Government-backed mortgages offer lower interest rates and easier qualification for first-time homebuyers by providing federal guarantees, reducing lender risk. Digital mortgages streamline the home acquisition process through online applications and automated approvals, increasing convenience and speed. Choosing between these options depends on balancing financial benefits with the desire for a faster, tech-driven experience in securing a mortgage.

Table of Comparison

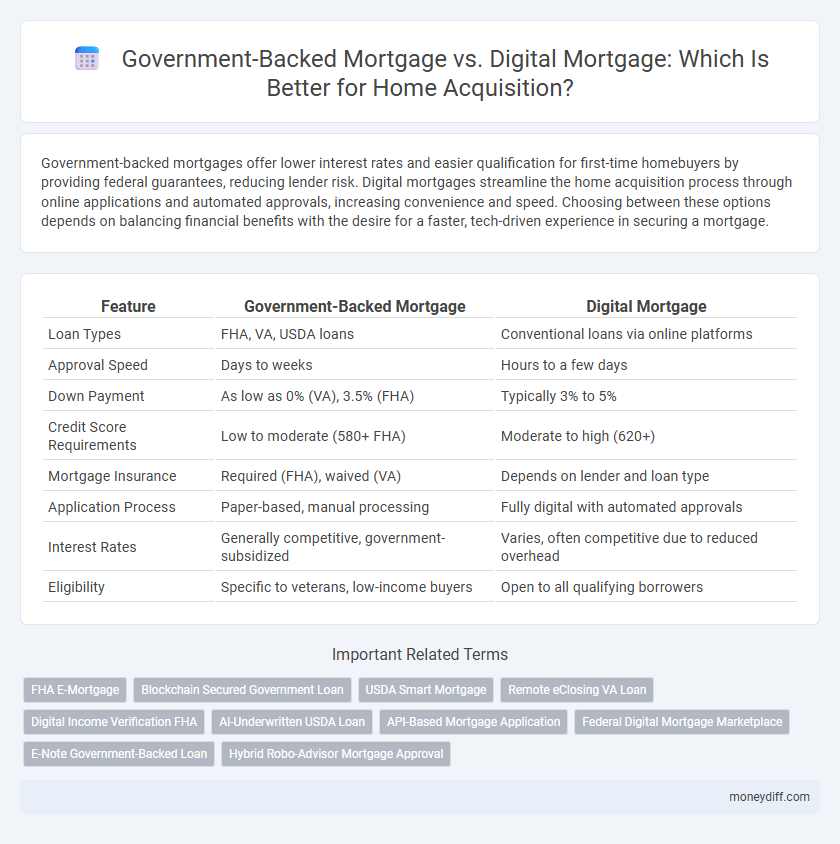

| Feature | Government-Backed Mortgage | Digital Mortgage |

|---|---|---|

| Loan Types | FHA, VA, USDA loans | Conventional loans via online platforms |

| Approval Speed | Days to weeks | Hours to a few days |

| Down Payment | As low as 0% (VA), 3.5% (FHA) | Typically 3% to 5% |

| Credit Score Requirements | Low to moderate (580+ FHA) | Moderate to high (620+) |

| Mortgage Insurance | Required (FHA), waived (VA) | Depends on lender and loan type |

| Application Process | Paper-based, manual processing | Fully digital with automated approvals |

| Interest Rates | Generally competitive, government-subsidized | Varies, often competitive due to reduced overhead |

| Eligibility | Specific to veterans, low-income buyers | Open to all qualifying borrowers |

Understanding Government-Backed Mortgages: Key Features

Government-backed mortgages, such as FHA, VA, and USDA loans, offer lower down payment requirements and reduced credit score thresholds compared to conventional loans, making homeownership more accessible. These loans are insured by government agencies, which lowers the lender's risk and often results in more favorable interest rates. Understanding eligibility criteria, loan limits, and specific benefits is crucial for maximizing the advantages of government-backed mortgage programs.

