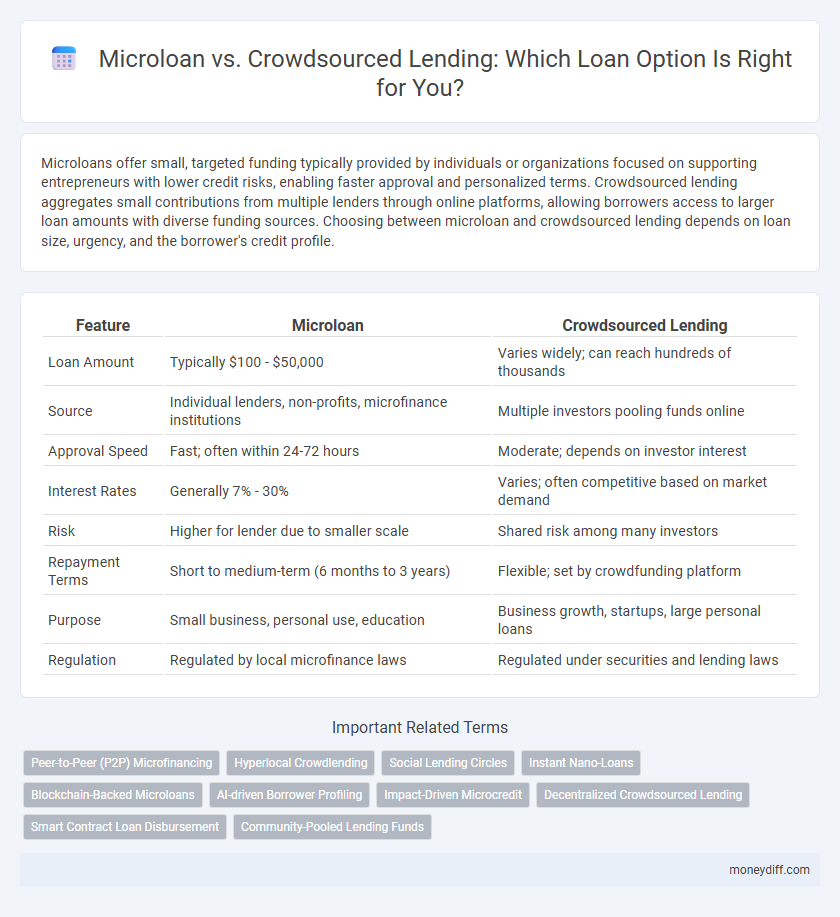

Microloans offer small, targeted funding typically provided by individuals or organizations focused on supporting entrepreneurs with lower credit risks, enabling faster approval and personalized terms. Crowdsourced lending aggregates small contributions from multiple lenders through online platforms, allowing borrowers access to larger loan amounts with diverse funding sources. Choosing between microloan and crowdsourced lending depends on loan size, urgency, and the borrower's credit profile.

Table of Comparison

| Feature | Microloan | Crowdsourced Lending |

|---|---|---|

| Loan Amount | Typically $100 - $50,000 | Varies widely; can reach hundreds of thousands |

| Source | Individual lenders, non-profits, microfinance institutions | Multiple investors pooling funds online |

| Approval Speed | Fast; often within 24-72 hours | Moderate; depends on investor interest |

| Interest Rates | