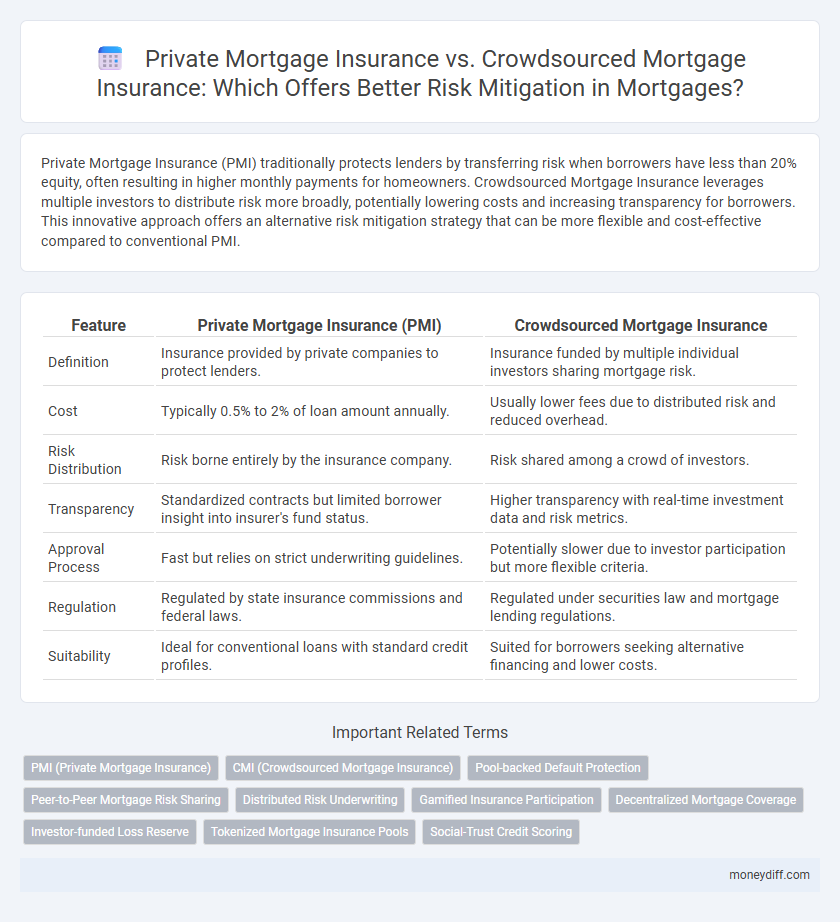

Private Mortgage Insurance (PMI) traditionally protects lenders by transferring risk when borrowers have less than 20% equity, often resulting in higher monthly payments for homeowners. Crowdsourced Mortgage Insurance leverages multiple investors to distribute risk more broadly, potentially lowering costs and increasing transparency for borrowers. This innovative approach offers an alternative risk mitigation strategy that can be more flexible and cost-effective compared to conventional PMI.

Table of Comparison

| Feature | Private Mortgage Insurance (PMI) | Crowdsourced Mortgage Insurance |

|---|---|---|

| Definition | Insurance provided by private companies to protect lenders. | Insurance funded by multiple individual investors sharing mortgage risk. |

| Cost | Typically 0.5% to 2% of loan amount annually. | Usually lower fees due to distributed risk and reduced overhead. |

| Risk Distribution | Risk borne entirely by the insurance company. | Risk shared among a crowd of investors. |

| Transparency | Standardized contracts but limited borrower insight into insurer's fund status. | Higher transparency with real-time investment data and risk metrics. |

| Approval Process | Fast but relies on strict underwriting guidelines. | Potentially slower due to investor participation but more flexible criteria. |

| Regulation | Regulated by state insurance commissions and federal laws. | Regulated under securities law and mortgage lending regulations. |

| Suitability | Ideal for conventional loans with standard credit profiles. | Suited for borrowers seeking alternative financing and lower costs. |

Understanding Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) protects lenders from default risk when borrowers have less than 20% equity in a home, typically requiring monthly premiums based on loan-to-value (LTV) ratios and credit scores. PMI reduces lender risk by covering a portion of losses if the borrower defaults, enabling buyers to qualify for loans with smaller down payments. Understanding PMI's cost structure and cancellation criteria is crucial for borrowers to optimize mortgage affordability and risk mitigation strategies.

What Is Crowdsourced Mortgage Insurance?

