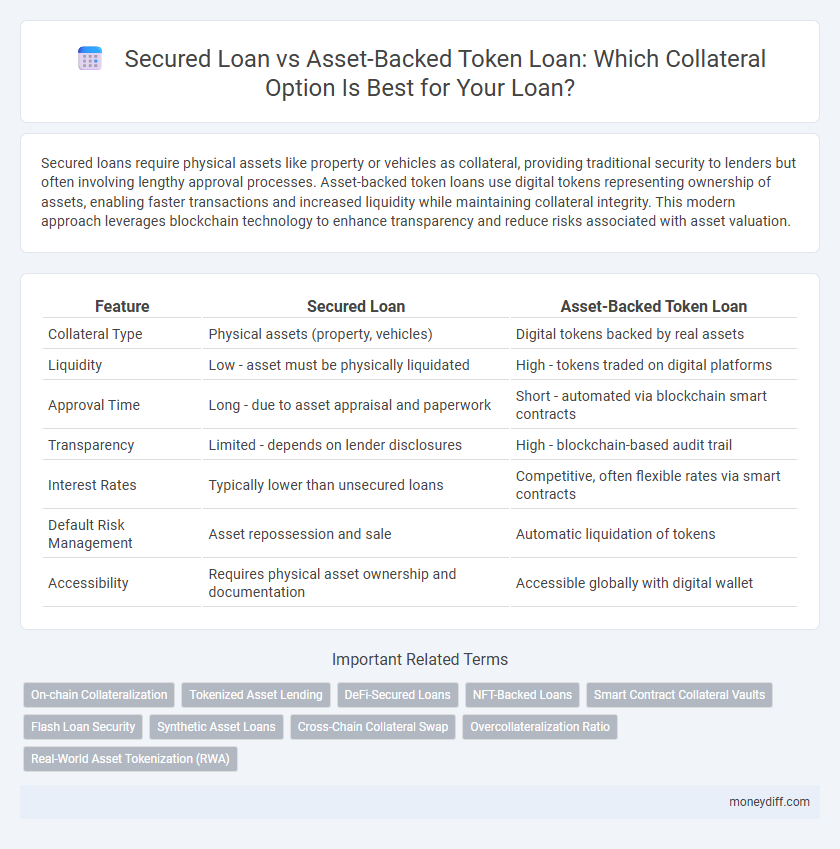

Secured loans require physical assets like property or vehicles as collateral, providing traditional security to lenders but often involving lengthy approval processes. Asset-backed token loans use digital tokens representing ownership of assets, enabling faster transactions and increased liquidity while maintaining collateral integrity. This modern approach leverages blockchain technology to enhance transparency and reduce risks associated with asset valuation.

Table of Comparison

| Feature | Secured Loan | Asset-Backed Token Loan |

|---|---|---|

| Collateral Type | Physical assets (property, vehicles) | Digital tokens backed by real assets |

| Liquidity | Low - asset must be physically liquidated | High - tokens traded on digital platforms |

| Approval Time | Long - due to asset appraisal and paperwork | Short - automated via blockchain smart contracts |

| Transparency | Limited - depends on lender disclosures | High - blockchain-based audit trail |

| Interest Rates | Typically lower than unsecured loans | Competitive, often flexible rates via smart contracts |

| Default Risk Management | Asset repossession and sale | Automatic liquidation of tokens |

| Accessibility | Requires physical asset ownership and documentation | Accessible globally with digital wallet |

Understanding Secured Loans: Traditional Approach to Collateral

Secured loans require borrowers to pledge tangible assets such as real estate, vehicles, or equipment as collateral to mitigate lender risk and often secure lower interest rates. The traditional approach relies on asset valuation by financial institutions to determine loan eligibility and terms, ensuring repayment potential through tangible guarantees. This model emphasizes legal ownership and clear asset control, providing lenders with a claim on collateral in case of default.

What are Asset-Backed Token Loans?

