A traditional mortgage requires full responsibility for the loan amount and interest payments, offering complete ownership of the property once repaid. Shared equity mortgages involve a partner sharing the purchase cost and any future property profit or loss, reducing the borrower's initial loan burden. This option can make homeownership more accessible but may limit future financial gains compared to a standard mortgage.

Table of Comparison

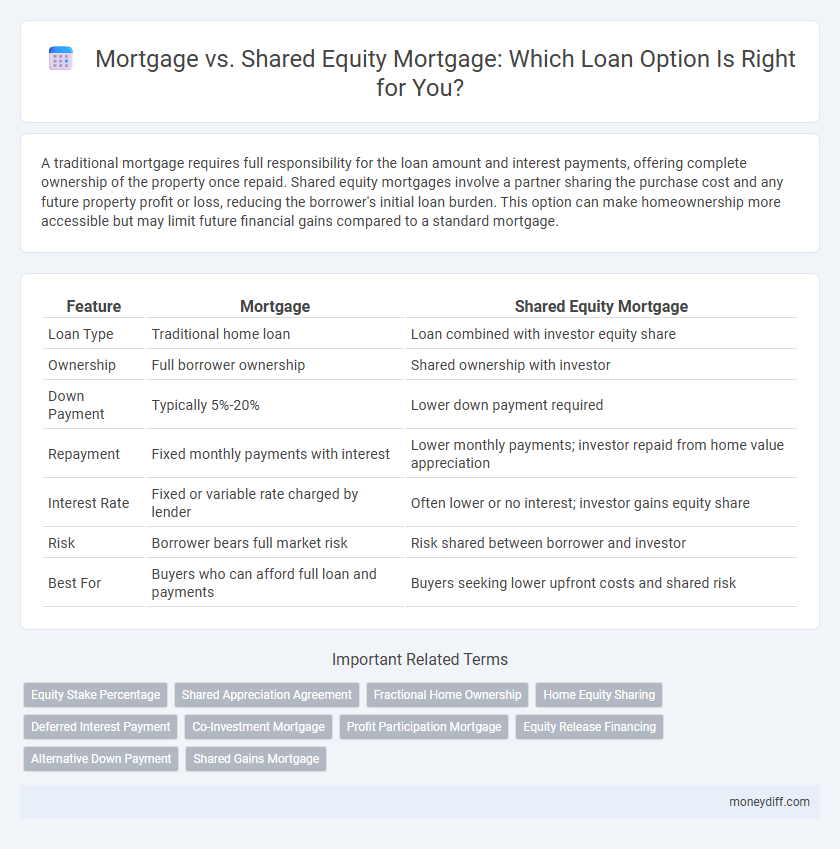

| Feature | Mortgage | Shared Equity Mortgage |

|---|---|---|

| Loan Type | Traditional home loan | Loan combined with investor equity share |

| Ownership | Full borrower ownership | Shared ownership with investor |

| Down Payment | Typically 5%-20% | Lower down payment required |

| Repayment | Fixed monthly payments with interest | Lower monthly payments; investor repaid from home value appreciation |

| Interest Rate | Fixed or variable rate charged by lender | Often lower or no interest; investor gains equity share |

| Risk | Borrower bears full market risk | Risk shared between borrower and investor |

| Best For | Buyers who can afford full loan and payments | Buyers seeking lower upfront costs and shared risk |

Understanding Mortgage Loans: Basics and Benefits

Mortgage loans provide borrowers with a fixed or variable interest rate to purchase property, allowing homeownership with manageable monthly payments over a set term. Shared equity mortgage loans involve a third party, often an investor or government entity, who contributes to the property purchase in exchange for a percentage of future home value appreciation. Understanding these options helps borrowers balance upfront costs, long-term financial commitment, and potential equity growth.

What is a Shared Equity Mortgage?

A Shared Equity Mortgage is a home loan where the lender or investor provides a portion of the down payment in exchange for a percentage of the property's future value. Unlike traditional mortgages, borrowers benefit from lower initial costs but share both appreciation and depreciation risks with the equity partner. This arrangement can reduce monthly payments and make homeownership more accessible to buyers with limited upfront capital.

Comparing Monthly Payments: Traditional vs Shared Equity

Traditional mortgage monthly payments consist of principal and interest, often resulting in higher installment amounts compared to shared equity mortgages. Shared equity mortgage payments are typically lower because borrowers repay only a portion of the property's value while sharing future appreciation or depreciation with the lender or equity partner. This payment structure reduces initial cash flow burden, making homeownership more accessible but may lead to sharing profits when the property is sold.

Down Payment Differences: Mortgage vs Shared Equity

Traditional mortgages typically require a substantial down payment, often ranging from 10% to 20% of the property's purchase price, which can pose a barrier for many buyers. Shared equity mortgages reduce this upfront cost by allowing a third party, such as an investor or government entity, to contribute a portion of the down payment in exchange for a share in the property's future appreciation. This arrangement lowers the initial financial burden for borrowers but may involve sharing profits when the property is sold or refinanced.

Eligibility Criteria for Each Loan Type

Mortgage eligibility typically requires a stable income, good credit score above 620, and a down payment of at least 5%, with lenders assessing debt-to-income ratio below 43%. Shared Equity Mortgage eligibility often targets first-time homebuyers or low-to-moderate income applicants, requiring proof of financial need and willingness to share future property appreciation with the equity partner. Both loan types demand property appraisal and legal documentation but differ significantly in applicant financial thresholds and partnership agreements.

