A Conventional Mortgage typically offers standard financing terms without specific incentives for energy-saving features, focusing on creditworthiness and down payment size. Energy Efficient Mortgages (EEMs) allow homebuyers to finance energy-efficient improvements into the mortgage, potentially lowering monthly utility costs and increasing property value. Choosing an EEM can result in long-term savings and support sustainable living by promoting investments in energy-efficient appliances and home upgrades.

Table of Comparison

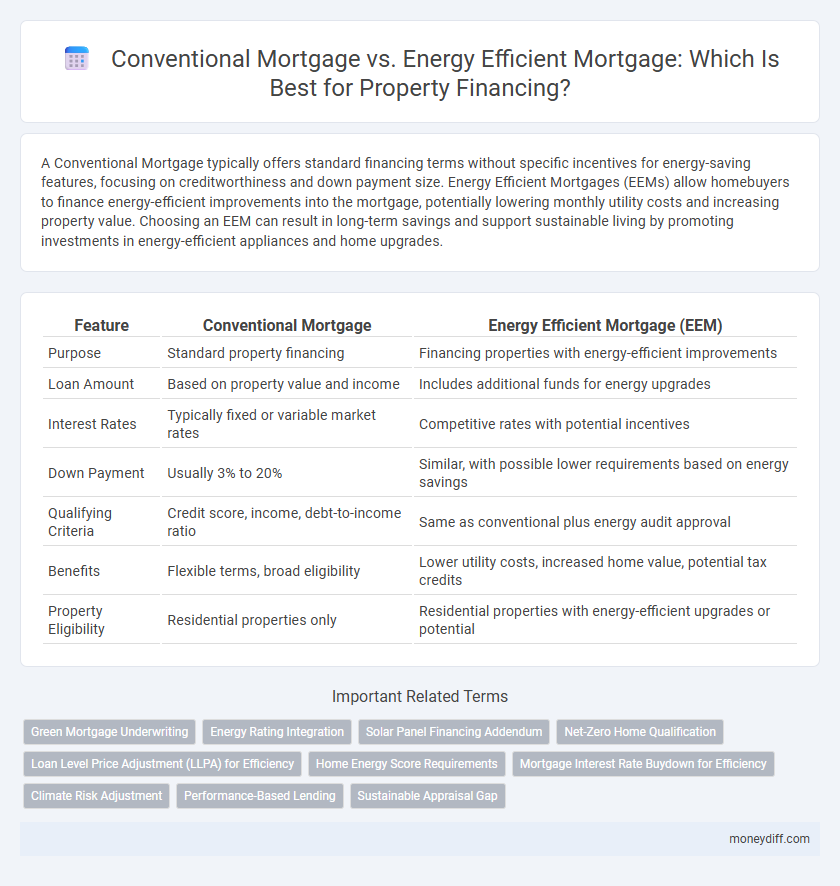

| Feature | Conventional Mortgage | Energy Efficient Mortgage (EEM) |

|---|---|---|

| Purpose | Standard property financing | Financing properties with energy-efficient improvements |

| Loan Amount | Based on property value and income | Includes additional funds for energy upgrades |

| Interest Rates | Typically fixed or variable market rates | Competitive rates with potential incentives |

| Down Payment | Usually 3% to 20% | Similar, with possible lower requirements based on energy savings |

| Qualifying Criteria | Credit score, income, debt-to-income ratio | Same as conventional plus energy audit approval |

| Benefits | Flexible terms, broad eligibility | Lower utility costs, increased home value, potential tax credits |

| Property Eligibility | Residential properties only | Residential properties with energy-efficient upgrades or potential |

Understanding Conventional Mortgages

Conventional mortgages are traditional home loans not insured by the government, typically requiring a higher credit score and larger down payment compared to specialized loans. These loans offer fixed or adjustable interest rates and are suitable for borrowers with strong financial profiles seeking flexible terms. Understanding conventional mortgages helps buyers evaluate their eligibility and financing options before exploring alternatives like Energy Efficient Mortgages, which incentivize green home improvements.

What Is an Energy Efficient Mortgage?

