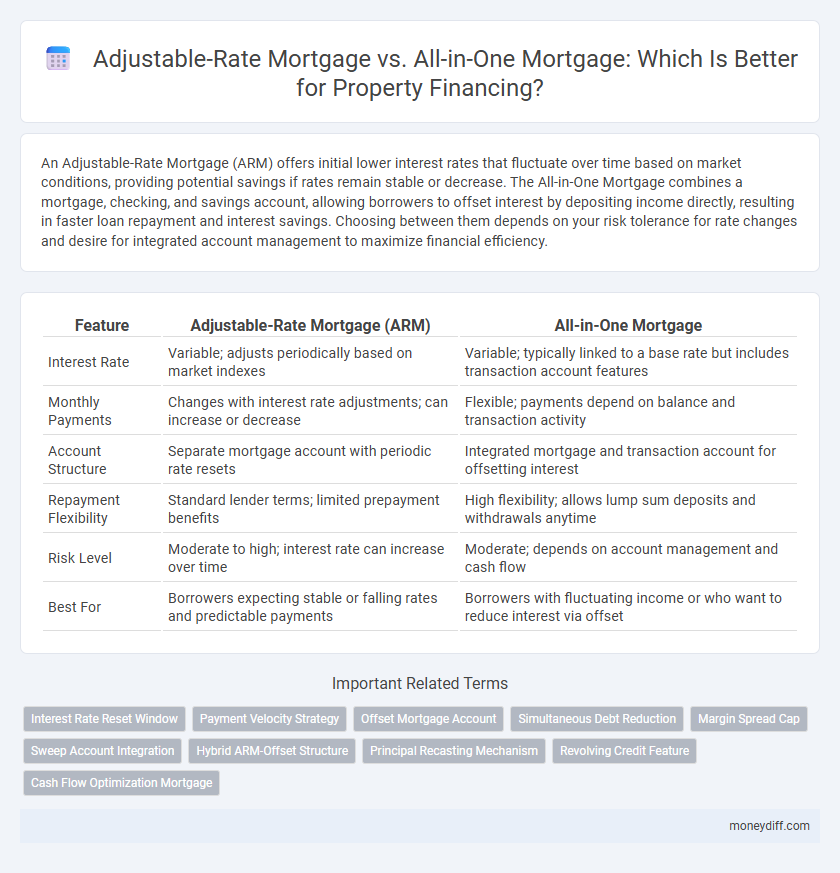

An Adjustable-Rate Mortgage (ARM) offers initial lower interest rates that fluctuate over time based on market conditions, providing potential savings if rates remain stable or decrease. The All-in-One Mortgage combines a mortgage, checking, and savings account, allowing borrowers to offset interest by depositing income directly, resulting in faster loan repayment and interest savings. Choosing between them depends on your risk tolerance for rate changes and desire for integrated account management to maximize financial efficiency.

Table of Comparison

| Feature | Adjustable-Rate Mortgage (ARM) | All-in-One Mortgage |

|---|---|---|

| Interest Rate | Variable; adjusts periodically based on market indexes | Variable; typically linked to a base rate but includes transaction account features |

| Monthly Payments | Changes with interest rate adjustments; can increase or decrease | Flexible; payments depend on balance and transaction activity |

| Account Structure | Separate mortgage account with periodic rate resets | Integrated mortgage and transaction account for offsetting interest |

| Repayment Flexibility | Standard lender terms; limited prepayment benefits | High flexibility; allows lump sum deposits and withdrawals anytime |

| Risk Level | Moderate to high; interest rate can increase over time | Moderate; depends on account management and cash flow |

| Best For | Borrowers expecting stable or falling rates and predictable payments | Borrowers with fluctuating income or who want to reduce interest via offset |

Understanding Adjustable-Rate Mortgages: Key Features

Adjustable-rate mortgages (ARMs) offer property financing with interest rates that fluctuate based on market indices, typically starting with a lower fixed rate for an initial period before adjusting periodically. Key features of ARMs include caps on rate increases, adjustment intervals, and index benchmarks such as LIBOR or the U.S. Treasury rate that influence payment changes. Understanding these components helps borrowers evaluate the potential risks and benefits compared to all-in-one mortgages, which combine mortgage principal, interest, and transaction accounts for flexible repayments.

What Is an All-in-One Mortgage? Overview and Benefits

An All-in-One Mortgage combines a home loan, savings, and everyday banking into a single account, allowing borrowers to offset interest by reducing the principal with their account balance. This flexible financing tool accelerates mortgage repayment and reduces interest costs by linking income and expenses directly to the loan. Compared to an Adjustable-Rate Mortgage, an All-in-One Mortgage offers greater control over cash flow and can result in faster equity buildup.

