Unsecured loans offer quick access to credit without collateral but often come with higher interest rates, making them suitable for borrowers with strong credit profiles. Social lending platforms connect borrowers directly with individual lenders, potentially providing more flexible terms and lower rates due to peer-to-peer interactions. Choosing between unsecured loans and social lending depends on creditworthiness, desired loan amount, and preference for traditional versus community-based borrowing options.

Table of Comparison

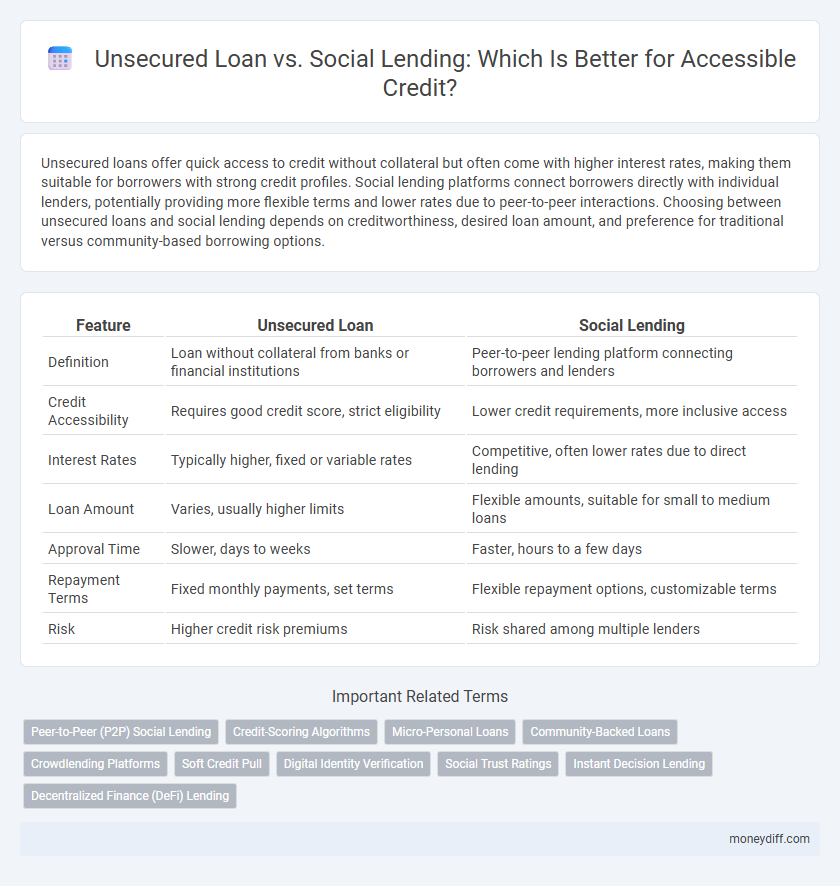

| Feature | Unsecured Loan | Social Lending |

|---|---|---|

| Definition | Loan without collateral from banks or financial institutions | Peer-to-peer lending platform connecting borrowers and lenders |

| Credit Accessibility | Requires good credit score, strict eligibility | Lower credit requirements, more inclusive access |

| Interest Rates | Typically higher, fixed or variable rates | Competitive, often lower rates due to direct lending |

| Loan Amount | Varies, usually higher limits | Flexible amounts, suitable for small to medium loans |

| Approval Time | Slower, days to weeks | Faster, hours to a few days |

| Repayment Terms | Fixed monthly payments, set terms | Flexible repayment options, customizable terms |

| Risk | Higher credit risk premiums | Risk shared among multiple lenders |

Understanding Unsecured Loans: Fundamentals and Features

Unsecured loans provide accessible credit without requiring collateral, relying primarily on the borrower's creditworthiness and income stability. Key features include higher interest rates compared to secured loans, flexible usage, and varying repayment terms based on the lender's assessment of risk. Unlike social lending platforms, unsecured loans typically involve traditional financial institutions, offering faster approval but less community-driven borrower evaluation.

What is Social Lending? A Modern Approach to Borrowing

Social lending, also known as peer-to-peer (P2P) lending, connects borrowers directly with individual investors through online platforms, bypassing traditional financial institutions. This modern approach to borrowing often offers lower interest rates and more flexible terms compared to unsecured loans from banks, making credit more accessible to a broader range of borrowers. By leveraging technology and social networks, social lending enhances transparency and efficiency in the loan process, expanding financial opportunities for individuals with diverse credit profiles.

Eligibility Criteria: Unsecured Loans vs Social Lending

Unsecured loans primarily require a good credit score, steady income, and proof of identity, making eligibility reliant on individual financial history. Social lending platforms assess borrowers through community trust, peer recommendations, and social reputation, often enabling access for those with limited credit history. Both options offer accessible credit but differ significantly in eligibility requirements, with unsecured loans emphasizing traditional creditworthiness and social lending prioritizing social credibility.

Interest Rates Comparison: Traditional Banks vs Peer-to-Peer Platforms

Traditional banks typically offer unsecured loans with interest rates ranging from 7% to 20%, influenced by credit scores and financial history. Peer-to-peer (P2P) lending platforms often provide more competitive rates between 5% and 15%, benefiting borrowers with moderate risk profiles. Social lending leverages community trust and technology to reduce costs, making credit more accessible and affordable compared to conventional unsecured loans.

Application Process: Unsecured Loans and Social Lending Simplified

Unsecured loans offer a straightforward application process requiring minimal documentation, typically focusing on credit score and income verification for quick approval. Social lending platforms, leveraging peer-to-peer networks, simplify applications by enabling borrowers to connect directly with individual lenders through user-friendly online interfaces. Both options prioritize accessibility, but social lending often provides more flexible qualification criteria and faster funding times.

