Microfinance loans provide structured, formal financing with fixed repayment schedules and interest rates, suitable for individuals seeking predictable terms and credit building opportunities. Community lending circles offer informal, trust-based borrowing with flexible repayment and interest-free or low-cost funds, fostering social support and financial inclusion. Choosing between microfinance loans and community lending circles depends on the borrower's need for formal credit history versus personalized, low-cost access to small loans.

Table of Comparison

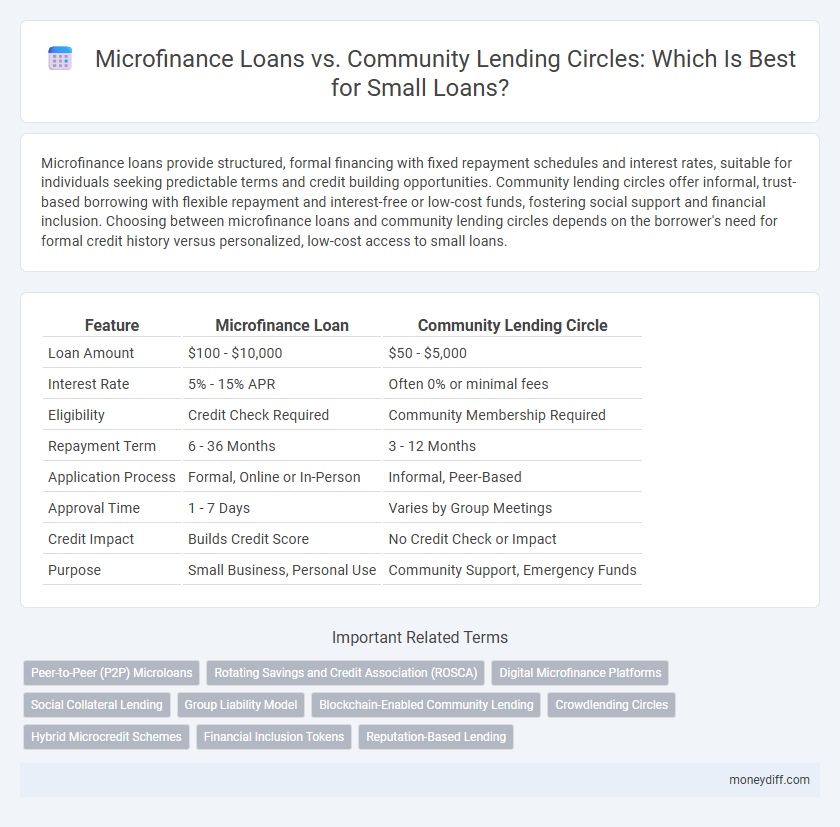

| Feature | Microfinance Loan | Community Lending Circle |

|---|---|---|

| Loan Amount | $100 - $10,000 | $50 - $5,000 |

| Interest Rate | 5% - 15% APR | Often 0% or minimal fees |

| Eligibility | Credit Check Required | Community Membership Required |

| Repayment Term | 6 - 36 Months | 3 - 12 Months |

| Application Process | Formal, Online or In-Person | Informal, Peer-Based |

| Approval Time | 1 - 7 Days | Varies by Group Meetings |

| Credit Impact | Builds Credit Score | No Credit Check or Impact |

| Purpose | Small Business, Personal Use | Community Support, Emergency Funds |

Introduction to Microfinance Loans and Community Lending Circles

Microfinance loans provide small, affordable credit options tailored for low-income individuals and entrepreneurs lacking access to traditional banking. Community lending circles operate as informal groups where members contribute savings and offer interest-free loans to each other based on trust and social ties. Both methods support financial inclusion but differ in structure, with microfinance relying on formal institutions and lending circles depending on mutual cooperation.

Key Differences Between Microfinance Loans and Lending Circles

Microfinance loans typically involve formal financial institutions offering small, fixed-amount loans with set interest rates and repayment terms to low-income borrowers. Lending circles rely on community-based pooled funds where members contribute and borrow in rotation, emphasizing trust and social collateral over formal credit checks. The key differences lie in microfinance's structured, interest-bearing model versus lending circles' interest-free, cooperative approach fostering community support.

Eligibility Criteria: Microfinance vs Community Lending

Microfinance loans typically require applicants to demonstrate consistent income, provide proof of business ownership or employment, and meet credit assessment criteria, making eligibility more stringent. Community Lending Circles often prioritize trustworthiness and community relationships over formal credit history, allowing members to qualify based on social connections and mutual accountability. This contrast highlights that Microfinance demands institutional documentation, while Lending Circles rely on communal trust and social capital for loan approval.

Loan Application Process Compared

Microfinance loans typically involve a formal application process requiring credit checks, documentation of income, and collateral assessments, which can extend approval times. Community lending circles streamline the loan application by relying on mutual trust and group guarantees, often eliminating the need for credit evaluations and reducing processing time. Small business owners seeking quick access to funds may prefer lending circles for faster, less bureaucratic approval compared to microfinance institutions.

Interest Rates and Fees: What to Expect

Microfinance loans typically feature fixed interest rates that are higher than traditional bank loans but lower than payday loans, often ranging from 15% to 30% annually, with additional processing fees that can add 1% to 5% of the loan amount. Community lending circles usually operate with little to no interest and minimal or no fees, relying on group trust and social collateral to facilitate small loans. Borrowers seeking affordable small loans may find community lending circles more cost-effective, while microfinance loans offer structured repayment schedules and legal protections.

