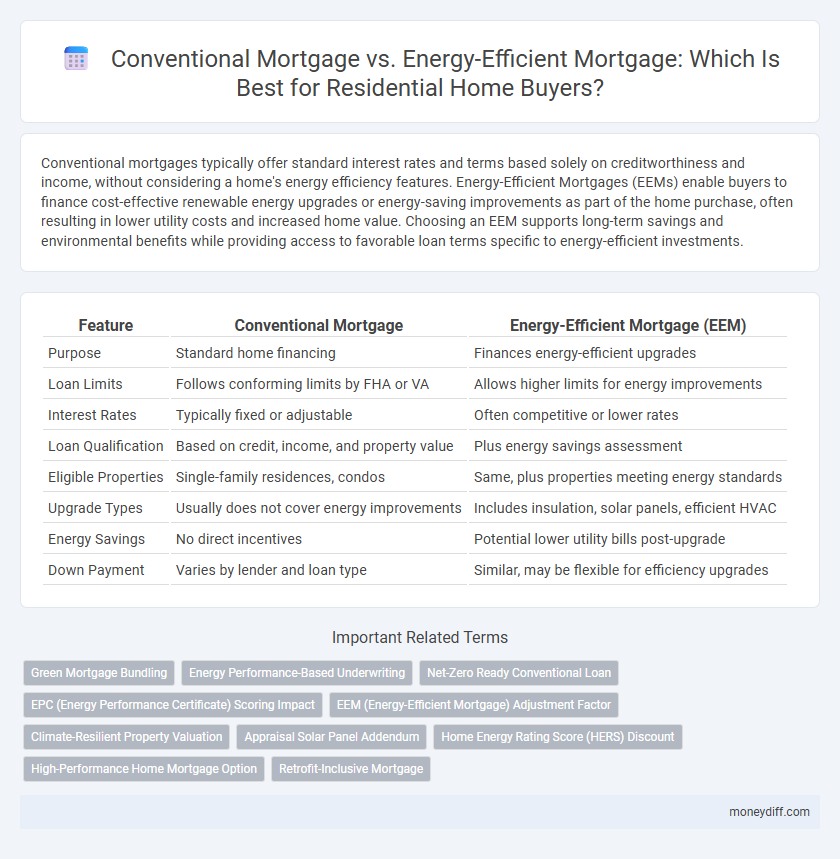

Conventional mortgages typically offer standard interest rates and terms based solely on creditworthiness and income, without considering a home's energy efficiency features. Energy-Efficient Mortgages (EEMs) enable buyers to finance cost-effective renewable energy upgrades or energy-saving improvements as part of the home purchase, often resulting in lower utility costs and increased home value. Choosing an EEM supports long-term savings and environmental benefits while providing access to favorable loan terms specific to energy-efficient investments.

Table of Comparison

| Feature | Conventional Mortgage | Energy-Efficient Mortgage (EEM) |

|---|---|---|

| Purpose | Standard home financing | Finances energy-efficient upgrades |

| Loan Limits | Follows conforming limits by FHA or VA | Allows higher limits for energy improvements |

| Interest Rates | Typically fixed or adjustable | Often competitive or lower rates |

| Loan Qualification | Based on credit, income, and property value | Plus energy savings assessment |

| Eligible Properties | Single-family residences, condos | Same, plus properties meeting energy standards |

| Upgrade Types | Usually does not cover energy improvements | Includes insulation, solar panels, efficient HVAC |

| Energy Savings | No direct incentives | Potential lower utility bills post-upgrade |

| Down Payment | Varies by lender and loan type | Similar, may be flexible for efficiency upgrades |

Understanding Conventional Mortgages: Basics and Features

Conventional mortgages are standard home loans not insured or guaranteed by the government, typically requiring a higher credit score and a down payment of at least 5%. These loans offer fixed or adjustable interest rates with terms ranging from 10 to 30 years, providing flexibility in budgeting and repayment. Borrowers benefit from predictable monthly payments but may face stricter approval criteria compared to government-backed options.

What Is an Energy-Efficient Mortgage? Key Principles Explained

An Energy-Efficient Mortgage (EEM) allows homebuyers to finance energy-saving improvements as part of their home purchase or refinancing, reducing utility costs while increasing property value. Unlike conventional mortgages, EEMs consider the projected energy savings when qualifying borrowers, potentially enabling higher loan amounts based on improved energy efficiency. Key principles include verifying energy improvements through audits, integrating costs of upgrades into the loan, and promoting sustainable homeownership by offsetting higher mortgage payments with lower energy bills.

