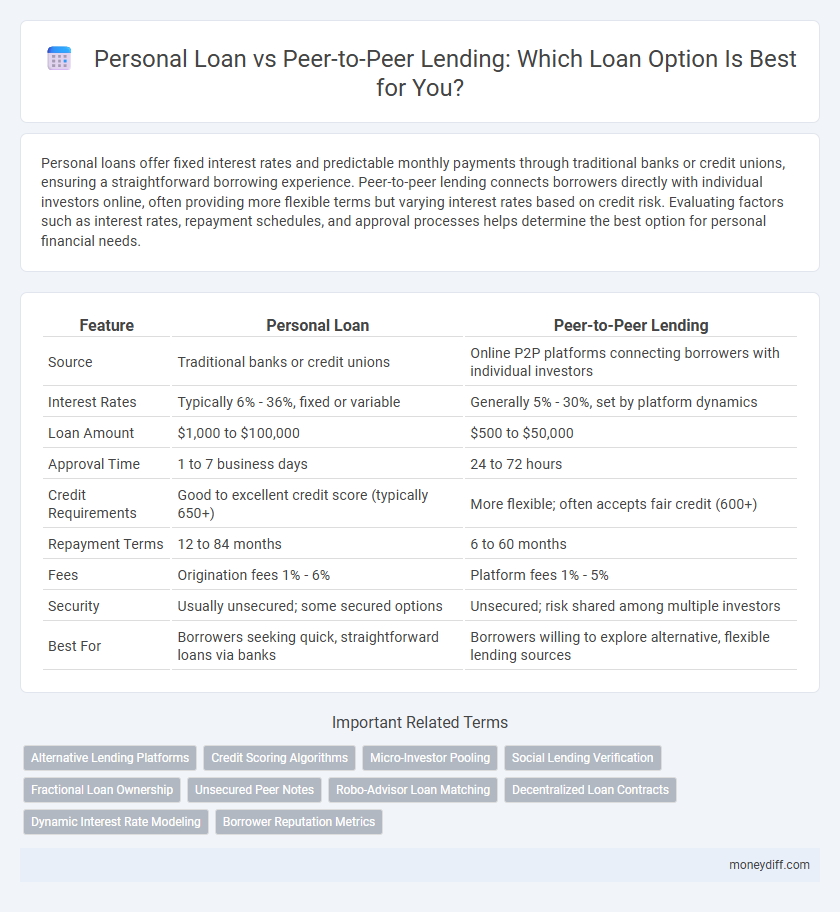

Personal loans offer fixed interest rates and predictable monthly payments through traditional banks or credit unions, ensuring a straightforward borrowing experience. Peer-to-peer lending connects borrowers directly with individual investors online, often providing more flexible terms but varying interest rates based on credit risk. Evaluating factors such as interest rates, repayment schedules, and approval processes helps determine the best option for personal financial needs.

Table of Comparison

| Feature | Personal Loan | Peer-to-Peer Lending |

|---|---|---|

| Source | Traditional banks or credit unions | Online P2P platforms connecting borrowers with individual investors |

| Interest Rates | Typically 6% - 36%, fixed or variable | Generally 5% - 30%, set by platform dynamics |

| Loan Amount | $1,000 to $100,000 | $500 to $50,000 |

| Approval Time | 1 to 7 business days | 24 to 72 hours |

| Credit Requirements | Good to excellent credit score (typically 650+) | More flexible; often accepts fair credit (600+) |

| Repayment Terms | 12 to 84 months | 6 to 60 months |

| Fees | Origination fees 1% - 6% | Platform fees 1% - 5% |

| Security | Usually unsecured; some secured options | Unsecured; risk shared among multiple investors |

| Best For | Borrowers seeking quick, straightforward loans via banks | Borrowers willing to explore alternative, flexible lending sources |

Understanding Personal Loans: Basics and Features

Personal loans are unsecured loans offered by banks and credit unions with fixed interest rates and repayment terms ranging from one to seven years, making them suitable for consolidating debt, financing major purchases, or covering emergencies. These loans typically require a good credit score and stable income, with amounts varying from $1,000 to $50,000 or more depending on the lender and borrower profile. Unlike peer-to-peer lending, personal loans have standardized approval processes and regulatory oversight, providing predictable repayment schedules and established borrower protections.

