An Interest-Only Mortgage allows borrowers to pay only the interest for a set period, reducing initial monthly payments but leaving the principal unchanged. An Offset Mortgage links your savings account to your mortgage balance, reducing interest paid and accelerating principal repayment. Choosing between the two depends on your cash flow needs and long-term financial goals for efficient mortgage repayment.

Table of Comparison

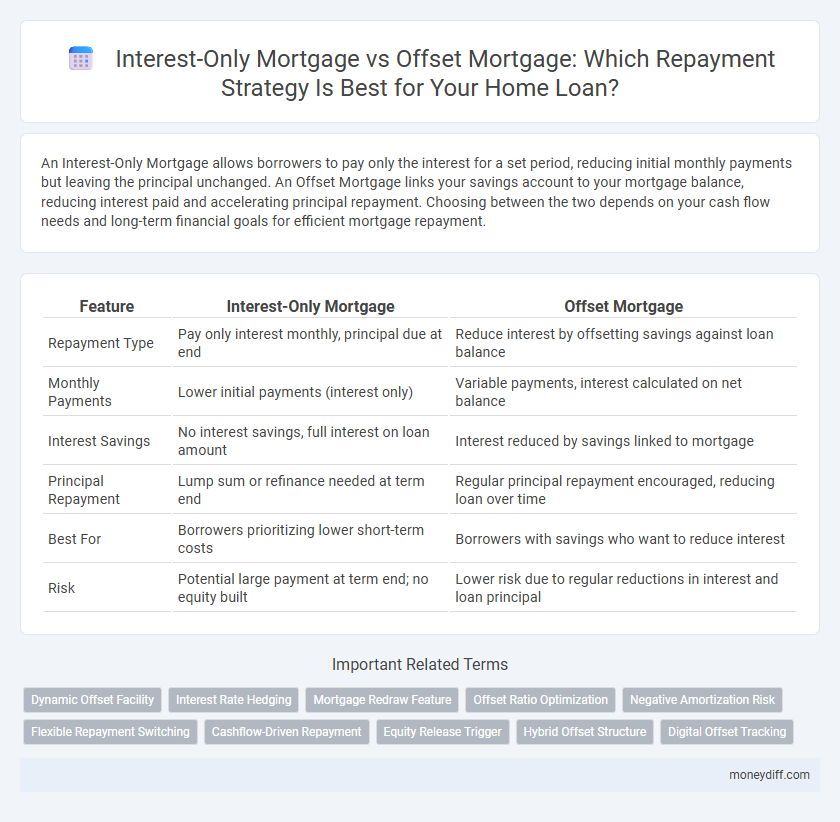

| Feature | Interest-Only Mortgage | Offset Mortgage |

|---|---|---|

| Repayment Type | Pay only interest monthly, principal due at end | Reduce interest by offsetting savings against loan balance |

| Monthly Payments | Lower initial payments (interest only) | Variable payments, interest calculated on net balance |

| Interest Savings | No interest savings, full interest on loan amount | Interest reduced by savings linked to mortgage |

| Principal Repayment | Lump sum or refinance needed at term end | Regular principal repayment encouraged, reducing loan over time |

| Best For | Borrowers prioritizing lower short-term costs | Borrowers with savings who want to reduce interest |

| Risk | Potential large payment at term end; no equity built | Lower risk due to regular reductions in interest and loan principal |

Understanding Interest-Only Mortgages

Interest-only mortgages allow borrowers to pay only the interest on the loan for a set period, typically 5 to 10 years, without reducing the principal balance. This repayment strategy can result in lower initial monthly payments but requires a clear plan for repaying the principal once the interest-only term ends. Understanding the risks and benefits of interest-only mortgages is crucial, as they can impact long-term financial stability and overall mortgage costs compared to offset mortgages that link savings to loan balance reduction.

What Is an Offset Mortgage?