Crowdsourced Mortgage Insurance (CMI) leverages a pool of individual investors who collectively provide coverage for mortgage lenders, reducing the reliance on traditional private mortgage insurance (PMI) companies. Unlike PMI, which typically requires borrowers to pay high premiums until they reach a 20% home equity threshold, CMI offers potentially lower costs and increased transparency by distributing risk among a broad community. This innovative approach enhances risk mitigation by diversifying insurer exposure and enabling more flexible underwriting standards.

Key Differences Between PMI and Crowdsourced Insurance

Private Mortgage Insurance (PMI) typically requires borrowers to pay a monthly premium to a single insurer until the home equity reaches 20%, offering traditional risk mitigation for lenders. Crowdsourced Mortgage Insurance spreads the risk among numerous individual investors who collectively insure the loan, potentially lowering costs and increasing transparency. Key differences include the financing structure, with PMI being a centralized service and crowdsourced insurance leveraging decentralized funding, impacting premium variability and claim processes.

How Each Insurance Model Mitigates Risk

Private Mortgage Insurance (PMI) mitigates risk by transferring the lender's exposure to borrower default through a traditional insurer, requiring borrowers to pay premiums until sufficient equity is built. Crowdsourced Mortgage Insurance distributes risk among multiple individual investors, leveraging collective funding to cover potential losses and often offering more flexible terms and potentially lower costs. Both models enhance lender confidence, but PMI relies on established insurance companies, while crowdsourced insurance uses decentralized capital to share risk dynamically.

Cost Comparison: PMI vs Crowdsourced Mortgage Insurance

Private Mortgage Insurance (PMI) typically costs between 0.3% and 1.5% of the original loan amount annually, increasing the overall homeownership expense. Crowdsourced Mortgage Insurance offers a potentially lower-cost alternative by pooling risk among multiple investors, reducing premiums through shared exposure and streamlined operations. Homebuyers seeking cost-effective risk mitigation may find crowdsourced options more affordable, particularly in competitive lending environments with high PMI rates.

Eligibility Criteria for PMI and Crowdsourced Options

Private Mortgage Insurance (PMI) eligibility typically requires a down payment of less than 20% and applies primarily to conventional loans with credit scores above 620. Crowdsourced Mortgage Insurance platforms often feature more flexible eligibility criteria, sometimes accommodating borrowers with lower credit scores or smaller down payments by pooling risk among multiple investors. Understanding the distinct qualification metrics for PMI and crowdsourced options enables borrowers to select risk mitigation strategies aligned with their financial profiles.

Policyholder Protections and Limitations

Private Mortgage Insurance (PMI) offers established policyholder protections regulated by state and federal laws, including clear cancellation rights once a loan-to-value ratio reaches 80%. Crowdsourced Mortgage Insurance, leveraging peer-to-peer risk pooling, may lack standardized regulatory oversight, potentially leading to variability in claim approval processes and policyholder protections. Limitations of crowdsourced models include less predictability in coverage terms and dispute resolution mechanisms compared to the structured guarantees and consumer safeguards found in traditional PMI.

Impact on Mortgage Approval and Interest Rates

Private Mortgage Insurance (PMI) typically increases monthly mortgage costs and can impact mortgage approval by requiring higher credit scores or larger down payments to offset lender risk. Crowdsourced Mortgage Insurance leverages community-funded risk pools, often enabling more flexible approval criteria and potentially lower interest rates due to diversified risk distribution. Borrowers using crowdsourced insurance might experience enhanced mortgage approval chances and more competitive interest rates compared to traditional PMI models.

Technological Innovations in Crowdsourced Insurance

Crowdsourced mortgage insurance leverages blockchain and AI technologies to enhance transparency and risk assessment accuracy, reducing reliance on traditional private mortgage insurance providers. Advanced algorithms analyze diverse data points from multiple investors, enabling dynamic premium pricing and faster claim processing. This innovative approach improves risk mitigation efficiency and lowers costs for borrowers compared to conventional private mortgage insurance models.

Choosing the Right Insurance Model for Homebuyers

Private Mortgage Insurance (PMI) requires borrowers to pay premiums to a traditional insurer, protecting lenders against default but increasing monthly mortgage costs. Crowdsourced Mortgage Insurance pools funds from individual investors, often offering more competitive rates and potentially greater flexibility for homebuyers. Evaluating factors such as cost efficiency, risk tolerance, and lender acceptance helps determine the optimal insurance model for mitigating mortgage risk.

