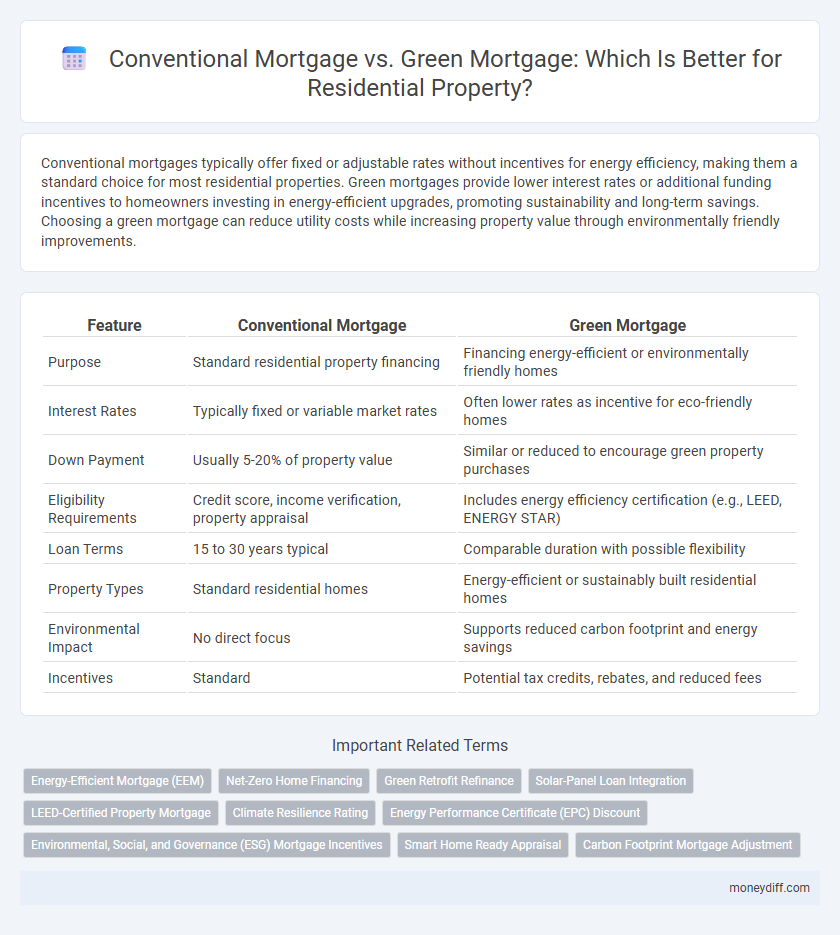

Conventional mortgages typically offer fixed or adjustable rates without incentives for energy efficiency, making them a standard choice for most residential properties. Green mortgages provide lower interest rates or additional funding incentives to homeowners investing in energy-efficient upgrades, promoting sustainability and long-term savings. Choosing a green mortgage can reduce utility costs while increasing property value through environmentally friendly improvements.

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Standard residential property financing | Financing energy-efficient or environmentally friendly homes |

| Interest Rates | Typically fixed or variable market rates | Often lower rates as incentive for eco-friendly homes |

| Down Payment | Usually 5-20% of property value | Similar or reduced to encourage green property purchases |

| Eligibility Requirements | Credit score, income verification, property appraisal | Includes energy efficiency certification (e.g., LEED, ENERGY STAR) |

| Loan Terms | 15 to 30 years typical | Comparable duration with possible flexibility |

| Property Types | Standard residential homes | Energy-efficient or sustainably built residential homes |

| Environmental Impact | No direct focus | Supports reduced carbon footprint and energy savings |

| Incentives | Standard | Potential tax credits, rebates, and reduced fees |

Understanding Conventional Mortgages: Key Features and Benefits

Conventional mortgages typically require a higher credit score and a down payment of at least 3-5%, making them accessible for a broad range of borrowers with stable financial profiles. These loans offer fixed or adjustable interest rates, providing predictable monthly payments and long-term homeownership stability. Conventional mortgages do not directly incentivize energy efficiency but remain a popular choice due to flexible terms and widespread availability across financial institutions.