Rate Structures: Adjustable-Rate vs All-in-One Mortgage

Adjustable-rate mortgages (ARMs) feature interest rates that vary periodically based on a benchmark index, offering lower initial rates with potential future fluctuations, while all-in-one mortgages combine mortgage, savings, and transaction accounts into one, allowing flexible repayments and interest savings on the entire balance. ARMs typically have fixed initial periods followed by rate adjustments, exposing borrowers to interest rate risk, whereas all-in-one mortgages provide continuous interest calculation on reduced principal due to offsetting deposits, optimizing cash flow management. Understanding these rate structures helps borrowers choose between ARMs' predictable resets and all-in-one's dynamic balance-driven interest benefits for effective property financing.

Flexibility in Repayment: Comparing Mortgage Options

Adjustable-Rate Mortgages (ARMs) offer flexible repayment terms with interest rates that adjust periodically based on market indexes, allowing borrowers to benefit from lower initial rates but face potential increases over time. All-in-One Mortgages integrate a mortgage, savings, and transaction account, providing unparalleled flexibility by enabling borrowers to offset interest charges through daily deposits and make lump-sum repayments at any time without penalties. Choosing between ARM and All-in-One Mortgage depends on the borrower's preference for interest rate variability versus cash flow control and repayment agility.

Interest Rate Risks and Rewards in Each Mortgage Type

Adjustable-Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indexes, exposing borrowers to potential rate increases that can raise monthly payments but also offering lower initial rates that may reduce early costs. All-in-One Mortgages combine a mortgage with a deposit account, allowing for flexible payments that can reduce interest expenses by offsetting the loan principal with deposit balances, though the interest rates are typically variable and influenced by the lender's policies. Understanding the risk of rising rates in ARMs versus the potential interest savings and cash flow control in All-in-One Mortgages is crucial for borrowers managing long-term financing strategy and payment predictability.

Suitability: Who Should Consider Adjustable-Rate Mortgages?

Adjustable-rate mortgages (ARMs) suit borrowers anticipating stable or rising incomes who seek lower initial interest rates and potential savings during the early loan period. They are ideal for homeowners planning to sell or refinance before rate resets or those comfortable with fluctuating monthly payments. This financing type appeals to buyers expecting short-term property ownership or those confident in managing future interest rate variability.

Optimal Borrower Profiles for All-in-One Mortgages

All-in-One Mortgages are ideal for financially disciplined borrowers who maintain irregular income streams or prioritize debt consolidation and savings integration, leveraging the combined transaction account to reduce interest expenses. Borrowers with strong cash flow management skills benefit from the flexible principal repayments and interest recalculations tied to their daily account balances, optimizing overall mortgage efficiency. This product suits individuals seeking accelerated loan payoff strategies while maintaining liquidity, contrasting with Adjustable-Rate Mortgages suited for those expecting income growth or short-term ownership.

Impact on Long-Term Wealth: Which Mortgage Wins?

An Adjustable-Rate Mortgage (ARM) offers lower initial interest rates that can increase or decrease over time, potentially impacting long-term wealth by introducing payment variability and interest cost uncertainty. An All-in-One Mortgage combines a mortgage and a transaction account, allowing borrowers to reduce interest by offsetting their loan with their income and savings, often accelerating repayment and wealth accumulation. For long-term wealth building, an All-in-One Mortgage typically provides greater financial flexibility and interest savings compared to the fluctuating costs of an ARM.

Hidden Costs and Potential Savings Explained

Adjustable-rate mortgages often feature lower initial interest rates but may incur hidden costs such as rate adjustments and caps that increase monthly payments unpredictably over time. All-in-One Mortgages combine mortgage and checking accounts, offering potential savings on interest by offsetting balances, yet they may include fees and require disciplined cash flow management to avoid escalating costs. Evaluating these financing options requires careful analysis of interest variability, fees, and the borrower's financial behavior to optimize long-term savings and minimize unexpected expenses.

Choosing the Right Mortgage: Decision Factors and Tips

Choosing between an Adjustable-Rate Mortgage (ARM) and an All-in-One Mortgage involves evaluating interest rate fluctuations versus flexible payment structures. ARM offers lower initial rates with adjustments tied to market indexes, ideal for buyers expecting rate drops or short-term ownership. An All-in-One Mortgage combines mortgage repayment with access to savings and income accounts, maximizing cash flow and reducing interest costs for financially organized homeowners.

