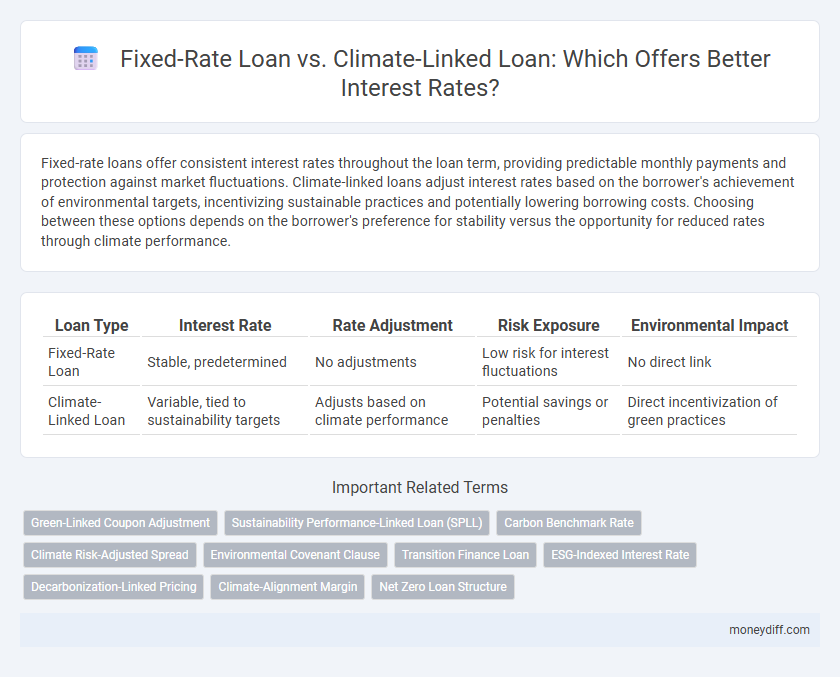

Fixed-rate loans offer consistent interest rates throughout the loan term, providing predictable monthly payments and protection against market fluctuations. Climate-linked loans adjust interest rates based on the borrower's achievement of environmental targets, incentivizing sustainable practices and potentially lowering borrowing costs. Choosing between these options depends on the borrower's preference for stability versus the opportunity for reduced rates through climate performance.

Table of Comparison

| Loan Type | Interest Rate | Rate Adjustment | Risk Exposure | Environmental Impact |

|---|---|---|---|---|

| Fixed-Rate Loan | Stable, predetermined | No adjustments | Low risk for interest fluctuations | No direct link |

| Climate-Linked Loan | Variable, tied to sustainability targets | Adjusts based on climate performance | Potential savings or penalties | Direct incentivization of green practices |

Understanding Fixed-Rate Loans

Fixed-rate loans offer borrowers a stable interest rate that remains unchanged throughout the loan term, providing predictable monthly payments and simplifying budget management. In contrast, climate-linked loans adjust interest rates based on the borrower's achievement of sustainability or environmental targets, encouraging green investments. Understanding fixed-rate loans helps borrowers weigh financial stability against the potential incentives and variability offered by climate-linked loan structures.

What Is a Climate-Linked Loan?

A Climate-Linked Loan ties its interest rate to the borrower's achievement of specific environmental, social, and governance (ESG) targets, incentivizing sustainable practices. Unlike traditional fixed-rate loans, where the interest rate remains constant throughout the loan term, climate-linked loans adjust rates based on verifiable progress toward climate goals such as carbon emissions reduction or renewable energy adoption. This dynamic pricing encourages businesses to integrate sustainability into their operations, potentially lowering financing costs through improved environmental performance.

Key Differences in Interest Rate Structures

Fixed-rate loans maintain a constant interest rate throughout the loan term, offering predictability and stability for budgeting purposes. Climate-linked loans adjust interest rates based on the borrower's achievement of predefined environmental targets, incentivizing sustainable practices by potentially lowering rates upon meeting these goals. The primary distinction lies in fixed-rate loans providing consistent costs, while climate-linked loans tie interest variability directly to climate performance metrics.

Stability of Fixed-Rate Loans

Fixed-rate loans offer borrowers consistent and predictable interest payments throughout the loan term, ensuring financial stability regardless of market fluctuations. This stability contrasts with climate-linked loans, where interest rates vary based on environmental performance metrics and sustainability targets. Choosing a fixed-rate loan minimizes exposure to interest rate volatility, making it a preferred option for borrowers seeking long-term financial certainty.

How Climate Benchmarks Affect Interest Rates

Climate-linked loans adjust interest rates based on a borrower's sustainability performance relative to established climate benchmarks, incentivizing lower carbon emissions and improved environmental practices. Fixed-rate loans maintain a constant interest rate regardless of environmental impact, offering predictability but no direct reward for climate goals. Lenders use climate benchmarks to evaluate risk, often resulting in reduced interest rates for borrowers demonstrating strong climate commitment through measurable targets.

Risks and Benefits of Fixed vs. Climate-Linked Loans

Fixed-rate loans offer predictable monthly payments and protection against interest rate volatility, reducing financial uncertainty for borrowers. Climate-linked loans adjust interest rates based on achieving specific environmental targets, incentivizing sustainable practices but introducing variability and potential risk in financing costs. Borrowers seeking stability may prefer fixed-rate loans, while those prioritizing sustainability and potential cost savings could benefit from climate-linked loan structures.

