortgages, designed for energy-efficient homes, often provide lower interest rates or incentives that can lead to significant savings on energy bills and overall housing costs. Comparing long-term savings potential, green mortgages may deliver added value through reduced utility expenses and increased property value, complementing traditional fixed-rate loan benefits.

Environmental Benefits of Green Mortgages

Green mortgages provide significant environmental benefits by incentivizing energy-efficient home improvements, reducing carbon footprints, and promoting sustainable living practices. Unlike fixed-rate mortgages that focus solely on consistent interest payments, green mortgages often offer lower rates or financial incentives tied to the environmental performance of the property. Homebuyers choosing green mortgages contribute to reduced energy consumption and support eco-friendly construction standards.

Risk Factors and Stability

Fixed-rate mortgages offer predictable monthly payments and long-term stability by locking in an interest rate, minimizing the risk of payment increases due to market fluctuations. Green mortgages often provide lower interest rates or incentives for energy-efficient homes but may carry risks tied to property qualification and potential changes in regulatory benefits. Borrowers prioritizing financial stability typically choose fixed-rate loans, while those seeking environmental benefits must carefully evaluate the long-term value and risks associated with green mortgage criteria.

Government Incentives and Support Programs

Government incentives for fixed-rate mortgages usually focus on stability and affordability through tax deductions on mortgage interest and first-time homebuyer credits. Green mortgages benefit from specialized support programs offering reduced interest rates or down payment assistance for energy-efficient home improvements, promoted by agencies like the Department of Energy and Environmental Protection. These targeted incentives make green mortgages a financially attractive option for environmentally conscious borrowers seeking long-term savings on utility costs alongside favorable loan terms.

Choosing the Right Mortgage for Your Financial Goals

Fixed-rate mortgages offer predictable monthly payments with stable interest rates over the loan term, making them ideal for homeowners seeking long-term financial certainty. Green mortgages provide incentives like lower interest rates or down payment assistance for energy-efficient homes, aligning with sustainability goals and reducing overall utility costs. Evaluating your financial priorities, such as budget stability versus environmental impact, helps determine the best mortgage option tailored to your financial goals.

Related Important Terms

Carbon-Neutral Mortgage

A carbon-neutral mortgage, a type of green mortgage, offers borrowers lower interest rates and incentives for purchasing energy-efficient homes or implementing eco-friendly upgrades, reducing both loan costs and environmental impact. Fixed-rate mortgages provide consistent monthly payments with stable interest rates, but lack the sustainability benefits and potential financial advantages tied to carbon-neutral home financing options.

Energy-Efficient Mortgage (EEM)

Fixed-rate mortgages offer predictable monthly payments with stable interest rates, while Energy-Efficient Mortgages (EEMs) specifically support homebuyers aiming to finance energy-saving improvements, often providing higher loan limits and lower rates to encourage sustainability. EEMs integrate energy efficiency into the home loan by allowing borrowers to finance energy upgrades, reducing utility costs and enhancing property value while benefiting from favorable mortgage terms.

Net-Zero Home Loan

A Fixed-Rate Mortgage offers predictable monthly payments with a stable interest rate over the loan term, while a Green Mortgage, such as a Net-Zero Home Loan, provides financial incentives for energy-efficient homes aiming to reduce carbon emissions and lower utility costs. Homebuyers seeking sustainable living benefit from Net-Zero Home Loans through lower interest rates, potential rebates, and support for environmentally friendly upgrades that increase long-term property value.

Mortgage Interest Rate Buydown

Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing predictable monthly payments, while green mortgages often include interest rate buydown incentives to encourage energy-efficient home purchases. Interest rate buydowns in green mortgages can significantly lower the effective mortgage interest rate, reducing overall borrowing costs and promoting sustainable homeownership.

Renewable Energy Incentivized Mortgage

Fixed-rate mortgages offer predictable monthly payments with stable interest rates, making budgeting easier for homeowners, while green mortgages provide specialized incentives such as lower interest rates or down payment assistance to support energy-efficient homes with renewable energy features. Renewable energy incentivized mortgages prioritize financing for properties equipped with solar panels, geothermal heating, or other sustainable technologies, often resulting in long-term savings through reduced utility costs and increased property value.

Climate-Linked Mortgage

Fixed-rate mortgages offer stable interest rates over the loan term, providing predictability in monthly payments, while climate-linked green mortgages incentivize borrowers to adopt energy-efficient home improvements by offering lower rates or financial rewards. Climate-linked mortgages support sustainable housing by linking loan terms to environmental performance metrics, such as reduced carbon emissions or improved energy ratings, encouraging eco-friendly investments in real estate.

Green Appraisal Adjustment

Green appraisal adjustments increase home value estimates by accounting for energy-efficient upgrades, making green mortgages more attractive by potentially lowering loan-to-value ratios compared to fixed-rate mortgages. Incorporating energy-saving features into appraisals helps borrowers qualify for better terms and reflects long-term cost savings in green mortgage financing.

Sustainability-Indexed Home Loan

Sustainability-indexed home loans, often referred to as green mortgages, offer borrowers lower interest rates tied to the home's energy efficiency and environmental impact, promoting sustainable living. Unlike fixed-rate mortgages that provide consistent interest rates regardless of property sustainability, green mortgages incentivize energy-efficient upgrades and reduce overall carbon footprint through financial benefits.

Environmental Performance Mortgage

A Fixed-Rate Mortgage offers stable interest payments over the loan term, while a Green Mortgage, also known as an Environmental Performance Mortgage, provides incentives such as lower interest rates or rebates for homes that meet energy efficiency or sustainability standards. These loans promote eco-friendly construction and renovations by rewarding homeowners for reducing their carbon footprint and utility costs.

Resilience-Focused Mortgage

Resilience-focused mortgages emphasize long-term financial stability by offering fixed-rate mortgage options that provide consistent monthly payments regardless of market fluctuations, reducing borrower risk during economic uncertainty. Green mortgages, while promoting energy-efficient home improvements, often include variable components that may affect payment predictability, making fixed-rate resilience-focused loans a more secure choice for homeowners prioritizing fiscal stability.

Fixed-Rate Mortgage vs Green Mortgage for home loans. Infographic

moneydiff.com

moneydiff.com