Asset-backed token loans use digital tokens representing ownership of real-world assets like real estate, commodities, or securities as collateral to secure financing. These loans leverage blockchain technology to provide transparency, liquidity, and faster transactions compared to traditional secured loans backed by physical assets. Tokenizing assets allows borrowers to access capital without liquidating their holdings while lenders benefit from programmable, easily transferable collateral.

Key Differences Between Secured Loans and Asset-Backed Token Loans

Secured loans require physical collateral such as property or vehicles, which lenders can seize upon default, while asset-backed token loans use blockchain-based digital tokens representing ownership of assets as collateral. The key difference lies in liquidity and transferability; asset-backed token loans offer enhanced liquidity through tokenization, enabling easier trading and fractional ownership, unlike traditional secured loans. Moreover, asset-backed token loans often provide faster loan approval and settlement times due to smart contracts automating processes, contrasting the manual procedures in secured loans.

How Collateral Works in Secured Loans

In secured loans, collateral serves as a tangible asset pledged by the borrower to guarantee loan repayment, reducing lender risk and often resulting in lower interest rates. Common collateral includes real estate, vehicles, or equipment, which lenders can repossess or sell if the borrower defaults. This mechanism ensures that the loan is backed by a physical or financial asset, providing security and influencing loan approval and terms.

Tokenized Assets as Collateral: A Digital Revolution

Tokenized assets as collateral in secured loans transform traditional lending by enabling digital representation of physical or financial assets on blockchain platforms, enhancing transparency and liquidity. Unlike conventional secured loans that rely on physical collateral, asset-backed token loans leverage smart contracts to automate enforcement and reduce counterparty risk. This digital revolution facilitates faster loan processing, fractional ownership, and access to global markets, redefining collateralization in modern finance.

Risk Factors: Secured Loans vs. Asset-Backed Token Loans

Secured loans involve tangible collateral such as real estate or vehicles, exposing borrowers to risks like asset depreciation and potential foreclosure. Asset-backed token loans leverage digital tokens representing fractional ownership of assets, introducing risks related to token volatility, regulatory uncertainty, and smart contract vulnerabilities. Understanding the comparative risk profiles of traditional collateral and digital asset tokens is crucial for informed lending decisions and risk management.

Loan Accessibility: Who Qualifies for Each Option?

Secured loans typically require tangible assets like real estate or vehicles as collateral, limiting accessibility to borrowers who possess valuable physical assets. Asset-backed token loans expand eligibility by allowing digital tokens representing assets such as cryptocurrency or tokenized real estate to serve as collateral, increasing opportunities for individuals without traditional collateral. This shift in collateral options enhances loan accessibility for a broader range of borrowers beyond conventional secured loan qualifications.

Interest Rates and Repayment Terms Compared

Secured loans typically feature fixed or variable interest rates influenced by credit scores, with repayment terms ranging from months to several years, providing predictable payment schedules. Asset-backed token loans often present lower interest rates due to blockchain transparency and reduced risk, coupled with flexible repayment terms enabled by smart contracts that allow partial or early repayments without penalties. The integration of digital assets in token loans enhances liquidity and efficiency, contrasting with conventional collateral evaluations and rigid repayment structures in secured loans.

Legal Protections and Regulatory Considerations

Secured loans offer robust legal protections through established lien rights and judicial enforcement mechanisms, ensuring lenders maintain priority claims over collateral. In contrast, asset-backed token loans operate within emerging regulatory frameworks that vary by jurisdiction, often lacking uniform legal clarity and enforcement protocols. Borrowers and lenders must navigate evolving compliance standards, including securities laws and digital asset regulations, to mitigate risks associated with tokenized collateral.

Choosing the Right Collateral Loan: Factors to Consider

Choosing the right collateral loan involves evaluating factors such as risk tolerance, liquidity, and asset valuation stability. Secured loans typically rely on physical assets like property or vehicles, offering clear legal rights during default, whereas asset-backed token loans use blockchain tokens representing assets, providing faster access and enhanced transparency. Understanding the market volatility of tokenized assets and the legal framework governing secured loans ensures an informed decision tailored to financial goals and collateral availability.

