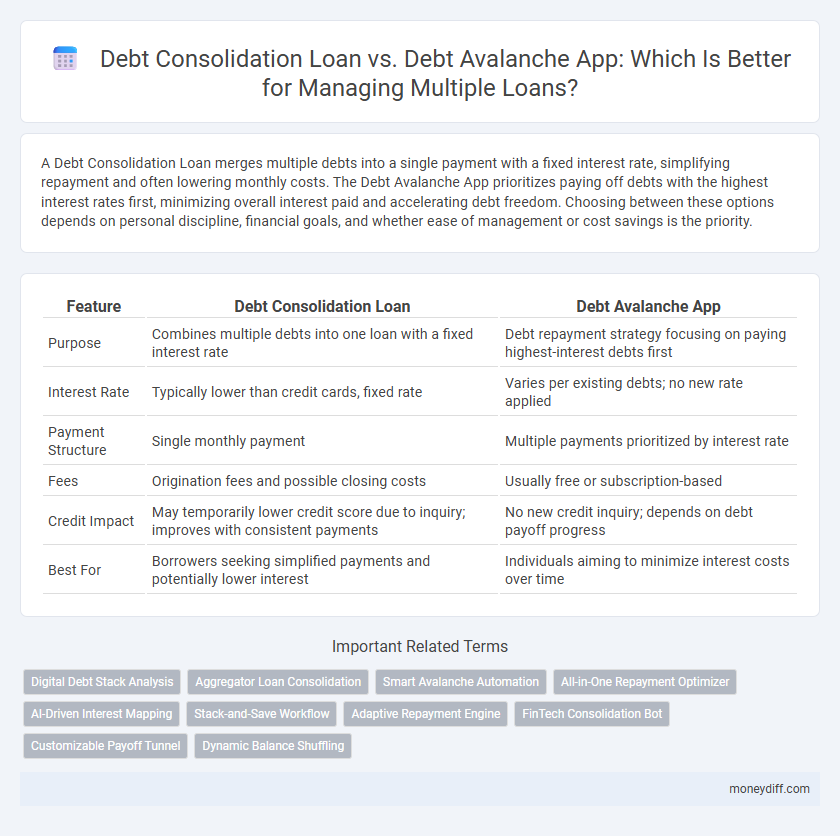

A Debt Consolidation Loan merges multiple debts into a single payment with a fixed interest rate, simplifying repayment and often lowering monthly costs. The Debt Avalanche App prioritizes paying off debts with the highest interest rates first, minimizing overall interest paid and accelerating debt freedom. Choosing between these options depends on personal discipline, financial goals, and whether ease of management or cost savings is the priority.

Table of Comparison

| Feature | Debt Consolidation Loan | Debt Avalanche App |

|---|---|---|

| Purpose | Combines multiple debts into one loan with a fixed interest rate | Debt repayment strategy focusing on paying highest-interest debts first |

| Interest Rate | Typically lower than credit cards, fixed rate | Varies per existing debts; no new rate applied |

| Payment Structure | Single monthly payment | Multiple payments prioritized by interest rate |

| Fees | Origination fees and possible closing costs | Usually free or subscription-based |

| Credit Impact | May temporarily lower credit score due to inquiry; improves with consistent payments | No new credit inquiry; depends on debt payoff progress |

| Best For | Borrowers seeking simplified payments and potentially lower interest | Individuals aiming to minimize interest costs over time |

Understanding Debt Consolidation Loans: A Comprehensive Overview

Debt consolidation loans combine multiple debts into a single loan with a fixed interest rate, simplifying payments and potentially lowering overall interest costs. This financial tool helps borrowers manage credit card balances, personal loans, and other liabilities more efficiently by reducing the number of monthly payments. Understanding key factors such as loan term, interest rates, and fees is crucial for maximizing the benefits of debt consolidation while improving credit scores.

