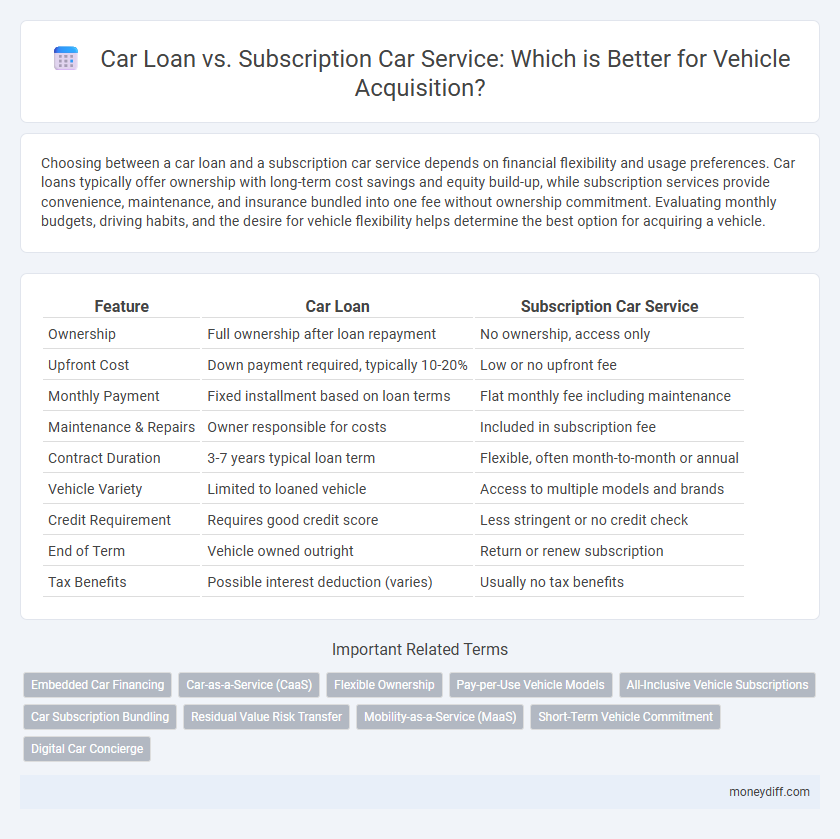

Choosing between a car loan and a subscription car service depends on financial flexibility and usage preferences. Car loans typically offer ownership with long-term cost savings and equity build-up, while subscription services provide convenience, maintenance, and insurance bundled into one fee without ownership commitment. Evaluating monthly budgets, driving habits, and the desire for vehicle flexibility helps determine the best option for acquiring a vehicle.

Table of Comparison

| Feature | Car Loan | Subscription Car Service |

|---|---|---|

| Ownership | Full ownership after loan repayment | No ownership, access only |

| Upfront Cost | Down payment required, typically 10-20% | Low or no upfront fee |

| Monthly Payment | Fixed installment based on loan terms | Flat monthly fee including maintenance |

| Maintenance & Repairs | Owner responsible for costs | Included in subscription fee |

| Contract Duration | 3-7 years typical loan term | Flexible, often month-to-month or annual |

| Vehicle Variety | Limited to loaned vehicle | Access to multiple models and brands |

| Credit Requirement | Requires good credit score | Less stringent or no credit check |

| End of Term | Vehicle owned outright | Return or renew subscription |

| Tax Benefits | Possible interest deduction (varies) | Usually no tax benefits |

Understanding Car Loans: Traditional Financing Explained

Car loans provide traditional financing options where borrowers secure funds to purchase a vehicle, usually with fixed interest rates and structured monthly payments over a set term. This method allows full ownership once the loan is paid off, often requiring a credit check and down payment. Understanding car loans involves evaluating interest rates, loan terms, and total cost of ownership compared to alternative options like subscription services.

What Is a Subscription Car Service?

A subscription car service offers users access to a variety of vehicles under a flexible, all-inclusive monthly fee that typically covers insurance, maintenance, and roadside assistance. Unlike traditional car loans requiring long-term financial commitments and ownership responsibilities, subscription services provide convenience and the ability to switch vehicles without ownership burdens. This model appeals to consumers seeking short-term use, predictable expenses, and simplified vehicle management compared to the complexities of financing through car loans.

Upfront Costs: Car Loan vs Subscription Car Service

Car loans typically require a significant upfront payment including down payment, taxes, and fees, often amounting to 10-20% of the vehicle's value. Subscription car services eliminate large initial costs by offering a monthly fee that covers the vehicle, insurance, maintenance, and taxes, reducing financial barriers to vehicle acquisition. Comparing upfront costs reveals subscription services provide a more accessible option for those seeking lower immediate expenditures.

Monthly Payment Comparison: Which Option Saves More?

Car loan monthly payments typically involve fixed installments based on loan amount, interest rate, and loan term, often resulting in higher long-term costs due to interest accrual. Subscription car services charge a flat monthly fee that covers insurance, maintenance, and depreciation, providing predictable costs but sometimes higher monthly expenses than loans in the short term. Analyzing total monthly outflow alongside ownership benefits reveals that car loans may save more money over time, while subscriptions offer convenience and flexibility without large upfront payments.

Ownership vs Access: Key Differences

Car loans provide full ownership of the vehicle after the repayment period, allowing for long-term asset accumulation and customization. Subscription car services offer flexible vehicle access without ownership, covering maintenance, insurance, and the option to switch models regularly. The primary difference lies in ownership rights versus temporary access, impacting financial commitment and user experience.

Maintenance and Insurance: Included or Extra?

