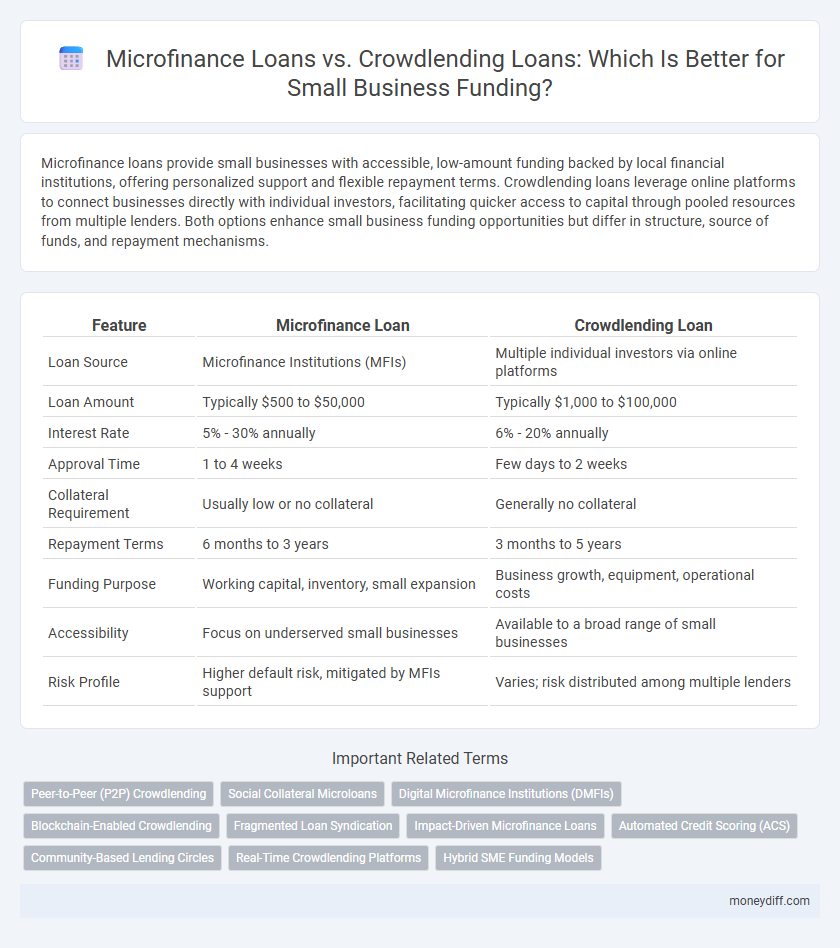

Microfinance loans provide small businesses with accessible, low-amount funding backed by local financial institutions, offering personalized support and flexible repayment terms. Crowdlending loans leverage online platforms to connect businesses directly with individual investors, facilitating quicker access to capital through pooled resources from multiple lenders. Both options enhance small business funding opportunities but differ in structure, source of funds, and repayment mechanisms.

Table of Comparison

| Feature | Microfinance Loan | Crowdlending Loan |

|---|---|---|

| Loan Source | Microfinance Institutions (MFIs) | Multiple individual investors via online platforms |

| Loan Amount | Typically $500 to $50,000 | Typically $1,000 to $100,000 |

| Interest Rate | 5% - 30% annually | 6% - 20% annually |

| Approval Time | 1 to 4 weeks | Few days to 2 weeks |

| Collateral Requirement | Usually low or no collateral | Generally no collateral |

| Repayment Terms | 6 months to 3 years | 3 months to 5 years |

| Funding Purpose | Working capital, inventory, small expansion | Business growth, equipment, operational costs |

| Accessibility | Focus on underserved small businesses | Available to a broad range of small businesses |

| Risk Profile | Higher default risk, mitigated by MFIs support | Varies; risk distributed among multiple lenders |

Understanding Microfinance Loans for Small Businesses

Microfinance loans provide small businesses with accessible financing through institutions specializing in underserved markets, offering tailored loan amounts and flexible repayment terms designed to support micro-enterprises. These loans typically feature lower interest rates and longer durations compared to traditional credit options, enabling entrepreneurs to invest in inventory, equipment, or working capital. Understanding microfinance loan eligibility criteria, such as credit history and business viability, is crucial for securing funding that aligns with small business growth needs.