Community Support and Social Impact

Community Lending Circles foster strong social bonds by pooling resources within trusted groups, enabling members to access small loans with lower interest and flexible terms. This collective approach enhances financial inclusion and empowers underserved individuals through mutual accountability and support. The social impact extends beyond credit access, promoting financial literacy, community resilience, and economic upliftment.

Repayment Terms and Flexibility

Microfinance loans typically offer structured repayment terms with fixed installments over a set period, providing predictability but less flexibility. Community lending circles often provide more adaptable repayment schedules based on the group's agreement, allowing borrowers to adjust payments according to their cash flow. This flexibility in community lending circles can be advantageous for borrowers facing irregular income streams, whereas microfinance institutions maintain stricter timelines to manage risk.

Advantages of Microfinance Loans for Small Borrowers

Microfinance loans provide small borrowers with access to formal financial services, offering structured repayment plans and lower interest rates compared to informal borrowing methods. These loans typically come with financial education and support, enhancing borrowers' ability to manage funds effectively and improve creditworthiness. Access to microfinance institutions also enables small entrepreneurs to build credit history, facilitating future borrowing and business growth.

Benefits of Community Lending Circles for Participants

Community lending circles foster trust and social accountability, leading to higher repayment rates and stronger community ties among participants. These circles often provide more flexible terms and lower interest rates compared to traditional microfinance loans, making small loans more accessible and affordable. Participants also gain financial education and credit-building opportunities that promote long-term economic stability.

Choosing the Right Option for Your Small Loan Needs

Microfinance loans offer structured repayment plans and access to financial education, making them ideal for individuals seeking formal support and credit history building. Community Lending Circles provide flexible, interest-free borrowing through group trust, benefiting those who prioritize lower costs and peer accountability. Evaluating your repayment ability, loan purpose, and access to formal financial institutions will help determine the best choice for your small loan needs.

Related Important Terms

Peer-to-Peer (P2P) Microloans

Peer-to-Peer (P2P) microloans in microfinance offer small entrepreneurs quick access to funds with competitive interest rates and flexible repayment options, leveraging online platforms to connect individual lenders directly with borrowers. Community lending circles provide a socially driven alternative where trusted group members pool resources and distribute loans based on mutual trust and collective responsibility, often without formal credit checks or collateral.

Rotating Savings and Credit Association (ROSCA)

Microfinance loans offer individualized lending with formal interest rates and credit assessments, while Community Lending Circles operate as Rotating Savings and Credit Associations (ROSCAs), where members contribute fixed amounts regularly and take turns receiving lump sums without interest. ROSCAs provide a trust-based, community-centered alternative that fosters financial inclusion through collective savings and mutual support.

Digital Microfinance Platforms

Digital microfinance platforms offer faster access to microfinance loans with lower interest rates and flexible repayment options compared to traditional community lending circles, which rely heavily on social trust and group guarantees. These platforms leverage data analytics and mobile technology to streamline loan approval processes and expand financial inclusion for small borrowers.

Social Collateral Lending

Microfinance loans provide small, individual financing often backed by limited formal collateral, whereas community lending circles leverage social collateral by relying on trust and collective responsibility within a group to ensure repayment. This social collateral lending model reduces default risk through peer monitoring and fosters financial inclusion among underserved populations.

Group Liability Model

Microfinance loans often employ a group liability model where borrowers collectively guarantee repayment, reducing default risk and enabling access to capital for underserved individuals. Community lending circles operate similarly by pooling member funds and distributing small loans with mutual accountability, fostering trust and financial inclusion within local networks.

Blockchain-Enabled Community Lending

Blockchain-enabled community lending circles offer enhanced transparency and security compared to traditional microfinance loans, reducing the risk of fraud and enabling real-time tracking of loan disbursements and repayments. The decentralized nature of blockchain fosters trust among participants, lowers transaction costs, and facilitates faster access to small loans for underserved communities.

Crowdlending Circles

Crowdlending circles provide an innovative microfinance loan alternative by pooling resources from a community to offer small, low-interest loans sourced directly from peers, enhancing access without traditional bank requirements. These community lending circles reduce barriers like credit checks and high fees, fostering financial inclusion and trust among participants while enabling rapid funding for small business or personal needs.

Hybrid Microcredit Schemes

Hybrid microcredit schemes combine the structured approach of microfinance loans with the communal support of community lending circles, offering small loans with flexible terms and lower interest rates tailored for underserved borrowers. These hybrid models enhance financial inclusion by leveraging group guarantees and formal credit assessments to reduce default risk and improve access to capital for micro-entrepreneurs.

Financial Inclusion Tokens

Microfinance loans offer structured credit with interest rates tailored for low-income borrowers, promoting financial inclusion through verified credit histories and formal repayment plans. Community Lending Circles leverage trust-based group guarantees and financial inclusion tokens to enable access to small loans without traditional credit checks, fostering social cohesion and economic empowerment.

Reputation-Based Lending

Microfinance loans offer structured financial products with interest rates typically ranging from 15% to 30%, targeting underserved entrepreneurs who lack access to traditional banking services. Community lending circles rely heavily on reputation-based lending, leveraging social trust and peer accountability to provide small loans without formal credit checks, often resulting in lower costs and flexible repayment terms.

Microfinance Loan vs Community Lending Circle for small loans. Infographic

moneydiff.com

moneydiff.com