Qualification Criteria: Conventional vs Energy-Efficient Mortgages

Conventional mortgages typically require a minimum credit score of 620, a debt-to-income ratio below 43%, and a down payment of at least 3% to 20%, depending on lender policies. Energy-Efficient Mortgages (EEMs) extend these criteria by allowing borrowers to finance energy-saving upgrades, often requiring an energy assessment and approval of eligible improvements to qualify. Both mortgage types demand proof of stable income and adequate assets, but EEMs prioritize energy efficiency certification to leverage additional borrowing power for green improvements.

Down Payments and Closing Costs: How Do They Compare?

Down payments for conventional mortgages typically range from 3% to 20% of the home's purchase price, whereas energy-efficient mortgages (EEMs) often allow for similar or slightly lower down payment requirements due to their focus on energy improvements. Closing costs on conventional loans vary widely but may not include allowances for energy upgrades; in contrast, EEMs can incorporate energy-related expenses into the loan amount, potentially reducing upfront closing costs. Both mortgage types require careful evaluation of lender policies, but EEMs offer financial benefits by integrating energy efficiency incentives directly into the mortgage structure.

Interest Rates and Loan Terms: Side-by-Side Analysis

Conventional mortgages typically offer interest rates ranging from 5% to 7% with loan terms spanning 15 to 30 years, depending on creditworthiness and market conditions. Energy-Efficient Mortgages (EEMs) may feature slightly lower or comparable interest rates, often with added incentives or subsidies to encourage energy upgrades, while maintaining standard 15 to 30-year terms. The inclusion of energy-efficiency improvements in EEMs allows borrowers to finance upgrades within the mortgage, potentially resulting in long-term savings despite similar or marginally higher rates compared to conventional loans.

Upfront and Long-Term Costs for Homebuyers

Conventional mortgages typically require standard down payments and closing costs, with no direct incentives for energy-efficient improvements, leading to potentially higher monthly utility expenses over time. Energy-Efficient Mortgages (EEMs) allow homebuyers to finance both the home purchase and energy-saving upgrades within a single loan, often resulting in lower utility bills and long-term savings that offset the slightly higher upfront financing costs. Choosing an EEM can reduce overall housing expenses by integrating energy efficiency into the mortgage, making it a cost-effective option for environmentally conscious buyers.

Benefits of Conventional Mortgages for Residential Purchases

Conventional mortgages offer competitive interest rates and flexible loan terms, making them a popular choice for homebuyers seeking predictable monthly payments and lower upfront costs. These loans typically require a higher credit score, ensuring qualified borrowers receive better financing options and potentially lower private mortgage insurance premiums. Conventional mortgages also provide the advantage of not being limited by property energy standards, allowing for a broader range of eligible homes in residential purchases.

Advantages of Energy-Efficient Mortgages for Homeowners

Energy-Efficient Mortgages (EEMs) allow homeowners to finance energy-saving improvements, resulting in lower utility bills and increased property value. These loans often offer higher borrowing limits and can cover costs for upgrades such as solar panels, insulation, and energy-efficient windows. By reducing monthly energy expenses, EEMs enhance affordability and promote sustainable living compared to traditional conventional mortgages.

Potential Drawbacks: Risks and Limitations of Each Option

Conventional mortgages often have stricter qualification criteria, making it difficult for some buyers to secure financing, and they do not provide incentives for energy-saving home improvements. Energy-Efficient Mortgages (EEMs) may involve additional appraisal requirements and limited lender participation, potentially increasing upfront costs and processing times. Both options carry risks such as fluctuating interest rates for adjustable loans and the possibility that anticipated energy savings may not offset higher loan amounts or added fees.

Which Mortgage Type Is Right for You? Key Decision Factors

Choosing between a conventional mortgage and an energy-efficient mortgage depends on your home's energy performance and budget priorities. Conventional mortgages offer flexibility for standard home purchases without specific energy requirements, while energy-efficient mortgages include added funds for upgrades that reduce utility costs and environmental impact. Assess your long-term savings potential, initial costs, and eligibility criteria to determine which mortgage aligns best with your financial goals and sustainability values.