What Is a Digital Mortgage? Exploring the Basics

A digital mortgage streamlines the home loan process by leveraging online platforms for application, document submission, and approval, significantly reducing paperwork and processing time. Unlike traditional government-backed mortgages, which often require extensive manual verification and face-to-face interactions, digital mortgages use automated systems and electronic signatures to enhance efficiency and accessibility. This technology-driven approach enables prospective homeowners to secure financing faster while maintaining compliance with regulatory standards.

Eligibility Requirements: Government-Backed vs. Digital Mortgages

Government-backed mortgages, such as FHA, VA, and USDA loans, require specific eligibility criteria including credit score minimums, income limits, and property location regulations to qualify for federal insurance or guarantees. Digital mortgages streamline the application process by leveraging automated income verification and digital identity authentication but may still require traditional credit and employment verification depending on the lender's underwriting standards. Borrowers seeking government-backed loans benefit from lower down payment options and more lenient credit requirements, whereas digital mortgages prioritize efficiency and speed, often appealing to tech-savvy applicants who meet conventional loan eligibility.

Application Process Comparison: Traditional vs. Digital

Government-backed mortgage applications typically require extensive paperwork, in-person verification, and longer processing times due to regulatory compliance and manual review. Digital mortgage platforms streamline the application process with online forms, automated document submission, and faster approval through AI-driven underwriting. Borrowers benefit from increased convenience and transparency in digital applications, contrasting with the more rigid and time-consuming nature of traditional government-backed mortgage processes.

Interest Rates: How Government-Backed and Digital Mortgages Differ

Government-backed mortgages typically offer lower interest rates due to federal insurance by agencies like FHA, VA, or USDA, reducing lender risk and enabling more affordable borrowing costs. Digital mortgages often feature competitive rates driven by streamlined online processing and reduced overhead, but may not match the subsidies provided by government insurance programs. Borrowers must weigh the potentially lower interest rates of government-backed loans against the speed and convenience of digital mortgage platforms when acquiring a home.

Down Payment and Assistance Programs: Benefits and Limitations

Government-backed mortgages often require lower down payments, sometimes as low as 3.5%, and provide access to assistance programs like FHA or VA loans, which help reduce upfront costs and include benefits such as mortgage insurance subsidies. Digital mortgages streamline the application process but generally maintain standard down payment requirements, rarely offering specialized assistance programs, which may limit affordability for some buyers. Understanding these differences in down payment flexibility and program availability can significantly impact the overall affordability and accessibility of home acquisition.

Processing Speed and Approval Times: Digital vs. Government-Backed

Digital mortgages significantly reduce processing speed and approval times, often delivering decisions within 24 to 48 hours through automated verification and AI-driven underwriting. Government-backed mortgages, such as FHA or VA loans, typically require more extensive documentation and manual review, resulting in approval timelines ranging from 30 to 60 days. Faster turnaround in digital mortgages accelerates home acquisition but may lack the flexible credit considerations inherent in government-backed options.

Credit Score Considerations in Both Mortgage Types

Government-backed mortgages typically require a minimum credit score ranging from 580 to 620, allowing borrowers with lower creditworthiness to qualify for home acquisition. Digital mortgages often implement automated credit scoring models that may offer faster approvals but generally favor higher credit scores above 700 for optimal terms. Understanding credit score thresholds in both mortgage types is crucial for borrowers aiming to maximize approval chances and secure favorable interest rates.

Long-Term Costs: Comparing Total Ownership Expenses

Government-backed mortgages typically offer lower initial interest rates and down payment requirements, reducing upfront costs for homebuyers. Digital mortgages streamline the approval process, potentially lowering administrative fees and closing costs but may not guarantee the same interest rate advantages. Over the long term, the total ownership expenses of government-backed loans can be more predictable due to fixed-rate options, while digital mortgages often involve variable rates that could increase overall payments.

Which Mortgage Fits Your Needs: Government-Backed or Digital?

