Interest-only mortgages offer lower initial monthly payments by requiring only interest repayment, making them attractive for short-term cash flow management but resulting in higher payments later. Offset mortgages link your savings to your loan balance, reducing interest costs and monthly payments over time while maintaining principal repayment. Choosing between these options depends on your financial goals, whether prioritizing immediate affordability or long-term interest savings.

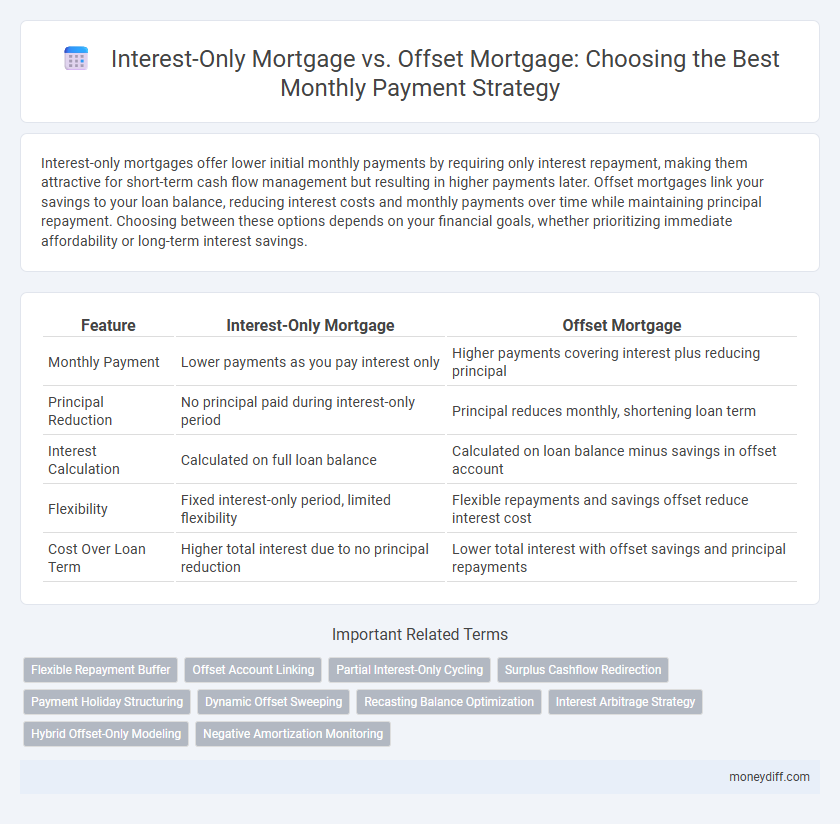

Table of Comparison

| Feature | Interest-Only Mortgage | Offset Mortgage |

|---|---|---|

| Monthly Payment | Lower payments as you pay interest only | Higher payments covering interest plus reducing principal |

| Principal Reduction | No principal paid during interest-only period | Principal reduces monthly, shortening loan term |

| Interest Calculation | Calculated on full loan balance | Calculated on loan balance minus savings in offset account |

| Flexibility | Fixed interest-only period, limited flexibility | Flexible repayments and savings offset reduce interest cost |

| Cost Over Loan Term | Higher total interest due to no principal reduction | Lower total interest with offset savings and principal repayments |

Understanding Interest-Only Mortgages for Monthly Payments

Interest-only mortgages allow borrowers to pay only the interest on the loan for a set period, typically resulting in lower initial monthly payments compared to traditional mortgages. This strategy can improve short-term cash flow but does not reduce the principal balance, potentially leading to higher payments later when principal repayments begin. Understanding the structure and implications of interest-only payments is crucial for effective monthly payment planning and long-term financial management.

What Is an Offset Mortgage? Key Features Explained

An offset mortgage links your savings account to your mortgage balance, reducing the interest charged by offsetting your savings against the loan principal. Key features include paying interest only on the net balance between your mortgage and savings, flexible access to your savings, and potential to shorten the mortgage term or reduce monthly payments. This strategy optimizes cash flow by maximizing savings utility, unlike interest-only mortgages where principal remains unchanged during the interest-only period.

Comparing Monthly Payment Structures: Interest-Only vs Offset

Interest-only mortgages require borrowers to pay only the interest portion of the loan each month, resulting in lower initial monthly payments but no principal reduction during the interest-only period. Offset mortgages link a savings account to the loan balance, reducing the interest charged and enabling simultaneous principal repayment, which can lead to higher monthly payments but faster equity buildup. Comparing these structures, interest-only offers short-term payment relief, while offset mortgages provide long-term savings and more efficient debt reduction.

Cash Flow Benefits of Interest-Only Mortgages

Interest-only mortgages provide significant cash flow benefits by requiring payments solely on the loan principal interest, reducing initial monthly outlays compared to offset mortgages. This option allows borrowers to maximize liquidity for investment or other expenses, making it ideal for those with irregular income or short-term financial goals. While offset mortgages reduce interest by linking savings to the loan balance, interest-only plans prioritize immediate cash flow flexibility during the payment period.

How Offset Mortgages Reduce Monthly Interest Costs

Offset mortgages link a savings account to the mortgage balance, effectively reducing the outstanding loan amount on which interest is calculated, leading to lower monthly interest payments. By offsetting deposited savings against the principal, borrowers can decrease interest accumulation without altering monthly repayments. This strategy maximizes cash flow efficiency and accelerates mortgage repayment compared to traditional interest-only mortgages with fixed monthly interest costs.

Flexibility and Risks: Choosing the Right Mortgage Strategy

Interest-only mortgages offer lower initial monthly payments by requiring payment of interest only, providing short-term cash flow flexibility but increasing risk due to principal repayment at term end. Offset mortgages link a savings account to the mortgage balance, reducing interest charged and allowing flexible payments, minimizing long-term interest costs and risk exposure. Selecting the right strategy depends on balancing cash flow needs and risk tolerance, with offset mortgages often preferred for long-term savings efficiency and interest reduction.

