Credit Union loans typically offer lower interest rates and more personalized service due to their member-owned structure, making them a cost-effective choice for borrowers seeking flexibility. Community Development Financial Institution (CDFI) loans focus on supporting underserved communities with accessible funding and often provide more flexible qualification criteria, ideal for borrowers with less-than-perfect credit. Comparing both options highlights the importance of balancing interest rates, eligibility requirements, and the social impact of the lending institution when choosing the best loan for your needs.

Table of Comparison

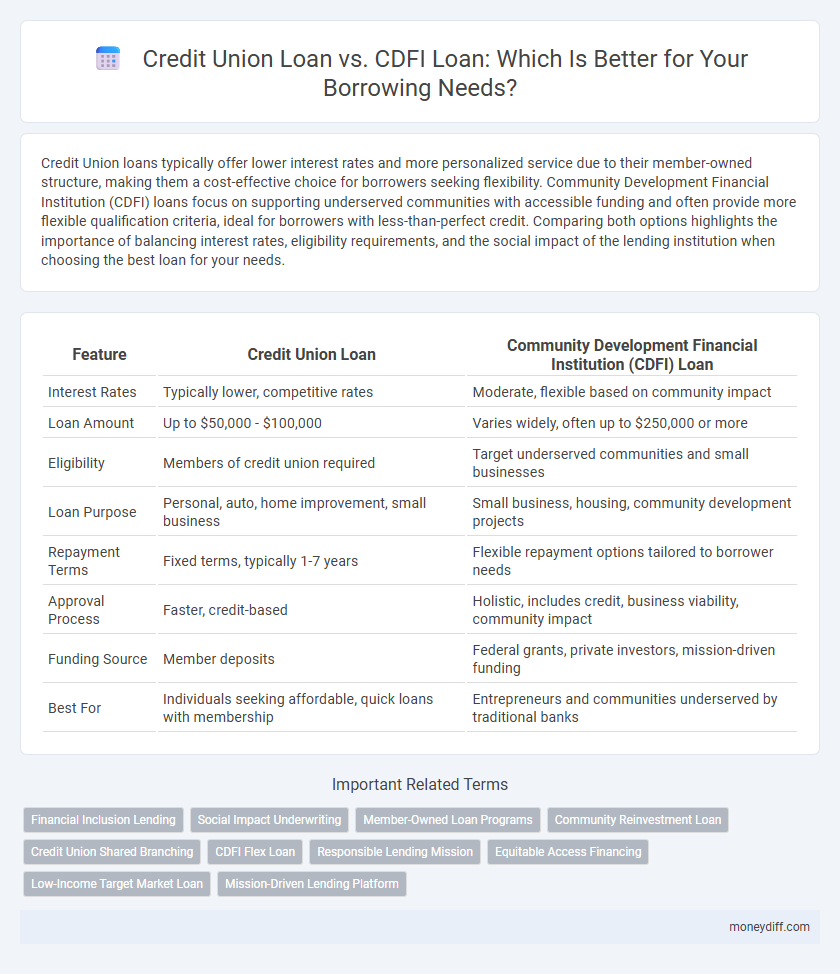

| Feature | Credit Union Loan | Community Development Financial Institution (CDFI) Loan |

|---|---|---|

| Interest Rates | Typically lower, competitive rates | Moderate, flexible based on community impact |

| Loan Amount | Up to $50,000 - $100,000 | Varies widely, often up to $250,000 or more |

| Eligibility | Members of credit union required | Target underserved communities and small businesses |

| Loan Purpose | Personal, auto, home improvement, small business | Small business, housing, community development projects |

| Repayment Terms | Fixed terms, typically 1-7 years | Flexible repayment options tailored to borrower needs |

| Approval Process | Faster, credit-based | Holistic, includes credit, business viability, community impact |

| Funding Source | Member deposits | Federal grants, private investors, mission-driven funding |

| Best For | Individuals seeking affordable, quick loans with membership | Entrepreneurs and communities underserved by traditional banks |

Understanding Credit Union Loans: Key Features

Credit union loans offer competitive interest rates, flexible repayment terms, and personalized service tailored to members' financial needs. These loans often require membership, which may involve eligibility based on geographic location, employment, or community ties. Credit union loans emphasize member ownership benefits, lower fees, and a focus on financial education, distinguishing them from typical financial institution lending practices.

What Are Community Development Financial Institution (CDFI) Loans?

Community Development Financial Institution (CDFI) loans are designed to provide affordable financing to underserved communities and individuals who may not qualify for traditional bank loans. CDFIs specialize in offering flexible terms and lower interest rates to support small businesses, affordable housing, and community revitalization projects. These loans aim to promote economic growth and financial inclusion in low-income and disadvantaged areas, distinguishing them from standard credit union loans.

Eligibility Requirements: Credit Unions vs CDFIs

Credit Union loans typically require membership based on specific common bonds such as geographic location, employer, or association membership, restricting eligibility to defined groups. Community Development Financial Institution (CDFI) loans have broader eligibility, targeting underserved or low-income communities without strict membership constraints, making them accessible to a wider range of borrowers. Both loan types emphasize creditworthiness, but CDFIs often offer more flexible criteria to support borrowers with limited credit history.

Interest Rates and Fees: Comparing Loan Costs

Credit union loans typically offer lower interest rates and fewer fees compared to Community Development Financial Institution (CDFI) loans, making them more cost-effective for borrowers with strong credit profiles. CDFI loans often have higher interest rates but provide flexible terms and support for underserved communities, potentially offsetting additional costs. Evaluating the total loan cost, including any origination fees or prepayment penalties, is essential to determine which option offers better financial value.

