Personal loans offer fixed interest rates and structured repayment terms, providing predictability and often lower overall costs compared to Buy Now Pay Later (BNPL) plans, which may include higher fees and shorter repayment periods. Unlike BNPL, personal loans can be used for a wider range of expenses beyond immediate purchases, making them more versatile financial tools. Choosing between the two depends on the borrower's need for flexibility, loan amount, and repayment preference.

Table of Comparison

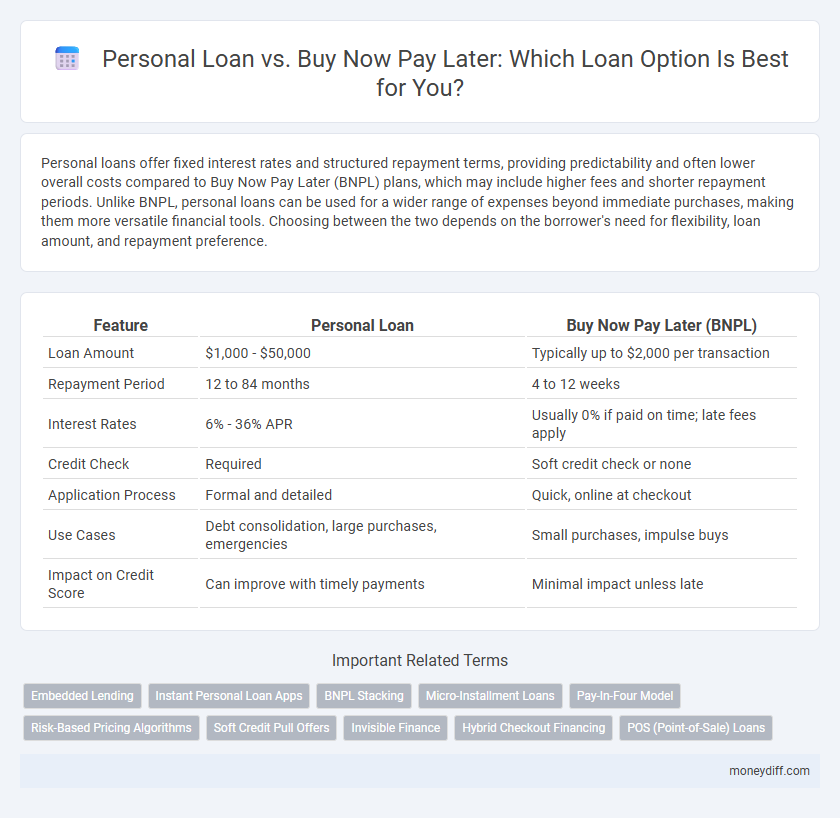

| Feature | Personal Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Loan Amount | $1,000 - $50,000 | Typically up to $2,000 per transaction |

| Repayment Period | 12 to 84 months | 4 to 12 weeks |

| Interest Rates | 6% - 36% APR | Usually 0% if paid on time; late fees apply |

| Credit Check | Required | Soft credit check or none |

| Application Process | Formal and detailed | Quick, online at checkout |

| Use Cases | Debt consolidation, large purchases, emergencies | Small purchases, impulse buys |

| Impact on Credit Score | Can improve with timely payments | Minimal impact unless late |

Understanding Personal Loans and Buy Now Pay Later

Personal loans offer a lump sum amount with fixed interest rates and repayment terms, making them suitable for larger expenses and long-term financial planning. Buy Now Pay Later (BNPL) services provide short-term, interest-free installment plans primarily for smaller purchases, often integrated at the point of sale for convenience. Understanding the differences in interest rates, repayment flexibility, and credit impact helps consumers choose the best loan option for their financial needs.