An Energy Efficient Mortgage (EEM) allows borrowers to finance energy-saving improvements within their home loan, reducing monthly utility costs while increasing property value. Unlike conventional mortgages, EEMs incorporate the cost of upgrades such as solar panels, insulation, and energy-efficient windows directly into the loan amount. This financing option supports sustainable homeownership by promoting energy conservation and long-term savings.

Key Differences Between Conventional and Energy Efficient Mortgages

Conventional mortgages rely on standard loan terms without factoring in energy-saving upgrades or utility cost reductions, while energy-efficient mortgages (EEMs) incorporate the value of energy improvements into the loan amount, allowing borrowers to finance green home retrofits as part of the purchase or refinance. EEMs typically require a home energy assessment and may offer lower interest rates or higher loan limits compared to conventional loans, targeting long-term savings through decreased utility expenses. The key difference lies in EEMs promoting sustainable homeownership by integrating energy efficiency into property financing, contrasting with conventional mortgages that focus solely on property value and creditworthiness.

Eligibility Requirements for Each Mortgage Type

Eligibility for a Conventional Mortgage typically requires a strong credit score above 620, a stable income, and a down payment of 3% to 20%, with debt-to-income ratios under 43%. Energy Efficient Mortgages (EEMs) necessitate meeting standard mortgage qualifications plus providing an energy audit or home energy assessment to qualify for additional funds aimed at home improvements. Both mortgage types demand borrower financial stability but EEMs uniquely support financing based on projected energy savings from approved upgrades.

Comparing Interest Rates and Loan Terms

Conventional mortgages typically offer fixed interest rates ranging from 5% to 7% with loan terms of 15 to 30 years, whereas Energy Efficient Mortgages (EEMs) often provide slightly lower interest rates due to their incentives for sustainable property improvements. Loan terms for EEMs align closely with conventional mortgages but can include added flexibility to finance energy-saving upgrades, potentially reducing monthly payments through lower utility costs. Borrowers considering an EEM benefit from a combined loan amount that includes both home purchase and energy efficiency improvements, helping to maximize long-term savings despite comparable or slightly improved loan conditions.

Upfront Costs and Down Payment Considerations

Conventional mortgages typically require a down payment ranging from 3% to 20%, with higher upfront costs including appraisal and private mortgage insurance (PMI) if under 20%. Energy Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements within the loan, often requiring similar or slightly lower down payments but with additional upfront costs related to energy assessments or audits. Incorporating energy efficiency expenses into the mortgage can reduce initial cash outflows while promoting long-term savings on utility bills.

Long-Term Savings: Energy Efficiency Benefits

Energy Efficient Mortgages (EEMs) offer long-term savings by reducing utility costs through financing improvements like solar panels and insulation, unlike Conventional Mortgages that do not specifically account for energy upgrades. These savings can increase the property's value and lower monthly expenses, making EEMs a financially advantageous option for energy-conscious buyers. Incorporating energy efficiency into mortgage financing enhances overall affordability and supports sustainable housing investments.

Impact on Property Value and Resale

Conventional mortgages typically do not account for energy efficiency features, resulting in standard property valuations that may overlook potential long-term savings. Energy Efficient Mortgages (EEMs) can enhance property value by financing energy-saving improvements, which appeal to eco-conscious buyers and reduce utility costs. Properties financed through EEMs often experience higher resale potential due to increased marketability and lower operating expenses.

Choosing the Best Mortgage for Your Financial Goals

Conventional mortgages offer standard financing options with fixed or variable interest rates, making them suitable for typical home purchases without specific energy considerations. Energy Efficient Mortgages (EEMs) provide additional funds to finance energy-saving improvements, reducing utility costs and increasing property value, which supports long-term financial savings. Selecting the best mortgage depends on evaluating your priorities between upfront costs, potential energy savings, and overall loan terms aligned with your financial goals.

Frequently Asked Questions About Green Home Financing

Conventional mortgages typically require standard credit qualification and down payments without considering property energy performance, while Energy Efficient Mortgages (EEMs) allow borrowers to finance energy-saving upgrades within the loan, potentially lowering utility costs and increasing home value. Frequently asked questions about green home financing include eligibility criteria for EEMs, the impact on loan limits, and how energy improvements affect appraisals and monthly payments. Borrowers often inquire about the types of energy-efficient upgrades covered and the documentation needed to qualify for these specialized loans.