What Are Crowdlending Loans?

Crowdlending loans involve raising capital directly from multiple individual investors through online platforms, offering small businesses an alternative to traditional bank financing. These loans typically feature competitive interest rates and flexible terms, making them attractive for startups and small enterprises with limited access to conventional credit. The peer-to-peer lending model of crowdlending enhances funding accessibility while enabling business owners to build a broader investor base.

Key Differences Between Microfinance and Crowdlending

Microfinance loans typically involve small amounts of capital provided by specialized financial institutions to underserved entrepreneurs, emphasizing social impact and financial inclusion. Crowdlending loans, facilitated through online platforms, connect multiple individual lenders directly with small businesses, often offering more flexible terms and faster access to funds. Key differences include the source of funds, approval processes, risk distribution, and regulatory oversight, with microfinance relying on institutional funds and crowdlending leveraging peer-to-peer lending dynamics.

Eligibility Criteria: Microfinance vs Crowdlending

Microfinance loans typically require borrowers to demonstrate low income levels, business viability, and often membership in targeted communities or groups, focusing on underserved individuals. Crowdlending loans prioritize creditworthiness, business plans, and online platform profiles, making eligibility more flexible but requiring digital literacy and transparent financial documentation. Both options serve small business funding needs, yet microfinance emphasizes social impact while crowdlending leans on investor confidence and digital reach.

Loan Amounts and Terms for Small Business Owners

Microfinance loans typically offer smaller loan amounts ranging from $500 to $50,000 with flexible repayment terms spanning 6 months to 3 years, making them ideal for startups and micro-entrepreneurs. Crowdlending loans often provide higher funding options, from $10,000 up to $500,000, with terms varying between 1 to 5 years, attracting small businesses seeking more substantial capital. Small business owners should assess their funding needs and repayment capabilities when choosing between the typically smaller, shorter-term microfinance loans and the larger, longer-term crowdlending options.

Interest Rates and Fees: A Comparative Overview

Microfinance loans for small businesses typically offer lower interest rates ranging from 8% to 20% annually, with additional fees often capped at 2-5%, reflecting regulatory oversight aimed at protecting borrowers. Crowdlending loans usually feature variable interest rates between 10% and 30%, influenced by platform risk assessment and investor demand, accompanied by origination fees that can reach up to 5%. Comparing both, microfinance loans tend to be more affordable for small enterprises seeking predictable costs, while crowdlending provides flexible funding but with potentially higher expenses due to market-driven interest and fees.

Application Process: Microfinance vs Crowdlending

Microfinance loans typically require a formal application process involving credit checks, documentation of business plans, and collateral verification, often demanding in-person visits to lending institutions. Crowdlending loans streamline access through online platforms where small businesses submit digital applications, allowing multiple investors to finance projects with less stringent credit requirements. The online nature of crowdlending accelerates approval times and broadens accessibility compared to traditional microfinance loan procedures.

Pros and Cons of Microfinance Loans

Microfinance loans offer small business owners access to capital with flexible terms and lower interest rates compared to traditional bank loans, promoting financial inclusion for underserved entrepreneurs. However, these loans often come with limited funding amounts and strict eligibility criteria that can restrict growth potential. Borrowers may also face challenges with longer approval processes and less diverse loan products compared to crowdlending platforms.

Advantages and Disadvantages of Crowdlending

Crowdlending offers small businesses access to diverse investors, enabling quicker funding without traditional bank requirements, which is ideal for entrepreneurs with limited credit history. However, the interest rates can be higher than microfinance loans, and the reliance on multiple lenders may complicate repayment structures. Businesses must also consider the variability in lender engagement and potential regulatory challenges that can affect loan terms and borrower protections.