How the Debt Avalanche Method App Works

The Debt Avalanche Method app prioritizes paying off debts with the highest interest rates first, minimizing overall interest payments and reducing debt faster. Users input their multiple debts, balances, and interest rates, and the app creates a customized payment plan that targets the most expensive debts while maintaining minimum payments on others. Automated reminders and progress tracking features help users stay on course and achieve debt freedom efficiently.

Pros and Cons of Debt Consolidation Loans

Debt consolidation loans simplify managing multiple debts by combining them into a single monthly payment, often with a lower interest rate, which can reduce overall financial strain and improve credit scores. However, they may require good credit for approval, potentially involve fees, and risk extended repayment periods that can increase total interest paid. Compared to the Debt Avalanche App, which prioritizes paying off high-interest debts first, consolidation loans offer ease and predictability but might lack the aggressive payoff strategy of avalanche methods.

Benefits of Using Debt Avalanche Apps for Debt Repayment

Debt Avalanche apps prioritize high-interest debts first, maximizing savings on interest payments and accelerating overall debt repayment. These apps offer personalized payment plans and real-time tracking, enhancing motivation and financial discipline. Automated notifications and progress visualizations streamline management, making it easier to stay on track and achieve debt freedom faster.

Interest Rates: Debt Consolidation Loan vs Debt Avalanche Approach

Debt consolidation loans typically offer fixed interest rates that simplify monthly payments by combining multiple debts into one, often at a lower average rate than the original debts. The debt avalanche approach targets debts with the highest interest rates first, minimizing total interest paid over time but requires strict discipline and multiple payments. Comparing both, a debt consolidation loan can streamline finances with predictable costs, while the avalanche method optimizes interest savings through strategic repayment prioritization.

Credit Score Impact: Loan vs Avalanche Method

Debt consolidation loans simplify multiple debts into a single monthly payment, potentially lowering credit utilization and improving credit score if managed responsibly. The debt avalanche method targets high-interest debts first through regular payments, maintaining individual accounts which can positively impact credit score by demonstrating consistent on-time payments. Choosing between a debt consolidation loan and the debt avalanche approach depends on individual financial goals and the ability to maintain disciplined repayment habits.

Monthly Payments and Repayment Timelines Compared

Debt consolidation loans streamline multiple debts into a single monthly payment, often lowering interest rates and extending repayment timelines, which can reduce monthly financial strain but may lead to longer debt duration. The debt avalanche app prioritizes paying off debts with the highest interest rates first, potentially shortening overall repayment time and minimizing total interest paid by optimizing monthly payments strategically. Comparing both, debt consolidation offers simplicity and stable payments, while the debt avalanche app requires disciplined planning but accelerates debt freedom through targeted repayment strategies.

Flexibility and Customization: Loan Solutions vs App Technologies

Debt consolidation loans offer flexibility through fixed repayment schedules and customizable loan amounts tailored to borrower credit profiles, enabling manageable monthly payments. Debt Avalanche apps provide intelligent automation by prioritizing high-interest debts and adapting payoff plans in real-time based on user inputs and financial changes. While loans emphasize structured financial commitment, app technologies enhance personalization and dynamic adjustments for optimized debt management.

Key Factors to Consider Before Choosing a Strategy

Evaluating a Debt Consolidation Loan against a Debt Avalanche App involves analyzing interest rates, monthly payment amounts, and total payoff time to optimize debt management. Assessing your credit score and financial discipline is crucial, as consolidation loans may require good credit, while avalanche apps enforce structured payments targeting high-interest debts first. Consider flexibility, potential fees, and user interface ease when selecting the most effective strategy for reducing multiple debts efficiently.

Which Is Right for You: Debt Consolidation Loan or Debt Avalanche App?

Choosing between a debt consolidation loan and a debt avalanche app depends on your financial goals and discipline. Debt consolidation loans simplify payments by combining multiple debts into one with a fixed interest rate, ideal for those seeking streamlined management and predictable monthly expenses. The debt avalanche app prioritizes paying off high-interest debts first, saving more on interest over time, suitable for disciplined borrowers willing to track and adjust payments actively.

