Installment loans provide consumers with fixed monthly payments over a set period, often with lower interest rates, making them ideal for larger purchases and long-term budgeting. Buy Now, Pay Later offers flexible, often interest-free payments spread over a short timeframe but may carry higher fees or penalties if missed. Choosing between an installment loan and Buy Now, Pay Later depends on purchase size, repayment comfort, and overall financial goals.

Table of Comparison

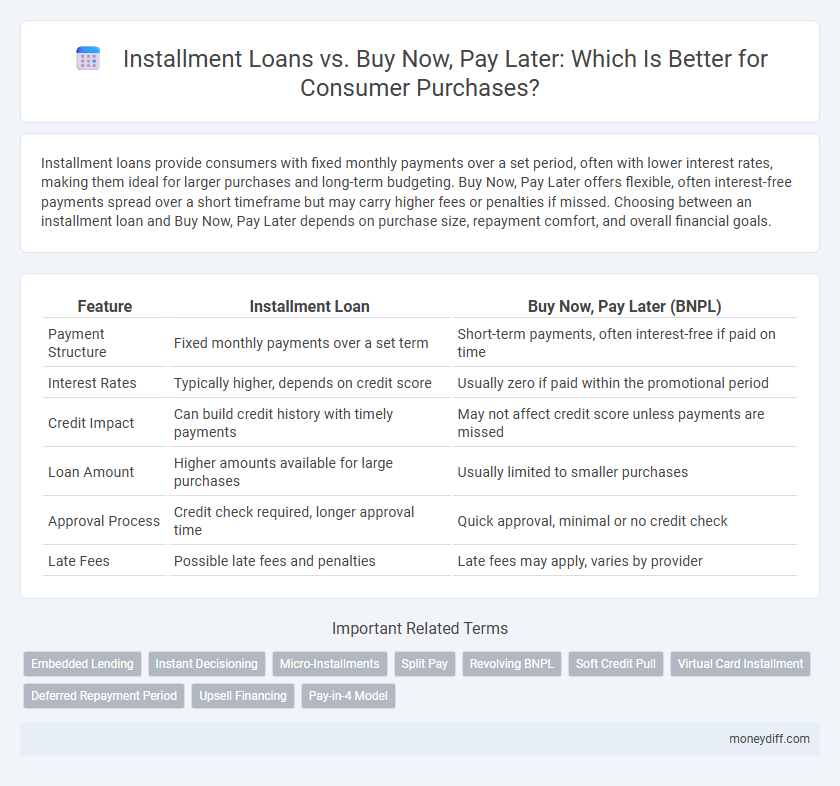

| Feature | Installment Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Payment Structure | Fixed monthly payments over a set term | Short-term payments, often interest-free if paid on time |

| Interest Rates | Typically higher, depends on credit score | Usually zero if paid within the promotional period |

| Credit Impact | Can build credit history with timely payments | May not affect credit score unless payments are missed |

| Loan Amount | Higher amounts available for large purchases | Usually limited to smaller purchases |

| Approval Process | Credit check required, longer approval time | Quick approval, minimal or no credit check |

| Late Fees | Possible late fees and penalties | Late fees may apply, varies by provider |

Understanding Installment Loans and Buy Now, Pay Later (BNPL)

Installment loans require borrowers to repay a fixed amount over a set period, typically with interest, providing predictable monthly payments and clear total cost. Buy Now, Pay Later (BNPL) allows consumers to split purchases into smaller, interest-free or low-interest payments, usually due within weeks or months, offering flexible short-term financing without traditional credit checks. Understanding the differences helps consumers select the best option based on repayment terms, interest rates, and spending needs.

Key Differences Between Installment Loans and BNPL

Installment loans require fixed monthly payments over a set term with interest, offering predictable repayment schedules and typically higher credit requirements. Buy Now, Pay Later (BNPL) options allow consumers to split purchases into multiple smaller payments without immediate interest, often with no credit check but usually shorter repayment periods. Key differences include credit impact, repayment duration, interest charges, and application processes, making installment loans better for larger, planned expenses while BNPL suits smaller, short-term purchases.

How Installment Loans Work for Consumers

Installment loans require consumers to borrow a fixed amount and repay it over a set period with regular monthly payments, including interest and fees. These loans offer predictable payment schedules and often lower interest rates compared to Buy Now, Pay Later options, making them suitable for larger or longer-term purchases. Consumers benefit from clear amortization plans, helping build credit history through consistent, timely payments.

The Mechanics of Buy Now, Pay Later Services

Buy Now, Pay Later (BNPL) services allow consumers to split purchases into fixed installments without traditional credit checks, offering a seamless checkout experience integrated with retailers. Unlike installment loans that require a lump sum disbursal and often involve interest accrual, BNPL typically provides interest-free periods if payments are made on time, leveraging technology to automate payment schedules. These services use real-time underwriting based on transaction data, enabling instant approval and improved affordability for consumers.

Eligibility and Approval Criteria: Installment Loan vs BNPL

Installment loans typically require a thorough credit check, proof of income, and a stable credit history, making approval more stringent but offering higher loan amounts and longer repayment terms. Buy Now, Pay Later (BNPL) services often have lenient eligibility criteria with minimal credit checks, allowing quick approvals and smaller purchase limits, appealing to consumers with limited credit history. BNPL approval focuses on recent payment behavior and purchase value, whereas installment loans prioritize overall creditworthiness and debt-to-income ratios.

