Personal loans offer fixed interest rates and set repayment schedules, providing predictable monthly payments and quick access to funds through traditional banks or credit unions. Peer-to-peer lending connects borrowers directly with individual investors, often resulting in competitive interest rates and more flexible terms, but may pose higher approval risks and longer funding times. Choosing between the two depends on credit profile, funding urgency, and preference for institutional versus online lending platforms.

Table of Comparison

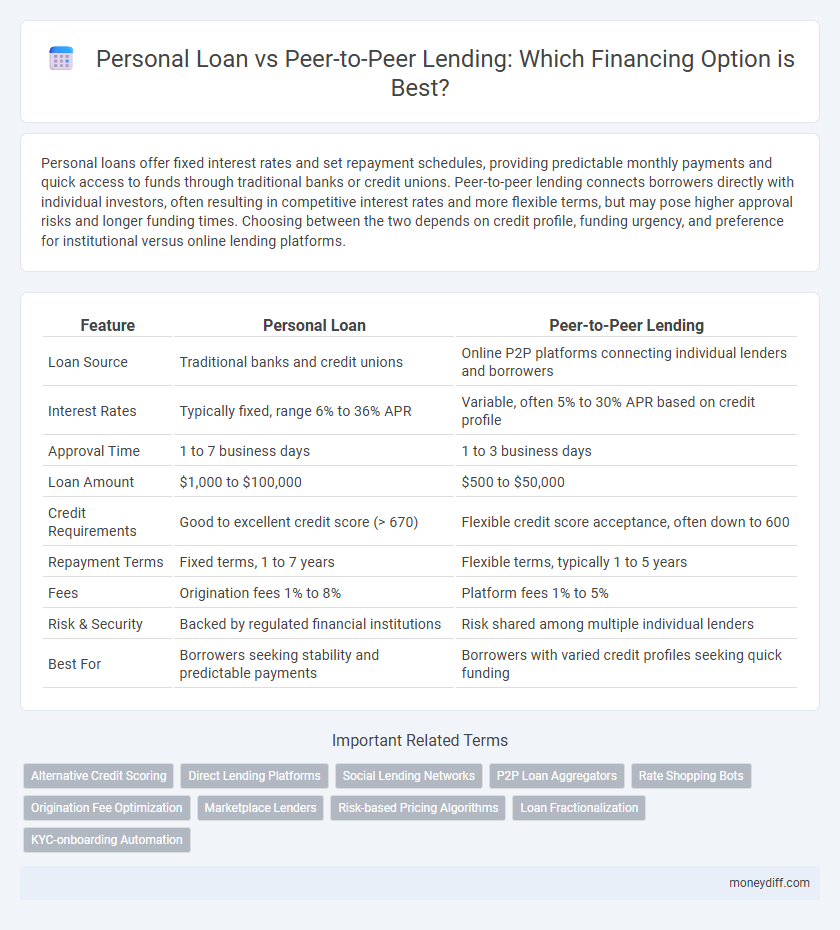

| Feature | Personal Loan | Peer-to-Peer Lending |

|---|---|---|

| Loan Source | Traditional banks and credit unions | Online P2P platforms connecting individual lenders and borrowers |

| Interest Rates | Typically fixed, range 6% to 36% APR | Variable, often 5% to 30% APR based on credit profile |

| Approval Time | 1 to 7 business days | 1 to 3 business days |

| Loan Amount | $1,000 to $100,000 | $500 to $50,000 |

| Credit Requirements | Good to excellent credit score (> 670) | Flexible credit score acceptance, often down to 600 |

| Repayment Terms | Fixed terms, 1 to 7 years | Flexible terms, typically 1 to 5 years |

| Fees | Origination fees 1% to 8% | Platform fees 1% to 5% |

| Risk & Security | Backed by regulated financial institutions | Risk shared among multiple individual lenders |

| Best For | Borrowers seeking stability and predictable payments | Borrowers with varied credit profiles seeking quick funding |

Understanding Personal Loans: A Quick Overview

Personal loans are unsecured funds offered by banks or credit unions based on creditworthiness, often featuring fixed interest rates and repayment terms ranging from one to seven years. Borrowers receive a lump sum upfront, making personal loans ideal for consolidating debt, financing major purchases, or covering emergencies. Understanding credit score impact, interest rates, and monthly installment obligations is essential when comparing personal loans to peer-to-peer lending options.