Related Important Terms

Digital Debt Stack Analysis

Debt consolidation loans streamline multiple debts into a single payment with potentially lower interest rates, while debt avalanche apps use digital debt stack analysis to prioritize high-interest debts for faster repayment. Leveraging real-time tracking and personalized payment strategies, debt avalanche apps enhance financial efficiency and reduce overall interest costs more effectively than traditional consolidation methods.

Aggregator Loan Consolidation

Aggregator Loan Consolidation offers a streamlined solution by combining multiple debts into a single loan with a lower interest rate, simplifying repayment compared to the Debt Avalanche App's strategy of prioritizing high-interest debts for faster payoff. Utilizing an aggregator platform reduces complexity and may optimize credit management, enhancing financial control and potentially lowering overall debt costs.

Smart Avalanche Automation

Debt consolidation loans simplify multiple debts into a single payment with fixed interest rates, while Debt Avalanche apps leverage smart avalanche automation to prioritize high-interest debts for faster payoff and reduced interest costs. Utilizing AI-driven algorithms, these apps dynamically adjust payment schedules to optimize debt repayment efficiency and minimize financial burden.

All-in-One Repayment Optimizer

The All-in-One Repayment Optimizer combines the strategic focus of a Debt Avalanche App with the comprehensive coverage of a Debt Consolidation Loan by prioritizing high-interest debts while streamlining payments into a single plan. This approach enhances debt repayment efficiency by minimizing interest costs and simplifying management across multiple loans.

AI-Driven Interest Mapping

Debt consolidation loans streamline multiple debts into a single payment with a fixed interest rate, simplifying repayment schedules. AI-driven interest mapping in debt avalanche apps analyzes each debt's interest rates to prioritize high-interest balances, optimizing payoff speed and minimizing total interest paid.

Stack-and-Save Workflow

Debt Consolidation Loans simplify repayment by combining multiple debts into a single loan with a fixed interest rate, streamlining monthly payments and potentially lowering overall interest costs. The Debt Avalanche App enhances the stack-and-save workflow by prioritizing high-interest debts first, accelerating payoff and maximizing interest savings through a structured, data-driven approach.

Adaptive Repayment Engine

Debt consolidation loans simplify multiple debts into a single payment with fixed interest rates, while Debt Avalanche apps leverage an adaptive repayment engine that prioritizes debts by interest rate dynamically, optimizing payoff speed and minimizing total interest paid. The adaptive repayment engine continuously recalculates priorities based on real-time payment progress and interest accrual, delivering a tailored and efficient debt reduction strategy.

FinTech Consolidation Bot

A FinTech consolidation bot simplifies managing multiple debts by automating the debt avalanche method, targeting high-interest balances first to minimize overall interest paid. Compared to traditional debt consolidation loans, these apps offer personalized repayment plans and real-time tracking, enhancing user control and financial efficiency.

Customizable Payoff Tunnel

The Debt Consolidation Loan offers a streamlined approach by combining multiple debts into a single monthly payment with fixed interest rates, simplifying budgeting and reducing overall interest costs. In contrast, the Debt Avalanche App features a customizable payoff tunnel that prioritizes high-interest debts first, allowing users to tailor repayment schedules dynamically to minimize interest and accelerate debt freedom.

Dynamic Balance Shuffling

Debt consolidation loans simplify multiple debts into a single monthly payment with fixed interest, while the debt avalanche app utilizes dynamic balance shuffling to prioritize high-interest debts, optimizing repayment speed and minimizing overall interest. Dynamic balance shuffling continuously recalculates payment allocations based on fluctuating balances and interest rates, enhancing the efficiency of debt payoff compared to static consolidation methods.

Debt Consolidation Loan vs Debt Avalanche App for managing multiple debts. Infographic

moneydiff.com

moneydiff.com