Student loans provide a fixed amount with interest to be repaid over time, offering predictable payments but potentially leading to debt regardless of income. Income share agreements (ISAs) finance education by requiring a percentage of future income for a set period, aligning repayment with earnings and reducing risk of unmanageable debt. Choosing between student loans and ISAs depends on financial stability, career prospects, and willingness to share future income.

Table of Comparison

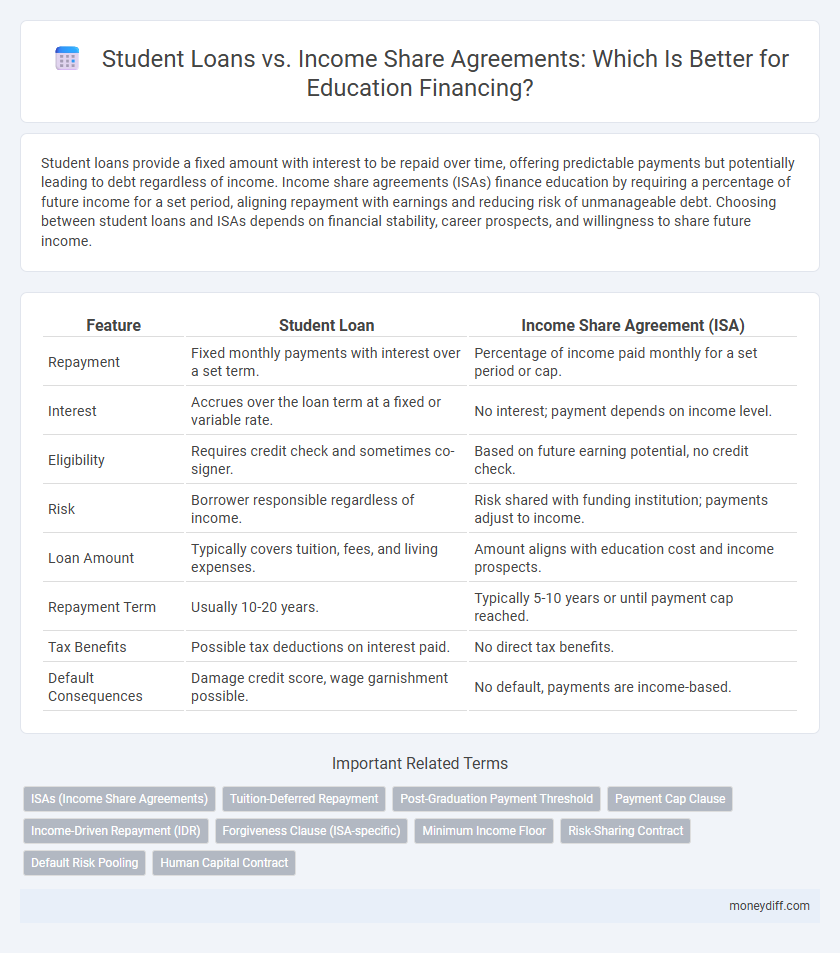

| Feature | Student Loan | Income Share Agreement (ISA) |

|---|---|---|

| Repayment | Fixed monthly payments with interest over a set term. | Percentage of income paid monthly for a set period or cap. |

| Interest | Accrues over the loan term at a fixed or variable rate. | No interest; payment depends on income level. |

| Eligibility | Requires credit check and sometimes co-signer. | Based on future earning potential, no credit check. |

| Risk | Borrower responsible regardless of income. | Risk shared with funding institution; payments adjust to income. |

| Loan Amount | Typically covers tuition, fees, and living expenses. | Amount aligns with education cost and income prospects. |

| Repayment Term | Usually 10-20 years. | Typically 5-10 years or until payment cap reached. |

| Tax Benefits | Possible tax deductions on interest paid. | No direct tax benefits. |

| Default Consequences | Damage credit score, wage garnishment possible. | No default, payments are income-based. |

Understanding Student Loans and Income Share Agreements

Student loans provide fixed amounts of money with set repayment schedules and interest rates, requiring borrowers to repay both principal and interest over time. Income Share Agreements (ISAs) offer an alternative by allowing students to finance education in exchange for a fixed percentage of future income for a predetermined period, eliminating traditional debt and interest charges. Understanding the repayment structure, financial risks, and eligibility criteria of both options is essential for making informed decisions about education financing.

