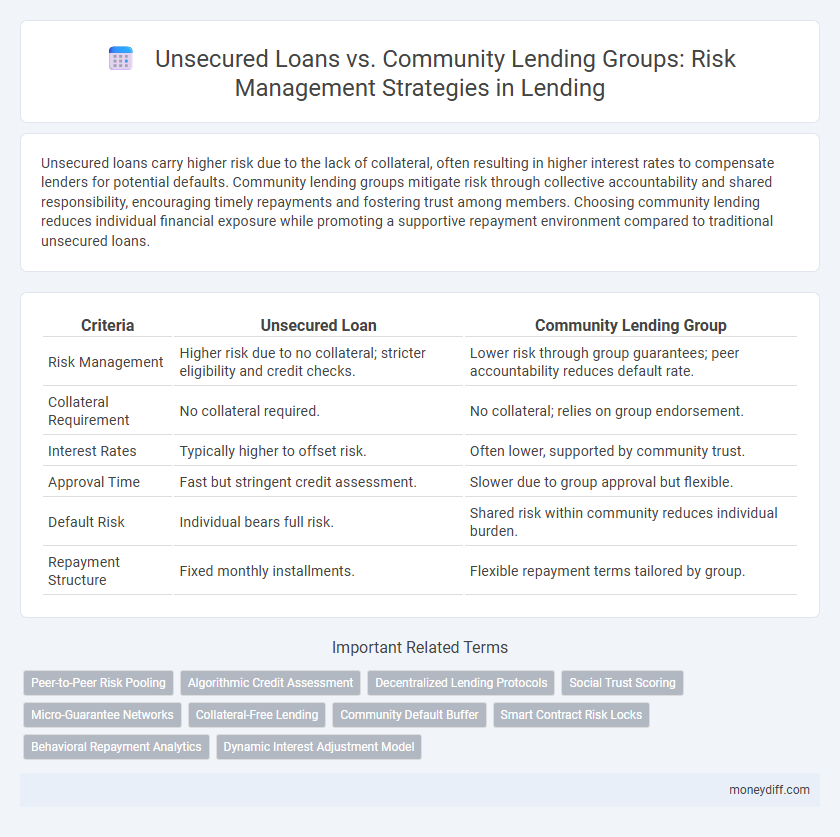

Unsecured loans carry higher risk due to the lack of collateral, often resulting in higher interest rates to compensate lenders for potential defaults. Community lending groups mitigate risk through collective accountability and shared responsibility, encouraging timely repayments and fostering trust among members. Choosing community lending reduces individual financial exposure while promoting a supportive repayment environment compared to traditional unsecured loans.

Table of Comparison

| Criteria | Unsecured Loan | Community Lending Group |

|---|---|---|

| Risk Management | Higher risk due to no collateral; stricter eligibility and credit checks. | Lower risk through group guarantees; peer accountability reduces default rate. |

| Collateral Requirement | No collateral required. | No collateral; relies on group endorsement. |

| Interest Rates | Typically higher to offset risk. | Often lower, supported by community trust. |

| Approval Time | Fast but stringent credit assessment. | Slower due to group approval but flexible. |

| Default Risk | Individual bears full risk. | Shared risk within community reduces individual burden. |

| Repayment Structure | Fixed monthly installments. | Flexible repayment terms tailored by group. |

Understanding Unsecured Loans: Key Features and Risks

Unsecured loans, unlike Community Lending Group loans, do not require collateral, increasing the lender's risk of default but offering faster access to funds for borrowers. Key features of unsecured loans include higher interest rates to compensate for increased risk and stricter credit score requirements to mitigate potential losses. Effective risk management involves thorough credit assessments and leveraging borrower financial history to predict repayment capability accurately.

What Is Community Lending Group? An Overview

Community Lending Group is a financial cooperative that provides loans to members based on mutual trust and shared economic interests, often focusing on underserved communities. Unlike unsecured loans from traditional lenders, Community Lending Groups leverage social collateral and peer accountability to reduce default risk and offer more flexible repayment terms. This group-based approach enhances risk management by combining collective responsibility with personalized lending criteria.

Comparing Application Processes: Unsecured Loan vs Community Lending Group

Unsecured loans typically require a straightforward online or in-branch application with minimal documentation, relying heavily on credit scores for approval, whereas community lending groups often involve a more personalized application process emphasizing community ties and character references. The community lending group process may include group meetings and peer evaluations to assess risk, fostering mutual accountability among members. This contrast highlights that unsecured loans prioritize creditworthiness and speed, while community lending groups focus on social collateral and collective risk mitigation.

Credit Requirements: Who Qualifies for Each Option?

Unsecured loans typically require a strong credit score and consistent income to qualify, as lenders assess borrower risk without collateral protection. Community lending groups often have more flexible credit requirements, focusing on personal relationships and community reputation rather than high credit scores. This approach allows individuals with limited or poor credit histories to access funding while spreading risk through collective responsibility.

Interest Rates and Fee Structures: A Comparative Analysis

Unsecured loans typically carry higher interest rates due to the absence of collateral, increasing the lender's risk and resulting in potentially significant fees and penalties for borrowers. Community lending groups often offer more favorable interest rates and transparent fee structures by leveraging collective trust and local relationships, reducing default risks and associated costs. Comparing these options reveals that community lending groups can provide more affordable and risk-adjusted financial solutions than traditional unsecured loan providers.

