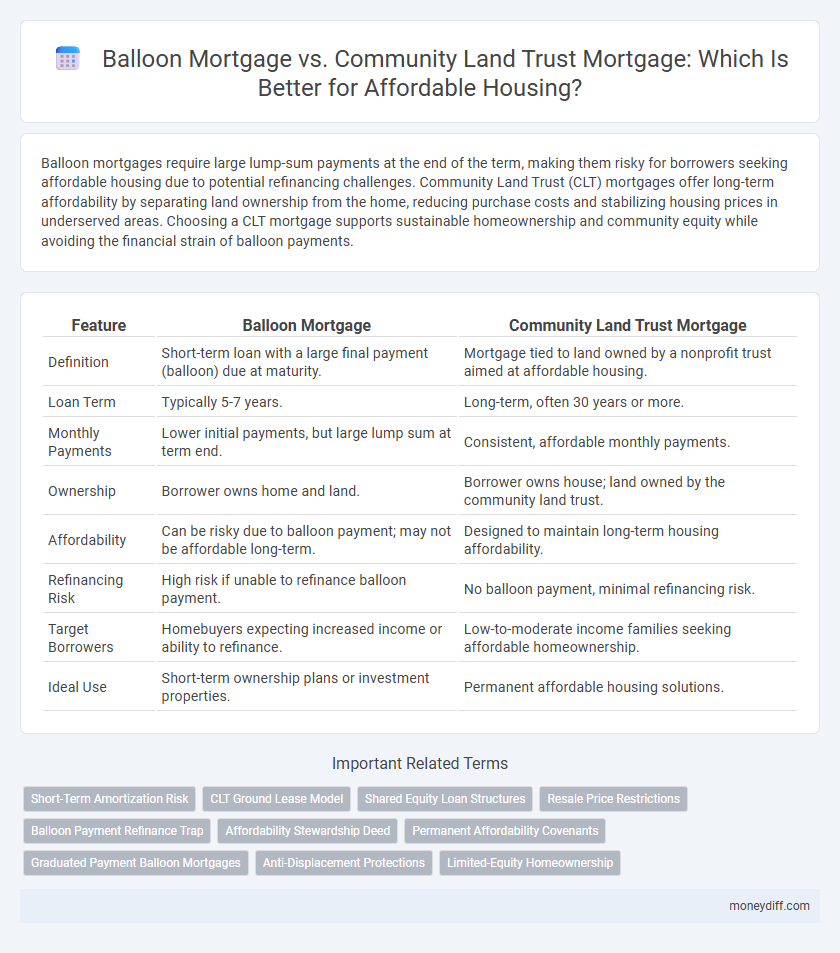

Balloon mortgages require large lump-sum payments at the end of the term, making them risky for borrowers seeking affordable housing due to potential refinancing challenges. Community Land Trust (CLT) mortgages offer long-term affordability by separating land ownership from the home, reducing purchase costs and stabilizing housing prices in underserved areas. Choosing a CLT mortgage supports sustainable homeownership and community equity while avoiding the financial strain of balloon payments.

Table of Comparison

| Feature | Balloon Mortgage | Community Land Trust Mortgage |

|---|---|---|

| Definition | Short-term loan with a large final payment (balloon) due at maturity. | Mortgage tied to land owned by a nonprofit trust aimed at affordable housing. |

| Loan Term | Typically 5-7 years. | Long-term, often 30 years or more. |

| Monthly Payments | Lower initial payments, but large lump sum at term end. | Consistent, affordable monthly payments. |

| Ownership | Borrower owns home and land. | Borrower owns house; land owned by the community land trust. |

| Affordability | Can be risky due to balloon payment; may not be affordable long-term. | Designed to maintain long-term housing affordability. |

| Refinancing Risk | High risk if unable to refinance balloon payment. | No balloon payment, minimal refinancing risk. |

| Target Borrowers | Homebuyers expecting increased income or ability to refinance. | Low-to-moderate income families seeking affordable homeownership. |

| Ideal Use | Short-term ownership plans or investment properties. | Permanent affordable housing solutions. |

Understanding Balloon Mortgages: Key Features and Risks

Balloon mortgages require large principal payments at the loan's end, creating potential refinancing risks due to sudden high costs. These loans often have lower initial monthly payments, appealing for short-term affordability but can lead to default if borrowers cannot secure refinancing. Understanding these risks is crucial when comparing them to community land trust mortgages, which offer long-term affordability by separating land ownership from housing costs.

