An amortizing mortgage requires borrowers to make regular payments that cover both principal and interest, gradually reducing the loan balance over time. In contrast, an interest-only mortgage allows homeowners to pay only the interest for a specified period, resulting in lower initial payments but no reduction in principal during that phase. Choosing between these structures impacts long-term costs and equity buildup, with amortizing loans providing steady debt reduction and interest-only loans offering short-term payment flexibility.

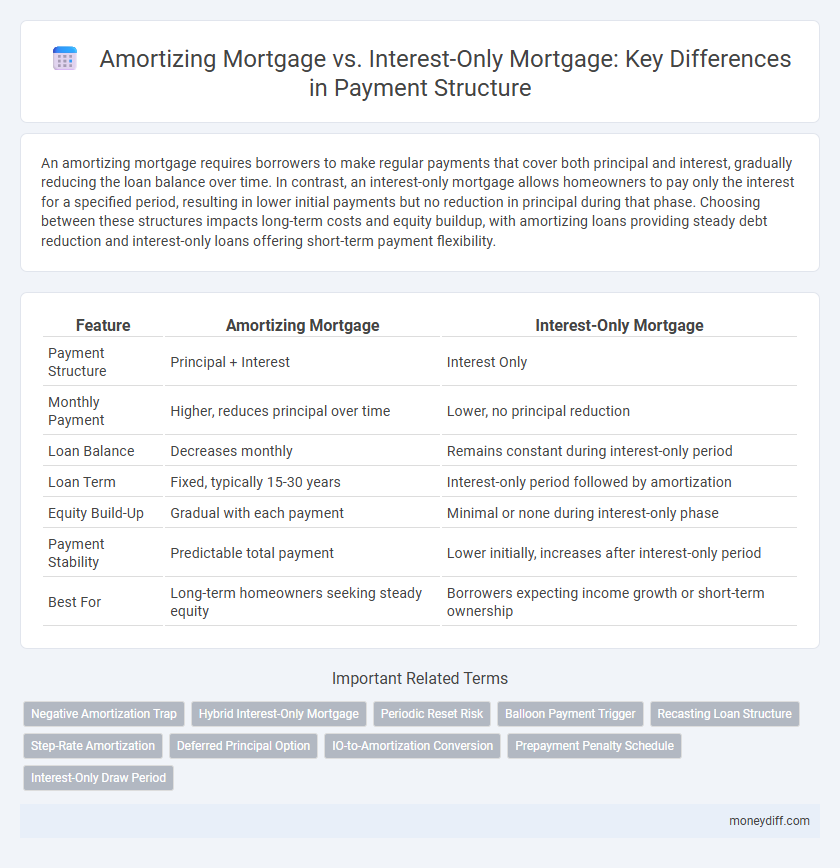

Table of Comparison

| Feature | Amortizing Mortgage | Interest-Only Mortgage |

|---|---|---|

| Payment Structure | Principal + Interest | Interest Only |

| Monthly Payment | Higher, reduces principal over time | Lower, no principal reduction |

| Loan Balance | Decreases monthly | Remains constant during interest-only period |

| Loan Term | Fixed, typically 15-30 years | Interest-only period followed by amortization |

| Equity Build-Up | Gradual with each payment | Minimal or none during interest-only phase |

| Payment Stability | Predictable total payment | Lower initially, increases after interest-only period |

| Best For | Long-term homeowners seeking steady equity | Borrowers expecting income growth or short-term ownership |

Understanding Amortizing Mortgages

Amortizing mortgages require borrowers to make fixed monthly payments that cover both principal and interest, gradually reducing the loan balance over time until fully paid off. This structured payment plan offers predictability and builds equity through consistent principal repayment. Understanding amortizing mortgages is essential for planning long-term financial commitments and avoiding balance shocks.

Exploring Interest-Only Mortgages

Interest-only mortgages require borrowers to pay only the interest for a set period, usually 5 to 10 years, resulting in lower initial monthly payments compared to amortizing mortgages. During the interest-only term, the principal balance remains unchanged, leading to larger payments once the repayment period begins or the loan term ends. This structure appeals to borrowers seeking lower upfront costs but carries the risk of payment shock and slower equity buildup over time.

Key Differences Between Amortizing and Interest-Only Payments

Amortizing mortgages require payments that cover both principal and interest, gradually reducing the loan balance over time until fully paid off, resulting in consistent equity buildup. Interest-only mortgages demand payments solely on interest for a specified period, keeping the principal unchanged and leading to lower initial payments but larger future obligations. The key difference lies in payment structure: amortizing loans combine principal and interest in each payment, while interest-only loans separate these phases, impacting cash flow and long-term financial planning.

Payment Structure Comparison: Amortizing vs Interest-Only

Amortizing mortgages require monthly payments that cover both principal and interest, gradually reducing the loan balance until full repayment by term end. Interest-only mortgages demand lower initial payments, covering only interest for a set period, after which principal repayments increase significantly. This payment structure comparison highlights amortizing loans' stability versus interest-only loans' short-term affordability followed by higher future costs.

Impact on Monthly Payments

Amortizing mortgages require monthly payments that cover both principal and interest, resulting in gradually decreasing loan balance and stable payment amounts over time. Interest-only mortgages involve lower initial monthly payments since they cover only interest, but payments increase significantly once principal repayment begins. Choosing between these options affects long-term affordability and cash flow management during the loan term.

Total Interest Paid Over Loan Life

An amortizing mortgage requires monthly payments that cover both principal and interest, resulting in gradually decreasing interest over the loan term and lower total interest paid compared to an interest-only mortgage. An interest-only mortgage allows payments covering only interest initially, causing the principal balance to remain unchanged and leading to higher total interest costs over the life of the loan. Borrowers choosing an interest-only structure typically face increased financial burden once principal payments begin, significantly raising the total interest expense compared to an amortizing mortgage.

