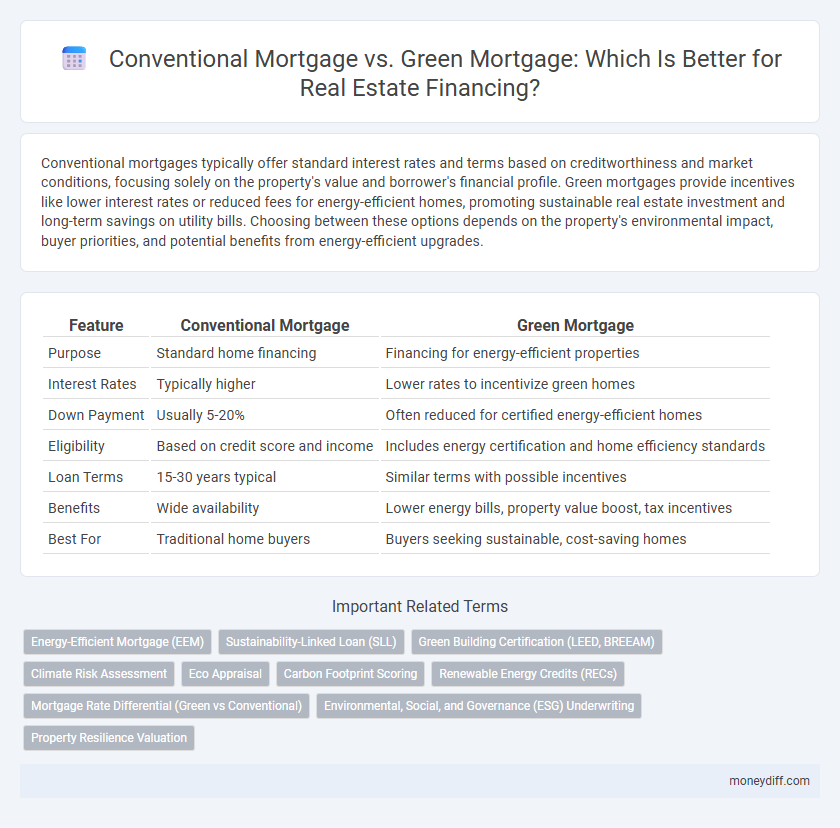

Conventional mortgages typically offer standard interest rates and terms based on creditworthiness and market conditions, focusing solely on the property's value and borrower's financial profile. Green mortgages provide incentives like lower interest rates or reduced fees for energy-efficient homes, promoting sustainable real estate investment and long-term savings on utility bills. Choosing between these options depends on the property's environmental impact, buyer priorities, and potential benefits from energy-efficient upgrades.

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Standard home financing | Financing for energy-efficient properties |

| Interest Rates | Typically higher | Lower rates to incentivize green homes |

| Down Payment | Usually 5-20% | Often reduced for certified energy-efficient homes |

| Eligibility | Based on credit score and income | Includes energy certification and home efficiency standards |

| Loan Terms | 15-30 years typical | Similar terms with possible incentives |

| Benefits | Wide availability | Lower energy bills, property value boost, tax incentives |

| Best For | Traditional home buyers | Buyers seeking sustainable, cost-saving homes |

Understanding Conventional Mortgages

Conventional mortgages are traditional home loans not insured or guaranteed by the government, typically requiring a down payment of at least 5% and a strong credit score above 620. These loans offer fixed or adjustable interest rates and are widely used for primary residences, second homes, or investment properties. Understanding the conventional mortgage structure helps borrowers evaluate eligibility, interest costs, and long-term financial commitments compared to niche options like green mortgages.

What is a Green Mortgage?