Key Differences Between Student Loans and ISAs

Student loans require fixed repayments with interest over a set term, while Income Share Agreements (ISAs) involve paying a percentage of future income for a defined period without accumulating debt. Student loans often have rigid repayment schedules regardless of the borrower's financial situation, whereas ISAs adjust payments based on actual earnings, reducing financial risk. Unlike loans, ISAs do not build interest but might cost more if the borrower's income grows significantly.

How Student Loans Work: Terms and Repayment

Student loans typically involve borrowing a fixed amount with predetermined interest rates and set repayment terms, requiring borrowers to start repayments after graduation or a grace period. Repayment schedules can span 10 to 25 years, with options for income-driven plans adjusting monthly payments based on the borrower's earnings. In contrast, income share agreements (ISAs) require no upfront loan but obligate borrowers to pay a fixed percentage of future income for a set period, aligning repayment directly with earnings rather than a fixed loan balance.

How Income Share Agreements Operate

Income Share Agreements (ISAs) operate by allowing students to receive funding for education in exchange for a fixed percentage of their future income over a predetermined period, rather than accumulating traditional debt. Payments under ISAs are flexible and directly tied to the borrower's earnings, meaning if the income falls below a certain threshold, payments pause, reducing financial strain. This model contrasts with student loans by shifting the risk from the student to the funder, aligning repayment obligations with actual career success.

Eligibility Criteria for Student Loans vs ISAs

Student loans typically require proof of enrollment in an accredited institution and may consider credit history or a co-signer for eligibility, while Income Share Agreements (ISAs) often focus on the student's potential future income and skill set rather than creditworthiness. Eligibility for student loans can be stricter, involving fixed criteria like enrollment status and financial need, whereas ISAs may offer more flexible access based on projected earnings and career paths. Understanding these eligibility distinctions helps students choose the optimal financing option aligned with their financial situation and career goals.

Financial Impact: Interest Rates vs Income Percentage

Student loans often feature fixed or variable interest rates that can significantly increase the total repayment amount over time, especially if the borrower has a lower income after graduation. Income share agreements (ISAs) require a fixed percentage of the borrower's income for a set period, aligning repayment obligations with the borrower's financial success and potentially lowering the overall cost if earnings are modest. Comparing these financial impacts helps students choose between the predictability of interest-based loans and the flexible, income-contingent nature of ISAs.

Risks and Benefits of Student Loans

Student loans offer a fixed repayment plan with predictable monthly payments, enabling students to access education funds immediately, but they carry the risk of long-term debt accumulation and high interest rates. Borrowers may face financial strain if income remains low after graduation, potentially leading to default or damaged credit scores. Despite these risks, student loans build credit history and provide government protections like deferment and forgiveness options in qualifying cases.

Pros and Cons of Income Share Agreements

Income Share Agreements (ISAs) offer flexible repayment terms based on a percentage of future income, reducing financial risk for students compared to traditional student loans which require fixed payments regardless of earnings. ISAs can alleviate debt burden if income is low, but often have caps and can result in higher overall payments if income grows substantially. However, limited availability and potential lack of regulatory protections pose drawbacks compared to conventional student loan programs.

Choosing the Right Financing Option for Your Education

Choosing the right education financing option depends on your financial goals and risk tolerance. Student loans offer fixed repayment terms and interest rates, providing predictable monthly payments but accumulating debt regardless of post-graduation income. Income share agreements adjust repayment based on your future earnings, reducing risk if income is low but potentially leading to higher total payments if your salary increases significantly.