Key Differences Between Personal Loans and BNPL

Personal loans offer fixed amounts with set repayment terms and interest rates, making them suitable for larger expenses and planned budgeting. Buy Now Pay Later (BNPL) provides short-term, interest-free installments, primarily for smaller purchases with quicker repayment cycles. Personal loans impact credit scores differently than BNPL, as BNPL often involves soft credit checks and may not appear on credit reports, affecting long-term credit-building opportunities.

Eligibility Criteria for Personal Loans vs BNPL

Personal loans typically require a strong credit score, stable income, and proof of employment, with lenders assessing debt-to-income ratio and credit history to determine eligibility. Buy Now Pay Later (BNPL) options often have more lenient criteria, focusing on basic identity verification and a recent credit check, making them accessible to a broader range of consumers. While personal loans involve a formal application process and creditworthiness evaluation, BNPL approval is usually instant with minimal credit impact.

Interest Rates and Fees Comparison

Personal loans typically offer lower interest rates compared to Buy Now Pay Later (BNPL) plans, which often charge higher fees and late payment penalties. Personal loans may have fixed or variable interest rates ranging from 6% to 36%, while BNPL options usually impose interest rates or fees upwards of 20% if payments are missed. Evaluating the total cost, including APR and additional charges, helps borrowers choose the more cost-effective financing method.

Repayment Terms: Flexibility and Duration

Personal loans typically offer longer repayment durations ranging from 12 to 84 months with fixed monthly installments, providing predictable budgeting and more flexibility for larger expenses. Buy Now Pay Later (BNPL) plans usually require repayment within shorter periods, often 30 to 90 days, sometimes interest-free but less adaptable for extended repayment. The structured terms of personal loans support financial planning, whereas BNPL suits immediate, smaller purchases with quicker turnover.

Impact on Credit Score: Personal Loan vs BNPL

Personal loans typically require a hard credit inquiry, which can temporarily lower your credit score but may improve it over time with consistent, on-time payments reported to credit bureaus. Buy Now Pay Later (BNPL) services often perform soft credit checks that do not impact credit scores initially, but missed or late payments might not be reported or could result in collections, ultimately harming your credit. Choosing between these options depends on your ability to manage repayment schedules and whether you prefer long-term credit building with personal loans or short-term financing with variable credit reporting through BNPL.

Application Process: Which Is Easier?

Applying for a Buy Now Pay Later (BNPL) service typically involves a faster and more streamlined process compared to a personal loan, often requiring minimal documentation and instant approval. Personal loans demand a more detailed application, including credit checks, income verification, and longer approval times, which can be cumbersome for some borrowers. Therefore, BNPL is generally considered easier and quicker to access for smaller purchases, while personal loans suit larger financing needs with a more thorough approval process.

Best Situations for Choosing Personal Loans

Personal loans are best suited for borrowers needing larger sums of money with fixed repayment terms, such as debt consolidation or home improvements. They offer lower interest rates and longer repayment periods compared to Buy Now Pay Later (BNPL) options, making them ideal for planned major expenses. Personal loans provide predictable monthly payments and credit-building opportunities, unlike BNPL, which caters mainly to short-term, small purchases with higher fees for missed payments.

When to Opt for Buy Now Pay Later

Buy Now Pay Later (BNPL) is ideal for short-term financing of small to medium purchases with no or low interest, offering flexible repayment terms often spread over weeks or months. Personal loans suit larger expenses requiring longer repayment durations and fixed interest rates, providing predictable monthly installments. Opt for BNPL when managing cash flow for smaller purchases without upfront funds, avoiding long-term debt commitment.

Deciding the Right Loan Option for Your Needs

Choosing between a personal loan and Buy Now Pay Later (BNPL) depends on your financial goals, repayment flexibility, and interest rates. Personal loans typically offer lower interest rates and fixed repayment terms, making them suitable for larger purchases or debt consolidation. BNPL options provide short-term, interest-free installments ideal for smaller expenses but may lead to higher costs if payments are missed.