What Is Peer-to-Peer Lending?

Peer-to-peer lending connects borrowers directly with individual investors through online platforms, bypassing traditional financial institutions. This method offers competitive interest rates and faster approval compared to conventional personal loans, making it an attractive alternative for financing. Borrowers benefit from transparent terms and flexible repayment options, while investors gain opportunities for diversified returns.

Key Differences Between Personal Loans and P2P Lending

Personal loans are typically offered by traditional financial institutions with fixed interest rates and established credit requirements, providing borrowers predictable repayment terms. Peer-to-peer (P2P) lending platforms connect individual investors directly with borrowers, often offering more flexible approval criteria but variable interest rates based on risk assessment. While personal loans rely on lender underwriting standards, P2P lending leverages a marketplace model that can result in faster funding and potentially lower or higher costs depending on borrower creditworthiness and investor demand.

Interest Rates: Personal Loans vs Peer-to-Peer Lending

Personal loans typically feature fixed interest rates set by traditional financial institutions, often ranging from 6% to 36% based on credit scores and loan terms. Peer-to-peer lending platforms may offer more competitive rates, usually between 5% and 30%, influenced by borrower risk assessments and investor demand. Comparing these options enables borrowers to select financing with potentially lower interest costs tailored to their creditworthiness and loan purpose.

Eligibility and Approval Criteria Compared

Personal loans typically require a strong credit score, stable income, and proof of employment, with approval times ranging from a few hours to a few days. Peer-to-peer lending platforms evaluate borrowers using credit profiles but often consider additional factors such as social verification and lending community feedback, potentially offering more flexible eligibility standards. While traditional banks enforce strict criteria, P2P lending may accommodate borrowers with lower credit scores, although interest rates can vary significantly based on risk assessment.

Loan Amounts and Repayment Flexibility

Personal loans typically offer higher loan amounts, ranging from $1,000 to $50,000, with fixed repayment schedules over 2 to 7 years. Peer-to-peer lending platforms provide more flexible repayment options, often allowing customized terms and varied loan sizes depending on borrower credit profiles and investor demand. The flexibility in peer-to-peer lending can accommodate irregular income streams, while personal loans generally require consistent monthly payments.

Processing Times: Which Is Faster?

Personal loans typically offer faster processing times, often approving and disbursing funds within one to three business days due to streamlined bank procedures. Peer-to-peer lending platforms may take longer, generally around five to seven days, as they involve borrower verification and matching with individual investors. Choosing between the two depends on urgency, with personal loans providing quicker access to capital for immediate financing needs.

Risks and Security: Evaluating Both Options

Personal loans from traditional banks offer regulated security with fixed interest rates and predictable repayment schedules, reducing uncertainty for borrowers. Peer-to-peer lending platforms involve higher risk due to less stringent borrower verification and variable interest rates, which may lead to potential defaults or fraud. Investors and borrowers must carefully assess platform credibility, borrower creditworthiness, and regulatory protections to mitigate risks effectively.

Pros and Cons of Personal Loans and P2P Lending

Personal loans offer fixed interest rates and predictable repayment schedules, providing borrowers with financial stability and quicker access to funds through established banks or credit unions. Peer-to-peer (P2P) lending platforms often present lower interest rates and more flexible qualification criteria but involve higher variability in terms, longer approval times, and less regulatory protection. While personal loans typically come with stricter credit requirements and fees, P2P lending carries risks such as borrower default and less transparency, making the choice dependent on one's credit profile, urgency, and risk tolerance.

