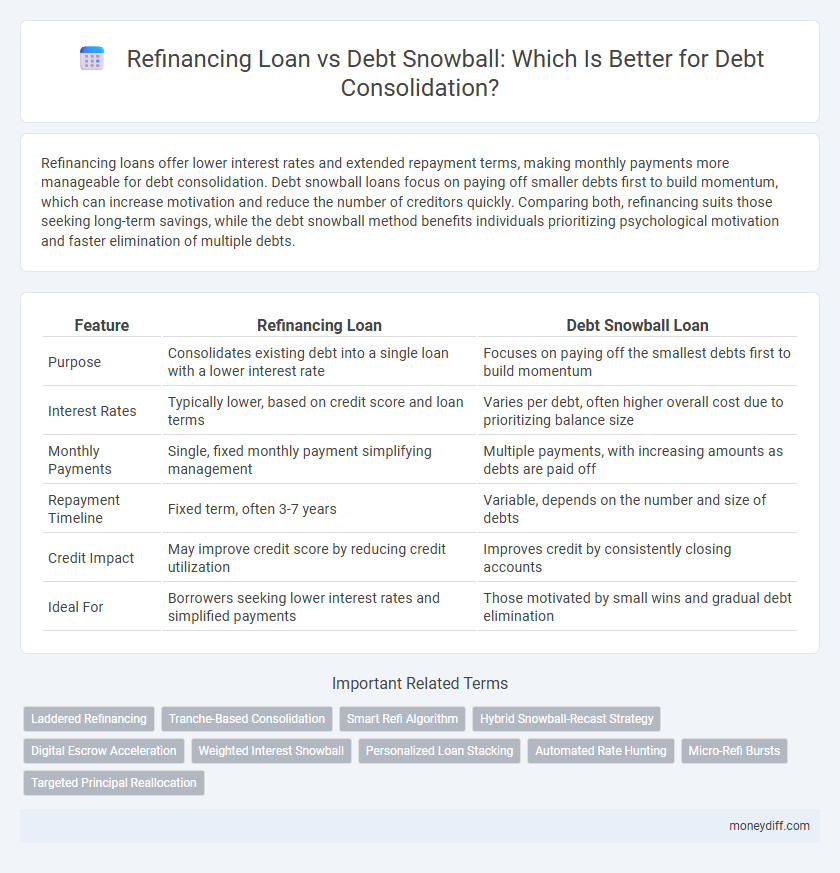

Refinancing loans offer lower interest rates and extended repayment terms, making monthly payments more manageable for debt consolidation. Debt snowball loans focus on paying off smaller debts first to build momentum, which can increase motivation and reduce the number of creditors quickly. Comparing both, refinancing suits those seeking long-term savings, while the debt snowball method benefits individuals prioritizing psychological motivation and faster elimination of multiple debts.

Table of Comparison

| Feature | Refinancing Loan | Debt Snowball Loan |

|---|---|---|

| Purpose | Consolidates existing debt into a single loan with a lower interest rate | Focuses on paying off the smallest debts first to build momentum |

| Interest Rates | Typically lower, based on credit score and loan terms | Varies per debt, often higher overall cost due to prioritizing balance size |

| Monthly Payments | Single, fixed monthly payment simplifying management | Multiple payments, with increasing amounts as debts are paid off |

| Repayment Timeline | Fixed term, often 3-7 years | Variable, depends on the number and size of debts |

| Credit Impact | May improve credit score by reducing credit utilization | Improves credit by consistently closing accounts |

| Ideal For | Borrowers seeking lower interest rates and simplified payments | Those motivated by small wins and gradual debt elimination |

Understanding Refinancing Loans for Debt Consolidation

Refinancing loans for debt consolidation involve replacing multiple high-interest debts with a single loan that offers a lower interest rate and more manageable monthly payments. This strategy can reduce overall interest costs and simplify repayment by extending the loan term or securing better loan terms. Borrowers should evaluate credit scores, loan fees, and interest rates to ensure refinancing provides tangible financial benefits compared to other methods like the debt snowball approach.

What is the Debt Snowball Method?

The Debt Snowball Method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on larger ones, gradually building momentum as each balance is cleared. This method boosts motivation and psychological wins, encouraging consistent payments and debt reduction. It contrasts with refinancing loans, which consolidate debt into a single loan often with lower interest rates, whereas the Debt Snowball focuses on behavioral change and incremental progress.

Comparing Refinancing Loan and Debt Snowball Loan

Refinancing loans consolidate debt by replacing multiple high-interest loans with a single loan that typically offers a lower interest rate, reducing overall monthly payments and saving on interest costs. Debt snowball loans prioritize paying off debts from smallest to largest balances, creating momentum through psychological wins while potentially incurring higher interest expenses compared to refinancing. Choosing between refinancing and the debt snowball method depends on factors like current interest rates, credit score, and the borrower's discipline to commit to consistent payments.

Pros and Cons of Refinancing for Managing Debt

Refinancing loans for debt consolidation offer lower interest rates and simplified monthly payments, making debt management more affordable and less stressful. However, refinancing may extend the loan term, potentially increasing the total interest paid over time, and may require good credit scores to qualify. Unlike the debt snowball method, refinancing consolidates all debts into one loan, which can improve cash flow but risks accumulating more debt if spending habits are not controlled.

Advantages and Disadvantages of the Debt Snowball Approach

The Debt Snowball Loan strategy accelerates debt repayment by targeting the smallest balances first, fostering motivation through quick wins and improved psychological momentum. This method, however, may result in higher overall interest costs compared to refinancing loans, as it doesn't prioritize debts with the highest interest rates. The approach benefits individuals focused on behavioral change and managing multiple smaller debts but can be less efficient for minimizing total repayment expenses.

