Bank loans for online shopping offer fixed terms, predictable interest rates, and direct control over borrowed funds, making them suitable for consumers seeking transparency and structured repayment schedules. Embedded lending integrates financing options directly within e-commerce platforms, providing seamless checkout experiences and instant credit approvals without redirecting users. Choosing between bank loans and embedded lending depends on preferences for flexibility, speed, and user convenience during the online purchase process.

Table of Comparison

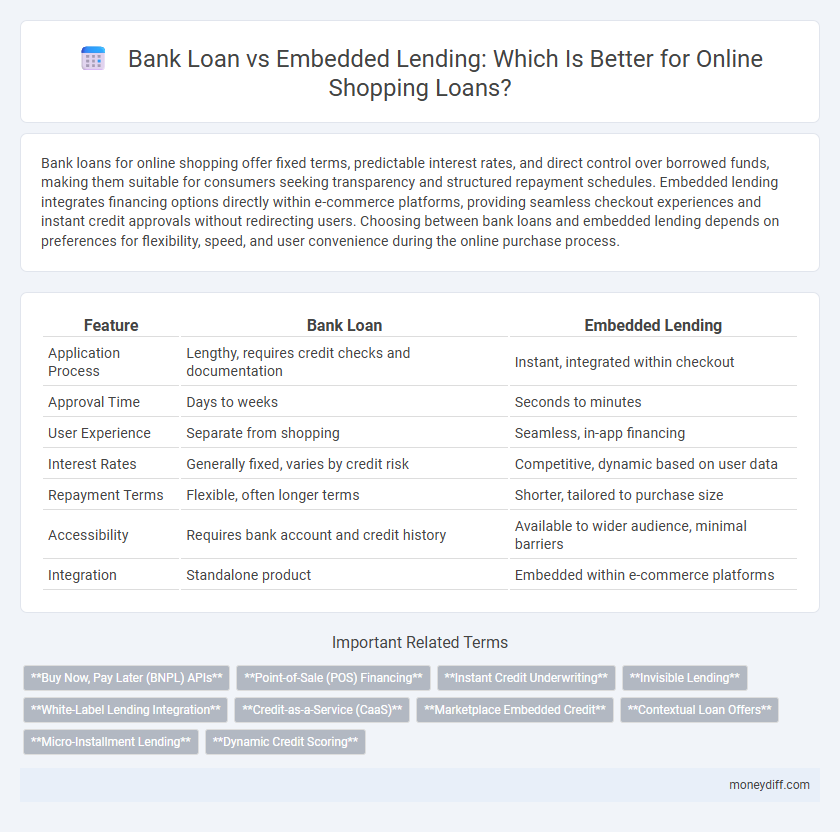

| Feature | Bank Loan | Embedded Lending |

|---|---|---|

| Application Process | Lengthy, requires credit checks and documentation | Instant, integrated within checkout |

| Approval Time | Days to weeks | Seconds to minutes |

| User Experience | Separate from shopping | Seamless, in-app financing |

| Interest Rates | Generally fixed, varies by credit risk | Competitive, dynamic based on user data |

| Repayment Terms | Flexible, often longer terms | Shorter, tailored to purchase size |

| Accessibility | Requires bank account and credit history | Available to wider audience, minimal barriers |

| Integration | Standalone product | Embedded within e-commerce platforms |

Understanding Bank Loans for Online Shopping

Bank loans for online shopping typically involve fixed interest rates and structured repayment terms, offering customers predictable monthly payments and formal credit underwriting by financial institutions. These loans often require credit checks and documentation, providing consumers with higher borrowing limits and longer repayment periods compared to embedded lending options. Understanding the approval process and associated fees is crucial for borrowers seeking traditional bank financing for e-commerce purchases.

What is Embedded Lending in E-Commerce?

Embedded lending in e-commerce integrates financing options directly within the online shopping experience, allowing customers to access loans at the point of sale without leaving the merchant's platform. This seamless approach leverages advanced APIs and real-time credit assessments to provide instant credit approvals and flexible repayment terms. Unlike traditional bank loans that require separate applications and approvals, embedded lending enhances customer convenience and boosts sales conversion rates by simplifying the borrowing process.

Key Differences: Bank Loan vs Embedded Lending

Bank loans for online shopping typically require a formal application process, credit checks, and fixed repayment schedules, offering structured financing with potentially lower interest rates. Embedded lending, integrated directly into the shopping platform, provides instant credit approvals and flexible payment options by leveraging real-time purchase data and customer behavior analytics. Key differences include the speed of approval, user experience seamlessness, and reliance on data integration versus traditional underwriting.

Approval Process: Traditional Banks vs Embedded Platforms

Traditional banks typically have a rigorous loan approval process involving extensive credit checks, manual documentation, and longer processing times, which can delay access to funds for online shopping. Embedded lending platforms streamline approval by integrating directly with e-commerce systems, leveraging real-time data and automated credit assessments to offer instant or near-instant credit decisions. This seamless, technology-driven approach reduces friction and improves the customer experience during online purchases.

Interest Rates and Fees Comparison

Bank loans typically feature fixed or variable interest rates with structured repayment terms, often accompanied by origination fees and stricter credit requirements. Embedded lending in online shopping platforms usually offers more flexible, smaller loans with potentially higher interest rates and transparent, upfront fees integrated into purchase costs. Consumers benefit from faster access to credit through embedded lending but may face overall higher costs compared to traditional bank loans with lower interest rates and formal fee structures.

