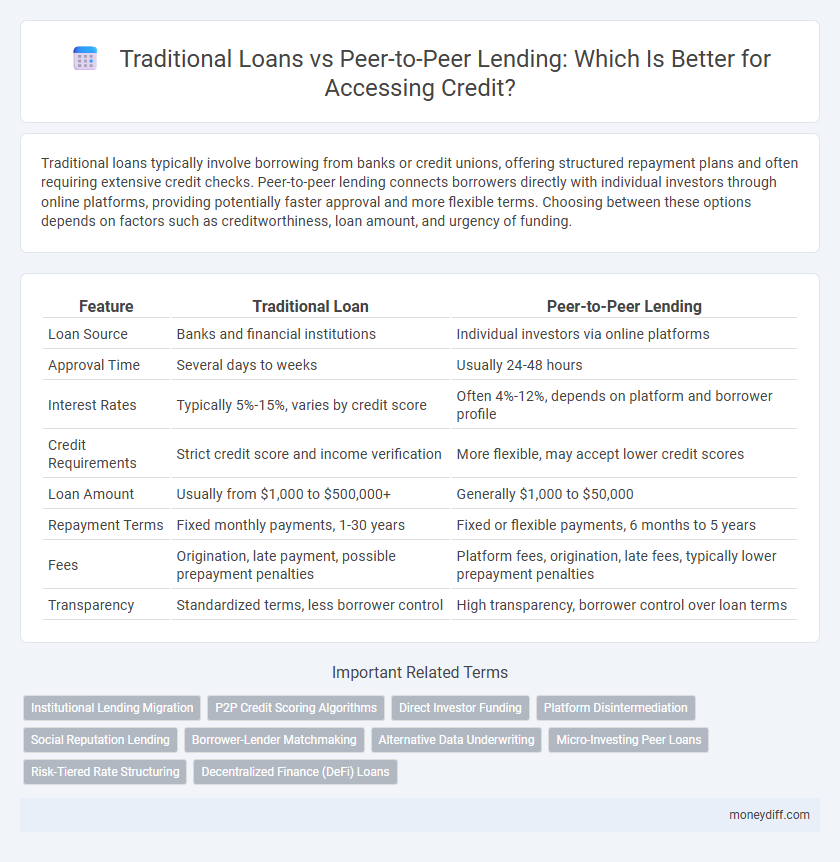

Traditional loans typically involve borrowing from banks or credit unions, offering structured repayment plans and often requiring extensive credit checks. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, providing potentially faster approval and more flexible terms. Choosing between these options depends on factors such as creditworthiness, loan amount, and urgency of funding.

Table of Comparison

| Feature | Traditional Loan | Peer-to-Peer Lending |

|---|---|---|

| Loan Source | Banks and financial institutions | Individual investors via online platforms |

| Approval Time | Several days to weeks | Usually 24-48 hours |

| Interest Rates | Typically 5%-15%, varies by credit score | Often 4%-12%, depends on platform and borrower profile |

| Credit Requirements | Strict credit score and income verification | More flexible, may accept lower credit scores |

| Loan Amount | Usually from $1,000 to $500,000+ | Generally $1,000 to $50,000 |

| Repayment Terms | Fixed monthly payments, 1-30 years | Fixed or flexible payments, 6 months to 5 years |

| Fees | Origination, late payment, possible prepayment penalties | Platform fees, origination, late fees, typically lower prepayment penalties |

| Transparency | Standardized terms, less borrower control | High transparency, borrower control over loan terms |

Understanding Traditional Loans: Basics and Features

Traditional loans are financial agreements provided by banks or credit unions where borrowers receive a fixed amount of money with set repayment terms, including interest rates and loan duration. These loans often require credit checks, collateral, and a detailed application process to assess borrower risk. Key features include structured payment schedules, regulated lending practices, and eligibility criteria based on credit history and income verification.