Interest Rates and Hidden Fees Comparison

Installment loans typically feature fixed interest rates that range from 5% to 36%, offering predictable monthly payments, whereas Buy Now, Pay Later (BNPL) options often advertise zero percent interest but may impose steep late fees or short promotional periods that lead to high effective costs. Hidden fees in buy now, pay later plans can include return fees, late payment penalties up to $30, and deferred interest charges if balances aren't paid on time, contrasting with installment loans where fees are more transparent and usually limited to origination or prepayment penalties. Consumers seeking long-term financing benefit from installment loans' stability, while BNPL suits short-term purchases if payments are managed carefully to avoid unexpected fees.

Impact on Credit Score: Installment Loans vs BNPL

Installment loans typically have a more significant impact on credit scores because they involve fixed monthly payments reported to credit bureaus, demonstrating consistent repayment behavior. Buy Now, Pay Later (BNPL) services often do not affect credit scores unless payments are missed or accounts are sent to collections, as many BNPL providers do not report to credit bureaus regularly. Consumers seeking to build or maintain credit should consider installment loans for their positive reporting and credit score benefits.

Repayment Flexibility and Terms

Installment loans offer fixed repayment schedules with consistent monthly payments over a set term, providing structured and predictable budgeting for consumers. Buy Now, Pay Later (BNPL) plans typically allow interest-free short-term payments but may impose strict deadlines and fees for missed installments. Consumers seeking longer repayment flexibility and clearer terms often benefit more from installment loans, while BNPL suits smaller, immediate purchases with rapid repayment.

Pros and Cons: Choosing the Right Option

Installment loans offer fixed monthly payments and often lower interest rates, providing predictable budgeting and long-term credit building benefits, but may require credit checks and incur fees for early repayment. Buy Now, Pay Later (BNPL) services allow flexible, interest-free short-term payments with quick approval and no credit impact initially, yet they risk encouraging overspending and often charge high fees or interest if payments are missed. Consumers should evaluate their financial discipline, credit goals, and repayment ability to choose between the structured repayment plan of installment loans and the immediate convenience of BNPL options.

Making Smart Consumer Purchases With Responsible Borrowing

Installment loans offer structured repayment schedules with fixed monthly payments and interest rates, promoting disciplined budgeting and credit building for consumers. Buy Now, Pay Later plans provide short-term, often interest-free financing but carry risks of overspending and missed payments that can impact credit scores. Making smart consumer purchases involves evaluating loan terms, interest costs, and repayment ability to ensure responsible borrowing and avoid debt pitfalls.

Related Important Terms

Embedded Lending

Embedded lending integrates installment loans directly into the checkout process, enabling consumers to split payments into manageable installments without leaving the merchant's platform. Buy Now, Pay Later (BNPL) solutions offer short-term, interest-free repayment options but often lack the credit flexibility and longer-term benefits that embedded installment loans provide for larger consumer purchases.

Instant Decisioning

Installment loans provide consumers with fixed repayment schedules and interest rates, offering predictable monthly payments and typically requiring credit checks that influence approval time. Buy Now, Pay Later (BNPL) services prioritize instant decisioning using minimal credit information, enabling quick approval and immediate purchasing power but often with shorter repayment terms and potential for higher fees.

Micro-Installments

Micro-installments in installment loans offer consumers flexible repayment options with smaller, frequent payments that reduce financial strain compared to Buy Now, Pay Later (BNPL) plans, which typically require lump-sum payments at short intervals. This approach enhances budget management and credit building opportunities by spreading the cost over time with lower interest rates and less risk of default.

Split Pay

Installment loans offer fixed repayment terms with interest over several months, providing a structured payment plan for consumers, while Buy Now, Pay Later (BNPL) services like Split Pay allow consumers to divide purchases into smaller, interest-free payments over a short period. Split Pay's flexible, no-interest installments improve cash flow management and reduce upfront costs, distinguishing it from traditional installment loans that may incur higher interest rates and longer commitment periods.

Revolving BNPL

Revolving Buy Now, Pay Later (BNPL) offers consumers flexible repayment options with no fixed loan term, allowing them to carry a balance and make interest-free payments over time, unlike fixed installment loans that require predetermined monthly payments. This revolving credit model increases purchasing power and convenience but may lead to higher debt accumulation if payments are deferred beyond promotional periods.

Soft Credit Pull

Installment loans often involve a soft credit pull, allowing consumers to access funds without impacting their credit score, unlike some Buy Now, Pay Later options that may perform hard inquiries. Soft credit checks facilitate easier approval for installment loans, making them a preferred choice for credit-conscious buyers seeking manageable payment plans.

Virtual Card Installment

Virtual card installment loans offer consumers flexible payment options by splitting purchases into manageable monthly payments with fixed interest rates, enhancing budgeting and credit management. Compared to Buy Now, Pay Later services, virtual card installment loans provide stronger consumer protections, credit reporting benefits, and wider merchant acceptance for diverse purchase categories.

Deferred Repayment Period

Installment loans offer fixed monthly payments over a set term, allowing consumers to budget effectively without interest accruing during the deferred repayment period. Buy Now, Pay Later (BNPL) typically provides short-term deferral with zero interest if paid on time, but missed payments can trigger high fees and impact credit scores.

Upsell Financing

Installment loans offer structured repayment plans with fixed interest rates, providing consumers with clear, manageable monthly payments that can improve credit scores over time. Buy Now, Pay Later (BNPL) options typically feature interest-free short-term financing but may encourage impulsive spending without building credit history, making installment loans a preferable choice for upsell financing strategies aiming to boost customer loyalty and higher-value purchases.

Pay-in-4 Model

The Pay-in-4 model, a popular Buy Now, Pay Later option, splits consumer purchases into four interest-free installments over a short period, enhancing affordability without impacting credit scores. Unlike traditional installment loans, this model offers quicker approval and no long-term debt commitment, making it ideal for budget-conscious shoppers seeking flexibility.

Installment Loan vs Buy Now, Pay Later for consumer purchases. Infographic

moneydiff.com

moneydiff.com