Accessibility and Convenience for Shoppers

Bank loans typically require extensive credit checks and lengthy approval processes, limiting accessibility for many online shoppers. Embedded lending integrates financing options directly into e-commerce platforms, enabling instant approval and seamless checkout experiences that enhance convenience. This real-time access to credit empowers shoppers to complete purchases without leaving the online store, improving overall customer satisfaction.

Speed of Funds Disbursement

Bank loans for online shopping generally involve longer approval processes, often taking several days to weeks due to credit checks and documentation, whereas embedded lending enables near-instant funds disbursement integrated directly at the point of sale. The embedded lending model leverages advanced APIs and real-time data analytics, significantly accelerating loan approval and fund transfer to consumers. This speed advantage enhances customer experience by reducing wait times, increasing conversion rates, and enabling seamless purchases with immediate financing options.

Impact on Credit Score: Bank Loans versus Embedded Lending

Bank loans often involve a hard credit inquiry, which can temporarily lower credit scores, while embedded lending platforms typically use soft checks or alternative data, resulting in minimal impact on credit profiles. The repayment behavior on bank loans is reported directly to credit bureaus, influencing credit history positively or negatively, whereas embedded lending may not always be fully reported. Consumers should weigh these differences when choosing financing options for online shopping to optimize their credit score outcomes.

Security and Regulatory Considerations

Bank loans offer robust security measures with strict regulatory oversight from financial authorities, ensuring compliance with consumer protection laws and reducing fraud risks. Embedded lending platforms, while convenient, often operate under varied regulatory frameworks that may not provide the same level of data protection and transparency for borrowers. Prioritizing strong encryption, secure data handling practices, and adherence to local financial regulations are critical for both options to safeguard consumer information and promote responsible lending.

Choosing the Right Option for Your Online Purchases

Choosing the right financing option for online shopping depends on factors such as interest rates, repayment terms, and convenience. Bank loans typically offer lower interest rates but involve longer approval processes and stricter credit requirements, while embedded lending provides instant credit within the e-commerce platform with flexible repayment options, though at potentially higher costs. Evaluating your credit profile and purchase urgency helps determine whether a traditional bank loan or embedded lending best suits your online shopping needs.

Related Important Terms

Buy Now, Pay Later (BNPL) APIs

Bank loan integration for online shopping often involves traditional underwriting and longer approval times, whereas Embedded Lending through Buy Now, Pay Later (BNPL) APIs offers seamless, real-time credit approvals directly within the checkout process, enhancing customer experience and increasing conversion rates. BNPL APIs enable merchants to provide flexible payment options without assuming credit risk, leveraging data analytics and instant credit scoring for tailored installment plans.

Point-of-Sale (POS) Financing

Point-of-sale (POS) financing through embedded lending offers seamless access to credit directly within online shopping platforms, enhancing customer convenience by eliminating the need to apply separately for a bank loan. Embedded lending integrates loan approval, disbursement, and repayment within the checkout process, increasing purchase conversion rates and providing merchants with real-time financing options tailored to consumer behavior.

Instant Credit Underwriting

Bank loans often require extensive manual credit checks and longer approval times, whereas embedded lending leverages instant credit underwriting algorithms within online shopping platforms to provide real-time credit decisions and seamless purchase experiences. This automation reduces friction, increases approval rates, and enhances consumer convenience by integrating credit evaluation directly into the checkout process.

Invisible Lending

Invisible lending enhances the online shopping experience by seamlessly integrating bank loans into the checkout process without redirecting customers to external sites. This embedded lending model increases conversion rates and customer satisfaction by offering instant credit approvals and personalized loan options within the shopping platform.

White-Label Lending Integration

White-label lending integration enables banks to offer seamless, branded loan solutions directly within online shopping platforms, enhancing customer experience by providing instant financing options without redirecting users. Embedded lending leverages this integration to streamline credit approval and disbursement, increasing conversion rates and customer loyalty through personalized, in-app loan offerings.

Credit-as-a-Service (CaaS)

Credit-as-a-Service (CaaS) enhances online shopping by integrating embedded lending directly into digital platforms, allowing customers to access instant financing without leaving the retailer's website. In contrast to traditional bank loans, CaaS offers seamless, real-time credit approval and personalized repayment options, improving user experience and increasing conversion rates for merchants.

Marketplace Embedded Credit

Marketplace embedded credit integrates seamlessly into online shopping platforms, offering customers instant financing options without leaving the marketplace, thereby enhancing conversion rates and customer experience. Unlike traditional bank loans that require separate applications and longer approval times, embedded lending leverages transaction data for real-time credit decisions, optimizing risk management and driving higher sales.

Contextual Loan Offers

Contextual loan offers leverage real-time data and user behavior to provide tailored financing options during the online shopping experience, enhancing approval rates and customer satisfaction. Embedded lending streamlines the loan process by integrating financing seamlessly within the checkout flow, whereas traditional bank loans require separate applications and longer processing times, often reducing conversion rates.

Micro-Installment Lending

Micro-installment lending embedded in online shopping platforms offers a seamless, credit-inclusive payment solution, enabling consumers to split purchases into small, manageable payments without separate bank loan applications. This fintech innovation bypasses traditional bank loan processes, reduces approval times, and enhances customer convenience by integrating credit options directly at checkout.

Dynamic Credit Scoring

Dynamic credit scoring enhances bank loans by continuously analyzing real-time financial behavior to adjust credit limits and interest rates, improving risk management accuracy. Embedded lending integrates this adaptive scoring directly into online shopping platforms, enabling instant, personalized loan offers that streamline customer experience and increase conversion rates.

Bank Loan vs Embedded Lending for online shopping. Infographic

moneydiff.com

moneydiff.com