Related Important Terms

Green Mortgage Underwriting

Conventional mortgage underwriting typically evaluates creditworthiness, income, and property value without accounting for energy efficiency, whereas energy efficient mortgage (EEM) underwriting incorporates projected utility savings and energy improvements to qualify higher loans. Green mortgage underwriting leverages comprehensive energy assessments and cost-effectiveness analyses to support financing of eco-friendly property upgrades, promoting sustainable homeownership and reduced long-term expenses.

Energy Rating Integration

Energy Efficient Mortgages integrate property energy ratings into financing by offering better terms based on energy efficiency, encouraging sustainable home improvements. Conventional mortgages lack this feature, typically offering uniform rates without accounting for energy performance or potential cost savings.

Solar Panel Financing Addendum

Conventional mortgages typically do not include provisions for energy-efficient upgrades, while Energy Efficient Mortgages (EEMs) facilitate financing for home improvements such as solar panel installations through a Solar Panel Financing Addendum. This addendum allows borrowers to incorporate the cost of solar panels into their mortgage, promoting long-term energy savings and increased property value.

Net-Zero Home Qualification

Conventional mortgages typically evaluate borrower credit and property value without considering energy efficiency, whereas Energy Efficient Mortgages (EEMs) offer financing incentives for homes meeting net-zero energy standards, allowing buyers to qualify for larger loan amounts based on projected utility savings. Net-zero home qualification under an EEM requires validation of energy performance through certified audits or ratings, which can reduce overall mortgage costs and enhance long-term affordability.

Loan Level Price Adjustment (LLPA) for Efficiency

Loan Level Price Adjustment (LLPA) incentives for energy efficient mortgages (EEMs) reduce interest rates or fees compared to conventional mortgages by rewarding borrowers for financing energy-saving improvements. EEM borrowers benefit from lower LLPA charges due to improved property energy ratings, which decrease lender risk and encourage sustainable home investments.

Home Energy Score Requirements

Conventional mortgages typically do not require a Home Energy Score, whereas Energy Efficient Mortgages (EEMs) mandate a detailed Home Energy Score to assess a property's energy performance and potential efficiency improvements. This score influences loan eligibility and limits, encouraging borrowers to invest in energy-saving upgrades that reduce long-term utility costs and increase property value.

Mortgage Interest Rate Buydown for Efficiency

Conventional mortgages typically offer fixed interest rates without incentives for property upgrades, whereas Energy Efficient Mortgages (EEMs) provide opportunities to buydown mortgage interest rates by incorporating the cost of energy-saving improvements into the loan amount, reducing overall borrowing expenses. Utilizing an EEM can lower monthly payments through interest rate reductions tied to increased home energy efficiency, making it an attractive option for eco-conscious buyers seeking sustainable financing solutions.

Climate Risk Adjustment

Conventional mortgages typically do not account for climate risk factors, potentially exposing borrowers to higher future costs from environmental hazards, whereas Energy Efficient Mortgages (EEMs) integrate climate risk adjustment by incentivizing energy-saving home improvements that reduce utility expenses and increase property resilience. Lenders offering EEMs benefit from lower default risks as properties become better equipped to withstand climate-related damages, enhancing long-term loan security and borrower affordability.

Performance-Based Lending

Conventional mortgages primarily assess creditworthiness and income without factoring in a property's energy efficiency, whereas Energy Efficient Mortgages (EEMs) integrate performance-based lending by evaluating projected energy savings and sustainable improvements to lower overall financing risk. Lenders offering EEMs often provide higher loan limits or favorable terms based on verified energy performance data, encouraging investments in energy-efficient upgrades that reduce utility costs and enhance property value.

Sustainable Appraisal Gap

Conventional mortgages often overlook energy efficiency, leading to appraisal gaps where the property's sustainable features are undervalued, whereas Energy Efficient Mortgages (EEMs) incorporate energy savings into the loan underwriting process, narrowing or eliminating the sustainable appraisal gap. This results in better financing terms for buyers investing in energy-efficient homes and promotes higher property values aligned with sustainability metrics.

Conventional Mortgage vs Energy Efficient Mortgage for property financing. Infographic

moneydiff.com

moneydiff.com