Refinancing your mortgage can significantly lower interest rates by replacing your existing loan with a new, more favorable one, often offering long-term savings. Instant refinance loans provide a quicker alternative with simplified approval processes but may come with higher rates or fees that impact overall savings. Carefully evaluating both options ensures you select the best strategy to reduce mortgage costs effectively.

Table of Comparison

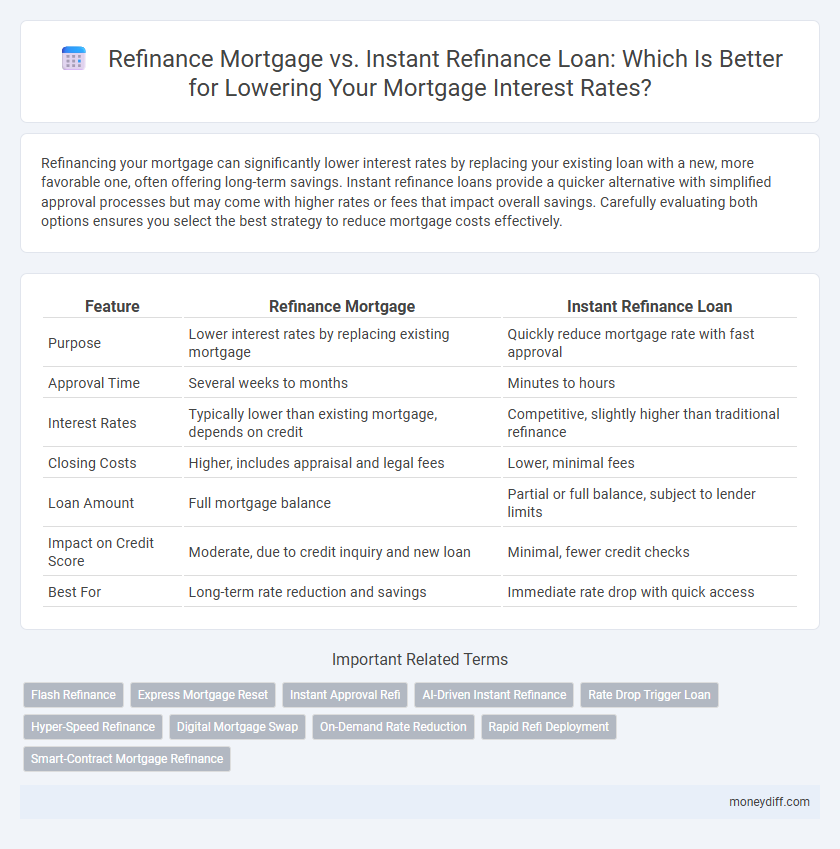

| Feature | Refinance Mortgage | Instant Refinance Loan |

|---|---|---|

| Purpose | Lower interest rates by replacing existing mortgage | Quickly reduce mortgage rate with fast approval |

| Approval Time | Several weeks to months | Minutes to hours |

| Interest Rates | Typically lower than existing mortgage, depends on credit | Competitive, slightly higher than traditional refinance |

| Closing Costs | Higher, includes appraisal and legal fees | Lower, minimal fees |

| Loan Amount | Full mortgage balance | Partial or full balance, subject to lender limits |

| Impact on Credit Score | Moderate, due to credit inquiry and new loan | Minimal, fewer credit checks |

| Best For | Long-term rate reduction and savings | Immediate rate drop with quick access |

Understanding Mortgage Refinance: Basics and Benefits

Mortgage refinance involves replacing an existing loan with a new mortgage that has better terms, typically lower interest rates, to reduce monthly payments and overall debt cost. Instant refinance loans offer a streamlined application and faster approval process, providing quick access to improved rates without extensive paperwork. Evaluating credit scores, current interest rates, and loan terms helps determine whether traditional or instant refinance best suits financial goals.

What Is an Instant Refinance Loan?

An Instant Refinance Loan is a streamlined mortgage refinancing option designed to reduce interest rates quickly without extensive paperwork or long approval processes. Unlike traditional refinance mortgages, it leverages automated underwriting and digital documentation to expedite loan approval and disbursement. This option suits borrowers seeking immediate interest rate reductions with minimal hassle compared to conventional refinancing.

Key Differences: Traditional Refinance vs Instant Refinance

Traditional refinance involves a comprehensive application process, credit checks, and appraisal, typically requiring several weeks to complete, which can lead to lower interest rates through thorough underwriting. Instant refinance loans offer a streamlined approval process with minimal documentation and faster disbursal, but may come with higher interest rates due to reduced lender risk assessment. Understanding these key differences helps borrowers balance speed and cost when choosing between traditional refinance and instant refinance loan options.

Interest Rate Reduction: How Both Options Compare

Refinance mortgages typically offer more substantial interest rate reductions by allowing borrowers to negotiate longer terms and better credit-based rates with lenders. Instant refinance loans provide quicker approvals but often come with higher interest rates and fewer opportunities for significant rate decreases. Comparing both options, traditional refinance mortgages generally deliver more cost savings over time through lower interest expenses.

Qualification Requirements for Each Refinance Approach

Refinance mortgage qualification typically requires a strong credit score, stable income, and minimum equity in the home, usually at least 20%. Instant refinance loans often have more lenient qualification criteria, leveraging automated underwriting and requiring less documentation but may come with higher interest rates. Borrowers with excellent credit and sufficient equity benefit most from traditional refinance mortgages, while those needing faster approval or with less perfect credit might consider instant refinance loans.

