Home equity loans allow homeowners to borrow against the value of their property, providing a lump sum with fixed interest rates and predictable payments, making it ideal for those seeking consistent cash flow. Sale-leaseback offers an alternative by selling the property to an investor and leasing it back, unlocking cash without increasing debt but potentially leading to loss of property ownership and future appreciation. Choosing between these options depends on the desire to maintain ownership, the need for immediate cash, and long-term financial goals.

Table of Comparison

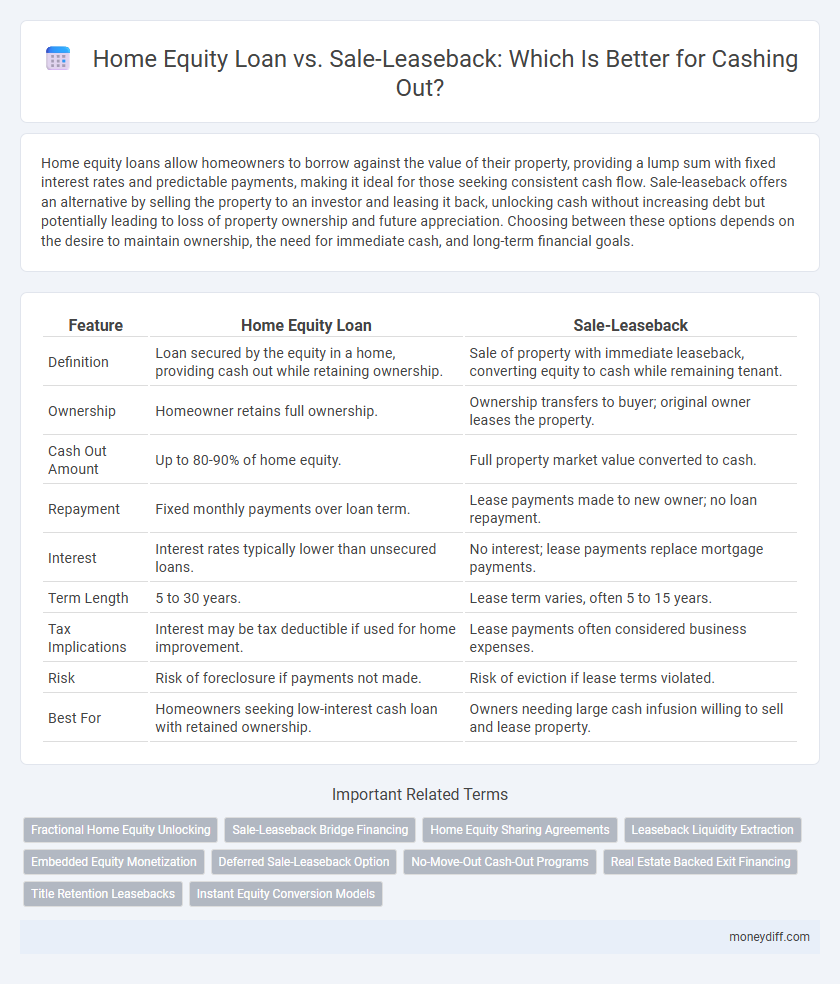

| Feature | Home Equity Loan | Sale-Leaseback |

|---|---|---|

| Definition | Loan secured by the equity in a home, providing cash out while retaining ownership. | Sale of property with immediate leaseback, converting equity to cash while remaining tenant. |

| Ownership | Homeowner retains full ownership. | Ownership transfers to buyer; original owner leases the property. |

| Cash Out Amount | Up to 80-90% of home equity. | Full property market value converted to cash. |

| Repayment | Fixed monthly payments over loan term. | Lease payments made to new owner; no loan repayment. |

| Interest | Interest rates typically lower than unsecured loans. | No interest; lease payments replace mortgage payments. |

| Term Length | 5 to 30 years. | Lease term varies, often 5 to 15 years. |

| Tax Implications | Interest may be tax deductible if used for home improvement. | Lease payments often considered business expenses. |

| Risk | Risk of foreclosure if payments not made. | Risk of eviction if lease terms violated. |

| Best For | Homeowners seeking low-interest cash loan with retained ownership. | Owners needing large cash infusion willing to sell and lease property. |

Understanding Home Equity Loans: An Overview

Home equity loans provide homeowners with a lump sum based on the accumulated equity in their property, offering fixed interest rates and predictable monthly payments for cash-out purposes. These loans allow borrowers to access funds without selling their home, maintaining full ownership while leveraging the property's value. Compared to a sale-leaseback, home equity loans generally involve lower costs and preserve long-term investment in the property.