Building Home Equity: Which Structure Wins?

Amortizing mortgages build home equity gradually by applying each monthly payment toward both principal and interest, reducing the loan balance over time. Interest-only mortgages restrict payments to interest during the initial term, delaying principal reduction and equity growth until later. The amortizing structure wins in building home equity efficiently and steadily throughout the loan duration.

Financial Flexibility and Risks

An amortizing mortgage requires consistent principal and interest payments, gradually reducing the loan balance and building home equity, providing financial stability but less short-term cash flow flexibility. An interest-only mortgage demands lower initial monthly payments by covering interest alone, offering greater cash flow flexibility but increasing risk due to no principal reduction and potential payment shocks when principal repayments commence. Borrowers must weigh financial goals against risks such as rising interest rates or refinancing challenges when choosing between these payment structures.

Suitability: Which Mortgage Fits Your Financial Goals?

An amortizing mortgage suits homeowners aiming for long-term equity growth and predictable monthly payments, as each installment covers both principal and interest, gradually reducing the loan balance. Interest-only mortgages fit borrowers seeking lower initial payments or greater cash flow flexibility, ideal for short-term ownership or investment strategies expecting property appreciation. Evaluating your financial goals, income stability, and future plans determines whether the steady amortization or temporary interest-only structure aligns better with your mortgage needs.

Final Thoughts: Choosing the Right Mortgage Payment Structure

Amortizing mortgages provide a structured payment plan that gradually reduces both principal and interest, resulting in full loan repayment by the end of the term, offering predictable budgeting and equity building. Interest-only mortgages lower initial payments by requiring only interest, but principal remains unchanged, leading to higher payments later or a balloon payment, carrying more financial risk. Selecting the right mortgage payment structure depends on financial goals, cash flow flexibility, and long-term affordability, with amortizing loans suited for stability and interest-only options aimed at short-term savings or investment strategies.

Related Important Terms

Negative Amortization Trap

Amortizing mortgages gradually reduce the principal balance through consistent monthly payments that cover both principal and interest, preventing negative amortization. Interest-only mortgages risk falling into the negative amortization trap when borrowers pay only the interest, causing the loan balance to increase if the principal remains unpaid.

Hybrid Interest-Only Mortgage

Hybrid interest-only mortgages combine an initial period of interest-only payments with subsequent amortizing payments, providing lower monthly costs initially before principal repayment begins. This structure balances early cash flow flexibility with eventual equity buildup, distinguishing it from standard amortizing mortgages that require both principal and interest payments from the start.

Periodic Reset Risk

An amortizing mortgage reduces principal with each payment, minimizing periodic reset risk by locking in a consistent principal and interest schedule over the loan term. In contrast, an interest-only mortgage exposes borrowers to higher periodic reset risk, as the principal remains unchanged requiring refinancing or lump-sum repayment at term end, subject to interest rate fluctuations.

Balloon Payment Trigger

Amortizing mortgages require fixed monthly payments that gradually reduce both principal and interest, eliminating balance by loan term end, while interest-only mortgages involve payments covering only interest, leading to a large balloon payment trigger at maturity when the full principal becomes due. Balloon payment triggers in interest-only mortgages pose significant refinancing or lump-sum challenges compared to the predictable payoff schedule of amortizing loans.

Recasting Loan Structure

Amortizing mortgages involve regular principal and interest payments, steadily reducing the loan balance, while interest-only mortgages require payments covering just the interest, keeping the principal unchanged until a later date. Recasting loan structure allows borrowers with amortizing loans to adjust payment amounts by applying a lump sum to the principal, thus lowering monthly payments without refinancing, which is generally unavailable in interest-only mortgage arrangements.

Step-Rate Amortization

Step-rate amortization structures mortgage payments by increasing the principal repayment portion gradually over predefined intervals, resulting in initially lower payments that rise over time, optimizing cash flow for borrowers. This contrasts with interest-only mortgages where payments cover solely interest during the initial term, deferring principal reduction and leading to a lump-sum payment later.

Deferred Principal Option

Amortizing mortgages require regular payments that cover both principal and interest, reducing the loan balance over time, while interest-only mortgages focus solely on interest payments initially, deferring principal repayment to a later stage, often through a Deferred Principal Option that allows borrowers to postpone principal payments for a set period. This deferred structure can improve cash flow short-term but typically results in higher total interest costs and a lump-sum principal payment at the end of the deferral.

IO-to-Amortization Conversion

An interest-only mortgage requires payments solely on the principal interest during the initial term, resulting in lower monthly payments but no principal reduction, whereas an amortizing mortgage includes both principal and interest, ensuring gradual loan balance payoff. Transitioning from an interest-only mortgage to an amortizing mortgage increases monthly payments significantly as principal repayment begins, affecting long-term affordability and financial planning.

Prepayment Penalty Schedule

Amortizing mortgages feature a prepayment penalty schedule that typically decreases over time, encouraging consistent principal reduction through scheduled payments, whereas interest-only mortgages often impose stricter or longer-lasting prepayment penalties due to the delayed principal amortization. Understanding the specific prepayment penalty terms for each mortgage type is crucial for borrowers aiming to refinance or pay off loans early to minimize additional costs.

Interest-Only Draw Period

An Interest-Only Mortgage features a draw period during which borrowers pay only the interest, resulting in lower initial monthly payments compared to an Amortizing Mortgage that requires principal and interest payments from the start. This structure can improve short-term cash flow but may lead to higher payments after the draw period ends due to the principal balance remaining unchanged.

Amortizing Mortgage vs Interest-Only Mortgage for payment structure. Infographic

moneydiff.com

moneydiff.com