Credit card loans offer convenience and flexibility for everyday purchases but often come with higher interest rates compared to point-of-sale financing, which typically provides lower or zero interest for short-term payments. Point-of-sale financing allows consumers to split purchases into manageable installments directly at checkout, making it a cost-effective alternative to accruing credit card debt. Choosing between the two depends on the purchase amount, repayment timeline, and personal financial goals.

Table of Comparison

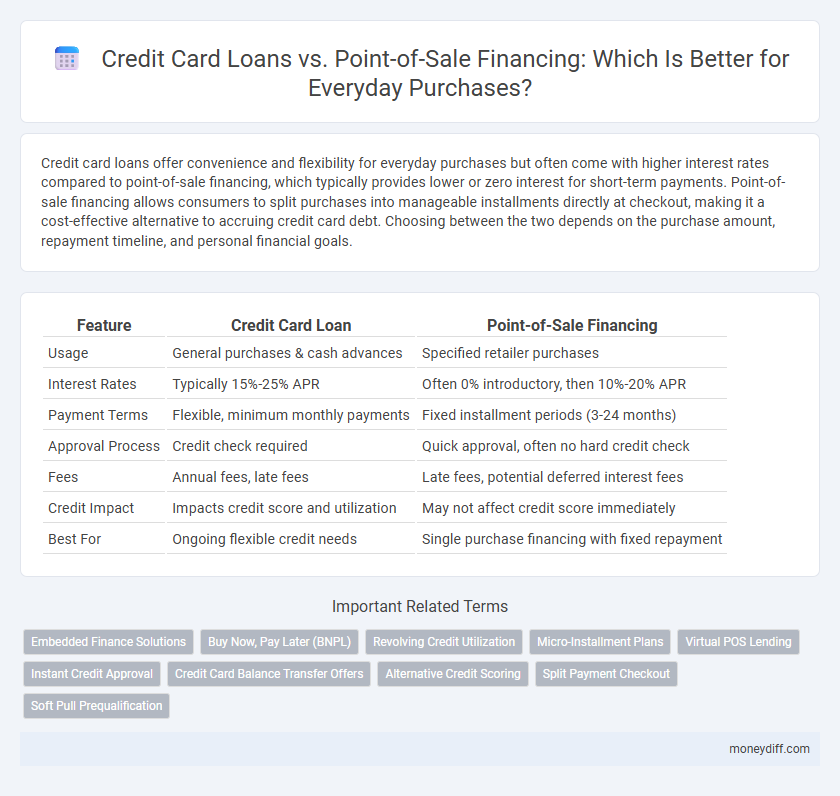

| Feature | Credit Card Loan | Point-of-Sale Financing |

|---|---|---|

| Usage | General purchases & cash advances | Specified retailer purchases |

| Interest Rates | Typically 15%-25% APR | Often 0% introductory, then 10%-20% APR |

| Payment Terms | Flexible, minimum monthly payments | Fixed installment periods (3-24 months) |

| Approval Process | Credit check required | Quick approval, often no hard credit check |

| Fees | Annual fees, late fees | Late fees, potential deferred interest fees |

| Credit Impact | Impacts credit score and utilization | May not affect credit score immediately |

| Best For | Ongoing flexible credit needs | Single purchase financing with fixed repayment |

Understanding Credit Card Loans and Point-of-Sale Financing

Credit card loans allow borrowers to access revolving credit with variable interest rates and flexible repayment terms, often used for everyday purchases or emergencies. Point-of-sale financing provides instant, installment-based credit directly at the checkout, typically offering fixed interest rates and promotional periods with no interest if paid on time. Understanding the differences in interest costs, repayment schedules, and credit impact helps consumers choose the best financing option for daily expenses.

Key Differences Between Credit Card Loans and POS Financing

Credit card loans allow borrowers to access revolving credit with flexible repayment options and interest rates typically ranging from 15% to 25%, while point-of-sale (POS) financing usually offers fixed-term, installment-based payments often at lower interest or promotional 0% APR for short periods. Credit cards provide broader usage for various purchases and cash advances, whereas POS financing is limited to specific retailers or service providers and often requires immediate credit approval at checkout. The credit score impact also differs: credit card utilization influences credit scores continuously, while POS loans appear as installment loans with set payment plans affecting credit reports differently.

Interest Rates: Comparing Costs for Everyday Purchases

Credit card loans often carry average interest rates ranging from 15% to 25% APR, making them more expensive for everyday purchases compared to point-of-sale (POS) financing, which can offer promotional 0% interest periods or lower upfront rates. POS financing is commonly provided through retailers or third-party lenders, allowing consumers to spread payments over several months without incurring high interest fees if paid within the promotional term. Evaluating the effective interest costs and potential fees of both options is crucial for consumers aiming to minimize the financial burden of routine purchases.

Approval Process and Accessibility

Credit card loans typically require a credit check and have variable approval times depending on the lender's criteria, often favoring those with established credit histories. Point-of-sale financing offers quicker approvals as it involves immediate credit decisions at the time of purchase, making it more accessible for consumers with limited credit backgrounds. Both financing options provide convenient access to funds, but point-of-sale financing emphasizes speed and ease, especially for everyday transactions.

Repayment Terms and Flexibility

Credit card loans typically offer revolving credit with minimum monthly payments and variable interest rates, allowing flexible repayment schedules based on the outstanding balance. Point-of-sale (POS) financing usually provides fixed repayment terms with predetermined installment amounts, simplifying budgeting but limiting payment flexibility. Understanding these differences helps borrowers choose options aligning with their cash flow and payment preferences for everyday purchases.