What Is a Green Mortgage? An Overview

A green mortgage is a specialized loan designed to finance energy-efficient, eco-friendly residential properties, often offering lower interest rates or incentives for sustainable home improvements. These mortgages prioritize properties with features like solar panels, energy-efficient windows, and sustainable materials, promoting reduced energy consumption and environmental impact. Conventional mortgages, by contrast, typically do not factor in energy efficiency or environmental sustainability in their terms or eligibility criteria.

Eligibility Criteria: Conventional vs Green Mortgages

Conventional mortgage eligibility typically requires a strong credit score, stable income, and a down payment of at least 3-5%, with no specific energy efficiency standards. Green mortgage eligibility often demands property certification for energy-efficient features such as ENERGY STAR or LEED, alongside standard credit and income requirements. Lenders may also offer better terms or higher loan limits for green mortgages when the home demonstrates reduced environmental impact and lower utility costs.

Interest Rates Comparison: Conventional and Green Mortgages

Interest rates for green mortgages on residential properties are often lower than those for conventional mortgages due to incentives promoting energy-efficient homes. Conventional mortgage rates typically range between 5% and 7%, while green mortgage rates can be reduced by 0.25% to 0.5% as lenders recognize the long-term value of sustainable improvements. This interest rate difference enhances affordability, making green mortgages an attractive option for environmentally conscious homebuyers.

Energy Efficiency Requirements for Green Mortgages

Green mortgages require residential properties to meet specific energy efficiency standards, such as ENERGY STAR certification or compliance with LEED criteria, to qualify for favorable loan terms. Conventional mortgages do not mandate energy performance benchmarks, thus offering standard interest rates and conditions regardless of a home's sustainability features. These energy efficiency requirements in green mortgages promote reduced utility costs, lower carbon footprints, and increased property value over time.

Upfront Costs and Long-Term Savings Analysis

Conventional mortgages typically require higher upfront costs, including larger down payments and closing fees, compared to green mortgages, which often offer incentives such as reduced interest rates or lower fees to encourage energy-efficient home purchases. Long-term savings with green mortgages can be substantial due to lower utility bills and potential tax credits for energy-efficient upgrades, offsetting the initial investment. Analyzing both options reveals that while conventional mortgages may have simpler qualification criteria, green mortgages provide significant financial benefits over time for environmentally conscious homeowners.

Environmental Impact: Green Mortgage Advantages

Green mortgages offer significant environmental benefits by incentivizing energy-efficient home improvements, which reduce carbon emissions and lower utility bills. Unlike conventional mortgages, green mortgages specifically target properties with sustainable features such as solar panels, high-performance insulation, and energy-efficient windows, promoting greener living standards. This environmentally-focused financing option encourages homeowners to invest in eco-friendly upgrades, contributing to long-term energy conservation and reduced environmental footprint.

Government Incentives for Green Home Financing

Government incentives for green home financing often include tax credits, reduced interest rates, and rebates that make green mortgages more attractive compared to conventional mortgages. These programs aim to encourage energy-efficient home improvements and sustainable building practices by lowering borrowing costs and promoting environmental benefits. Homebuyers opting for green mortgages can access exclusive benefits that support reduced carbon footprints and long-term savings on utility bills.

Which Mortgage Suits Your Financial Goals?

Conventional mortgages offer flexibility and wider lender options suitable for buyers prioritizing competitive interest rates and standard loan terms. Green mortgages provide incentives like lower interest rates or reduced down payments for energy-efficient homes, aligning with financial goals centered on long-term utility savings and environmental impact. Choosing between the two depends on your priorities: immediate affordability and broader options versus sustainability-driven savings and environmental benefits.