A green mortgage is a specialized loan designed to finance energy-efficient homes or sustainable building improvements, offering lower interest rates or favorable terms to borrowers who invest in environmentally friendly properties. This type of mortgage incentivizes buyers to choose homes with energy-saving features such as solar panels, high-efficiency windows, or insulation that reduces utility costs and carbon footprints. Compared to conventional mortgages, green mortgages support the real estate market's shift toward sustainability by encouraging energy-conscious investments that increase property value while lowering long-term expenses.

Key Differences: Conventional vs Green Mortgages

Conventional mortgages typically require standard credit scores, fixed or variable interest rates, and conventional underwriting criteria without specific environmental considerations. Green mortgages offer incentives such as lower interest rates or higher loan-to-value ratios for energy-efficient properties or improvements, promoting sustainable real estate investments. Key differences include eligibility criteria focused on energy performance, financial benefits tied to environmental impact, and regulatory requirements supporting eco-friendly housing developments.

Eligibility Criteria for Each Mortgage Type

Conventional mortgages typically require a minimum credit score of 620, a stable income source, and a debt-to-income ratio below 43%, with down payments ranging from 3% to 20%. Green mortgages often demand property certifications such as LEED or ENERGY STAR, proof of energy-efficient upgrades, and may require slightly higher credit scores or reserves to qualify. Lenders assess eligibility based on standard financial credentials for conventional loans, whereas green mortgages emphasize environmental performance and potential utility savings.

Interest Rates and Loan Terms Comparison

Conventional mortgages typically feature fixed or variable interest rates ranging from 5% to 7% with standard loan terms of 15 to 30 years, offering broad accessibility for real estate financing. Green mortgages often provide lower interest rates, sometimes up to 0.5% less, and may include flexible loan terms or incentives tied to energy-efficient property standards, promoting sustainable investment. Borrowers securing green mortgages benefit from reduced financing costs over the term, which can significantly lower overall repayment amounts compared to conventional loans.

Upfront Costs and Potential Savings

Conventional mortgages typically require higher upfront costs, including down payments and closing fees, which can range from 3% to 20% of the property value, whereas green mortgages often offer reduced or waived fees to incentivize energy-efficient property purchases. Green mortgages provide potential savings through lower interest rates or additional rebates tied to energy improvements, translating to significant long-term cost reductions in utility expenses and loan repayments. Evaluating both upfront costs and ongoing savings is crucial when choosing between conventional and green mortgage options for real estate financing.

Environmental Impact and Incentives

Conventional mortgages provide standard financing options without specific environmental considerations, often resulting in higher energy costs and greater carbon footprints for homebuyers. Green mortgages encourage energy-efficient home purchases and improvements by offering lower interest rates, discounts, or cash incentives, promoting sustainable real estate development. These incentives reduce monthly expenses and contribute to decreased greenhouse gas emissions by supporting eco-friendly construction and renewable energy installations.

Suitability for Homebuyers and Investors

Conventional mortgages offer broad accessibility and flexibility, making them suitable for homebuyers and investors seeking standard loan terms without property energy requirements. Green mortgages target environmentally-conscious borrowers by providing incentives like lower interest rates or higher loan-to-value ratios for energy-efficient homes, appealing to those prioritizing sustainability and long-term savings. Investors focused on green real estate can benefit from increased property value and market demand through green mortgage programs, while conventional loans remain a reliable choice for traditional real estate investments.

Repayment Flexibility and Financial Planning

Conventional mortgages typically offer standardized repayment terms with fixed or adjustable rates, providing predictability but limited flexibility in modifying payment schedules. Green mortgages often include incentives such as lower interest rates or extended repayment periods to support energy-efficient property investments, enabling borrowers to better align repayments with cost savings from reduced utility bills. This enhanced repayment flexibility allows homeowners to optimize financial planning by integrating eco-friendly improvements into their long-term real estate investment strategy.