What is Peer-to-Peer Lending? Key Concepts Explained

Peer-to-peer (P2P) lending is a decentralized form of borrowing where individuals or businesses obtain loans directly from other individuals through an online platform, bypassing traditional financial institutions. This lending method involves investors funding loan requests in exchange for interest payments, typically resulting in competitive rates and faster approval compared to personal loans from banks. Key concepts include risk assessment algorithms, credit scoring, and platform fees, which ensure transparency and security for both borrowers and lenders.

Eligibility Criteria: Personal Loans vs P2P Lending

Personal loans typically require a good credit score, stable income, and a low debt-to-income ratio to qualify, as they are offered by traditional financial institutions. Peer-to-peer (P2P) lending platforms often have more flexible eligibility criteria, allowing borrowers with varied credit profiles to access funds through individual investors. Understanding these differences in credit checks, income verification, and approval processes is crucial for choosing the right loan option.

Interest Rates Comparison: Which Offers Better Deals?

Personal loans from traditional lenders typically have fixed or variable interest rates ranging from 6% to 36%, influenced by credit scores and income stability. Peer-to-peer lending platforms often provide competitive rates between 5% and 25%, driven by direct borrower-lender interaction and credit risk assessment algorithms. Comparing interest rates, peer-to-peer loans can offer better deals for borrowers with moderate to high creditworthiness seeking flexible terms.

Application Processes: Traditional Banks vs P2P Platforms

Personal loan applications through traditional banks typically involve extensive credit checks, income verification, and in-person documentation, which can extend approval times. Peer-to-peer lending platforms streamline the process by utilizing online applications, automated credit evaluations, and digital identity verification, resulting in faster approvals. This efficiency in P2P platforms appeals to borrowers seeking quicker access to funds without compromising security.

Approval Speed and Funding Timeframes

Personal loans typically offer faster approval and funding, often within one to two business days due to streamlined processes at traditional banks and credit unions. Peer-to-peer lending may take longer, generally ranging from several days up to two weeks, as it involves vetting by both the platform and individual investors. The speed differences impact borrowers needing immediate funds versus those able to wait for potentially lower rates from peer-to-peer sources.

Credit Score Impact: Differences Between Loan Types

Personal loans from traditional lenders typically require a minimum credit score of 600 to 700, and timely payments can improve credit history, while late payments may significantly damage credit scores. Peer-to-peer lending platforms may offer more flexible credit requirements, allowing borrowers with lower credit scores to access funding, but inconsistent repayments can still negatively affect credit reports. Understanding the credit score impact is crucial when choosing between personal loans and peer-to-peer loans, as it influences future borrowing potential and overall financial health.

Risks Involved: Personal Loans vs P2P Lending

Personal loans from banks typically carry lower default risk due to stringent credit checks and regulatory oversight, while peer-to-peer (P2P) lending involves higher risk as investments depend on individual borrower reliability without traditional financial institution guarantees. P2P platforms may lack sufficient risk mitigation mechanisms, exposing investors to potential losses from borrower defaults or platform failure. Evaluating credit scores, platform reputation, and diversification strategies is crucial for minimizing risks in both personal loans and P2P lending.

Pros and Cons: Side-by-Side Comparison

Personal loans offer fixed interest rates, predictable monthly payments, and often faster approval through traditional banks, but typically require good credit and may have higher interest rates. Peer-to-peer lending provides access to funds from individual investors with potentially lower rates and flexible terms, yet involves variable approval standards and less regulatory protection. Choosing between them depends on credit profile, desired loan terms, and risk tolerance for borrower-investor interactions.

Which Loan Type Suits Your Financial Goals?

