Personal loans offer fixed interest rates and repayment terms, making them suitable for larger expenses with predictable monthly payments. Buy now pay later options provide flexible, short-term financing without interest if paid on time, ideal for smaller purchases or emergencies. Evaluating interest rates, repayment schedules, and total costs helps determine the best borrowing method for individual financial needs.

Table of Comparison

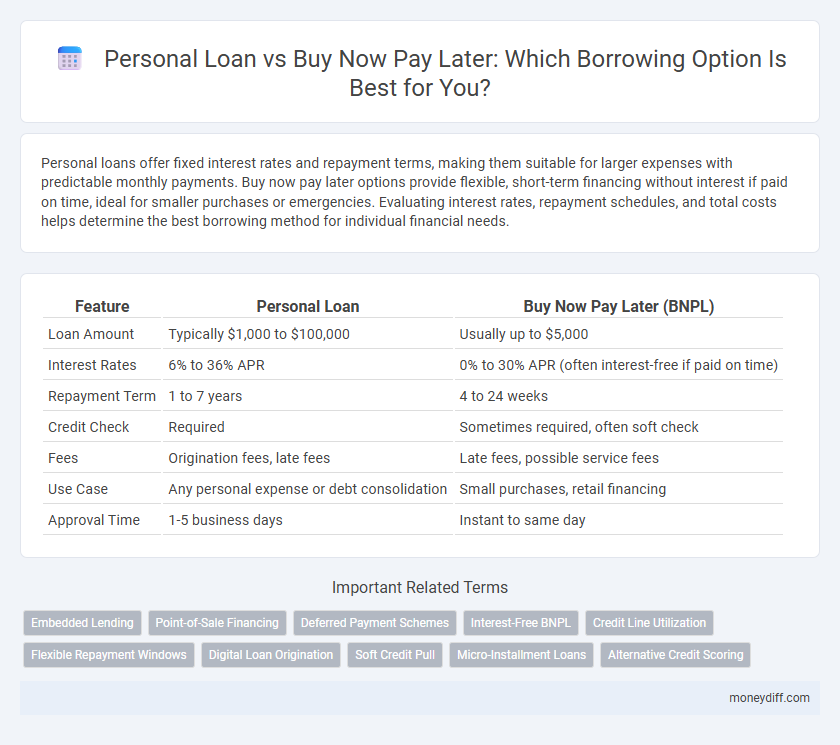

| Feature | Personal Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Loan Amount | Typically $1,000 to $100,000 | Usually up to $5,000 |

| Interest Rates | 6% to 36% APR | 0% to 30% APR (often interest-free if paid on time) |

| Repayment Term | 1 to 7 years | 4 to 24 weeks |

| Credit Check | Required | Sometimes required, often soft check |

| Fees | Origination fees, late fees | Late fees, possible service fees |

| Use Case | Any personal expense or debt consolidation | Small purchases, retail financing |

| Approval Time | 1-5 business days | Instant to same day |

Understanding Personal Loans vs Buy Now Pay Later

Personal loans offer fixed interest rates, longer repayment terms, and higher borrowing limits, making them suitable for larger expenses or debt consolidation. Buy Now Pay Later (BNPL) services provide short-term, interest-free installments primarily for smaller purchases, but they may include late fees and impact credit scores if payments are missed. Borrowers should evaluate their financial needs, the total cost of borrowing, and repayment flexibility when choosing between personal loans and BNPL options.

Key Differences Between Personal Loans and BNPL

Personal loans offer fixed amounts with set repayment terms and interest rates, making them suitable for larger expenditures or consolidating debt. Buy Now Pay Later (BNPL) services provide short-term, interest-free installments, ideal for smaller purchases with flexible repayment schedules. Unlike personal loans, BNPL typically involves minimal credit checks and faster approval processes but may carry higher fees or penalties for missed payments.