Choosing the Right Loan Option for Your Small Business

Microfinance loans provide small businesses with accessible funding through regulated financial institutions focused on underserved markets, offering personalized support and lower interest rates. Crowdlending loans connect businesses directly with individual investors via online platforms, enabling flexible terms and potentially faster approval, but may involve higher risk and variable interest rates. Evaluating factors like loan amount, repayment flexibility, interest costs, and business credit profile helps determine the most suitable funding source.

Related Important Terms

Peer-to-Peer (P2P) Crowdlending

Peer-to-peer (P2P) crowdlending offers small businesses access to diverse individual lenders, often providing more flexible terms and faster approval compared to traditional microfinance loans. This decentralized funding model leverages online platforms to connect entrepreneurs with potential investors, reducing reliance on formal financial institutions and increasing capital availability.

Social Collateral Microloans

Social collateral microloans leverage community trust and peer relationships to secure funding, making them ideal for small businesses lacking traditional credit history, while crowdlending loans rely on broader investor networks through online platforms to provide diverse funding sources. Microfinance loans emphasize social capital and group accountability, fostering higher repayment rates and stronger local economic impact compared to the more transactional nature of crowdlending.

Digital Microfinance Institutions (DMFIs)

Digital Microfinance Institutions (DMFIs) offer microfinance loans with streamlined application processes, lower interest rates, and personalized credit scoring algorithms tailored for small businesses, contrasting with crowdlending loans that rely on peer-to-peer platforms and may exhibit variable funding speeds and investor-driven pricing. DMFIs leverage technology and data analytics to provide faster, more accessible funding solutions, enhancing financial inclusion for underserved entrepreneurs compared to the often fragmented and market-dependent nature of crowdlending loan structures.

Blockchain-Enabled Crowdlending

Blockchain-enabled crowdlending offers small businesses enhanced transparency, lower transaction costs, and faster access to funds compared to traditional microfinance loans, which often involve higher interest rates and limited borrower reach. The decentralized nature of blockchain ensures secure, trustless peer-to-peer lending, unlocking new opportunities for small business funding through global investor pools.

Fragmented Loan Syndication

Microfinance loans offer tailored funding options through localized institutions, while crowdlending loans leverage online platforms to connect small businesses with numerous individual investors, creating a more fragmented loan syndication structure. This fragmentation in crowdlending allows for diversified risk distribution but may result in complex management and slower decision-making compared to the more centralized microfinance loan process.

Impact-Driven Microfinance Loans

Impact-driven microfinance loans provide small businesses with tailored financial support that fosters social and environmental goals, often offering lower interest rates and flexible repayment options compared to crowdlending loans. These loans prioritize sustainable development and inclusivity, targeting underserved entrepreneurs who may lack access to traditional crowdfunding platforms or investor networks.

Automated Credit Scoring (ACS)

Microfinance loans leverage Automated Credit Scoring (ACS) to quickly assess borrower risk using alternative data, enhancing access for small businesses with limited credit history. Crowdlending loans utilize ACS algorithms to streamline investor decisions by providing real-time credit evaluations, improving funding efficiency and transparency.

Community-Based Lending Circles

Community-Based Lending Circles in microfinance loans provide small businesses with accessible, low-interest funds through trust-driven peer networks, enhancing financial inclusion and credit-building opportunities. In contrast, crowdlending loans tap into a broader online investor base, offering faster funding but typically involve higher interest rates and less personalized community support.

Real-Time Crowdlending Platforms

Real-time crowdlending platforms offer small businesses instant access to diverse funding sources by connecting numerous individual investors through online marketplaces, unlike traditional microfinance loans which often involve slower approval processes and limited capital. These digital platforms enhance transparency with real-time updates on funding progress and loan disbursement, enabling faster growth opportunities for small enterprises.

Hybrid SME Funding Models

Hybrid SME funding models combine microfinance loans and crowdlending loans, offering small businesses diversified access to capital with flexible repayment terms and community-driven support. This approach leverages microfinance's personalized credit assessment alongside crowdlending's broad investor base, enhancing funding scalability and risk distribution.

Microfinance Loan vs Crowdlending Loan for small business funding. Infographic

moneydiff.com

moneydiff.com