Government-backed mortgages, such as FHA, VA, and USDA loans, offer lower down payments and more flexible credit requirements, making them ideal for first-time buyers or those with limited credit history. Digital mortgages streamline the home acquisition process through online applications, faster approvals, and automated document verification, appealing to tech-savvy buyers seeking convenience and speed. Assess your financial situation, credit score, and preference for traditional support versus digital efficiency to determine which mortgage fits your needs best.

Related Important Terms

FHA E-Mortgage

FHA E-Mortgages combine the security of government-backed loans with the efficiency of digital processing, streamlining approval timelines and reducing paperwork for homebuyers. This hybrid approach offers competitive interest rates and lower down payment requirements while enabling faster electronic document handling compared to traditional digital mortgages without federal insurance.

Blockchain Secured Government Loan

Blockchain-secured government loans enhance transparency and security in government-backed mortgages by leveraging decentralized ledger technology to prevent fraud and ensure accurate record-keeping. Digital mortgages streamline the application process but integrating blockchain with government-backed loans offers a robust framework for secure, efficient, and trustworthy house acquisition financing.

USDA Smart Mortgage

USDA Smart Mortgage offers competitive, government-backed financing specifically designed for rural and suburban homebuyers, eliminating the need for a down payment while providing flexible credit requirements. Digital mortgages streamline application and approval processes through automated technology, enhancing speed and convenience but may lack some of the tailored benefits and security features found in USDA Smart Mortgage programs.

Remote eClosing VA Loan

Remote eClosing for VA loans enhances the government-backed mortgage process by allowing veterans to complete home acquisitions securely and efficiently from any location, reducing the need for in-person meetings. Digital mortgage platforms streamline document submission and verification, accelerating approval times while maintaining compliance with VA regulations and ensuring a seamless borrower experience.

Digital Income Verification FHA

Digital income verification through FHA streamlines the mortgage approval process by securely accessing real-time employment and income data, reducing manual paperwork and speeding up loan processing. This technology enhances accuracy and transparency compared to traditional government-backed mortgage methods, improving borrower experience and eligibility assessment.

AI-Underwritten USDA Loan

AI-underwritten USDA loans, a subset of government-backed mortgages, leverage artificial intelligence to streamline eligibility verification and risk assessment, significantly reducing processing time and improving accuracy for rural homebuyers. Digital mortgage platforms integrate AI algorithms to automate credit scoring and income verification, enabling faster approval rates while maintaining the USDA loan's benefits such as no down payment and lower mortgage insurance premiums.

API-Based Mortgage Application

Government-backed mortgages offer stability with federally insured loans like FHA and VA, while digital mortgages streamline the home acquisition process through API-based applications, enabling faster approval and integration with financial data services. API-based mortgage applications enhance efficiency by automating document verification, reducing manual errors, and providing real-time loan status updates for borrowers and lenders.

Federal Digital Mortgage Marketplace

The Federal Digital Mortgage Marketplace streamlines access to government-backed mortgages by integrating automated processes with regulatory compliance, enhancing efficiency and transparency for homebuyers. This platform reduces paperwork and accelerates approval times compared to traditional government-backed mortgages, supporting faster house acquisition.

E-Note Government-Backed Loan

Government-backed mortgages, such as FHA, VA, and USDA loans, utilize E-Note technology to streamline the loan process with secure electronic promissory notes, enhancing efficiency and reducing paperwork for homebuyers. Digital mortgages leverage automated platforms for application, approval, and closing, but government-backed E-Note loans specifically guarantee federal insurance and compliance, combining technological innovation with government protections in house acquisition.

Hybrid Robo-Advisor Mortgage Approval

Hybrid robo-advisor mortgage approval integrates government-backed mortgage benefits with digital mortgage efficiency, leveraging AI-driven risk assessment to expedite loan processing while ensuring access to low down payments and competitive interest rates. This hybrid system enhances borrower experience by combining automated underwriting accuracy with personalized guidance, streamlining house acquisition through faster decisions and government loan program compliance.

Government-Backed Mortgage vs Digital Mortgage for House Acquisition. Infographic

moneydiff.com

moneydiff.com