Eligibility Criteria for Personal Loans and BNPL

Personal loans require applicants to meet strict eligibility criteria such as a minimum credit score, stable income proof, and sometimes a debt-to-income ratio threshold, ensuring borrowers can repay over the loan term. Buy Now Pay Later (BNPL) services generally have more relaxed eligibility standards, often requiring only minimal credit checks and basic personal identification, making them accessible to a broader audience. The stringent verification for personal loans results in lower interest rates but longer approval times, whereas BNPL offers quick approval with potentially higher fees and limited repayment flexibility.

Interest Rates: Personal Loans vs Buy Now Pay Later

Personal loans generally offer lower interest rates compared to Buy Now Pay Later (BNPL) options, with average APRs ranging from 6% to 36% for personal loans versus 20% to 30% or higher for BNPL plans. BNPL typically features zero or low interest if payments are made on time but imposes high fees and backdated interest rates for missed or late payments. Borrowers seeking long-term financing with predictable payments often benefit more from personal loans due to stable interest costs and structured repayment terms.

Repayment Terms and Flexibility

Personal loans offer fixed repayment terms typically ranging from 12 to 60 months with consistent monthly installments, providing borrowers predictable budgeting and long-term financial planning. Buy now pay later (BNPL) options usually feature shorter repayment periods, often spanning a few weeks to months, with flexible installment amounts but may incur higher fees or interest if payments are missed or extended. The structured nature of personal loans contrasts with the convenience and variable terms of BNPL, making repayment flexibility a key factor depending on the borrower's financial discipline and need for manageable cash flow.

Impact on Credit Score: Personal Loan vs BNPL

Personal loans typically have a more significant impact on credit scores due to hard credit inquiries and longer repayment terms, which demonstrate creditworthiness over time. Buy Now Pay Later (BNPL) services often involve soft credit checks and shorter payment periods, causing minimal or no immediate effect on credit scores, but missed payments can still negatively affect credit history. Lenders view personal loans as traditional credit accounts, which can either improve or harm credit scores based on repayment behavior, whereas BNPL is considered a short-term financing option that may not be reported consistently to credit bureaus.

Borrowing Limits and Accessibility

Personal loans typically offer higher borrowing limits, ranging from $1,000 to $100,000 depending on creditworthiness, making them suitable for substantial expenses. Buy now, pay later (BNPL) services usually have lower limits, often between $100 and $2,000 per transaction, designed for smaller, immediate purchases. Accessibility favors BNPL due to minimal credit checks and instant approval, whereas personal loans require more rigorous credit evaluations and longer application processes.

Hidden Fees and Costs Comparison

Personal loans often have transparent interest rates and fixed repayment schedules, but borrowers should watch for origination fees, late payment penalties, and prepayment charges that can increase overall costs. Buy Now Pay Later (BNPL) services may appear interest-free but frequently impose hidden fees such as late fees, account reopening charges, or increased costs if payments are missed, which can significantly impact the total amount owed. Comparing the annual percentage rate (APR) and reviewing the fine print of personal loans versus BNPL options reveals that personal loans generally offer clearer cost structures, while BNPL can involve unpredictable hidden fees.

Pros and Cons of Personal Loans

Personal loans offer fixed interest rates and predictable monthly payments, making budgeting easier compared to Buy Now Pay Later (BNPL) options which often have deferred payments and variable fees. They provide higher borrowing limits suitable for larger expenses, but typically require a credit check and longer approval times, whereas BNPL services are more accessible with minimal credit hurdles. The longer repayment terms of personal loans can reduce monthly payments but may result in higher total interest costs compared to the short-term nature of BNPL financing.

Pros and Cons of Buy Now Pay Later

Buy Now Pay Later (BNPL) offers a flexible repayment option with typically no interest if paid on time, making it attractive for managing short-term purchases without upfront costs. However, BNPL can lead to overspending and higher fees or interest rates if payments are missed or delayed, causing potential debt accumulation. Unlike personal loans, BNPL lacks long-term credit-building benefits and often provides lower borrowing limits, restricting its use for larger expenses.

