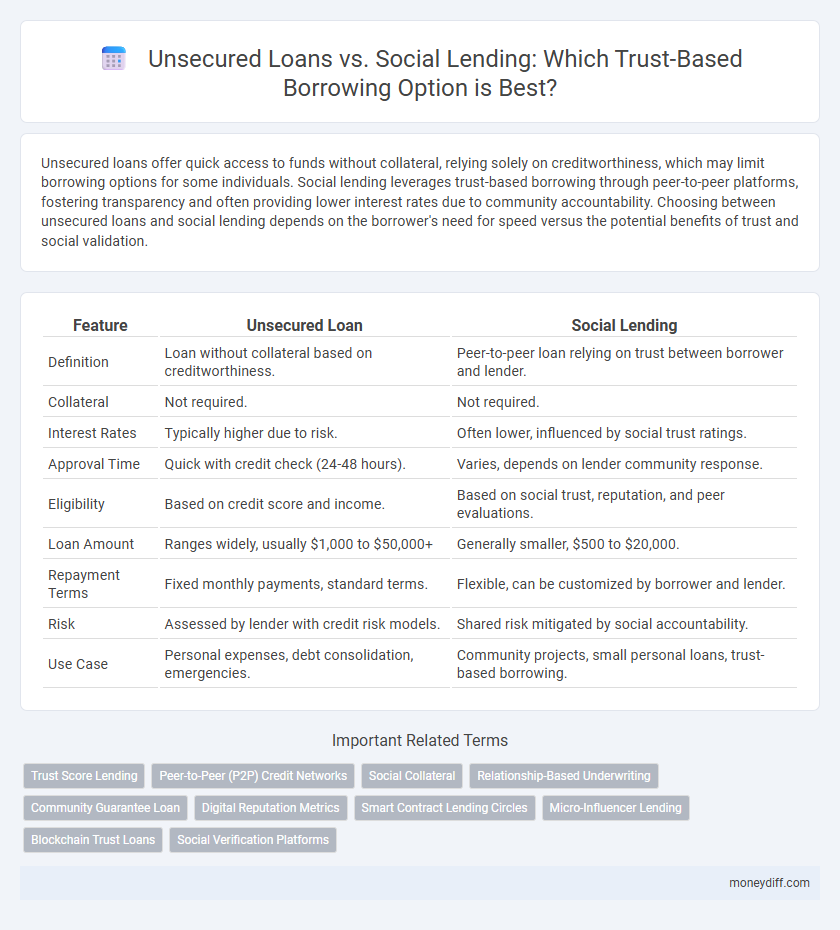

Unsecured loans offer quick access to funds without collateral, relying solely on creditworthiness, which may limit borrowing options for some individuals. Social lending leverages trust-based borrowing through peer-to-peer platforms, fostering transparency and often providing lower interest rates due to community accountability. Choosing between unsecured loans and social lending depends on the borrower's need for speed versus the potential benefits of trust and social validation.

Table of Comparison

| Feature | Unsecured Loan | Social Lending |

|---|---|---|

| Definition | Loan without collateral based on creditworthiness. | Peer-to-peer loan relying on trust between borrower and lender. |

| Collateral | Not required. | Not required. |

| Interest Rates | Typically higher due to risk. | Often lower, influenced by social trust ratings. |

| Approval Time | Quick with credit check (24-48 hours). | Varies, depends on lender community response. |

| Eligibility | Based on credit score and income. | Based on social trust, reputation, and peer evaluations. |

| Loan Amount | Ranges widely, usually $1,000 to $50,000+ | Generally smaller, $500 to $20,000. |

| Repayment Terms | Fixed monthly payments, standard terms. | Flexible, can be customized by borrower and lender. |

| Risk | Assessed by lender with credit risk models. | Shared risk mitigated by social accountability. |

| Use Case | Personal expenses, debt consolidation, emergencies. | Community projects, small personal loans, trust-based borrowing. |

Understanding Unsecured Loans: Definition and Features

Unsecured loans are financial products that do not require collateral, relying solely on the borrower's creditworthiness and trust to secure the debt. These loans often feature higher interest rates compared to secured loans due to increased lender risk and include flexible terms tailored to individual credit profiles. Social lending, a trust-based borrowing alternative, connects borrowers directly with investors, emphasizing reputation and community endorsement rather than traditional credit checks.

