Fixed rate mortgages offer predictable monthly payments and stability by locking in an interest rate for the entire loan term, making budgeting easier for homeowners. Adjustable rate mortgages typically start with lower initial rates that can fluctuate over time based on market conditions, potentially reducing early payments but increasing future financial uncertainty. Choosing between these options depends on factors such as risk tolerance, the expected length of homeownership, and the likelihood of interest rate changes.

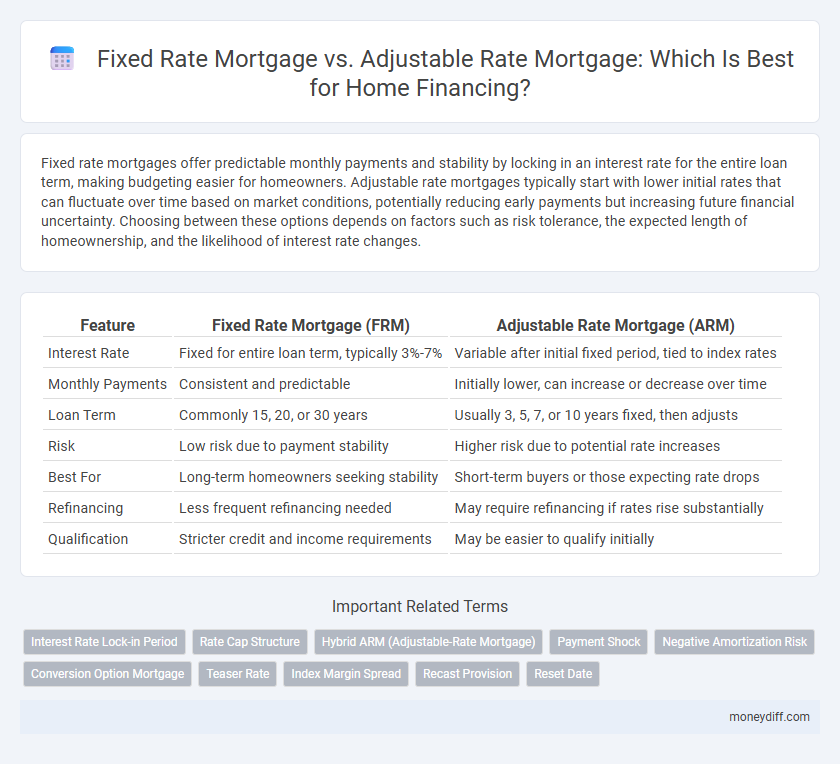

Table of Comparison

| Feature | Fixed Rate Mortgage (FRM) | Adjustable Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Fixed for entire loan term, typically 3%-7% | Variable after initial fixed period, tied to index rates |

| Monthly Payments | Consistent and predictable | Initially lower, can increase or decrease over time |

| Loan Term | Commonly 15, 20, or 30 years | Usually 3, 5, 7, or 10 years fixed, then adjusts |

| Risk | Low risk due to payment stability | Higher risk due to potential rate increases |

| Best For | Long-term homeowners seeking stability | Short-term buyers or those expecting rate drops |

| Refinancing | Less frequent refinancing needed | May require refinancing if rates rise substantially |

| Qualification | Stricter credit and income requirements | May be easier to qualify initially |

Understanding Fixed Rate Mortgages

Fixed rate mortgages provide homeowners with predictable monthly payments by locking in a consistent interest rate for the entire loan term, typically 15 to 30 years. This stability helps borrowers budget effectively without the risk of rate fluctuations common in adjustable rate mortgages (ARMs). Fixed rate mortgages are ideal for buyers planning to stay in their homes long-term, seeking financial certainty and protection against rising interest rates.

Key Features of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate periodically based on a specific benchmark or index, such as the LIBOR or Treasury rate, which can lead to lower initial monthly payments compared to fixed-rate loans. Commonly, ARMs start with a fixed introductory period, ranging from 3 to 10 years, after which the interest rate adjusts annually within predefined caps to limit increases. Borrowers benefit from potentially lower rates during the initial period but face the risk of higher payments if market rates rise, making ARMs suitable for those planning to sell or refinance before rate adjustments begin.

Interest Rate Stability: Fixed vs Adjustable

Fixed rate mortgages provide a consistent interest rate throughout the loan term, ensuring predictable monthly payments and long-term financial stability. Adjustable rate mortgages (ARMs) start with a lower initial interest rate, which can fluctuate based on market conditions, potentially increasing or decreasing monthly payments over time. Choosing between fixed and adjustable rate mortgages depends on the borrower's risk tolerance and anticipated duration of homeownership.

Initial Costs and Long-Term Payment Outlook

Fixed rate mortgages generally have higher initial costs due to higher interest rates, providing predictable monthly payments throughout the loan term. Adjustable rate mortgages often start with lower initial interest rates and payments, but these can increase over time based on market conditions, leading to potential payment fluctuations. Homebuyers must weigh the stability of fixed payments against the potential short-term savings and risk of rising costs inherent in adjustable rate loans.

Pros and Cons of Fixed Rate Mortgages

Fixed rate mortgages offer the stability of consistent monthly payments and protection against interest rate increases over the loan term, making budgeting easier for homeowners. The main downside is typically higher initial interest rates compared to adjustable rate mortgages, which can result in higher early payments. Borrowers with long-term homeownership plans often benefit more from fixed rate mortgages despite less flexibility when interest rates fall.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to Fixed Rate Mortgages, which can result in reduced monthly payments and greater initial affordability for homebuyers. However, ARMs carry the risk of rate adjustments that may increase monthly payments significantly after the fixed-rate period, leading to potential financial uncertainty. Homebuyers should carefully evaluate interest rate caps, adjustment intervals, and their long-term financial plans before choosing an ARM.