Related Important Terms

Interest Rate Reset Window

Adjustable-Rate Mortgage (ARM) typically features interest rate reset windows every one to five years, allowing rates to fluctuate based on market indexes and potentially resulting in variable monthly payments. All-in-One Mortgages usually have fixed or less frequent reset periods, integrating principal, interest, and transactions in a single account to optimize cash flow but with more predictable interest rate adjustments.

Payment Velocity Strategy

Adjustable-rate mortgages (ARMs) offer initial lower interest rates that adjust over time, aligning payment velocity with market fluctuations and potentially increasing monthly payments as rates rise. All-in-One mortgages integrate a credit facility with the home loan, allowing rapid payment of both principal and interest through flexible deposits, accelerating debt repayment and optimizing cash flow management.

Offset Mortgage Account

An Adjustable-Rate Mortgage (ARM) offers property financing with interest rates that fluctuate based on market indices, potentially lowering initial payments but increasing long-term cost uncertainty, whereas an All-in-One Mortgage integrates a mortgage, savings, and spending account to reduce interest through offset mechanisms by applying deposits directly against the loan principal. The Offset Mortgage Account in an All-in-One Mortgage structure leverages deposited funds to minimize interest charges, effectively allowing borrowers to save on interest payments while maintaining liquidity for everyday expenses.

Simultaneous Debt Reduction

Adjustable-Rate Mortgages (ARMs) offer fluctuating interest rates that can lower initial monthly payments, potentially accelerating debt reduction when rates drop, while All-in-One Mortgages combine transaction accounts with the mortgage balance, enabling simultaneous debt repayment through income and savings offset. Homeowners leveraging an All-in-One Mortgage experience continuous principal reduction by using their full cash flow for debt repayment, contrasting with ARMs where debt reduction depends on variable interest rates and payment adjustments.

Margin Spread Cap

Adjustable-rate mortgages feature a margin added to the index rate, affecting monthly payments, while all-in-one mortgages often combine checking, savings, and mortgage accounts to manage interest efficiently. The margin spread cap in adjustable-rate mortgages limits how much the interest rate can increase over the life of the loan, providing crucial payment stability compared to the flexible but potentially variable interest in all-in-one mortgage products.

Sweep Account Integration

Adjustable-rate mortgages (ARMs) offer variable interest rates tied to market indexes, while all-in-one mortgages integrate a sweep account that consolidates income, expenses, and loan balances to reduce interest costs. Sweep account integration enables borrowers to offset their mortgage principal with daily deposits, effectively lowering interest payments and accelerating loan repayment compared to traditional ARMs.

Hybrid ARM-Offset Structure

A Hybrid Adjustable-Rate Mortgage (ARM) combined with an All-in-One mortgage offers property buyers a flexible financing solution by linking a variable interest rate to an offset account, reducing interest payments as daily deposits lower the principal balance. This hybrid ARM-offset structure optimizes cash flow management while providing potential interest savings, making it a strategic choice for borrowers seeking dynamic control over their mortgage repayment.

Principal Recasting Mechanism

Adjustable-Rate Mortgages (ARMs) offer interest rates that fluctuate based on market indexes, providing initial lower payments but variable future costs, while All-in-One Mortgages integrate mortgage and everyday banking, enabling principal recasting through lump-sum payments that directly reduce the loan balance and interest accrual. The principal recasting mechanism in All-in-One Mortgages accelerates equity build-up and can significantly lower interest expenses compared to ARMs, which typically lack flexible principal adjustment features.

Revolving Credit Feature

An Adjustable-Rate Mortgage (ARM) offers fluctuating interest rates tied to market indexes, causing periodic changes in monthly payments, while an All-in-One Mortgage integrates a revolving credit feature that combines a mortgage, savings, and transaction account, enabling borrowers to offset interest by using deposited funds to reduce the principal balance dynamically. The revolving credit component in All-in-One Mortgages provides greater financial flexibility by allowing borrowers to manage cash flow efficiently and minimize interest costs compared to the fixed scheduling of ARMs.

Cash Flow Optimization Mortgage

Adjustable-rate mortgages offer initial low interest rates that adjust periodically based on market indexes, helping borrowers optimize cash flow with lower initial payments. All-in-One mortgages combine a mortgage and transaction account into one, enabling flexible cash flow management by reducing interest costs on the mortgage principal through direct income deposits.

Adjustable-Rate Mortgage vs All-in-One Mortgage for property financing. Infographic

moneydiff.com

moneydiff.com