Installment loans provide a fixed repayment schedule with predictable monthly payments, making them suitable for short-term borrowing with clear budgeting. Buy Now, Pay Later options allow consumers to delay payments without interest for a set period, offering flexible short-term financing for purchases. Understanding the terms and fees of each option helps borrowers choose the best solution for managing immediate expenses.

Table of Comparison

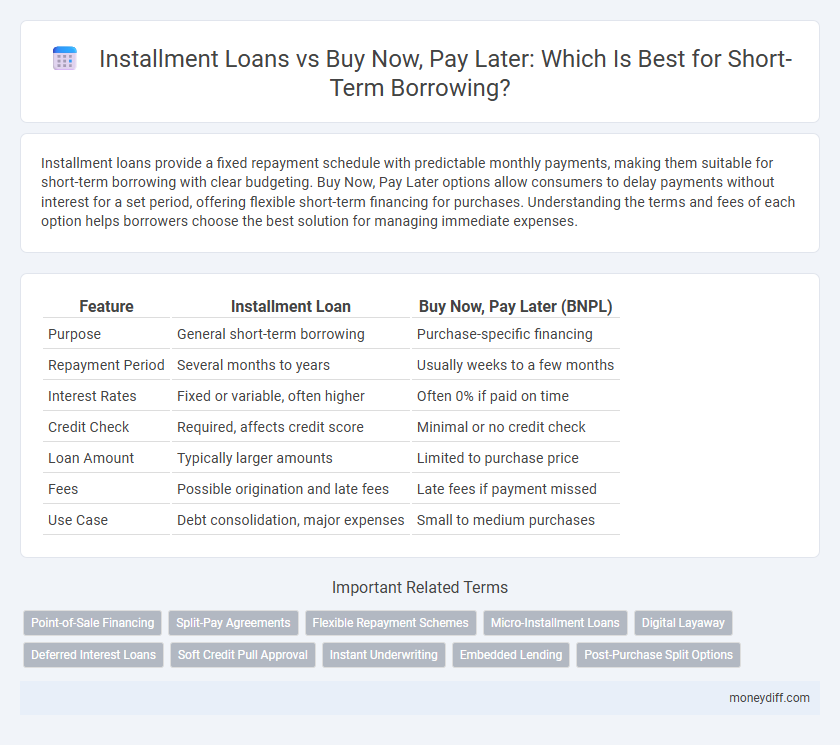

| Feature | Installment Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Purpose | General short-term borrowing | Purchase-specific financing |

| Repayment Period | Several months to years | Usually weeks to a few months |

| Interest Rates | Fixed or variable, often higher | Often 0% if paid on time |

| Credit Check | Required, affects credit score | Minimal or no credit check |

| Loan Amount | Typically larger amounts | Limited to purchase price |

| Fees | Possible origination and late fees | Late fees if payment missed |

| Use Case | Debt consolidation, major expenses | Small to medium purchases |

Understanding Installment Loans and Buy Now, Pay Later

Installment loans offer a fixed loan amount repaid over a set period with consistent monthly payments, providing predictable budgeting for short-term borrowing. Buy Now, Pay Later (BNPL) options allow consumers to split purchases into interest-free installments, typically without a credit check, making it attractive for smaller, immediate expenses. Understanding the differences in repayment structure, interest rates, and credit impact is essential for choosing between installment loans and BNPL for short-term financial needs.

Key Differences Between Installment Loans and BNPL

Installment loans require borrowers to repay a fixed amount over a set period with interest, offering predictability and credit building benefits. Buy Now, Pay Later (BNPL) services allow consumers to split purchases into interest-free or low-interest payments over a short term, often without a credit check. Unlike installment loans, BNPL is typically limited to point-of-sale financing and may lead to higher risks of overspending due to easier access.

Eligibility Requirements: Installment Loans vs BNPL

Installment loans typically require a credit check, proof of income, and a stable financial history to qualify, making them suitable for borrowers with moderate to good credit scores. Buy Now, Pay Later (BNPL) services offer more lenient eligibility criteria, often requiring minimal credit checks and allowing instant approval for short-term purchases. BNPL is preferred for consumers seeking quick, low-risk borrowing without extensive documentation.

Application Process Comparison

Installment loans require a comprehensive application process, including credit checks, income verification, and longer approval times, making them more suitable for borrowers with established credit histories. Buy Now, Pay Later (BNPL) services typically offer a streamlined, digital application process with minimal credit checks and instant approval, catering to quick, short-term borrowing needs. The ease and speed of BNPL applications often appeal to consumers seeking fast access to funds without extensive documentation.

Interest Rates and Fees: What You Need to Know

Installment loans typically offer fixed interest rates and structured repayment schedules, providing borrowers with predictable monthly payments and potentially lower overall costs compared to Buy Now, Pay Later (BNPL) options. BNPL plans often feature zero or low interest if paid within a promotional period, but late fees and high deferred interest rates can significantly increase the cost. Understanding the terms, including APR, fees for late or missed payments, and total repayment amount, is crucial for managing short-term borrowing effectively.

Impact on Credit Score: Installment Loan vs BNPL

Installment loans typically require fixed monthly payments over a set period, which can help build or improve credit scores when payments are made on time. Buy Now, Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, resulting in minimal impact on credit scores during regular use. Responsible management of installment loans generally has a more positive and lasting influence on credit profiles compared to most BNPL options.