What Is Social Lending? An Overview

Social lending, also known as peer-to-peer (P2P) lending, is a method of borrowing money directly from individuals or groups via online platforms without traditional financial institutions. It relies heavily on trust-based relationships and social credibility, offering an alternative to unsecured loans that often require higher interest rates and stricter credit checks. Social lending platforms evaluate borrowers through community-driven ratings and social profiles, enhancing transparency and potentially lowering borrowing costs.

Key Differences Between Unsecured Loans and Social Lending

Unsecured loans rely solely on the borrower's creditworthiness without collateral, typically offered by banks or financial institutions with fixed interest rates and structured repayment schedules. Social lending, or peer-to-peer lending, connects borrowers directly with individual lenders through online platforms, emphasizing trust and community relationships, often resulting in more flexible terms and personalized agreements. The key differences lie in the source of funds, the role of trust, and the flexibility of repayment, making social lending a viable option for borrowers seeking alternatives to traditional unsecured loans.

Trust and Risk: How Social Lending Stands Apart

Social lending leverages peer-to-peer networks to create a trust-based borrowing environment, reducing dependency on traditional credit scores and institutional approvals, which often dominate unsecured loans. This model distributes risk among multiple lenders, enhancing transparency and accountability through social verification mechanisms. Consequently, social lending fosters stronger borrower-lender relationships, mitigating default rates compared to conventional unsecured loan products.

Interest Rates: Unsecured Loans vs Social Lending Platforms

Interest rates for unsecured loans typically range from 6% to 36%, influenced by credit scores and lender policies, often making them higher due to perceived risk. Social lending platforms offer competitive rates between 4% and 12%, leveraging trust-based networks that reduce default risk and enable more favorable borrowing terms. Borrowers using social lending benefit from community reputation and peer assessments, which can significantly lower interest costs compared to traditional unsecured loan products.

Credit Requirements and Borrower Eligibility Compared

Unsecured loans typically require a strong credit score and verified income to qualify, as lenders rely on financial history to assess risk. In contrast, social lending platforms emphasize trust and community reputation, allowing borrowers with limited credit history to access funds through peer verification and social collateral. Borrower eligibility on social lending networks is often more flexible, promoting inclusivity for those excluded from traditional credit systems.

Flexibility in Repayment: Which Option Offers More Ease?

Unsecured loans typically provide fixed repayment schedules set by financial institutions, offering less flexibility but predictable monthly payments. Social lending platforms often allow borrowers to negotiate repayment terms directly with lenders, enabling more adaptable schedules tailored to individual cash flows. Trust-based borrowing in social lending fosters personalized agreements that can accommodate financial fluctuations more easily than conventional unsecured loans.

Borrowing Experience: Traditional Lenders vs Peer Networks

Unsecured loans from traditional lenders often involve strict credit checks and formal approval processes, leading to less personalized borrowing experiences. Social lending leverages peer networks, fostering trust-based borrowing with flexible terms and community-driven accountability. This peer-to-peer model enhances accessibility and nurtures mutual trust, contrasting with the impersonal nature of conventional unsecured loans.

Potential Pitfalls: Default Risks and Protections

Unsecured loans carry a higher default risk due to the absence of collateral, often resulting in increased interest rates to mitigate lender losses. Social lending platforms rely on trust-based borrowing and collective community oversight, but they may lack formal protections, exposing lenders to potential defaults without legal recourse. Understanding these risks is crucial for borrowers and lenders to make informed decisions in unsecured and social lending environments.