Approval Speed: Which Option is Faster for Borrowers?

Unsecured loans typically offer faster approval speeds due to automated underwriting and established lending criteria, enabling borrowers to access funds within a few business days. Social lending platforms, also known as peer-to-peer lending, may experience longer processing times as loan approvals depend on peer investor decisions and platform verification processes. For borrowers prioritizing quick access to credit, unsecured loans generally provide a more efficient approval timeline compared to social lending options.

Accessibility: Who Benefits Most from Social Lending?

Social lending platforms enhance accessibility by connecting borrowers directly with individual investors, often offering approval to those with limited credit histories or moderate credit scores who might be declined by traditional lenders. Unsecured loans from banks typically require higher creditworthiness and strict eligibility criteria, limiting access for many individuals. Social lending benefits underserved populations by providing more flexible terms and faster funding through a peer-to-peer model.

Risks and Protections: Borrowers’ Perspective

Unsecured loans typically offer faster access to credit but carry higher interest rates and fewer consumer protections, increasing financial risk for borrowers. Social lending platforms provide a community-driven approach with transparent terms and often lower rates, yet they may pose risks such as less regulatory oversight and potential defaults by peer lenders. Borrowers should evaluate creditworthiness criteria, platform reputation, and legal safeguards to minimize risks and ensure security in accessible credit options.

Impact on Credit Score: Unsecured Loan vs Social Lending

Unsecured loans can impact credit scores significantly since timely repayments are reported to credit bureaus, improving credit history, while missed payments may harm the score. Social lending platforms often perform soft credit checks initially, reducing immediate impact on credit scores, but defaulting on peer-to-peer loan repayments can still negatively affect credit records. Borrowers seeking accessible credit should weigh the potential credit score implications between traditional unsecured loans and social lending options.

Choosing the Right Option: Factors to Consider for Accessible Credit

When choosing between unsecured loans and social lending for accessible credit, consider interest rates, approval speed, and credit score requirements. Unsecured loans typically require higher credit scores but offer faster disbursement, while social lending platforms often provide more flexible eligibility criteria and peer-reviewed terms. Assessing repayment terms, borrower protections, and the platform's reputation ensures a tailored financial solution suited to individual credit needs.

Related Important Terms

Peer-to-Peer (P2P) Social Lending

Unsecured loans provide accessible credit without collateral but often involve higher interest rates and stricter credit requirements, limiting options for some borrowers. Peer-to-peer (P2P) social lending platforms connect borrowers directly with individual lenders, offering more flexible terms, lower costs, and increased accessibility for those with limited credit history.

Credit-Scoring Algorithms

Unsecured loans rely heavily on traditional credit-scoring algorithms that assess creditworthiness based on credit history, income, and debt-to-income ratio, often limiting access for borrowers with thin credit files. Social lending platforms utilize alternative data and community-driven credit assessments to offer more inclusive credit access, leveraging peer evaluations and non-traditional metrics to enhance approval rates.

Micro-Personal Loans

Unsecured loans provide micro-personal loans without collateral but often involve higher interest rates and stricter credit requirements, limiting accessibility for some borrowers. Social lending platforms leverage peer-to-peer networks to offer more flexible, lower-cost micro-personal loans by connecting individual lenders directly with borrowers, enhancing credit access for underserved populations.

Community-Backed Loans

Unsecured loans offer accessible credit without collateral but often come with higher interest rates and stringent eligibility criteria, limiting options for some borrowers. Community-backed social lending leverages group trust and peer support to provide more affordable, flexible credit solutions, fostering financial inclusion and shared responsibility among participants.

Crowdlending Platforms

Unsecured loans offer accessible credit without collateral, but social lending through crowdlending platforms connects borrowers directly with individual lenders, often resulting in competitive interest rates and flexible terms. Crowdlending platforms leverage peer-to-peer networks to democratize credit access, enhancing financial inclusion for individuals who may not qualify for traditional bank loans.

Soft Credit Pull

Unsecured loans typically involve a hard credit pull that can temporarily lower credit scores, while social lending platforms often use a soft credit pull, preserving credit standing during the application. Soft credit pulls enable borrowers to access accessible credit without impacting their credit score, making social lending an attractive option for those seeking flexible financing.

Digital Identity Verification

Unsecured loans typically rely on traditional credit scores for approval, whereas social lending platforms enhance accessible credit by integrating digital identity verification methods, enabling faster and more inclusive borrower assessments. Digital identity verification reduces fraud risks and streamlines approval processes, making social lending a more efficient option for individuals with limited credit histories.

Social Trust Ratings

Social lending platforms leverage social trust ratings to assess borrower credibility, enabling more accessible credit without collateral compared to traditional unsecured loans. These trust ratings reduce default risk by incorporating peer reviews and community feedback, fostering transparent and reliable lending environments.

Instant Decision Lending

Unsecured loans offer instant decision lending by providing quick access to funds without collateral, while social lending platforms leverage peer-to-peer networks to facilitate accessible credit with potentially lower interest rates. Instant decision lending enhances financial inclusivity by using advanced algorithms for rapid credit assessments, making funds available within minutes.

Decentralized Finance (DeFi) Lending

Unsecured loans offer accessible credit without collateral but typically feature higher interest rates due to increased lender risk, whereas social lending leverages peer-to-peer networks to provide alternative funding options. Decentralized Finance (DeFi) lending platforms enhance accessibility by enabling trustless, transparent transactions and often use smart contracts to reduce intermediaries and lower costs.

Unsecured Loan vs Social Lending for accessible credit Infographic

moneydiff.com

moneydiff.com