What is Peer-to-Peer Lending? An Overview

Peer-to-peer lending (P2P lending) is a decentralized financial platform that connects individual borrowers directly with investors, bypassing traditional banks. This model leverages online marketplaces where loans are funded by multiple lenders, often resulting in lower interest rates and faster approval compared to conventional loans. P2P lending platforms use algorithms to assess credit risk and facilitate secure, transparent transactions between parties.

Key Differences Between Traditional Loans and P2P Lending

Traditional loans are typically issued by banks with rigorous credit checks, standardized interest rates, and longer approval times, relying heavily on borrowers' credit scores and collateral. Peer-to-peer (P2P) lending connects borrowers directly with individual investors through online platforms, offering potentially lower interest rates, quicker approval, and more flexible credit requirements. P2P lending also often involves higher risk for investors due to borrower default probabilities but provides an alternative for those with limited access to conventional banking credit.

Interest Rates: Traditional Loans vs P2P Lending

Traditional loans typically feature fixed or variable interest rates determined by banks based on credit scores and financial history, often resulting in higher rates for riskier borrowers. Peer-to-peer lending platforms offer competitive, market-driven interest rates that can be lower due to reduced overhead and direct borrower-lender interaction. This difference in interest rate structures influences overall borrowing costs and accessibility to credit for diverse financial profiles.

Loan Approval Process: Speed and Eligibility

Traditional loan approval processes often require extensive documentation and credit checks, leading to slower approval times, sometimes taking several weeks. Peer-to-peer lending platforms utilize automated algorithms that streamline credit evaluation, enabling faster decisions, often within days, and offer more flexible eligibility criteria. Borrowers with non-traditional credit profiles may find peer-to-peer lending more accessible compared to traditional banks.

Accessibility and Flexibility in Borrowing Options

Traditional loans often require stringent credit checks and lengthy approval processes, limiting accessibility for borrowers with lower credit scores or urgent funding needs. Peer-to-peer lending platforms enhance accessibility by connecting borrowers directly with individual investors, offering more flexible terms and quicker approval times. This flexibility includes customizable repayment schedules and varied loan amounts, making peer-to-peer lending an attractive alternative for diverse borrowing needs.

Risks and Security Concerns in Both Models

Traditional loans typically involve rigorous credit checks, regulatory oversight, and established institutions that offer a degree of security and risk mitigation for borrowers and lenders. Peer-to-peer lending platforms, while providing alternative access to credit, carry higher risks related to borrower default and platform vulnerability due to less stringent regulatory frameworks and reliance on technology-based matchmaking. Both models require careful assessment of security protocols, borrowing terms, and risk exposure to safeguard financial interests effectively.

Impact on Credit Scores: Which is Better?

Traditional loans typically have a more direct impact on credit scores due to regular reporting by established financial institutions to credit bureaus, which can improve credit through timely payments. Peer-to-peer lending platforms may report loan activity inconsistently, making their influence on credit scores less predictable and potentially less beneficial. Borrowers seeking to build or enhance credit profiles often find traditional loans more reliable for positive credit score impact.

Fees and Hidden Costs: What Borrowers Should Know

Traditional loans often involve multiple fees such as origination fees, prepayment penalties, and hidden administrative costs that can significantly increase the total repayment amount. Peer-to-peer lending platforms typically offer more transparent fee structures, with lower origination fees and no hidden charges, making it easier for borrowers to understand the true cost of their credit. Borrowers should carefully compare interest rates and fee disclosures on both loan types to avoid unexpected expenses and ensure cost-effective borrowing.

Choosing the Right Option: Factors to Consider for Borrowers

Borrowers should evaluate interest rates, approval speed, and eligibility criteria when choosing between traditional loans and peer-to-peer lending. Traditional loans often provide larger amounts with structured repayment terms, while peer-to-peer lending may offer more flexible conditions and quicker approval for those with varied credit profiles. Assessing credit score impact, lender reputation, and fees ensures an informed decision that aligns with financial goals.