Car loans typically require borrowers to handle maintenance and insurance costs separately, increasing the overall ownership expenses. Subscription car services often include maintenance and insurance as part of the monthly fee, providing a more predictable and hassle-free payment structure. Choosing between these options depends on whether upfront ownership responsibilities or convenience and bundled services are prioritized.

Flexibility and Commitment: Choosing the Right Fit

Car loans require a long-term commitment with fixed monthly payments and ownership responsibilities, offering flexibility in vehicle customization and unlimited mileage. Subscription car services provide short-term contracts with inclusive maintenance, insurance, and the option to switch vehicles frequently, ideal for users seeking convenience and adaptability. Evaluating personal driving habits, financial goals, and lifestyle needs helps determine whether a car loan's ownership benefits or a subscription service's flexibility is the better fit.

Depreciation and Resale Value: Who Takes the Hit?

Car loans require the borrower to absorb full vehicle depreciation, impacting resale value and long-term cost. Subscription car services shield users from depreciation risks by including maintenance and allowing easy vehicle swaps. Choosing between the two depends on whether you prioritize ownership equity or flexibility without resale concerns.

Eligibility and Credit Requirements Explained

Car loans typically require a good credit score, proof of steady income, and a low debt-to-income ratio to qualify, with lenders often setting minimum credit scores around 600 to 700. Subscription car services usually have more flexible eligibility criteria, focusing on income verification and a soft credit check without heavily impacting credit scores. Understanding these differences helps potential vehicle buyers choose between traditional financing and subscription models based on their credit profile and qualification ease.

Making the Smart Choice: Car Loan or Car Subscription?

Choosing between a car loan and a subscription car service hinges on financial flexibility, ownership preferences, and usage patterns. Car loans offer long-term ownership benefits and equity accumulation, ideal for those seeking full control and cost predictability, while subscription services provide hassle-free access, insurance, and maintenance bundled in monthly fees, catering to users wanting convenience and frequent vehicle changes. Evaluating total cost of ownership, mileage requirements, and lifestyle needs ensures selecting the optimal vehicle acquisition method aligned with personal priorities.

Related Important Terms

Embedded Car Financing

Embedded car financing transforms vehicle acquisition by integrating loan options directly within subscription car services, offering seamless access to flexible payment plans and ownership opportunities. This approach combines the convenience of subscription models with the financial benefits of traditional car loans, optimizing cash flow and enhancing customer retention through tailored embedded credit solutions.

Car-as-a-Service (CaaS)

Car-as-a-Service (CaaS) offers a flexible alternative to traditional car loans by providing subscription-based access to vehicles without long-term financial commitments, covering maintenance, insurance, and depreciation in a single monthly fee. This model optimizes cash flow management and reduces ownership risks, appealing to consumers seeking convenience and adaptability in vehicle acquisition.

Flexible Ownership

Car loans offer fixed ownership with long-term financial commitment, while subscription car services provide flexible vehicle access without long-term contracts or depreciation concerns. Subscription models allow users to switch vehicles frequently, catering to dynamic lifestyles and reducing maintenance responsibilities compared to traditional car loans.

Pay-per-Use Vehicle Models

Pay-per-use vehicle models in car loans provide ownership with fixed monthly payments and long-term asset value, whereas subscription car services offer flexibility, all-inclusive maintenance, and the ability to switch vehicles frequently without ownership responsibilities. Consumers prioritizing cost predictability and vehicle customization often prefer car loans, while those valuing convenience and short-term access lean towards subscription services.

All-Inclusive Vehicle Subscriptions

All-inclusive vehicle subscriptions offer a flexible alternative to traditional car loans by bundling insurance, maintenance, and roadside assistance into a single monthly fee, eliminating upfront costs and depreciation concerns. This subscription model provides hassle-free vehicle access with the convenience of switching models frequently, while car loans typically require long-term financial commitment and responsibility for additional expenses.

Car Subscription Bundling

Car subscription services offer bundled vehicle acquisition benefits, including insurance, maintenance, and roadside assistance, which simplify budgeting compared to traditional car loans that require separate payments for insurance, taxes, and upkeep. Unlike car loans demanding long-term financial commitment and depreciation concerns, subscription car services provide flexible terms and immediate access to newer models without ownership responsibilities.

Residual Value Risk Transfer

Car loans transfer residual value risk to the borrower, who is responsible for the vehicle's depreciation and resale value at the end of the loan term. Subscription car services shift residual value risk to the provider, offering predictable monthly payments without concerns about depreciation or resale, enhancing financial stability for users.

Mobility-as-a-Service (MaaS)

Car loans offer ownership with fixed monthly payments and long-term asset value, while subscription car services provide flexible, all-inclusive access to vehicles without ownership responsibilities, aligning with Mobility-as-a-Service (MaaS) trends that emphasize convenience and adaptability. MaaS integrates various transportation options, and subscription models cater to users seeking short-term usage and lower commitment compared to traditional car financing.

Short-Term Vehicle Commitment

Car loans require long-term financial commitment with fixed monthly payments and interest over several years, making them less flexible for short-term vehicle needs. Subscription car services offer month-to-month plans with maintenance and insurance included, providing hassle-free short-term access without ownership obligations.

Digital Car Concierge

Digital Car Concierge services streamline vehicle acquisition by offering personalized recommendations, flexible subscription options, and seamless online management, reducing the need for traditional car loans. Unlike standard car loans that require extensive credit checks and long-term commitments, subscription services provide all-inclusive fees and hassle-free upgrades, enhancing consumer convenience and financial predictability.

Car Loan vs Subscription Car Service for vehicle acquisition Infographic

moneydiff.com

moneydiff.com