Risk Management in Unsecured Loans: Pitfalls and Precautions

Unsecured loans carry higher default risks due to the absence of collateral, making thorough credit assessments and borrower verification critical for effective risk management. Community lending groups mitigate risk through collective accountability and peer pressure, which often results in higher repayment rates and reduced default probabilities. Implementing strict eligibility criteria and ongoing monitoring can help lenders identify early warning signs and minimize losses associated with unsecured loans.

Community Lending Groups: Risk Mitigation Strategies

Community Lending Groups mitigate risk by leveraging collective accountability, where members guarantee each other's loans, reducing default rates through peer pressure and mutual support. Their detailed vetting processes and continuous monitoring of borrower behavior enhance early detection of repayment issues, enabling timely interventions. These groups also promote financial literacy and regular savings, strengthening borrowers' ability to meet obligations and lowering overall credit risk.

Default Scenarios: Consequences and Recovery Options

Unsecured loans pose higher risk in default scenarios due to lack of collateral, leading to severe credit score damage and aggressive debt collection efforts. Community lending groups mitigate default impact through peer accountability and social collateral, often enabling negotiated repayment plans and debt restructuring. Recovery options in community lending typically involve group intervention and tailored solutions, contrasting with the legal actions common in unsecured loan defaults.

Borrower Protections: Security and Support Mechanisms

Unsecured loans rely primarily on the borrower's creditworthiness without requiring collateral, increasing risk but offering faster access to funds. Community lending groups mitigate risk through shared responsibility, peer monitoring, and collective enforcement, enhancing borrower accountability and reducing default rates. These groups often provide stronger support mechanisms, including financial education and emotional encouragement, which improve repayment reliability and borrower protection.

Choosing the Right Option: Risk Assessment for Borrowers

Unsecured loans typically involve higher interest rates due to the absence of collateral, increasing the lender's risk when borrowers default. Community lending groups often mitigate risk through peer accountability and shared financial goals, offering more flexible repayment terms. Borrowers must assess their creditworthiness, repayment ability, and risk tolerance to choose the option that aligns best with their financial stability and goals.

Related Important Terms

Peer-to-Peer Risk Pooling

Unsecured loans expose lenders to higher default risk due to lack of collateral, whereas community lending groups mitigate this through peer-to-peer risk pooling, distributing potential losses among members. Peer-to-peer risk pooling enhances creditworthiness assessment and fosters collective accountability, reducing overall risk and improving repayment rates in community-based lending models.

Algorithmic Credit Assessment

Algorithmic credit assessment enhances risk management in unsecured loans by leveraging data-driven models to predict borrower behavior more accurately than traditional methods. Community lending groups rely on social collateral and collective accountability, which, while effective for mitigating risk in small networks, lack the scalability and precision offered by algorithm-based evaluations.

Decentralized Lending Protocols

Unsecured loans in decentralized lending protocols offer risk management through algorithmic credit assessments and smart contracts, minimizing reliance on traditional collateral. Community lending groups leverage collective trust and peer verification to reduce default risk, fostering a decentralized approach to creditworthiness within blockchain ecosystems.

Social Trust Scoring

Unsecured loans rely heavily on individual credit scores and financial history, often posing higher default risks due to lack of collateral, whereas community lending groups utilize social trust scoring, leveraging peer relationships and behavioral data to effectively mitigate risk and foster repayment accountability. Social trust scoring in community lending incorporates network interactions and reputational metrics, providing a more nuanced risk assessment that can enhance credit access for underserved borrowers while reducing lender exposure.

Micro-Guarantee Networks

Micro-Guarantee Networks in community lending groups reduce default risk by leveraging social collateral and peer monitoring, unlike unsecured loans that rely solely on individual creditworthiness. These networks enhance risk management through collective accountability and shared incentives, making community lending a more effective model for low-income borrowers.

Collateral-Free Lending

Unsecured loans eliminate the need for collateral, reducing barriers for borrowers but increasing risk exposure for lenders due to higher default probabilities. Community lending groups mitigate this risk through collective liability and peer monitoring, fostering repayment discipline without requiring physical collateral.

Community Default Buffer

Community Lending Groups reduce risk by implementing a Community Default Buffer, which pools member contributions to absorb potential defaults and protect individual borrowers. This collective risk-sharing mechanism contrasts with unsecured loans, where lenders face higher default risk due to lack of collateral and limited borrower support systems.

Smart Contract Risk Locks

Unsecured loans carry higher default risk due to lack of collateral, whereas community lending groups mitigate risk through collective accountability and peer monitoring. Smart contract risk locks enhance security in these settings by automating repayment enforcement and reducing fraud through transparent, tamper-proof blockchain protocols.

Behavioral Repayment Analytics

Unsecured loans rely heavily on behavioral repayment analytics to assess borrower risk by analyzing payment patterns, credit behavior, and financial habits, enabling lenders to predict default likelihood without collateral. Community Lending Groups leverage collective responsibility and social accountability, using behavioral data to enhance repayment discipline and reduce risk through group monitoring and peer influence.

Dynamic Interest Adjustment Model

Unsecured loans typically have higher risk profiles due to lack of collateral, which financial institutions mitigate by applying a Dynamic Interest Adjustment Model that adjusts rates based on borrower credit behavior and market conditions. Community lending groups reduce default risk through collective accountability and localized credit assessments, potentially allowing for more flexible and lower interest rates under a similarly adaptive interest adjustment framework.

Unsecured Loan vs Community Lending Group for risk management. Infographic

moneydiff.com

moneydiff.com