Related Important Terms

Embedded Lending

Embedded lending integrates personal loans directly within retail platforms, offering more flexible borrowing options and often lower interest rates compared to buy now, pay later (BNPL) services, which typically have shorter repayment periods and may include higher fees. Personal loans through embedded lending provide longer terms and larger loan amounts, making them more suitable for significant purchases than BNPL's usually small, short-term credit solutions.

Point-of-Sale Financing

Personal loans offer fixed interest rates and longer repayment terms, making them suitable for larger purchases with predictable monthly payments, while Buy Now Pay Later (BNPL) services provide instant point-of-sale financing with flexible short-term installments but often higher fees if payments are missed. BNPL integrates seamlessly at checkout, enhancing purchasing convenience, whereas personal loans require separate application processes and credit checks before funding.

Deferred Payment Schemes

Personal loans offer structured repayment schedules with fixed interest rates, ideal for larger or long-term financing needs, while Buy Now Pay Later (BNPL) services typically provide short-term deferred payment schemes with little to no interest if paid on time. Deferred payment schemes in BNPL allow consumers to delay payments for weeks or months, but late payments often trigger high fees or interest, making personal loans more cost-effective for extended borrowing periods.

Interest-Free BNPL

Personal loans typically involve fixed interest rates and longer repayment terms, making them suitable for larger financial needs, whereas Interest-Free Buy Now Pay Later (BNPL) options offer short-term, zero-interest installments for smaller purchases, enhancing affordability without additional cost. Interest-Free BNPL services like Klarna or Afterpay provide convenient, no-interest credit but often require prompt payments to avoid fees, contrasting with personal loans that build credit history over time.

Credit Line Utilization

Personal loans typically offer a fixed credit line with set repayment terms, which can help maintain steady credit line utilization and positively impact credit scores when managed properly. Buy Now Pay Later (BNPL) options often operate outside traditional credit reporting systems, resulting in no immediate effect on credit line utilization but potentially leading to increased debt if multiple BNPL plans remain unpaid.

Flexible Repayment Windows

Personal loans offer flexible repayment windows typically ranging from 12 to 84 months, allowing borrowers to choose terms that fit their financial situation, while Buy Now Pay Later (BNPL) options usually provide shorter, fixed repayment periods of a few weeks to months, often without interest if paid on time. The extended repayment terms of personal loans can help manage higher loan amounts with predictable monthly installments, contrasting BNPL's convenience for smaller purchases but with stricter, shorter deadlines.

Digital Loan Origination

Personal loans typically offer lower interest rates and longer repayment terms compared to Buy Now Pay Later (BNPL) options, which provide short-term financing with minimal credit checks through digital loan origination platforms. Digital loan origination streamlines approval for both lending types but emphasizes risk assessment and regulatory compliance differently, impacting borrower eligibility and cost.

Soft Credit Pull

Soft credit pulls for personal loans typically result in minimal impact on credit scores, making them a safer option for borrowers looking to preserve credit integrity. Buy now pay later services often use soft credit checks to approve purchases quickly, but repeated use can affect credit utilization and repayment history visibility.

Micro-Installment Loans

Micro-installment loans offer flexible repayment terms tailored for small personal expenses, often with predictable interest rates and established credit requirements, making them ideal for borrowers seeking manageable debt options. Buy now pay later services provide short-term financing with interest-free periods but may incur higher fees or penalties if payments are missed, which can impact credit scores and overall borrowing costs.

Alternative Credit Scoring

Personal loans typically rely on traditional credit scoring methods, while Buy Now Pay Later (BNPL) services increasingly utilize alternative credit scoring models that incorporate factors like payment history on utilities or rental payments to assess borrower risk. This alternative approach enables greater financial inclusion by offering credit access to individuals with limited or no conventional credit history.

Personal loan vs Buy now pay later for borrowing. Infographic

moneydiff.com

moneydiff.com