Choosing the Right Trust-Based Borrowing Solution

Unsecured loans provide quick access to funds without collateral but often come with higher interest rates and stricter credit requirements. Social lending, or peer-to-peer lending, leverages trust within communities to offer more flexible terms and lower rates based on personal relationships and social reputation. Selecting the optimal trust-based borrowing solution depends on evaluating creditworthiness, interest costs, repayment flexibility, and the strength of borrower-lender trust networks.

Related Important Terms

Trust Score Lending

Unsecured loans rely heavily on credit history and financial metrics, while social lending platforms use Trust Score Lending, leveraging borrower reputation and peer trust to facilitate borrowing without collateral. Trust Score Lending creates a transparent credit environment by assessing social behavior and repayment patterns, enhancing trust-based borrowing opportunities beyond traditional metrics.

Peer-to-Peer (P2P) Credit Networks

Unsecured loans rely on individual creditworthiness without collateral, while social lending through peer-to-peer (P2P) credit networks leverages trust-based borrowing by connecting borrowers directly with investors, often resulting in more flexible terms and community-driven risk assessment. P2P platforms use algorithms and social profiles to evaluate credit risk, enhancing transparency and enabling lower interest rates compared to traditional unsecured loans.

Social Collateral

Social lending utilizes social collateral, where trust within a community replaces traditional credit checks, enabling borrowers with limited credit history to access unsecured loans. This trust-based approach leverages peer networks to reduce default risk and encourage timely repayments, contrasting with conventional unsecured loans that rely solely on individual credit scores.

Relationship-Based Underwriting

Relationship-based underwriting in unsecured loans relies heavily on credit scores and financial history, limiting trust to quantifiable data, whereas social lending leverages peer networks and mutual trust, enabling borrowers to access funds based on social credibility and shared reputations. This trust model reduces reliance on traditional collateral, fostering more inclusive borrowing through community-validated risk assessments.

Community Guarantee Loan

Community Guarantee Loans leverage social lending frameworks where trust within a community replaces traditional collateral requirements, fostering access to unsecured loans through collective endorsement. This model enhances credit opportunities for borrowers by relying on peer accountability and shared financial responsibility rather than individual credit scores.

Digital Reputation Metrics

Unsecured loans rely heavily on credit scores and traditional financial history, while social lending platforms assess borrowing risk using digital reputation metrics such as social connections, online behavior, and peer reviews to build trust-based borrowing. These digital reputation metrics enable lenders to evaluate trustworthiness beyond conventional financial data, fostering more inclusive and personalized lending experiences.

Smart Contract Lending Circles

Smart Contract Lending Circles utilize blockchain technology to facilitate trust-based borrowing by automating loan agreements within social lending networks, eliminating the need for collateral unlike unsecured loans. This approach enhances transparency, reduces default risk through collective reputation, and offers efficient, decentralized credit access compared to traditional unsecured loan models.

Micro-Influencer Lending

Unsecured loans typically rely on creditworthiness and lack collateral, while social lending leverages trust within networks, making Micro-Influencer Lending a powerful model where influencers facilitate peer-to-peer borrowing based on credibility and social capital. This trust-based approach reduces lending risks and improves access to funds for borrowers often overlooked by traditional financing.

Blockchain Trust Loans

Blockchain trust loans leverage decentralized ledger technology to enhance transparency and security, making unsecured loans more reliable by reducing fraud risks and ensuring immutable credit histories. Social lending platforms integrated with blockchain enable peer-to-peer borrowing based on trust scores recorded on-chain, fostering trust-based borrowing without traditional collateral requirements.

Social Verification Platforms

Social verification platforms enhance trust-based borrowing by utilizing community ratings and peer reviews to assess borrower credibility, reducing risk for lenders in social lending environments. Unlike unsecured loans relying solely on credit scores, social lending leverages collective trust and transparency to facilitate more personalized and accessible financial support.

Unsecured Loan vs Social Lending for trust-based borrowing. Infographic

moneydiff.com

moneydiff.com