What is a Community Land Trust Mortgage?

A Community Land Trust (CLT) mortgage is a unique financing option designed to promote long-term affordable housing by separating land ownership from homeownership. In this model, the CLT retains ownership of the land, while the homeowner purchases the structure, significantly reducing the upfront cost and monthly payments. This arrangement safeguards affordability by limiting resale prices, making it an effective alternative to traditional balloon mortgages that can carry risk due to large lump-sum payments.

Comparing Loan Terms: Balloon vs Community Land Trust Mortgages

Balloon mortgages typically feature lower initial monthly payments with a large lump-sum payment due at the end of the term, posing refinancing risks for borrowers. Community Land Trust (CLT) mortgages often offer stable, long-term financing with reduced interest rates, designed to maintain affordability by separating land ownership from home ownership. Comparing loan terms reveals that balloon mortgages prioritize short-term cash flow, whereas CLT mortgages emphasize sustainable affordability and community stability.

Interest Rates and Payment Structures Explained

Balloon mortgages feature lower initial interest rates with a large lump-sum payment due at the end of the term, making monthly payments more affordable initially but potentially risky at maturity. Community Land Trust (CLT) mortgages offer fixed or below-market interest rates tied to long-term affordability goals, with stable payment structures designed to keep homeownership accessible. Interest rates on CLT mortgages are typically lower than conventional options, supported by nonprofit management that limits resale prices and preserves community affordability.

Affordability Analysis for Low-Income Homebuyers

Balloon mortgages offer lower initial payments but pose refinancing risks that can challenge low-income homebuyers' affordability over time. Community Land Trust (CLT) mortgages provide long-term affordability by separating land ownership from the home, reducing purchase prices and stabilizing monthly payments. Affordability analysis shows CLT mortgages significantly benefit low-income households by maintaining housing costs within sustainable limits while preserving equity.

Long-Term Ownership Stability: Finding Security

Balloon mortgages require large lump-sum payments after a short term, posing risks to long-term ownership stability due to potential refinancing challenges. Community Land Trust (CLT) mortgages promote lasting affordability and security by separating land ownership from housing, enabling homeowners to stabilize costs and preserve equity. CLTs ensure sustained community control and prevent market volatility from disrupting housing stability over decades.

Down Payment and Qualification Requirements

Balloon mortgages often require a lower initial down payment but demand full repayment or refinancing at the end of a short term, posing qualification challenges due to stricter credit and income criteria. Community Land Trust (CLT) mortgages typically offer reduced down payment requirements and more flexible qualification standards, as the trust retains ownership of land to maintain affordability. These distinctions influence accessibility for low- to moderate-income buyers seeking affordable housing options.

Resale Restrictions and Equity Accumulation

Balloon mortgages require lump-sum payment after a fixed term, carrying resale restrictions tied to the borrower's ability to refinance or sell, which may limit equity accumulation if housing market conditions are unfavorable. Community Land Trust (CLT) mortgages include resale restrictions set by the trust to maintain long-term affordability, often capping home appreciation and therefore limiting equity accumulation but ensuring continued access to affordable housing. Resale restrictions in CLTs prioritize community affordability over individual equity gains, contrasting with balloon mortgages where market-driven equity potential is higher but riskier.

Suitability for Affordable Housing Initiatives

Balloon mortgages offer initial low payments with a large lump sum due at the end, which may pose risks for long-term affordable housing stability. Community Land Trust (CLT) mortgages provide sustainable affordability by separating land ownership from housing, ensuring permanent price controls and community stewardship. CLT mortgages are generally more suitable for affordable housing initiatives due to their focus on long-term affordability and community empowerment.