Related Important Terms

Embedded Lending

Personal loans typically offer larger loan amounts with fixed interest rates and longer repayment terms, making them suitable for significant expenses, whereas Buy Now Pay Later (BNPL) solutions integrate seamless, short-term installment payments directly at the point of sale through embedded lending technology. Embedded lending enhances BNPL by providing real-time credit assessments and instant financing approval, improving customer experience and retailer conversion rates.

Instant Personal Loan Apps

Instant personal loan apps offer quick approval and flexible repayment terms, making them a convenient alternative to Buy Now Pay Later (BNPL) services which often come with higher interest rates and shorter payment periods. Users seeking larger loan amounts with transparent interest rates typically benefit more from personal loan apps than BNPL options limited to specific retailers and purchase caps.

BNPL Stacking

Buy Now Pay Later (BNPL) stacking allows consumers to combine multiple short-term credit offers, increasing total available financing without formal credit checks, unlike personal loans that require thorough credit evaluation and fixed repayment schedules. While personal loans offer structured interest rates and longer terms for larger amounts, BNPL stacking provides flexible, interest-free installments but risks accumulating unmanageable debt due to overlapping repayment obligations.

Micro-Installment Loans

Micro-installment loans offer smaller, manageable repayments over a fixed term, making them a suitable alternative to Buy Now Pay Later (BNPL) options, which often emphasize short-term, interest-free periods but may lead to higher cumulative costs if not paid on time. Personal loans typically provide larger sums with longer repayment schedules, but micro-installment loans bridge the gap by delivering flexible financing for everyday purchases without the pitfalls of BNPL's deferred payment risks.

Pay-In-Four Model

The Pay-In-Four model under Buy Now Pay Later options offers short-term, interest-free payments spaced over four installments, providing greater flexibility compared to traditional personal loans which typically involve fixed monthly payments with interest over a longer term. This method appeals to borrowers seeking smaller, manageable payments without incurring additional finance charges, making it an attractive alternative for short-term financing needs.

Risk-Based Pricing Algorithms

Risk-based pricing algorithms assess borrower creditworthiness by analyzing factors like credit score, income stability, and payment history, resulting in personalized interest rates for both personal loans and Buy Now Pay Later (BNPL) options. While personal loans often offer fixed repayment terms with interest rates tailored to risk profiles, BNPL services typically use simpler algorithms with fewer credit checks, potentially leading to higher default risk and less favorable terms for high-risk borrowers.

Soft Credit Pull Offers

Soft credit pull offers for personal loans typically provide borrowers with pre-approved loan options without affecting their credit score, offering transparent terms and fixed repayment schedules. Buy Now Pay Later (BNPL) services often use soft credit checks as well but usually involve smaller amounts and shorter payment windows, making them suitable for quick purchases but less ideal for larger financial needs or long-term borrowing.

Invisible Finance

Invisible Finance offers flexible Buy Now Pay Later solutions that provide instant credit approval with no hidden fees, contrasting with traditional personal loans that often require extensive credit checks and longer processing times. Their BNPL service enhances purchasing power by allowing consumers to split payments into manageable installments, making it a preferred alternative for short-term financing needs over conventional personal loan products.

Hybrid Checkout Financing

Hybrid checkout financing combines personal loans and Buy Now Pay Later (BNPL) options to offer flexible repayment plans with competitive interest rates and high credit limits, catering to diverse consumer credit profiles. This financing model enhances purchasing power by integrating traditional loan structures with BNPL's short-term, interest-free periods, optimizing affordability and approval speed.

POS (Point-of-Sale) Loans

Personal loans typically offer lower interest rates and flexible repayment terms compared to Buy Now Pay Later (BNPL) options, which provide quick, short-term credit directly at the Point-of-Sale (POS) with minimal credit checks. POS loans via BNPL services improve purchasing power but often carry higher fees and risks of accumulating debt due to fragmented payment schedules.

Personal Loan vs Buy Now Pay Later for loan options. Infographic

moneydiff.com

moneydiff.com