Personal loans offer fixed interest rates and predictable repayment schedules ideal for borrowers seeking stability and clear budgeting over short to medium terms. Peer-to-peer lending provides flexible terms and potentially lower rates by connecting borrowers directly with individual investors, suiting those comfortable with variable risk and personalized loan conditions. Selecting between these depends on your credit profile, risk tolerance, and whether you prioritize consistency or cost-effectiveness in achieving financial goals.

Related Important Terms

Alternative Lending Platforms

Personal loans typically involve borrowing from traditional financial institutions with fixed interest rates and clear repayment terms, while peer-to-peer lending platforms connect borrowers directly with individual investors, often offering more flexible underwriting criteria and competitive rates. Alternative lending platforms like P2P networks leverage technology and social data to evaluate creditworthiness, providing access to funds for consumers who may not qualify for conventional personal loans.

Credit Scoring Algorithms

Personal loans typically rely on traditional credit scoring algorithms like FICO or VantageScore that assess credit history, income, and debt levels to determine borrower eligibility. Peer-to-peer lending platforms often use alternative credit scoring models incorporating social data, payment behavior, and machine learning techniques to evaluate credit risk beyond conventional metrics.

Micro-Investor Pooling

Personal loans are typically offered by banks or financial institutions with fixed interest rates and repayment terms, while peer-to-peer (P2P) lending involves micro-investor pooling where multiple individual investors collectively fund a borrower's loan, often resulting in more competitive rates. P2P lending platforms leverage decentralized micro-investor networks to distribute risk and increase capital access, contrasting the centralized structure of traditional personal loans.

Social Lending Verification

Personal loans typically require extensive credit checks and verification through traditional financial institutions, ensuring borrower credibility with established credit bureaus. Peer-to-peer lending platforms employ social lending verification by leveraging borrower profiles, social connections, and alternative data sources, enhancing risk assessment beyond conventional credit scoring systems.

Fractional Loan Ownership

Personal loans typically involve borrowing a fixed sum from a financial institution with fixed repayment terms, offering straightforward ownership of debt by the borrower. Peer-to-peer lending allows fractional loan ownership where multiple investors fund portions of a loan, diversifying risk and potentially offering competitive interest rates through decentralized lending platforms.

Unsecured Peer Notes

Personal loans typically offer fixed interest rates and predictable repayment schedules, while unsecured peer-to-peer lending through peer notes provides flexible funding options directly from individual investors without traditional bank intermediaries. Unsecured peer notes carry higher risk for lenders but often lower fees for borrowers, making them an attractive alternative for those with strong credit seeking streamlined access to capital.

Robo-Advisor Loan Matching

Robo-advisor loan matching leverages advanced algorithms to compare personal loans and peer-to-peer lending options, optimizing interest rates and repayment terms based on individual credit profiles. This technology enhances borrower decision-making by seamlessly integrating data from traditional banks and P2P platforms, ensuring personalized loan matches with maximum financial efficiency.

Decentralized Loan Contracts

Personal loans offer fixed repayment schedules through traditional banks with centralized underwriting, while peer-to-peer lending uses decentralized loan contracts on blockchain platforms, enabling direct borrower-lender interactions without intermediaries. These decentralized contracts increase transparency and reduce costs by automating agreement enforcement via smart contracts in peer-to-peer lending ecosystems.

Dynamic Interest Rate Modeling

Dynamic interest rate modeling in personal loans typically relies on credit scores and borrower profiles, offering relatively stable rates, whereas peer-to-peer lending platforms utilize real-time market demand and investor risk appetite to adjust rates more fluidly. This adaptive approach in P2P lending can result in more competitive pricing but also introduces greater volatility compared to the fixed or semi-variable structures in traditional personal loans.

Borrower Reputation Metrics

Borrower reputation metrics for personal loans primarily rely on credit scores, income verification, and debt-to-income ratios assessed by traditional financial institutions, ensuring standardized risk evaluation. Peer-to-peer lending platforms incorporate alternative data such as social media activity, transaction history, and peer reviews to establish borrower credibility, often enabling access to credit for those with limited conventional credit profiles.

Personal Loan vs Peer-to-Peer Lending for loan. Infographic

moneydiff.com

moneydiff.com