Choosing the Right Mortgage for Your Housing Needs

Balloon mortgages offer lower initial payments with a large lump-sum due at the end, suitable for buyers expecting increased income or refinancing options. Community Land Trust mortgages secure affordability by separating land ownership from property ownership, reducing costs and promoting long-term housing stability. Choosing the right mortgage depends on financial readiness, long-term housing goals, and access to community resources supporting affordable homeownership.

Related Important Terms

Short-Term Amortization Risk

Balloon mortgages pose significant short-term amortization risk due to large lump-sum payments required at the end of a typically 5-7 year term, potentially causing refinancing challenges for borrowers. Community land trust mortgages mitigate this risk by offering longer-term, fixed-rate financing tied to affordable housing goals, reducing the likelihood of payment shocks and financial instability.

CLT Ground Lease Model

The Community Land Trust (CLT) ground lease model offers a sustainable approach to affordable housing by separating land ownership from homeownership, allowing buyers to purchase homes at lower costs while the CLT retains long-term land stewardship. Unlike balloon mortgages with large lump-sum payments, CLT ground leases stabilize monthly housing expenses and preserve affordability through long-term ground lease agreements and resale restrictions.

Shared Equity Loan Structures

Balloon mortgages require large lump-sum payments at the end of the loan term, posing risks for homeowners in affordable housing, whereas community land trust mortgages use shared equity loan structures that stabilize homeownership by splitting future appreciation between the buyer and the trust. Shared equity arrangements in community land trusts offer long-term affordability by limiting resale prices, ensuring sustainable housing options for low- to moderate-income families.

Resale Price Restrictions

Balloon mortgages require large lump-sum payments at the end of the term, often leading to refinancing challenges, whereas community land trust mortgages impose resale price restrictions to maintain long-term housing affordability by limiting the home's appreciated value. These resale price restrictions ensure that homes remain accessible to lower-income families, contrasting with balloon mortgages that prioritize short-term financing flexibility over sustained affordability.

Balloon Payment Refinance Trap

Balloon mortgages pose a significant refinance risk as borrowers face large lump-sum payments after a short term, often leading to financial strain or foreclosure, particularly challenging in affordable housing scenarios. Community Land Trust mortgages mitigate this risk by offering long-term, stable financing tied to land stewardship, ensuring affordability without exposing homeowners to balloon payment refinance traps.

Affordability Stewardship Deed

Balloon mortgages offer lower initial payments with a large final payment, posing affordability risks, while community land trust mortgages enhance long-term affordability through stewardship deeds that restrict resale prices. Stewardship deeds ensure ongoing housing affordability by maintaining control over property equity and preventing market-driven price escalations.

Permanent Affordability Covenants

Balloon mortgages typically require a large payment at the end of the term, posing affordability challenges, whereas community land trust mortgages incorporate permanent affordability covenants that restrict resale prices to maintain long-term housing affordability. These covenants ensure that homes remain accessible to low- and moderate-income buyers by controlling equity and preventing market-driven price escalation.

Graduated Payment Balloon Mortgages

Graduated Payment Balloon Mortgages offer lower initial payments that increase over time, making them a flexible option for borrowers with rising income, but they carry the risk of a large lump-sum payment at the end of the term. Community Land Trust Mortgages prioritize long-term affordability by separating land ownership from housing, often combined with special financing options like balloon payments to support sustainable homeownership in affordable housing programs.

Anti-Displacement Protections

Balloon mortgages require large final payments, which can increase the risk of displacement for low-income homeowners due to refinancing challenges and payment shocks. Community Land Trust mortgages offer stronger anti-displacement protections by maintaining long-term ownership affordability and restricting resale prices to ensure housing remains accessible to future low-income buyers.

Limited-Equity Homeownership

Balloon mortgages require a large lump-sum payment at the end of a short-term loan, often posing risk for buyers seeking stable, affordable housing, whereas community land trust mortgages enable limited-equity homeownership by separating land ownership from homeownership to maintain long-term affordability. Limited-equity models through community land trusts protect buyers from market fluctuations and promote sustainable homeownership within affordable housing frameworks.

Balloon Mortgage vs Community Land Trust Mortgage for Affordable Housing. Infographic

moneydiff.com

moneydiff.com