Choosing the Right Mortgage for Your Real Estate Goals

Choosing the right mortgage for your real estate goals involves comparing conventional mortgages and green mortgages based on interest rates, eligibility, and long-term savings. Conventional mortgages typically offer flexible financing for a wide range of properties with competitive rates, while green mortgages provide incentives like lower rates or higher loan limits for energy-efficient homes. Evaluating factors such as credit score, property type, and potential energy savings ensures optimal financing aligned with sustainability and financial objectives.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements as part of their home purchase or refinancing, typically offering lower interest rates and higher loan limits compared to conventional mortgages. These loans encourage investment in energy-efficient upgrades like solar panels or insulation, reducing utility costs and increasing property value while promoting sustainable real estate financing.

Sustainability-Linked Loan (SLL)

Conventional mortgages typically offer standard interest rates without incentives tied to environmental performance, whereas Green Mortgages, often structured as Sustainability-Linked Loans (SLLs), provide borrowers with interest rate reductions or financial benefits contingent on meeting specific sustainability targets like energy efficiency improvements or reduced carbon emissions. These SLLs drive sustainable real estate financing by aligning loan terms with measurable environmental goals, promoting greener building practices and long-term ecological impact reduction.

Green Building Certification (LEED, BREEAM)

Green mortgages leverage properties with Green Building Certifications such as LEED and BREEAM, offering lower interest rates and incentives due to proven energy efficiency and sustainability. Conventional mortgages typically lack these benefits, focusing solely on credit and property value without considering environmental performance.

Climate Risk Assessment

Conventional mortgages typically focus on creditworthiness and property value without integrating climate risk factors, whereas green mortgages include comprehensive climate risk assessments to evaluate potential impacts like flooding or extreme weather on property resilience and long-term value. Incorporating climate risk assessment in green mortgage applications supports sustainable real estate financing by promoting investments in energy-efficient, climate-resilient properties that align with environmental standards and reduce future financial risks.

Eco Appraisal

Eco appraisal in green mortgages assesses a property's energy efficiency and environmental impact, often leading to lower interest rates and better terms compared to conventional mortgages. Conventional mortgages typically focus on creditworthiness and property value without factoring in energy performance metrics or sustainability features.

Carbon Footprint Scoring

Conventional mortgages typically do not account for a property's environmental impact, whereas green mortgages incorporate carbon footprint scoring to evaluate and incentivize energy-efficient, low-emission real estate. This scoring system helps lenders offer better rates and terms for homes that minimize carbon emissions, promoting sustainable development and reducing the overall environmental impact of housing finance.

Renewable Energy Credits (RECs)

Conventional mortgages typically do not include incentives related to Renewable Energy Credits (RECs), whereas green mortgages often integrate REC benefits to promote energy-efficient homes and lower environmental impact. By leveraging RECs, green mortgage borrowers can reduce long-term costs and increase property value through sustainable energy use in real estate financing.

Mortgage Rate Differential (Green vs Conventional)

Green mortgages typically offer lower interest rates compared to conventional mortgages due to incentives for energy-efficient properties, often reflecting a rate differential of about 0.25% to 0.50%. This reduced mortgage rate supports borrowers in financing eco-friendly real estate while potentially lowering monthly payments and overall loan costs.

Environmental, Social, and Governance (ESG) Underwriting

Conventional mortgages typically assess borrower creditworthiness based on financial metrics alone, while green mortgages integrate Environmental, Social, and Governance (ESG) underwriting criteria to promote sustainable building practices and energy-efficient properties. Incorporating ESG factors in green mortgage underwriting enhances real estate financing by reducing carbon footprints and supporting socially responsible investments, aligning with growing investor and regulatory demands.

Property Resilience Valuation

Conventional mortgages typically base property valuation on market trends and physical characteristics, often overlooking long-term resilience factors such as energy efficiency and climate risk mitigation. Green mortgages prioritize property resilience valuation by incorporating sustainable features and environmental impact assessments, potentially leading to lower financing costs and increased property value in the face of climate change.

Conventional Mortgage vs Green Mortgage for Real Estate Financing. Infographic

moneydiff.com

moneydiff.com