Steps to Apply: Conventional vs Green Mortgage Process

Applying for a conventional mortgage involves submitting standard financial documents such as income verification, credit reports, and property appraisals, followed by lender underwriting and approval. In contrast, the green mortgage application process requires additional documentation on the property's energy efficiency, including energy audit reports and certification of green features like solar panels or insulation upgrades. Both processes demand a thorough credit check and income assessment, but green mortgages often include extra steps to validate environmental improvements for eligibility and potential financing incentives.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) enable homebuyers to finance energy-saving upgrades within a conventional mortgage, offering lower interest rates and increased loan limits based on projected utility savings. These mortgages support the purchase or refinancing of residential properties by integrating energy efficiency improvements, reducing long-term costs and environmental impact compared to standard conventional mortgage options.

Net-Zero Home Financing

Net-zero home financing through green mortgages offers lower interest rates and incentives for energy-efficient residential properties compared to conventional mortgages, which generally lack such benefits. Homebuyers seeking sustainable living can leverage green mortgage programs to reduce overall costs while supporting environmentally friendly construction and renovations.

Green Retrofit Refinance

Green Retrofit Refinance offers homeowners the advantage of refinancing their existing mortgage with better terms by funding energy-efficient upgrades, reducing both monthly payments and environmental impact. Conventional Mortgages lack this sustainability incentive, typically not accounting for improvements that lower utility costs or raise property value through eco-friendly enhancements.

Solar-Panel Loan Integration

Conventional mortgages typically do not include provisions for solar-panel loan integration, requiring separate financing for renewable energy installations, whereas green mortgages often incorporate solar-panel loans into a single, streamlined payment structure, reducing overall borrowing costs and promoting energy-efficient home improvements. This integration supports increased property value and long-term savings by aligning financing with sustainability goals.

LEED-Certified Property Mortgage

Conventional mortgages for residential properties typically offer standard interest rates and terms without incentives for energy efficiency, whereas green mortgages specifically cater to LEED-certified properties, providing lower interest rates and financial benefits that encourage sustainable building practices. LEED-certified property mortgages leverage the reduced environmental impact and energy savings of eco-friendly homes, potentially increasing property value and lowering utility costs for homeowners.

Climate Resilience Rating

Conventional mortgages typically do not consider a property's climate resilience rating, whereas green mortgages often prioritize or require assessments of energy efficiency and resilience to climate impacts such as flooding or extreme weather. Properties with higher climate resilience ratings can qualify for green mortgage incentives, like lower interest rates or reduced fees, reflecting reduced risk and promoting sustainable homeownership.

Energy Performance Certificate (EPC) Discount

A conventional mortgage typically offers standard interest rates without specific incentives tied to a property's energy efficiency, whereas green mortgages provide EPC discounts that reduce borrowing costs for homes with high Energy Performance Certificate ratings. These EPC discounts encourage energy-efficient upgrades by lowering monthly payments, ultimately saving homeowners money while promoting sustainable living.

Environmental, Social, and Governance (ESG) Mortgage Incentives

Conventional mortgages typically offer standard interest rates without incentives tied to sustainability, while green mortgages provide lower rates or financial benefits to promote energy-efficient home improvements, aligning with Environmental, Social, and Governance (ESG) criteria. ESG mortgage incentives encourage homeowners to invest in renewable energy systems, energy-efficient appliances, and sustainable building materials, enhancing property value and reducing carbon footprints.

Smart Home Ready Appraisal

Conventional mortgages typically assess property value based on general market conditions, while green mortgages with Smart Home Ready appraisal factor in energy-efficient features and smart home technologies, potentially increasing loan eligibility and property value. Incorporating smart home devices and energy-saving upgrades in appraisal reports can lead to lower interest rates and higher borrowing limits due to reduced long-term utility costs and environmental impact.

Carbon Footprint Mortgage Adjustment

Conventional mortgages typically offer standard interest rates without incentives tied to environmental impact, while green mortgages provide reduced rates or financial benefits based on energy-efficient features and lower carbon footprints of residential properties. Carbon footprint mortgage adjustments reward homeowners for sustainable building practices and energy savings, encouraging investments in eco-friendly upgrades that reduce overall greenhouse gas emissions.

Conventional Mortgage vs Green Mortgage for residential property. Infographic

moneydiff.com

moneydiff.com