Impact on Long-Term Debt: Interest-Only vs Offset Mortgages

Interest-only mortgages lower initial monthly payments by requiring interest payments only, which delays principal repayment and can extend the loan term, increasing total long-term debt. Offset mortgages link a savings account to the mortgage balance, reducing the principal on which interest is calculated and accelerating debt repayment, ultimately lowering total interest paid. Choosing between these strategies significantly affects long-term financial obligations and overall interest costs.

Suitability: Who Should Choose Each Mortgage Type?

Interest-only mortgages suit borrowers seeking lower initial monthly payments and expecting increased income or asset growth for future principal repayment. Offset mortgages benefit homeowners with savings balances aiming to reduce interest costs by linking savings to the mortgage balance. Those prioritizing long-term interest savings and flexible repayment typically prefer offset mortgages, while individuals needing short-term cash flow relief often opt for interest-only options.

Tips to Optimize Monthly Payments with Each Mortgage

Maximize monthly savings on an Interest-Only Mortgage by consistently paying more than the interest due to reduce principal faster, minimizing total interest over the loan term. For an Offset Mortgage, link your savings account directly to your mortgage balance, as every dollar in savings offsets the loan amount, effectively reducing interest charged and lowering monthly payments. Regularly review account balances and adjust payment strategies to leverage the full benefits of both mortgage types and optimize cash flow efficiently.

Final Comparison: Which Mortgage Fits Your Financial Goals?

Interest-Only Mortgages offer lower initial monthly payments by requiring interest-only payments for a set period, ideal for borrowers seeking short-term cash flow flexibility. Offset Mortgages link your savings to your mortgage balance, reducing interest payable and enabling faster principal repayment, suited for those prioritizing long-term debt reduction. Your choice depends on whether immediate affordability or accelerated equity build-up aligns better with your overall financial goals.

Related Important Terms

Flexible Repayment Buffer

Interest-only mortgages provide a flexible repayment buffer by allowing borrowers to pay only the interest portion each month, reducing initial monthly payments while preserving capital for other uses. Offset mortgages link a savings account to the loan balance, effectively reducing the interest charged and offering borrowers a dynamic way to lower monthly payments by adjusting saving behaviors.

Offset Account Linking

Offset mortgages link a savings account to the mortgage balance, reducing the principal on which interest is calculated and significantly lowering monthly payments. Unlike interest-only mortgages that require paying only interest for a period without reducing principal, offset accounts actively decrease interest costs, offering more effective long-term savings.

Partial Interest-Only Cycling

Partial Interest-Only Cycling combines phased interest-only repayments with principal repayments, reducing monthly payments during initial cycles and increasing them later to balance affordability and equity growth. Offset Mortgages link savings to the mortgage balance, lowering interest costs monthly and accelerating principal reduction while maintaining flexible access to funds.

Surplus Cashflow Redirection

Interest-only mortgages allow borrowers to redirect surplus cashflow towards investments or savings since monthly payments cover only interest, reducing immediate financial pressure. Offset mortgages use surplus cashflow to directly reduce the principal balance on which interest is calculated, effectively lowering monthly interest payments and accelerating equity build-up.

Payment Holiday Structuring

Interest-only mortgages allow borrowers to reduce monthly payments drastically by paying only the interest for a set period, creating a payment holiday that can improve short-term cash flow but delay principal repayment. Offset mortgages reduce interest charges by linking savings accounts to the loan balance, effectively lowering monthly payments without suspending principal payments, offering a flexible payment holiday structure that balances savings and loan reduction.

Dynamic Offset Sweeping

Dynamic Offset Sweeping in offset mortgages reduces monthly interest payments by continuously transferring surplus funds from a linked transaction account, effectively lowering the loan balance and maximizing interest savings compared to the fixed interest-only payments. This strategy enhances cash flow flexibility and enables faster principal repayment without increasing the monthly commitment, unlike traditional interest-only mortgage structures.

Recasting Balance Optimization

Interest-only mortgages reduce initial monthly payments by requiring borrowers to pay only interest, allowing more cash flow but leaving the principal balance unchanged until recasting, which can lead to large final payments; offset mortgages link savings accounts to the loan balance, effectively reducing the principal subject to interest and optimizing monthly payments by lowering interest costs during recasting. Strategic recasting in offset mortgages leverages accumulated savings to reduce the balance, thereby minimizing monthly payments faster than interest-only structures where recasting only occurs when principal is paid.

Interest Arbitrage Strategy

Interest-Only Mortgages enable borrowers to minimize initial monthly payments by paying only the interest, allowing funds to be invested elsewhere for potential higher returns through interest arbitrage. Offset Mortgages reduce payable interest by linking savings accounts to the mortgage balance, directly lowering monthly interest costs but limiting arbitrage opportunities compared to Interest-Only strategies.

Hybrid Offset-Only Modeling

Hybrid offset-only mortgage modeling combines the benefits of interest-only payments with an offset account that reduces interest charges by linking the mortgage balance to the account balance, effectively lowering monthly payments and accelerating principal repayment. This strategy optimizes cash flow management and minimizes interest expense compared to traditional interest-only or offset mortgage approaches.

Negative Amortization Monitoring

Interest-Only Mortgages risk negative amortization as monthly payments cover only interest, causing principal to remain unchanged or increase if payments are missed. Offset Mortgages link savings to the loan balance, reducing interest and preventing negative amortization by ensuring principal repayments exceed accrued interest.

Interest-Only Mortgage vs Offset Mortgage for monthly payment strategies. Infographic

moneydiff.com

moneydiff.com