Related Important Terms

Green Mortgage Bundling

Conventional mortgages offer standard financing terms without incentives for energy improvements, while Energy-Efficient Mortgages (EEMs) bundle green financing to cover the cost of energy-saving upgrades, lowering overall monthly payments through reduced utility bills. Green mortgage bundling enhances affordability by integrating energy-efficient improvements into the loan, increasing property value and promoting sustainable homeownership.

Energy Performance-Based Underwriting

Energy-efficient mortgages (EEMs) incorporate energy performance-based underwriting by evaluating a home's projected energy savings, allowing borrowers to qualify for larger loan amounts or better terms based on lower utility costs and improved energy efficiency measures. Conventional mortgages rely solely on income and creditworthiness, ignoring potential energy savings, while EEMs incentivize sustainability through financial benefits tied to energy performance metrics verified by standardized assessments.

Net-Zero Ready Conventional Loan

A Net-Zero Ready Conventional Loan offers homebuyers the ability to finance energy-efficient upgrades within a standard mortgage, promoting lower utility costs and increased property value compared to traditional conventional mortgages. This specialized loan integrates energy-saving improvements into the borrowing amount, enabling the purchase or refinancing of homes designed to achieve near-zero energy consumption.

EPC (Energy Performance Certificate) Scoring Impact

Conventional mortgages typically do not factor the Energy Performance Certificate (EPC) score in loan qualification, whereas Energy-Efficient Mortgages (EEMs) assess EPC ratings to incentivize properties with higher energy efficiency, potentially leading to lower interest rates and increased loan amounts. The EPC score directly influences the appraisal process in EEMs by quantifying energy savings, which can reduce borrower risk and enhance property value in sustainable residential purchases.

EEM (Energy-Efficient Mortgage) Adjustment Factor

Energy-Efficient Mortgages (EEM) include an adjustment factor that increases the borrowing limit based on the potential energy cost savings from home improvements, allowing buyers to finance energy-efficient upgrades within the mortgage. Conventional mortgages do not offer this adjustment, limiting financing options for environmentally friendly home enhancements and missing the opportunity to reduce overall living costs through energy savings.

Climate-Resilient Property Valuation

Conventional mortgages often overlook the enhanced value of climate-resilient features, whereas Energy-Efficient Mortgages (EEMs) explicitly factor in cost savings from energy-efficient upgrades and sustainable building materials, resulting in a more accurate property valuation. This valuation advantage in EEMs supports higher loan amounts and lower interest rates by recognizing long-term resilience against climate impacts and reduced utility expenses.

Appraisal Solar Panel Addendum

The Conventional Mortgage appraisal typically excludes renewable energy features, whereas the Energy-Efficient Mortgage (EEM) appraisal incorporates the Solar Panel Addendum to assess solar energy systems' value and energy savings. This addendum enables appraisers to quantify the cost-effectiveness and projected utility savings, potentially increasing loan eligibility and reducing monthly payments for homebuyers investing in solar panels.

Home Energy Rating Score (HERS) Discount

Conventional mortgages typically do not factor in a Home Energy Rating Score (HERS) discount, whereas Energy-Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements based on the HERS index, potentially lowering monthly payments by factoring in reduced utility costs. This HERS discount in EEMs encourages investment in energy-efficient upgrades, increasing property value and long-term savings for homeowners.

High-Performance Home Mortgage Option

A conventional mortgage offers standard financing without incentives for energy efficiency, whereas an Energy-Efficient Mortgage (EEM) incorporates extra funds to cover the cost of energy-saving improvements, making it ideal for high-performance homes that reduce utility expenses. The EEM program by HUD enables borrowers to finance energy-efficient upgrades into the home loan, boosting property value and long-term savings on residential purchases.

Retrofit-Inclusive Mortgage

Conventional mortgages typically offer standard loan terms without specific provisions for home energy upgrades, while energy-efficient mortgages (EEMs) allow borrowers to finance energy-saving retrofits within the total loan amount, reducing monthly utility costs and increasing property value. Retrofit-inclusive mortgages integrate the cost of improvements such as insulation, energy-efficient windows, or solar panels directly into the mortgage, making them a strategic option for homeowners seeking long-term savings through sustainable home enhancements.

Conventional Mortgage vs Energy-Efficient Mortgage for residential purchases. Infographic

moneydiff.com

moneydiff.com