Related Important Terms

PMI (Private Mortgage Insurance)

Private Mortgage Insurance (PMI) protects lenders by requiring borrowers with less than 20% down payment to pay premiums that offset default risk, typically costing 0.3% to 1.5% of the original loan amount annually. Unlike crowdsourced mortgage insurance, PMI is backed by established insurance companies providing standardized risk assessment and claims management, ensuring consistent protection for lenders.

CMI (Crowdsourced Mortgage Insurance)

Crowdsourced Mortgage Insurance (CMI) leverages multiple investors pooling capital to share mortgage risk collectively, often resulting in lower premiums and increased accessibility compared to traditional Private Mortgage Insurance (PMI). By distributing risk among a diversified group, CMI platforms enhance transparency and offer homeowners flexible coverage options tailored to specific loan-to-value ratios, promoting more efficient risk mitigation in mortgage financing.

Pool-backed Default Protection

Private Mortgage Insurance (PMI) offers individual borrower risk mitigation by transferring default risk to insurers, whereas Crowdsourced Mortgage Insurance leverages pool-backed default protection, distributing risk across a diversified group of investors. Pool-backed structures enhance capital efficiency and reduce reliance on traditional insurers by aggregating default risk into securitized tranches, optimizing loss absorption capacity in mortgage portfolios.

Peer-to-Peer Mortgage Risk Sharing

Private Mortgage Insurance (PMI) traditionally protects lenders by transferring default risk to insurance companies, whereas Crowdsourced Mortgage Insurance employs a peer-to-peer risk sharing model that distributes potential losses among a network of individual investors, enhancing transparency and reducing costs. This decentralized approach leverages blockchain technology for secure transactions and real-time risk assessment, offering a scalable alternative to conventional PMI with greater flexibility and potential for lower premiums.

Distributed Risk Underwriting

Distributed risk underwriting in crowdsourced mortgage insurance leverages multiple individual investors to spread risk more broadly compared to the concentrated risk held by private mortgage insurance (PMI) providers. This decentralized approach enhances risk mitigation by diversifying exposure and potentially lowering costs for borrowers through collective underwriting decisions.

Gamified Insurance Participation

Crowdsourced Mortgage Insurance leverages gamified insurance participation to engage a community of investors sharing risk, offering potentially lower premiums and increased transparency compared to traditional Private Mortgage Insurance (PMI). This innovative model aligns borrower incentives with collective risk management, enhancing coverage flexibility and promoting more efficient loss mitigation.

Decentralized Mortgage Coverage

Decentralized mortgage coverage, enabled by crowdsourced mortgage insurance platforms, reduces reliance on traditional private mortgage insurance by distributing risk among a network of individual investors, increasing transparency and potentially lowering costs for borrowers. This innovative approach leverages blockchain technology to enhance trust and efficiency in risk mitigation, offering a scalable alternative to conventional insurance providers.

Investor-funded Loss Reserve

Private Mortgage Insurance (PMI) is typically funded by individual borrowers to protect lenders against default, while Crowdsourced Mortgage Insurance leverages investor-funded loss reserves pooled from multiple stakeholders, distributing risk more broadly and potentially reducing premiums. The investor-funded loss reserve model enhances capital efficiency by using collective investment to cover loan losses, aligning risk mitigation with market-driven funding mechanisms.

Tokenized Mortgage Insurance Pools

Tokenized Mortgage Insurance Pools leverage blockchain technology to create decentralized risk-sharing mechanisms, offering enhanced transparency and liquidity compared to traditional Private Mortgage Insurance (PMI). Unlike PMI, which requires individual borrowers to pay high premiums, crowdsourced mortgage insurance reduces costs by distributing risk across multiple investors through digital tokens.

Social-Trust Credit Scoring

Private Mortgage Insurance (PMI) traditionally relies on established credit scores and lender risk assessment, whereas Crowdsourced Mortgage Insurance leverages Social-Trust Credit Scoring by analyzing peer-reviewed reputations and community-based financial behaviors to mitigate risk. This innovative approach enhances risk evaluation accuracy by incorporating social data metrics, offering a more dynamic and inclusive model for mortgage insurance underwriting.

Private Mortgage Insurance vs Crowdsourced Mortgage Insurance for risk mitigation. Infographic

moneydiff.com

moneydiff.com