What is Sale-Leaseback? Key Concepts Explained

Sale-leaseback is a financial transaction where a property owner sells their home to an investor and simultaneously leases it back, allowing continued occupancy while extracting cash from the property's equity. This arrangement provides immediate liquidity without taking on new debt, differing significantly from a home equity loan that uses the home as collateral for a loan payable over time. Key concepts include transfer of ownership, lease agreement terms, and potential tax implications for both parties involved.

Comparing Cash-Out Options: Home Equity Loans vs Sale-Leaseback

Home equity loans provide homeowners with a lump sum based on the accumulated equity in their property, typically offering fixed interest rates and predictable repayment terms. Sale-leaseback arrangements allow owners to sell their property to an investor and lease it back, converting equity into cash but potentially increasing long-term occupancy costs. Evaluating cash-out options requires assessing interest rates, repayment obligations, and the impact on property ownership before choosing between home equity loans and sale-leaseback agreements.

Qualification Requirements: Who Can Access Each Option?

Home equity loans typically require homeowners to have substantial equity, a good credit score, and steady income to qualify, making them accessible primarily to individuals with strong financial profiles. Sale-leaseback arrangements are available to property owners looking to free up cash by selling their property and leasing it back, with qualification often hinging on property type and the buyer's investment criteria rather than personal creditworthiness. Both options cater to different needs: home equity loans favor personal financial stability, while sale-leasebacks prioritize the property's marketability and lease terms.

Interest Rates and Fees: Evaluating the True Cost

Home equity loans typically offer lower interest rates compared to sale-leaseback agreements, making them a cost-effective option for homeowners seeking cash out. Sale-leaseback arrangements often involve higher fees and ongoing lease payments that can increase the overall cost despite upfront cash benefits. Evaluating the true cost requires careful comparison of fixed loan interest rates against variable lease costs and hidden charges in sale-leaseback deals.

Impact on Home Ownership and Control

Home equity loans allow homeowners to retain full ownership and control of their property while accessing cash by borrowing against accumulated equity. Sale-leaseback agreements transfer property ownership to an investor, providing immediate cash but requiring the seller to lease the home back, which can limit long-term control. The choice impacts financial flexibility, with home equity loans preserving homeowner rights and sale-leasebacks potentially altering property control and use.

Tax Implications: What Borrowers Need to Know

Home equity loans typically offer tax-deductible interest payments when the loan is used to improve the property, providing substantial tax benefits for borrowers. In contrast, sale-leaseback arrangements may result in the loss of mortgage interest deductions and could trigger capital gains taxes, affecting overall tax liability. Borrowers must carefully evaluate the IRS regulations on deductibility and potential tax consequences before choosing between these cash-out options.

Speed of Funding: How Quickly Can You Access Cash?

Home equity loans typically offer faster access to cash, with approval and disbursement often completed within two to four weeks, as they rely on existing property equity and established lending processes. Sale-leaseback transactions usually require more time, often several weeks to months, due to the complexity of transferring property ownership and negotiating lease terms. For immediate cash needs, home equity loans generally provide quicker funding compared to the longer procedural timeline inherent in sale-leaseback arrangements.

Long-Term Financial Consequences and Risks

Home equity loans offer fixed interest rates and predictable payments but increase mortgage debt, potentially impacting credit and repayment ability over time. Sale-leaseback transactions provide immediate cash without new debt but involve relinquishing property ownership, creating ongoing lease obligations that may rise and affect long-term financial stability. Evaluating risks includes considering interest rate fluctuations, tax implications, and the potential loss of home appreciation benefits in both options.