Related Important Terms

On-chain Collateralization

Secured loans utilize traditional physical assets as collateral, requiring manual verification and off-chain processes, while asset-backed token loans leverage on-chain collateralization, enabling transparent, programmable, and instantly verifiable ownership of digital tokens tied to real-world assets. On-chain collateralization reduces counterparty risk, accelerates loan approval, and enables decentralized finance applications through smart contracts, fundamentally transforming loan security and efficiency.

Tokenized Asset Lending

Secured loans rely on traditional collateral such as property or vehicles, offering lenders tangible assurance, whereas asset-backed token loans utilize tokenized digital assets on blockchain, enabling fractional ownership and faster collateral valuation. Tokenized asset lending enhances liquidity and transparency by converting real-world assets into secure, tradable tokens, revolutionizing access to credit markets.

DeFi-Secured Loans

DeFi-secured loans utilize blockchain technology to provide secured loans where collateral is tokenized as asset-backed tokens, enabling transparent, efficient, and permissionless access to liquidity compared to traditional secured loans that rely on physical assets or credit history. Asset-backed token loans enhance security and reduce counterparty risk by automating collateral management through smart contracts, optimizing loan-to-value ratios and liquidation processes in decentralized finance ecosystems.

NFT-Backed Loans

NFT-backed loans represent an innovative form of secured lending where non-fungible tokens serve as collateral, allowing borrowers to unlock liquidity without selling digital assets. Unlike traditional asset-backed loans that rely on physical or financial assets, NFT-backed loans leverage blockchain technology to provide transparent, verifiable ownership and fractionalized collateral options.

Smart Contract Collateral Vaults

Secured loans traditionally rely on tangible assets held as collateral, whereas asset-backed token loans utilize digital tokens stored in smart contract collateral vaults, providing enhanced transparency and automated enforcement of terms. These smart contract vaults reduce counterparty risk and enable real-time asset verification, streamlining collateral management and improving loan security.

Flash Loan Security

Secured loans require physical assets as collateral, which can be seized in case of default, whereas asset-backed token loans use digital tokens representing ownership of assets, enhancing liquidity and transparency on blockchain. Flash loan security in asset-backed token loans is strengthened by smart contracts that ensure instant repayment or automatic liquidation, minimizing counterparty risk.

Synthetic Asset Loans

Synthetic asset loans leverage blockchain technology to tokenize collateral, enabling borrowers to use digital representations of real-world assets for secured loans without transferring ownership. These asset-backed token loans offer enhanced liquidity, transparency, and faster settlement compared to traditional secured loans reliant on physical collateral verification and lengthy approval processes.

Cross-Chain Collateral Swap

Secured loans leverage tangible assets like real estate or vehicles as collateral, restricting liquidity and flexibility, whereas asset-backed token loans utilize blockchain technology to represent collateral digitally, enabling seamless cross-chain collateral swaps that enhance loan accessibility and diversification. Cross-chain collateral swap facilitates the transfer of tokenized assets across multiple blockchains, allowing borrowers to optimize collateral value and reduce risk through broader asset interoperability in decentralized finance ecosystems.

Overcollateralization Ratio

Secured loans typically require an overcollateralization ratio of 120% to 150% to mitigate lender risk, whereas asset-backed token loans often use blockchain technology to enable more precise and dynamic overcollateralization ratios, sometimes as low as 110%, enhancing capital efficiency. The transparency and real-time valuation of tokenized assets allow for adjusted collateral requirements, reducing excessive capital lock-up compared to traditional secured loans.

Real-World Asset Tokenization (RWA)

Secured loans rely on physical assets like property or vehicles as collateral, whereas asset-backed token loans utilize real-world asset tokenization (RWA) to convert tangible assets into digital tokens, enabling more efficient, transparent, and fractionalized collateral management. This innovation enhances liquidity and accessibility, allowing borrowers to leverage tokenized assets such as real estate, commodities, or invoices for financing without traditional asset transfer complexities.

Secured Loan vs Asset-Backed Token Loan for collateral. Infographic

moneydiff.com

moneydiff.com