An offset mortgage links your savings account to your mortgage balance, allowing the bank to offset your savings against the loan, reducing the amount of interest charged. This strategy can lower monthly interest payments and shorten the mortgage term without increasing monthly repayments. Unlike an interest-only mortgage, where monthly payments cover only interest, an offset mortgage helps borrowers pay down principal faster using their savings.

Key Differences Between Interest-Only and Offset Mortgages

Interest-only mortgages require borrowers to pay only the interest on the loan principal for a set period, resulting in lower initial monthly payments but no reduction in the principal balance during that term. Offset mortgages link the borrower's savings account to the mortgage balance, using the savings to reduce the interest charged, enabling faster principal repayment and potential interest savings over time. Key differences include repayment structure, interest calculation, and impact on loan duration, making offset mortgages preferable for reducing total interest and shortening the mortgage term, while interest-only options offer short-term payment flexibility.

Pros and Cons of Interest-Only Mortgages

Interest-only mortgages offer lower initial monthly payments since borrowers pay only the interest without reducing the principal balance, providing cash flow flexibility. However, this repayment strategy risks higher long-term costs as the principal remains untouched, potentially leading to increased total interest paid over the loan term. Borrowers face the challenge of repaying the full principal at the end of the term or refinancing, which can result in payment shocks or refinancing risks.

Advantages and Disadvantages of Offset Mortgages

Offset mortgages link your savings account to your mortgage balance, reducing the amount of interest charged and potentially saving thousands over the loan term. One advantage is the ability to save on interest without locking away savings, offering flexibility and access to funds anytime. However, offset mortgages often come with higher interest rates or fees, and their benefits are most significant for borrowers with substantial savings balances.

Impact on Monthly Repayments

Interest-only mortgages typically result in lower initial monthly repayments since borrowers pay only the interest without reducing the principal balance, increasing cash flow flexibility but extending overall loan duration. Offset mortgages link a savings account to the mortgage, reducing the effective loan balance and decreasing interest charged, which can lower monthly repayments and shorten the repayment term. Choosing between these options depends on prioritizing short-term affordability against long-term savings and mortgage payoff speed.

Long-Term Financial Implications

Interest-only mortgages typically result in higher total interest payments over the loan term, as principal remains unchanged until the end, potentially increasing long-term costs. Offset mortgages reduce interest by linking savings accounts to the loan balance, directly lowering the amount of interest charged and accelerating principal repayment. Choosing between these strategies impacts overall financial health, with offset mortgages often offering greater long-term savings despite potentially higher monthly payments.

Suitability for Different Types of Borrowers

Interest-only mortgages suit borrowers prioritizing lower initial payments and flexible cash flow, often ideal for investors or those expecting income growth. Offset mortgages benefit borrowers looking to reduce interest costs by linking savings with their mortgage balance, best for disciplined savers with stable incomes. Evaluating personal financial goals and repayment capabilities ensures selecting the optimal mortgage type for long-term affordability and wealth building.

Tax Considerations for Interest-Only and Offset Mortgages

Interest-only mortgages offer lower monthly payments since borrowers pay only the interest, but the principal remains unchanged, potentially affecting tax deductions based on the property's use and jurisdictional rules. Offset mortgages link the loan balance to a savings account, reducing interest earned on deposits and possibly altering deductible interest amounts, which can impact tax liabilities. Understanding specific regional tax regulations on mortgage interest deductions is essential for optimizing repayment strategies between interest-only and offset mortgage options.

Choosing the Right Mortgage Repayment Strategy

Interest-only mortgages offer lower initial payments by requiring borrowers to pay only interest for a set period, which can improve short-term cash flow but results in no equity buildup during that time. Offset mortgages link a savings account to the mortgage balance, reducing the interest charged and accelerating repayment through effective use of savings. Choosing the right strategy depends on financial goals, risk tolerance, and cash flow needs, with offset mortgages generally benefiting those who maintain substantial savings and interest-only options suiting those expecting increased future income.