Related Important Terms

Institutional Lending Migration

Traditional loans rely on institutional lenders such as banks and credit unions, which have established regulatory frameworks and credit assessment models, whereas peer-to-peer lending platforms facilitate direct borrowing from individual investors, often resulting in faster approval and more flexible terms. The migration from institutional lending to peer-to-peer platforms reflects a shift towards decentralized credit access, leveraging technology to reduce overhead costs and expand credit availability to underserved borrowers.

P2P Credit Scoring Algorithms

Peer-to-peer lending platforms utilize advanced credit scoring algorithms that analyze alternative data points such as social behavior, transaction history, and online activity to assess borrower risk more dynamically than traditional loans, which rely heavily on conventional credit scores from bureaus. These algorithms enhance accessibility to credit by enabling personalized risk assessments and potentially lower interest rates for borrowers with limited credit history.

Direct Investor Funding

Traditional loans rely on financial institutions for credit approval and funding, often involving lengthy approval processes and higher interest rates. Peer-to-peer lending connects borrowers directly with individual investors, enabling faster access to funds and potentially lower costs due to reduced intermediary fees.

Platform Disintermediation

Traditional loans involve financial institutions acting as intermediaries, which often leads to higher interest rates and longer approval times, whereas peer-to-peer lending platforms disintermediate banks by connecting borrowers directly with individual lenders, resulting in reduced costs and faster access to credit. This disintermediation enhances transparency and efficiency, enabling more competitive loan terms and expanding credit availability to underserved borrowers.

Social Reputation Lending

Social reputation lending leverages peer-to-peer platforms where borrowers' creditworthiness is assessed based on social endorsements and transaction history, contrasting traditional loans that rely primarily on credit scores and financial history. This innovative model provides enhanced access to credit for individuals with limited formal credit records by utilizing social trust as a key lending criterion.

Borrower-Lender Matchmaking

Traditional loans involve financial institutions that assess creditworthiness and set interest rates, often limiting access for borrowers with lower credit scores; peer-to-peer lending platforms leverage technology to directly match borrowers with individual lenders, enabling personalized loan terms and potentially faster approval. This borrower-lender matchmaking enhances transparency and flexibility, making peer-to-peer lending an innovative alternative to conventional credit access.

Alternative Data Underwriting

Traditional loans primarily rely on credit scores, income verification, and collateral for underwriting, often excluding many potential borrowers with limited credit history. Peer-to-peer lending platforms utilize alternative data such as social media activity, utility payments, and online behavior to assess creditworthiness, expanding access to credit for underserved individuals.

Micro-Investing Peer Loans

Traditional loans require approval through banks with stringent credit checks and fixed interest rates, often limiting access for small borrowers. Micro-investing peer loans within peer-to-peer lending platforms offer flexible credit options, lower entry barriers, and direct investor-borrower connections, enhancing accessibility for micro-entrepreneurs and individuals with limited credit history.

Risk-Tiered Rate Structuring

Traditional loans typically feature risk-tiered rate structuring based on credit scores, income verification, and collateral, resulting in fixed or variable interest rates aligned with borrower risk profiles. Peer-to-peer lending platforms offer more flexible risk assessment models using alternative data, often enabling borrowers with lower credit scores to access competitive rates through investor-driven risk evaluation and pricing.

Decentralized Finance (DeFi) Loans

Traditional loans rely on centralized banks with lengthy approval processes and strict credit requirements, while peer-to-peer lending in Decentralized Finance (DeFi) offers direct, blockchain-based borrowing with lower fees and faster access. DeFi loans utilize smart contracts to automate credit approval and collateral management, enhancing transparency and reducing reliance on intermediaries.

Traditional Loan vs Peer-to-Peer Lending for accessing credit. Infographic

moneydiff.com

moneydiff.com