Interest Rates: Refinancing vs Debt Snowball

Refinancing loans typically offer lower interest rates by replacing multiple high-rate debts with a single, often lower-rate loan, reducing overall interest costs and monthly payments. Debt snowball loans prioritize paying off smaller balances first regardless of interest rates, which may result in higher total interest paid over time. Choosing refinancing can lead to significant interest savings, while the snowball method focuses more on psychological momentum than interest rate optimization.

Eligibility Criteria for Loan Refinancing

Loan refinancing eligibility typically requires a stable income, good credit score, and existing debt to consolidate. Lenders assess debt-to-income ratio and collateral, if applicable, to approve refinancing applications. Unlike debt snowball loans, refinancing often demands a stronger financial profile for better interest rates and terms.

Timeframe to Debt Freedom: Snowball vs Refinancing

Refinancing loans typically offer a longer timeframe for debt freedom by lowering interest rates and monthly payments, allowing for steady repayment over several years. Debt snowball loans prioritize faster debt elimination by focusing on paying off the smallest balances first, which can lead to quicker psychological wins and increased motivation within months. Choosing between refinancing and debt snowball methods depends on whether the priority is overall interest savings and steady payoff or accelerated progress and behavioral momentum in the debt consolidation process.

Which Strategy Saves More Money?

Refinancing loans typically save more money by securing lower interest rates and consolidating multiple debts into a single payment, reducing overall interest costs. Debt snowball loans focus on paying off smaller debts first to build momentum, but may result in higher total interest paid due to longer repayment periods. Choosing refinancing is generally more cost-effective for borrowers prioritizing long-term savings over quick wins.

Choosing the Right Debt Consolidation Method

Refinancing loans offer lower interest rates and extended repayment terms, making them ideal for consolidating high-interest debts into a single monthly payment, which can reduce overall financial burden. Debt Snowball loans focus on paying off smaller debts first, providing psychological motivation and a clear path to becoming debt-free by building momentum. Evaluating individual financial situations, interest rates, loan terms, and personal motivation are essential for selecting the most effective debt consolidation method.

Related Important Terms

Laddered Refinancing

Laddered refinancing involves obtaining multiple loans with staggered terms to optimize interest rates and manage repayment schedules effectively, often resulting in lower overall costs compared to a debt snowball loan, which prioritizes paying off debts from smallest to largest regardless of interest rate. This strategy enhances cash flow flexibility and reduces financial strain during debt consolidation by aligning payment obligations with income cycles and minimizing total interest paid.

Tranche-Based Consolidation

Refinancing loans offer tranche-based consolidation by restructuring existing debts into separate segments with varying interest rates and terms, optimizing cash flow management and potentially lowering overall borrowing costs. Debt snowball loans prioritize paying off smaller balances first but lack the structured tranche segmentation that allows tailored repayment strategies essential for efficient tranche-based consolidation.

Smart Refi Algorithm

Refinancing loans use the Smart Refi Algorithm to optimize interest rates and repayment schedules, reducing overall debt cost faster than traditional debt snowball methods. This algorithm analyzes credit profiles and loan terms to prioritize high-impact payments, maximizing savings and accelerating debt consolidation.

Hybrid Snowball-Recast Strategy

The Hybrid Snowball-Recast Strategy combines the psychological benefits of targeting smaller debts first, as seen in a Debt Snowball Loan, with the financial efficiency of refinancing through a lower interest rate loan. This approach accelerates debt payoff by reducing overall interest costs while maintaining motivation, making it an effective debt consolidation method.

Digital Escrow Acceleration

Refinancing loans leverage lower interest rates to reduce overall debt costs, making them ideal for digital escrow acceleration by streamlining payment processes and ensuring faster fund disbursement. Debt snowball loans prioritize paying off smaller debts first, but lack the digital escrow integration that optimizes transaction speed and security in modern debt consolidation strategies.

Weighted Interest Snowball

Refinancing loans offer lower interest rates to reduce monthly payments, while debt snowball loans prioritize paying off smaller debts first regardless of interest rate, accelerating psychological motivation. Weighted Interest Snowball combines these strategies by targeting debts with the highest weighted interest rates, maximizing savings and speeding up overall debt elimination.

Personalized Loan Stacking

Refinancing loans offer lower interest rates and streamlined payments by consolidating high-interest debts into a single loan, while debt snowball loans prioritize paying off smaller balances first to build momentum and improve credit scores. Personalized loan stacking enhances debt consolidation by strategically layering multiple loan types to optimize interest rates and repayment schedules tailored to individual financial goals.

Automated Rate Hunting

Refinancing loans leverage automated rate hunting technology to continuously scan multiple lenders, securing the lowest possible interest rates for debt consolidation, thus optimizing monthly payments and total repayment costs. Debt snowball loans, while effective for structured payoff strategies, typically lack automated rate monitoring, potentially missing opportunities to refinance at better rates and reduce overall financial burden.

Micro-Refi Bursts

Micro-Refi Bursts enable strategic refinancing by breaking large loans into smaller, manageable segments to accelerate debt payoff, offering greater flexibility compared to traditional Debt Snowball Loans that prioritize smallest debt first. Refinancing loans often reduce interest rates and monthly payments, optimizing cash flow, while Debt Snowball Loans capitalize on psychological motivation through incremental victories but may incur higher overall interest costs.

Targeted Principal Reallocation

Refinancing loans for debt consolidation allow targeted principal reallocation by consolidating high-interest debts into a single lower-interest loan, reducing overall interest costs and accelerating repayment. Debt snowball loans prioritize reallocating payments toward the smallest balance first, boosting motivation through quick principal elimination while potentially costing more interest over time.

Refinancing Loan vs Debt Snowball Loan for debt consolidation. Infographic

moneydiff.com

moneydiff.com