Impact of Market Conditions on Mortgage Choice

Fixed rate mortgages offer stable monthly payments unaffected by market fluctuations, making them ideal during periods of rising interest rates or economic uncertainty. Adjustable rate mortgages typically start with lower initial rates that adjust based on benchmarks like the LIBOR or the U.S. Treasury index, which can lead to lower payments in declining rate environments but increased costs when rates rise. Homebuyers' choice between fixed and adjustable rate mortgages heavily depends on current and projected market interest rate trends and economic conditions influencing payment predictability and long-term affordability.

Who Should Consider a Fixed Rate Mortgage?

Homebuyers seeking predictable monthly payments and long-term financial stability are ideal candidates for fixed rate mortgages, especially those planning to stay in their homes for an extended period. Fixed rate mortgages protect against interest rate fluctuations, making them preferable in a rising rate environment or for borrowers with stable income sources. This option suits individuals prioritizing budgeting certainty over potential initial cost savings seen in adjustable rate mortgages.

Who Benefits Most from Adjustable Rate Mortgages?

Adjustable Rate Mortgages (ARMs) benefit homebuyers who plan to sell or refinance within a few years, as they offer lower initial interest rates compared to Fixed Rate Mortgages. Borrowers with fluctuating income or those expecting rates to decline may also gain from ARMs' rate adjustment features. Homeowners in stable or declining interest rate environments can leverage ARMs to reduce monthly payments and overall borrowing costs.

Decision Factors: Choosing the Best Mortgage for Your Situation

Fixed Rate Mortgages provide predictable monthly payments and stable interest rates, ideal for borrowers planning to stay long-term and valuing financial consistency. Adjustable Rate Mortgages often start with lower initial rates, appealing to buyers expecting short-term ownership or potential income growth, but they carry the risk of fluctuating payments due to rate adjustments. Key decision factors include financial stability, market interest rate trends, loan duration, and individual risk tolerance, guiding borrowers to select the mortgage type best aligned with their long-term home financing goals.

Related Important Terms

Interest Rate Lock-in Period

Fixed Rate Mortgages offer a consistent interest rate locked in for the entire loan term, providing predictable monthly payments and protection against market rate fluctuations. Adjustable Rate Mortgages feature an initial fixed period followed by variable rates that can change periodically, potentially lowering initial payments but risking future rate increases.

Rate Cap Structure

Fixed rate mortgages provide a stable interest rate throughout the loan term, offering predictable monthly payments without exposure to market fluctuations. Adjustable rate mortgages feature a rate cap structure limiting how much the interest rate can increase per adjustment period and over the life of the loan, providing initial lower rates while protecting borrowers from extreme rate hikes.

Hybrid ARM (Adjustable-Rate Mortgage)

Hybrid ARMs combine fixed interest rates for an initial period, typically 3, 5, 7, or 10 years, before transitioning to adjustable rates based on market indexes like LIBOR or SOFR, offering borrowers initial payment stability with potential long-term savings. This mortgage type balances the predictability of fixed-rate loans with the flexibility of adjustable rates, appealing to homeowners planning to sell or refinance before the adjustable period begins.

Payment Shock

Fixed rate mortgages provide predictable monthly payments, reducing the risk of payment shock over the loan term. Adjustable rate mortgages may start with lower initial payments but carry the risk of significant payment increases after the fixed-rate period, potentially causing payment shock for borrowers.

Negative Amortization Risk

Fixed Rate Mortgages provide predictable monthly payments without the risk of negative amortization, ensuring borrowers steadily reduce their principal balance. Adjustable Rate Mortgages, however, can lead to negative amortization if payments do not cover accruing interest during rate adjustments, increasing the loan principal and potentially causing financial strain.

Conversion Option Mortgage

A fixed rate mortgage offers stable monthly payments with interest rates locked in for the loan term, providing predictability in home financing costs. An adjustable rate mortgage with a conversion option allows borrowers to start with a lower initial rate and switch to a fixed rate later, combining flexibility with long-term rate security if market conditions change.

Teaser Rate

A teaser rate in an adjustable rate mortgage (ARM) offers an initially low interest rate that increases after a set period, contrasting with a fixed rate mortgage which maintains a constant interest rate and predictable monthly payments throughout the loan term. Borrowers should carefully evaluate the potential payment spikes post-teaser period in ARMs against the stability and long-term cost certainty provided by fixed rate mortgages.

Index Margin Spread

Fixed rate mortgages offer a constant interest rate and monthly payment over the loan term, providing stability and predictability for budgeting. Adjustable rate mortgages calculate interest based on a fluctuating index plus a fixed margin, causing payments to vary as the index changes.

Recast Provision

Fixed Rate Mortgages offer stability with consistent monthly payments, but typically lack a recast provision, limiting the ability to reduce payments after a lump-sum principal payment. Adjustable Rate Mortgages often include recast options, allowing homeowners to adjust the loan balance and lower payments when making significant extra payments toward the principal.

Reset Date

Fixed Rate Mortgages maintain a consistent interest rate throughout the loan term, eliminating the uncertainty of payment changes, while Adjustable Rate Mortgages feature a reset date at which the interest rate adjusts according to market indexes, potentially increasing or decreasing monthly payments. Understanding the timing and frequency of the reset date is crucial for borrowers to anticipate future financial obligations and manage risks associated with rate fluctuations.

Fixed Rate Mortgage vs Adjustable Rate Mortgage for home financing. Infographic

moneydiff.com

moneydiff.com