Suitability for Businesses and Individuals

Fixed-rate loans offer consistent interest payments ideal for businesses and individuals seeking budget stability and predictable financial planning. Climate-linked loans adjust interest rates based on environmental performance, incentivizing companies and environmentally-conscious borrowers to meet sustainability targets. Businesses with strong ESG commitments benefit from lower rates, while risk-averse individuals may prefer the certainty of a fixed-rate structure.

Long-Term Cost Projections

Fixed-rate loans offer predictable interest rates over the loan term, enabling accurate long-term cost projections without exposure to market fluctuations. In contrast, climate-linked loans adjust interest rates based on environmental performance metrics, potentially lowering costs if sustainability targets are met but increasing them if benchmarks are missed. Borrowers seeking financial stability may prefer fixed-rate loans, while organizations committed to climate goals might benefit from the variable incentives embedded in climate-linked loan structures.

Environmental Impact on Financial Strategy

Fixed-rate loans offer predictable interest payments, providing financial stability but lack incentives to reduce carbon emissions. Climate-linked loans tie interest rates to environmental performance metrics, encouraging borrowers to achieve sustainability targets and reduce their ecological footprint. Incorporating climate criteria into loan conditions aligns financial strategies with global carbon reduction goals, fostering greener investments.

Choosing the Right Loan for Your Financial Goals

Fixed-rate loans offer consistent interest rates throughout the repayment period, providing predictable monthly payments and stability for long-term financial planning. Climate-linked loans feature variable interest rates tied to sustainability performance metrics, potentially lowering costs if specific environmental targets are met. Selecting the right loan depends on an individual's risk tolerance, commitment to environmental goals, and preference for payment predictability versus incentive-based savings.

Related Important Terms

Green-Linked Coupon Adjustment

Fixed-rate loans maintain a constant interest rate throughout the loan term, providing predictable payments, while climate-linked loans feature a Green-Linked Coupon Adjustment that incentivizes borrowers to meet specific environmental targets by reducing interest rates. This adjustment mechanism aligns financing costs with sustainability performance, encouraging investments in greener projects and supporting climate goals.

Sustainability Performance-Linked Loan (SPLL)

Fixed-Rate Loans offer stable interest rates throughout the loan term, providing predictability, whereas Climate-Linked Loans, such as Sustainability Performance-Linked Loans (SPLL), adjust interest rates based on the borrower's achievement of predefined environmental and sustainability targets, incentivizing improved climate performance. SPLLs integrate ESG criteria directly into loan agreements, promoting corporate responsibility and enabling lower interest rates tied to measurable sustainability outcomes.

Carbon Benchmark Rate

Fixed-rate loans offer stable interest payments unaffected by market changes, while climate-linked loans adjust rates based on the Carbon Benchmark Rate, incentivizing borrowers to reduce carbon emissions. The Carbon Benchmark Rate serves as a key metric that ties interest costs to environmental performance, promoting sustainable financing practices.

Climate Risk-Adjusted Spread

Climate-linked loans adjust interest rates based on the borrower's climate performance, incorporating a climate risk-adjusted spread that incentivizes sustainable practices by reducing costs for lower emissions. Fixed-rate loans maintain a constant interest rate regardless of environmental factors, offering predictability but lacking the dynamic risk assessment present in climate-linked financial products.

Environmental Covenant Clause

Fixed-rate loans provide predictable interest payments over the loan term, while climate-linked loans adjust interest rates based on the borrower's compliance with environmental covenant clauses that incentivize sustainability practices. These environmental covenants often require meeting specific carbon reduction targets or energy efficiency benchmarks, directly influencing the loan's cost and promoting greener business operations.

Transition Finance Loan

Fixed-rate loans offer predictable interest rates throughout the loan term, providing financial stability, while climate-linked loans incorporate variable rates tied to the borrower's achievement of environmental targets, promoting sustainability. Transition finance loans bridge these options by supporting businesses in high-emission sectors with incentives for meeting climate goals, combining risk management with ecological impact reduction.

ESG-Indexed Interest Rate

Fixed-rate loans maintain consistent interest payments, providing stability irrespective of market fluctuations, while climate-linked loans adjust interest rates based on the borrower's achievement of environmental, social, and governance (ESG) targets. ESG-indexed interest rates incentivize sustainable practices by reducing costs for meeting predefined climate goals, aligning financial benefits with positive environmental impact.

Decarbonization-Linked Pricing

Fixed-rate loans offer predictable interest payments, while climate-linked loans feature decarbonization-linked pricing that adjusts rates based on environmental performance metrics, incentivizing borrowers to meet sustainability targets. This innovative pricing model aligns financial costs with carbon reduction goals, promoting investment in green initiatives.

Climate-Alignment Margin

Climate-linked loans offer a dynamic Climate-Alignment Margin that adjusts interest rates based on the borrower's environmental performance, incentivizing sustainable practices. Fixed-rate loans maintain constant interest rates regardless of climate impact, lacking alignment with environmental objectives.

Net Zero Loan Structure

Fixed-rate loans offer stable interest rates throughout the term, ensuring predictable repayments crucial for budgeting in net zero loan structures targeting sustainable projects. Climate-linked loans incorporate variable interest rates tied to environmental performance metrics, incentivizing borrowers to meet Net Zero targets and enhance energy efficiency for reduced loan costs.

Fixed-Rate Loan vs Climate-Linked Loan for interest rates. Infographic

moneydiff.com

moneydiff.com