Repayment Terms and Flexibility

Installment loans offer fixed repayment schedules with consistent monthly payments over a set period, providing predictable budgeting for short-term borrowing. Buy Now, Pay Later (BNPL) options typically allow for interest-free periods with flexible, often smaller installments, but may impose fees or higher interest if payments are missed or extended. The choice between the two depends on preference for structured payments versus short-term flexibility with potential cost variability.

Best Use Cases for Installment Loans and BNPL

Installment loans are ideal for higher-value purchases or consolidating debt, offering structured repayment with fixed interest over a defined term, which helps manage budgeting and credit building. Buy Now, Pay Later (BNPL) suits short-term, smaller purchases, providing interest-free periods that encourage immediate consumption without traditional credit checks. Both options enhance short-term borrowing flexibility, but installment loans benefit long-term financial planning, whereas BNPL supports quick, interest-free retail transactions.

Risks and Pitfalls of Each Short-Term Borrowing Option

Installment loans often come with fixed interest rates and set repayment schedules, which may lead to higher overall costs if payments are missed, affecting credit scores negatively. Buy Now, Pay Later (BNPL) services offer flexible payment options but can encourage overspending and typically lack robust credit reporting, increasing the risk of accumulating unmanageable debt. Both options require careful budgeting to avoid default and financial strain in short-term borrowing.

Choosing the Right Option for Your Financial Situation

Installment loans provide fixed monthly payments and set repayment terms, making budgeting easier and often featuring lower interest rates compared to Buy Now, Pay Later (BNPL) plans. BNPL offers flexible, interest-free periods for short-term purchases but can lead to higher costs if payments are missed or extended. Evaluate your cash flow, repayment discipline, and total cost of borrowing to choose between installment loans and BNPL for effective short-term financial management.

Related Important Terms

Point-of-Sale Financing

Installment loans offer structured repayment schedules with fixed interest rates, providing predictable monthly payments for short-term borrowing needs. Buy Now, Pay Later (BNPL) services enable instant point-of-sale financing with interest-free periods, but may include late fees and less transparent terms compared to traditional installment loans.

Split-Pay Agreements

Split-pay agreements under installment loans offer fixed repayment schedules with predictable interest rates, enhancing financial planning for short-term borrowing compared to buy now, pay later options, which often involve variable fees and deferred payments. These structured installments reduce the risk of debt accumulation while providing clear timelines for loan repayment.

Flexible Repayment Schemes

Installment loans offer structured repayment plans with fixed monthly payments over a set term, providing predictability and often lower interest rates for short-term borrowing. Buy Now, Pay Later options grant flexible, interest-free periods with smaller, staggered payments, appealing for immediate purchases but potentially incurring fees if repayments are missed.

Micro-Installment Loans

Micro-installment loans offer structured repayment plans with fixed monthly payments, making them ideal for borrowers needing predictable short-term financing compared to Buy Now, Pay Later (BNPL) options that often lack credit checks but may incur higher fees or penalties. These loans typically involve smaller amounts and lower interest rates, providing greater transparency and credit building benefits during short-term borrowing.

Digital Layaway

Installment loans offer fixed repayment schedules with interest over a set term, providing predictable costs for short-term borrowing, while Buy Now, Pay Later (BNPL) options, particularly through digital layaway platforms, allow consumers to split payments interest-free over time without traditional credit checks. Digital layaway enhances BNPL by securely reserving products online until full payment is made, blending convenience with flexibility ideal for managing immediate purchases without increasing debt.

Deferred Interest Loans

Installment loans provide fixed monthly payments and clear payoff schedules, while Buy Now, Pay Later (BNPL) often involves deferred interest loans that accrue interest if balances are not paid within the promotional period. Deferred interest loans can lead to high costs if the borrower fails to repay on time, making installment loans a more predictable option for short-term borrowing.

Soft Credit Pull Approval

Installment loans often require a soft credit pull for approval, minimizing impact on your credit score while providing fixed monthly payments over a set term. Buy Now, Pay Later options also utilize soft credit inquiries to quickly approve short-term borrowing, offering flexible repayment without affecting credit standing.

Instant Underwriting

Installment loans provide fixed payments over a set term with instant underwriting enabling quick approval and fund disbursement, ideal for borrowers seeking structured repayment. Buy Now, Pay Later options offer flexible, interest-free installments with instant underwriting at checkout, catering to consumers wanting immediate purchases without long-term commitments.

Embedded Lending

Embedded lending in installment loans integrates financing directly within the purchase process, providing fixed monthly payments and transparent interest rates ideal for short-term borrowing. Buy Now, Pay Later options offer flexible, interest-free periods but may lead to higher costs if payments are missed, making embedded installment loans a more predictable solution for budget management.

Post-Purchase Split Options

Installment loans offer fixed monthly payments with interest over a set term, providing predictable repayment schedules for short-term borrowing. Buy Now, Pay Later services allow consumers to split post-purchase payments into interest-free installments, often without credit checks, but may incur late fees and limited loan amounts.

Installment Loan vs Buy Now, Pay Later for short-term borrowing. Infographic

moneydiff.com

moneydiff.com