Choosing the Right Financing Option for Your Needs

Personal loans typically offer fixed interest rates and predictable repayment schedules, making them suitable for borrowers seeking stability and clear terms. Peer-to-peer lending platforms can provide competitive rates and faster approval but may involve variable terms depending on the lender's criteria and risk assessment. Evaluate your credit score, loan amount, repayment flexibility, and urgency to determine the most appropriate financing option tailored to your financial situation.

Related Important Terms

Alternative Credit Scoring

Personal loans typically rely on traditional credit scoring models, which assess factors like credit history and income, while peer-to-peer lending platforms increasingly utilize alternative credit scoring methods such as social behavior and transaction data to evaluate borrower risk. These alternative credit scoring approaches offer opportunities for individuals with limited credit history or non-traditional financial backgrounds to access financing through peer-to-peer lending.

Direct Lending Platforms

Direct lending platforms for personal loans offer borrowers faster access to funds with streamlined digital application processes and competitive interest rates compared to traditional peer-to-peer lending models, which rely on individual investors and may have longer approval times. These platforms provide enhanced credit evaluation technologies, increasing approval rates while ensuring more predictable repayment terms and reduced default risks.

Social Lending Networks

Social lending networks connect individual borrowers with investors through peer-to-peer platforms, offering more flexible approval criteria and often lower interest rates compared to traditional personal loans from banks. These platforms leverage social trust and technology to facilitate direct lending, reducing overhead costs and enabling competitive financing options for personal needs.

P2P Loan Aggregators

Peer-to-peer lending platforms connect borrowers directly with individual investors, often offering lower interest rates and faster approval than traditional personal loans from banks. P2P loan aggregators enhance this process by comparing multiple lending options, ensuring borrowers access the most competitive rates and flexible terms based on their credit profile.

Rate Shopping Bots

Rate shopping bots enable borrowers to quickly compare interest rates and terms between personal loans and peer-to-peer lending platforms, optimizing financing decisions based on real-time data. These automated tools analyze loan offers for factors like APR, repayment flexibility, and credit requirements, empowering users to select the most cost-effective funding source.

Origination Fee Optimization

Personal loans typically charge origination fees ranging from 1% to 8% of the loan amount, impacting the overall cost of borrowing, while peer-to-peer lending platforms often offer lower origination fees or none at all, providing a cost-effective alternative for borrowers. Optimizing origination fees by comparing rates and lender policies can significantly reduce the total repayment burden in both personal loans and peer-to-peer lending.

Marketplace Lenders

Marketplace lenders in peer-to-peer lending platforms connect borrowers directly with individual investors, offering competitive interest rates and flexible terms compared to traditional personal loans from banks or credit unions. Personal loans typically involve more rigid qualification criteria and higher fees, while marketplace lenders leverage online technology to streamline approval processes and provide tailored financing solutions.

Risk-based Pricing Algorithms

Risk-based pricing algorithms in personal loans evaluate credit scores, income, and borrowing history to determine interest rates tailored to individual risk profiles, while peer-to-peer lending platforms use similar data but incorporate investor risk preferences and market dynamics to set rates. This algorithmic approach enhances transparency and allows more precise risk assessment compared to traditional underwriting methods.

Loan Fractionalization

Personal loans involve borrowing a fixed amount directly from a financial institution with set repayment terms, whereas peer-to-peer lending utilizes loan fractionalization by distributing the loan amount among multiple individual investors, reducing risk exposure for lenders. Loan fractionalization in P2P lending enhances diversification and accessibility, allowing borrowers to secure funds through smaller contributions from various investors.

KYC-onboarding Automation

Personal loans typically involve traditional banks with stringent KYC-onboarding automation that ensures quick identity verification and compliance, enhancing borrower trust and reducing fraud. Peer-to-peer lending platforms leverage advanced digital KYC processes to streamline borrower onboarding, enabling faster loan disbursement and accessible financing options for underserved applicants.

Personal Loan vs Peer-to-Peer Lending for financing. Infographic

moneydiff.com

moneydiff.com