Loan Products and Terms: Variety and Flexibility

Credit Union loans typically offer a variety of loan products including personal, auto, and mortgage loans with competitive interest rates and flexible repayment terms tailored to members' financial situations. Community Development Financial Institution (CDFI) loans emphasize flexibility and accessibility, providing targeted loan products designed to support underserved communities, often featuring lower credit requirements and adaptable terms to foster financial inclusion. Both institutions prioritize affordable lending options but differ in loan product diversity and the specific borrower demographics they serve.

Community Impact: Supporting Local Economies

Community Development Financial Institution (CDFI) loans prioritize funding underserved local businesses and individuals, fostering economic growth and job creation within the community. These loans typically offer flexible terms and lower interest rates to support revitalization efforts in economically distressed areas. Credit Union loans also contribute to community impact but often have more stringent qualification criteria, focusing primarily on member financial health rather than broader economic development.

Credit Score Considerations and Approval Processes

Credit Union loans typically require higher credit scores, often above 650, due to their conservative approval processes prioritizing financial stability and risk mitigation. Community Development Financial Institution (CDFI) loans are more flexible with credit score requirements, frequently approving applicants with scores as low as 550 while emphasizing community impact and borrower potential. The approval process at Credit Unions is generally faster but stricter, whereas CDFIs offer more tailored support and longer review times to accommodate underserved borrowers.

Member and Customer Support Differences

Credit Union loans offer personalized member-focused service, prioritizing member financial well-being with lower interest rates and flexible repayment options. Community Development Financial Institution (CDFI) loans emphasize customer support through tailored financial education, counseling, and resources aimed at underserved communities. Both institutions provide distinct support frameworks, with credit unions fostering a cooperative member relationship and CDFIs focusing on community impact and financial inclusion.

Pros and Cons: Credit Union Loans

Credit Union loans offer lower interest rates and flexible repayment options, making them ideal for borrowers with good credit seeking affordable financing. However, their membership requirements can limit access, and loan amounts may be smaller compared to traditional lenders. Credit Unions often provide personalized service but may have fewer product options and longer approval times.

Pros and Cons: CDFI Loans

CDFI loans offer flexible qualification criteria and a strong focus on underserved communities, making them ideal for borrowers with limited credit history or lower income. Interest rates on CDFI loans can be higher compared to traditional credit union loans, and loan processing times may be longer due to detailed community impact assessments. CDFIs often provide personalized financial education and support, but limited funding resources might restrict loan amounts and availability.

Related Important Terms

Financial Inclusion Lending

Credit union loans tend to offer lower interest rates and more personalized service due to their member-owned structure, making them accessible for individuals with moderate credit histories. Community Development Financial Institution (CDFI) loans prioritize underserved populations and provide flexible underwriting criteria to promote financial inclusion and support economic development in disadvantaged communities.

Social Impact Underwriting

Credit Union loans prioritize member-centric social impact underwriting by offering lower interest rates and flexible terms tailored to improve individual financial stability within the community. Community Development Financial Institution (CDFI) loans focus on broader economic development, underwriting high-risk borrowers to support affordable housing, small businesses, and underserved populations, emphasizing measurable community revitalization outcomes.

Member-Owned Loan Programs

Credit Union loans offer member-owned loan programs that provide low-interest rates and personalized service, emphasizing community trust and financial education. Community Development Financial Institution (CDFI) loans focus on underserved populations, delivering flexible lending options with a mission-driven approach to promote economic growth and financial inclusion.

Community Reinvestment Loan

Community Reinvestment Loans provided by Community Development Financial Institutions (CDFIs) specifically target underserved neighborhoods, offering flexible terms and lower interest rates compared to traditional credit union loans. These loans promote economic development and affordable housing by prioritizing social impact over profit, making them ideal for borrowers seeking community-focused financial support.

Credit Union Shared Branching

Credit Union loans offer competitive interest rates and the benefit of Credit Union Shared Branching, enabling borrowers to access loan services at multiple locations nationwide with convenience and lower fees. Community Development Financial Institution loans focus on underserved communities but may lack the extensive branch network and seamless service access provided by Credit Union Shared Branching.

CDFI Flex Loan

CDFI Flex Loans offer tailored financing solutions with flexible terms and lower interest rates designed for underserved borrowers, contrasting with traditional Credit Union Loans that may have stricter eligibility and less adaptable repayment options. CDFI Flex Loans prioritize community impact and financial inclusion, providing critical capital for small businesses and personal needs often unmet by credit unions.

Responsible Lending Mission

Credit Union loans prioritize responsible lending by offering low-interest rates and personalized financial education to support member financial health, aligning with their cooperative mission. Community Development Financial Institution (CDFI) loans emphasize lending to underserved communities with flexible terms and targeted support to promote economic inclusion and local development.

Equitable Access Financing

Credit Union loans offer equitable access financing by providing lower interest rates and flexible terms tailored to underserved members, promoting financial inclusion within local communities. Community Development Financial Institution (CDFI) loans emphasize equitable access through targeted funding for economically disadvantaged individuals and businesses, often incorporating non-traditional credit evaluations to expand borrowing opportunities.

Low-Income Target Market Loan

Credit Union loans typically offer lower interest rates and more flexible repayment terms tailored to low-income borrowers, leveraging member-focused services and community trust. Community Development Financial Institution (CDFI) loans provide specialized financial products aimed at underserved low-income markets, often including technical assistance and support to promote economic development and financial inclusion.

Mission-Driven Lending Platform

Credit Union loans prioritize member-focused, not-for-profit mission-driven lending that often offers lower interest rates and personalized service tailored to community needs. Community Development Financial Institution (CDFI) loans emphasize equitable access to capital for underserved populations, providing flexible underwriting and targeted support to foster economic growth in low-income areas.

Credit Union Loan vs Community Development Financial Institution Loan for Loan Infographic

moneydiff.com

moneydiff.com