Choosing the Right Option: Factors to Consider for Homeowners

Homeowners should evaluate factors such as current interest rates, tax implications, and long-term financial goals when choosing between a home equity loan and a sale-leaseback for cash-out purposes. Home equity loans offer fixed interest rates and potential tax-deductible interest while maintaining property ownership, whereas sale-leaseback provides immediate liquidity but involves relinquishing ownership and assuming lease payments. Assessing repayment terms, credit score impact, and future market conditions are crucial to selecting the most beneficial option.

Related Important Terms

Fractional Home Equity Unlocking

Fractional home equity unlocking through a home equity loan allows borrowers to access a fixed portion of their property's value as cash, maintaining full ownership while leveraging favorable interest rates and predictable payments. Sale-leaseback offers immediate liquidity by selling property shares and leasing them back but can lead to diluted ownership and complex long-term lease obligations, making it less ideal for partial equity extraction.

Sale-Leaseback Bridge Financing

Sale-leaseback bridge financing offers homeowners immediate liquidity by selling their property to an investor while retaining the right to lease it back, providing cash out without incurring additional debt or affecting credit scores. This alternative to home equity loans eliminates interest payments and refinancing risks, making it a strategic option for accessing home equity quickly with flexible repayment terms.

Home Equity Sharing Agreements

Home Equity Sharing Agreements offer a flexible alternative to traditional home equity loans by allowing homeowners to access cash without monthly payments or increased debt, unlike sale-leaseback arrangements that involve selling the property and leasing it back. These agreements enable shared property appreciation, providing liquidity while retaining ownership and avoiding refinancing risks inherent in loan-based cash-out options.

Leaseback Liquidity Extraction

Leaseback liquidity extraction allows homeowners to convert home equity into cash without monthly loan payments by selling the property and leasing it back, providing immediate funds while retaining residence. Unlike home equity loans that increase debt with fixed repayments, sale-leaseback offers flexible cash flow and reduces financial liabilities through rental agreements.

Embedded Equity Monetization

Home equity loans allow homeowners to borrow against the embedded equity in their property, providing immediate cash out while retaining ownership and potential property appreciation. Sale-leaseback transactions monetize embedded equity by selling the property to an investor and leasing it back, offering cash liquidity without incurring new debt but forgoing future equity gains.

Deferred Sale-Leaseback Option

The Deferred Sale-Leaseback option allows homeowners to access cash by selling their property while retaining the right to lease it for a specified period, providing flexible liquidity without immediate relocation. This alternative to traditional home equity loans offers deferred repayment and can alleviate financial pressure while preserving occupancy rights.

No-Move-Out Cash-Out Programs

Home equity loans provide homeowners with a lump sum by leveraging their property's existing equity, allowing access to cash without relocating, while sale-leaseback programs enable owners to unlock capital by selling their home and immediately leasing it back, offering a no-move-out cash-out solution ideal for retaining residence and liquidity. Both options serve as no-move-out cash-out programs, but home equity loans maintain ownership and loan obligations, whereas sale-leasebacks transfer ownership but avoid the disruption of moving.

Real Estate Backed Exit Financing

Home equity loans leverage the homeowner's built-up equity to provide a lump sum cash out, offering fixed interest rates and predictable repayment terms based on the current market value of the property. Sale-leaseback arrangements convert real estate assets into immediate liquidity by selling the property and leasing it back, enabling businesses to maintain operational control while unlocking capital tied in high-value real estate holdings.

Title Retention Leasebacks

Home equity loans allow homeowners to borrow against their property's equity while retaining full ownership and title, providing a fixed repayment schedule and interest rate stability. Title retention sale-leaseback agreements enable property owners to sell the title to an investor for immediate cash while leasing the property back, maintaining operational control but shifting ownership risk.

Instant Equity Conversion Models

Home equity loans provide immediate cash based on the existing property value with fixed interest rates, while sale-leaseback transactions convert home equity into cash by selling the property and leasing it back, offering liquidity without additional debt. Instant equity conversion models in sale-leaseback structures optimize cash flow by leveraging property appreciation and rental income, often resulting in more flexible financial solutions compared to traditional home equity loans.

Home equity loan vs Sale-leaseback for cash out. Infographic

moneydiff.com

moneydiff.com