Related Important Terms

Dynamic Offset Facility

A Dynamic Offset Facility in an offset mortgage reduces the interest payable by linking your mortgage to your transaction account, allowing day-to-day balances to directly offset the loan principal and accelerate repayment without additional repayments. Unlike interest-only mortgages that require full principal repayment at term end, offset mortgages with dynamic offset offer ongoing interest savings and flexible repayment options, optimizing cash flow management and total interest costs over the loan term.

Interest Rate Hedging

Interest-Only Mortgages typically offer lower initial monthly payments but carry the risk of interest rate fluctuations impacting total repayment costs, making interest rate hedging crucial to stabilize future expenses. Offset Mortgages link savings to the mortgage balance, effectively reducing interest payable and providing a natural hedge against rising interest rates by lowering the overall loan interest burden.

Mortgage Redraw Feature

Interest-only mortgages allow borrowers to pay only the interest for a set period, reducing initial payments but limiting principal repayment and equity buildup, which can hinder the effectiveness of a mortgage redraw feature. Offset mortgages link a savings account to the loan balance, enabling borrowers to minimize interest while retaining the flexibility to redraw funds, optimizing cash flow and accelerating principal repayment.

Offset Ratio Optimization

Offset mortgage optimizes repayment by linking the mortgage balance with a savings account, reducing the interest payable based on the offset ratio between the two balances. This strategy effectively lowers total interest costs and shortens the loan term compared to interest-only mortgages, where principal remains unchanged during the interest-only period.

Negative Amortization Risk

Interest-only mortgages carry a significant negative amortization risk as monthly payments cover only interest, causing the principal balance to remain unchanged or even increase if payments fall short. Offset mortgages mitigate this risk by linking savings accounts to the loan balance, effectively reducing interest accrual and helping borrowers repay the principal faster.

Flexible Repayment Switching

Interest-only mortgages allow borrowers to pay only interest for a set period, maximizing short-term cash flow but requiring lump-sum principal repayment later, while offset mortgages link savings to the mortgage balance, reducing interest payments dynamically. Flexible repayment switching between these options enables homeowners to optimize cash flow and interest savings by adjusting their strategy according to financial circumstances and market conditions.

Cashflow-Driven Repayment

Interest-only mortgages provide lower initial monthly payments by requiring interest payments only, preserving cashflow for other investments or expenses, but result in higher total interest costs over time. Offset mortgages link savings to the mortgage balance, reducing interest accrued and supporting a cashflow-driven repayment strategy by lowering monthly interest expenses while allowing flexible lump-sum repayments.

Equity Release Trigger

An Interest-Only Mortgage allows borrowers to pay only the interest, preserving capital but delaying equity buildup, which can trigger limited equity release options compared to an Offset Mortgage that links savings to the mortgage balance, actively reducing interest and accelerating equity accumulation for more immediate equity release potential. Choosing between these repayment strategies impacts the timing and amount of accessible home equity, crucial for homeowners planning future financial flexibility.

Hybrid Offset Structure

A Hybrid Offset Mortgage combines the benefits of an Interest-Only Mortgage with an Offset Mortgage by allowing borrowers to pay interest on the principal while offsetting savings against the loan balance, reducing effective interest costs. This structure offers flexibility in repayment strategy by minimizing interest expenses and managing cash flow, making it an efficient choice for borrowers seeking to optimize mortgage repayment.

Digital Offset Tracking

Interest-only mortgages require paying only the interest for a set period, resulting in lower initial payments but no principal reduction, while offset mortgages link savings accounts to the mortgage balance, digitally tracking and reducing interest charges in real time based on the offset balance. Digital offset tracking platforms provide precise daily calculations of interest savings, enhancing repayment strategy efficiency by allowing borrowers to optimize their savings and reduce mortgage duration.

Interest-Only Mortgage vs Offset Mortgage for repayment strategy. Infographic

moneydiff.com

moneydiff.com