Impact on Your Credit Score

Credit card loans typically affect your credit utilization ratio, which directly impacts your credit score by reflecting how much credit you are using compared to your total available credit. Point-of-sale financing often appears as a separate installment loan on your credit report, potentially improving your credit mix but requiring timely payments to maintain a positive impact. Both options influence your credit history differently, so consistent on-time payments are crucial for preserving or boosting your credit score.

Fees and Hidden Charges to Watch Out For

Credit card loans often come with high-interest rates and potential annual fees that can significantly increase the cost of everyday purchases. Point-of-sale financing may offer promotional zero-interest periods but can include hidden charges such as deferred interest, late payment fees, and strict repayment terms that escalate costs if not managed carefully. Consumers should scrutinize the fine print on both credit card loans and point-of-sale financing agreements to avoid unexpected fees and financial pitfalls.

Which Option is More Convenient for Daily Expenses?

Credit Card Loans provide flexible spending with the convenience of revolving credit and rewards programs, making them suitable for frequent, small purchases. Point-of-Sale Financing often offers interest-free periods and easy approval directly at the purchase location, ideal for planned or larger expenses. Evaluating factors like repayment terms, interest rates, and purchase frequency helps determine the most convenient option for managing daily expenses efficiently.

Pros and Cons of Credit Card Loans vs POS Financing

Credit card loans offer flexible repayment terms and widespread acceptance but often come with higher interest rates and potential fees, making them costly for large or extended repayments. Point-of-sale (POS) financing provides instant approval and typically lower interest rates for specific purchases but may limit borrowing amounts and retail options. Evaluating the interest rates, repayment schedules, and available credit limits is essential when choosing between credit card loans and POS financing for everyday purchases.

How to Choose the Right Financing Method for Everyday Spending

Selecting the ideal financing method for everyday spending depends on interest rates, repayment terms, and convenience. Credit card loans typically offer flexible repayment options but may carry higher interest rates compared to point-of-sale financing, which often provides lower or zero-interest promotional periods for specific purchases. Evaluating your spending habits, ability to repay within promotional windows, and the total cost of borrowing ensures an informed decision tailored to your financial situation.

Related Important Terms

Embedded Finance Solutions

Credit card loans offer flexible repayment options and widespread acceptance, but point-of-sale financing embedded directly at checkout simplifies approval and promotes higher conversion rates for everyday purchases. Embedded finance solutions integrate financing seamlessly into the shopping experience, reducing friction and enabling real-time credit decisions tailored to individual consumer behavior.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services offer flexible repayment options for everyday purchases, often with no interest if paid within a promotional period, making them more appealing than traditional credit card loans that typically charge higher interest rates and fees. Point-of-Sale Financing integrates seamlessly at checkout, providing instant credit approval and predictable installment plans, whereas credit card loans can involve variable rates and impact credit utilization.

Revolving Credit Utilization

Credit card loans offer revolving credit utilization, allowing consumers to borrow repeatedly up to their credit limit, making them flexible for everyday purchases but potentially leading to higher interest costs if balances are not paid in full. Point-of-sale financing typically involves fixed installment plans with set terms and interest rates, which can help manage spending predictably but lacks the ongoing credit reuse that credit cards provide.

Micro-Installment Plans

Micro-installment plans offered through point-of-sale financing provide flexible repayment options with lower interest rates compared to traditional credit card loans, making everyday purchases more affordable. These plans enable consumers to split payments into manageable monthly amounts directly at checkout, reducing reliance on high-interest credit card debt and improving financial control.

Virtual POS Lending

Virtual POS lending offers seamless approval and instant access to funds at checkout, enabling consumers to manage everyday purchases without the high-interest rates often associated with credit card loans. Unlike traditional credit card loans, virtual POS financing enhances spending flexibility by integrating directly with e-commerce platforms, providing transparent repayment options and minimizing debt accumulation risks.

Instant Credit Approval

Credit card loans provide instant credit approval through pre-approved limits, enabling swift transactions for everyday purchases without additional credit checks. Point-of-sale financing often involves real-time credit assessments, which can delay approval but offer structured repayment plans tailored to specific retail purchases.

Credit Card Balance Transfer Offers

Credit card balance transfer offers provide an effective way to manage debt with low or 0% introductory APR, making them a cost-efficient alternative to point-of-sale financing for everyday purchases. These offers often include reduced interest rates for a set period, allowing borrowers to consolidate credit card debt and minimize finance charges compared to higher-rate POS financing options.

Alternative Credit Scoring

Alternative credit scoring evaluates creditworthiness using non-traditional data such as payment history on utilities and rental services, providing better access to credit card loans and point-of-sale financing for consumers lacking extensive credit history. This innovative approach enables more accurate risk assessment and personalized loan terms, facilitating everyday purchases through flexible payment options guided by alternative credit profiles.

Split Payment Checkout

Credit card loans offer revolving credit with flexible repayment options but often come with higher interest rates, whereas point-of-sale financing enables split payment checkout directly at the purchase location, enhancing affordability for everyday expenses. Utilizing split payment checkout through point-of-sale financing reduces immediate financial burden by dividing costs into manageable installments, typically with lower or no interest compared to traditional credit card loans.

Soft Pull Prequalification

Soft pull prequalification for credit card loans provides a hassle-free way to check eligibility without impacting credit scores, making it ideal for everyday purchases. Point-of-sale financing typically involves a soft pull to offer instant financing options, allowing consumers to compare terms without a hard inquiry or immediate credit damage.

Credit Card Loan vs Point-of-Sale Financing for everyday purchases Infographic

moneydiff.com

moneydiff.com