Processing Time: Traditional Refinance vs Instant Refinance

Traditional refinance mortgages typically require several weeks for processing due to extensive documentation, credit checks, and appraisal requirements, which can delay rate reductions. Instant refinance loans offer significantly faster processing times, often completing within days by leveraging automated underwriting and streamlined approval systems. Borrowers seeking immediate interest rate relief frequently choose instant refinance options to expedite savings and minimize market fluctuation risks.

Costs and Fees: Breaking Down the Expenses

Refinance mortgages typically involve appraisal fees, closing costs, and lender origination charges that can range from 2% to 6% of the loan amount, making upfront expenses significant but potentially offset by long-term savings. Instant refinance loans often feature lower initial fees or waived closing costs but may include higher interest rates or hidden charges that increase total repayment costs. Evaluating all fees, including prepayment penalties and administrative charges, is essential to determine which option offers the best financial benefit for lowering interest rates.

Credit Impact: What Borrowers Should Know

Refinance mortgage applications typically involve a hard credit inquiry, which can temporarily lower a borrower's credit score by a few points, potentially impacting loan eligibility. Instant refinance loans often use automated underwriting systems with soft credit checks, minimizing immediate credit score impact but may offer higher interest rates or stricter terms. Borrowers should weigh the credit impact alongside interest rate savings to choose the most beneficial refinance option.

When to Choose Instant Refinance Over Traditional Refinance

Instant refinance loans are ideal when homeowners need quick access to lower interest rates without the lengthy approval process typical of traditional mortgage refinancing. These loans often require less documentation and can close within days, making them suitable for borrowers facing rate increases or urgent financial shifts. Traditional refinance remains preferable for those seeking long-term savings through comprehensive credit checks and appraisal processes that ensure optimal mortgage terms.

Expert Tips for Lowering Your Mortgage Interest Rate

Expert tips for lowering your mortgage interest rate include thoroughly comparing traditional refinance mortgages with instant refinance loans to identify the best option for your financial situation. Traditional refinancing often offers lower interest rates and long-term savings, while instant refinance loans provide faster processing but may come with higher rates. Consulting with a mortgage advisor can help evaluate credit scores, loan terms, and closing costs to maximize interest rate reductions effectively.

Related Important Terms

Flash Refinance

Flash Refinance offers a streamlined alternative to traditional refinance mortgages by providing instant loan approval and funding, enabling homeowners to quickly lower their interest rates without extensive paperwork. This innovative solution leverages technology to reduce closing times and costs, making it an efficient choice for borrowers seeking fast, lower-rate refinancing options.

Express Mortgage Reset

Express Mortgage Reset offers a streamlined alternative to traditional refinance mortgages by instantly lowering interest rates without the lengthy approval process. This innovative option enables homeowners to reduce monthly payments quickly, leveraging current market rates for immediate financial relief.

Instant Approval Refi

Instant approval refinance loans expedite the process of lowering mortgage interest rates by providing swift credit decisions, often within minutes, compared to the traditional refinance mortgage which may take weeks. Borrowers seeking immediate financial relief benefit from the streamlined documentation and automated underwriting systems characteristic of instant refinance options.

AI-Driven Instant Refinance

AI-driven instant refinance loans utilize advanced algorithms and real-time market data to offer homeowners faster rate reductions compared to traditional refinance mortgages, which often involve lengthy approval processes. These instant loans optimize interest savings by dynamically matching borrowers with the lowest available rates using machine learning models and automated underwriting systems.

Rate Drop Trigger Loan

Rate Drop Trigger Loans offer borrowers the unique benefit of automatically adjusting the mortgage interest rate when market rates decline, providing flexibility not typically found in traditional refinance mortgages. Unlike instant refinance loans that require a full refinancing process to secure lower rates, Rate Drop Trigger Loans enable homeowners to reduce their interest payments without incurring extensive closing costs or refinancing fees.

Hyper-Speed Refinance

Hyper-Speed Refinance offers a streamlined, efficient alternative to traditional refinance mortgages by delivering near-instant approval and reduced processing times, enabling borrowers to capitalize on lower interest rates faster. This instant refinance loan mechanism minimizes paperwork and closing delays, making it a superior option for those seeking quick interest rate reductions without the prolonged hassle of standard refinancing.

Digital Mortgage Swap

Digital Mortgage Swap enables homeowners to lower interest rates efficiently by comparing Refinance Mortgage options with Instant Refinance Loans through real-time digital platforms. This technology streamlines the decision-making process by providing instant rate quotes and personalized loan terms, enhancing cost savings and approval speed.

On-Demand Rate Reduction

Refinance mortgages typically involve a thorough approval process and can take weeks to lower interest rates, while instant refinance loans offer on-demand rate reduction with minimal paperwork and immediate access to better rates. Leveraging instant refinance loans enables homeowners to quickly reduce monthly payments without the traditional delays associated with standard mortgage refinancing.

Rapid Refi Deployment

Rapid Refi Deployment accelerates the process of securing lower interest rates by offering instant refinance loan approvals compared to traditional refinance mortgages, which often involve lengthy underwriting and documentation. Instant refinance loans leverage automated underwriting systems and streamlined credit assessments to quickly reduce monthly payments and overall loan costs.

Smart-Contract Mortgage Refinance

Smart-contract mortgage refinance enables automated execution of loan terms, significantly reducing processing time and operational costs compared to traditional refinance mortgages, which can be slower and more paperwork-intensive. Instant refinance loans powered by blockchain smart contracts offer real-time interest rate adjustments and transparent underwriting, delivering lower rates and enhanced borrower control in mortgage refinancing.

Refinance Mortgage vs Instant Refinance Loan for lowering interest rates. Infographic

moneydiff.com

moneydiff.com