Ownership Rights: Full vs Partial Equity

Mortgage loans grant full ownership rights to borrowers upon completion, allowing them to build complete equity in the property. Shared equity mortgages involve a co-ownership arrangement where the lender or investor holds partial equity, sharing both the risks and rewards of property value changes. This partial ownership can reduce upfront costs but limits borrowers' full control and equity accumulation in the home.

Impact on Home Appreciation and Profit Sharing

A mortgage allows full home appreciation to accrue to the homeowner, maximizing potential profit upon sale, while a shared equity mortgage involves a lender or investor owning a stake in the property's equity, leading to profit sharing based on the agreed percentage. Homeowners with shared equity mortgages benefit from lower initial payments but share any home value increase, reducing net gains compared to traditional mortgages. The choice between these loan types impacts financial outcomes by balancing upfront affordability against long-term equity growth and profit distribution.

Risks and Drawbacks: Mortgage vs Shared Equity

Traditional mortgages carry risks such as fluctuating interest rates leading to higher monthly payments and the potential for foreclosure if borrowers fail to meet obligations. Shared equity mortgages reduce monthly payments by sharing property appreciation but expose homeowners to the risk of losing a portion of future equity gains and facing complexities during property sale or refinancing. Borrowers must weigh the stability and predictable payments of conventional mortgages against the equity-sharing risks and potential financial limitations inherent in shared equity arrangements.

Best Situations for Each Loan Option

A traditional mortgage is best suited for borrowers seeking full home ownership with predictable monthly payments and the ability to build complete equity over time. Shared equity mortgages are ideal for buyers who want to reduce upfront costs by sharing future home appreciation with an investor, making them suitable for those with limited down payments or uncertain income. Choosing between these loans depends on financial goals: full ownership and equity growth favor traditional mortgages, while lower initial expenses and risk-sharing favor shared equity options.

Deciding Which Mortgage is Right for You

Mortgage loans offer full property ownership through fixed or variable interest rates, providing long-term financial predictability and equity buildup. Shared equity mortgages involve partnering with an investor who shares property appreciation and initial costs, reducing upfront payments but affecting future gains. Evaluating your financial stability, homeownership goals, and willingness to share equity helps determine the best mortgage option for your loan needs.

Related Important Terms

Equity Stake Percentage

A traditional mortgage requires full repayment of the loan principal and interest, while a shared equity mortgage involves a lender or third party acquiring a percentage of the property's equity, typically ranging from 10% to 50%, which influences future profit or loss during sale. The equity stake percentage dictates the lender's share in the property's appreciation or depreciation, making it crucial for borrowers to understand potential financial outcomes beyond monthly repayments.

Shared Appreciation Agreement

A Shared Appreciation Agreement (SAA) in a Shared Equity Mortgage allows lenders to share in the property's future appreciation, reducing initial loan payments compared to traditional mortgages while aligning costs with property value growth. This structure provides borrowers with lower upfront costs and flexible repayment linked to the property's market performance, contrasting with the fixed payments of a conventional mortgage.

Fractional Home Ownership

A shared equity mortgage offers fractional home ownership by allowing multiple investors to own a percentage of the property, reducing upfront costs and monthly payments compared to a traditional mortgage which requires full ownership financing. This model provides flexibility in ownership transfer and potential equity growth, making it an attractive option for buyers seeking lower financial barriers and collaborative investment opportunities.

Home Equity Sharing

Home Equity Sharing allows homeowners to access funds by selling a percentage of their property's future appreciation without monthly repayments, offering an alternative to traditional mortgages that require fixed interest payments and principal amortization. Unlike standard mortgages, shared equity loans align lender returns with property performance, reducing borrower risk but potentially sharing significant appreciation gains.

Deferred Interest Payment

Mortgage loans typically require regular interest payments, while Shared Equity Mortgages often feature deferred interest payment options that allow borrowers to postpone interest until the property is sold or refinanced. Deferred interest payments in Shared Equity Mortgages reduce immediate financial burden but may increase the total repayment amount as interest accumulates over time.

Co-Investment Mortgage

Co-Investment Mortgages combine traditional mortgage lending with shared equity arrangements, allowing borrowers to reduce their initial loan burden by partnering with an investor who co-owns a portion of the property. This model offers lower monthly payments and increased affordability compared to conventional mortgages but requires shared property appreciation or depreciation upon sale.

Profit Participation Mortgage

A Profit Participation Mortgage allows lenders to receive a share of the property's future appreciation instead of fixed interest payments, offering flexibility compared to traditional mortgages where borrowers repay principal plus interest. Shared Equity Mortgages similarly involve lenders partnering for equity shares but typically require borrower profit sharing upon sale or refinancing, aligning both parties' incentives towards property value growth.

Equity Release Financing

Mortgage loans provide full homeownership with fixed or variable interest rates based on the principal borrowed, while shared equity mortgages enable borrowers to release equity by selling a portion of their property's future value to investors, reducing monthly payments without immediate debt increase. Equity release financing through shared equity arrangements offers a flexible option for homeowners aiming to unlock capital without traditional loan repayments or interest accumulation.

Alternative Down Payment

Shared equity mortgages offer an alternative down payment method by allowing borrowers to reduce upfront costs through partial homeownership with an investor, contrasting traditional mortgages that require full down payment funds. This arrangement can increase affordability and lower monthly payments, making homeownership accessible to buyers lacking substantial savings.

Shared Gains Mortgage

A Shared Gains Mortgage allows borrowers to access lower interest rates by sharing a portion of the property's future appreciation with the lender, contrasting with traditional mortgages where borrowers repay a fixed principal and interest amount. This loan structure enables more affordable homeownership while aligning lender returns with property market performance, reducing monthly payments compared to conventional mortgages.

Mortgage vs Shared Equity Mortgage for loan. Infographic

moneydiff.com

moneydiff.com