Future Trends in Education Financing: Loans vs ISAs

Future trends in education financing indicate a growing shift from traditional student loans to Income Share Agreements (ISAs), which offer repayment flexibility based on post-graduation income levels. ISAs align financial obligations with graduates' earnings, potentially reducing default risks compared to fixed-rate loans. Emerging technologies and regulatory changes are expected to further popularize ISAs, making them a viable alternative for funding higher education.

Related Important Terms

ISAs (Income Share Agreements)

Income Share Agreements (ISAs) offer a flexible alternative to traditional student loans by requiring borrowers to repay a fixed percentage of their future income for a set period, reducing financial risk if earnings are low after graduation. ISAs align incentives between students and educational institutions, promoting career success without the burden of fixed monthly debt payments typically associated with standard student loans.

Tuition-Deferred Repayment

Student loans typically require repayment with interest shortly after graduation, often placing immediate financial strain on borrowers, whereas Income Share Agreements (ISAs) offer tuition-deferred repayment tied to a fixed percentage of income for a set period, easing initial cash flow concerns. ISAs align repayment amounts with actual earnings, reducing the risk of excessive debt burdens for students facing variable post-education income levels.

Post-Graduation Payment Threshold

Student loans require fixed monthly repayments regardless of income, whereas Income Share Agreements (ISAs) initiate payments only after the graduate's income surpasses a specified post-graduation threshold, typically set between $30,000 and $40,000 annually. This threshold-based repayment structure allows ISA participants to manage financial obligations flexibly based on their actual earnings, reducing the risk of default compared to traditional student loan debt.

Payment Cap Clause

Student loans typically require fixed monthly payments with interest accruing over time, while income share agreements (ISAs) link repayment amounts to a percentage of the borrower's income until a payment cap or time limit is reached. The payment cap clause in ISAs provides borrowers with a maximum repayment ceiling, limiting total payments and offering financial predictability compared to traditional loan interest accumulation.

Income-Driven Repayment (IDR)

Income-Driven Repayment (IDR) plans offer flexible monthly payments based on income for federal student loans, while Income Share Agreements (ISAs) require a fixed percentage of future income regardless of loan amount. IDR plans cap repayment at a percentage of discretionary income, providing forgiveness after 20-25 years, contrasting with ISAs that often lack such borrower protections.

Forgiveness Clause (ISA-specific)

Income Share Agreements (ISAs) often include a Forgiveness Clause that releases students from repayment if their income falls below a predefined threshold or after a certain number of years, providing built-in financial relief not typically available in traditional student loans. In contrast, conventional student loans generally lack such income-contingent forgiveness, requiring fixed repayments regardless of post-graduation earnings.

Minimum Income Floor

Student loans typically require fixed monthly repayments regardless of earnings, while Income Share Agreements (ISAs) adjust payments based on a percentage of income, often incorporating a Minimum Income Floor to ensure a baseline repayment amount. This Minimum Income Floor in ISAs protects lenders by setting a lowest income threshold below which repayments do not decrease, balancing risk and affordability for education financing.

Risk-Sharing Contract

Student loans require fixed repayments regardless of income, posing financial risk if post-graduation earnings are low, whereas income share agreements (ISAs) align repayment with future income, distributing risk between the student and the financier. ISAs offer a risk-sharing contract that adjusts payment obligations based on actual earnings, reducing the likelihood of default and financial strain for borrowers.

Default Risk Pooling

Student loans carry a higher default risk pooling since borrowers often have fixed repayment schedules regardless of income, increasing the likelihood of missed payments during financial hardship. Income share agreements (ISAs) reduce default risk pooling by aligning repayments with actual income, distributing risk more evenly among participants based on earning capacity.

Human Capital Contract

Human Capital Contracts offer an alternative to traditional student loans by linking repayment directly to a graduate's future income, reducing the financial risk of education. Unlike fixed student loans, these agreements align incentives between investors and students, creating a market-driven model for education financing based on human capital value.

Student loan vs Income share agreement for education financing. Infographic

moneydiff.com

moneydiff.com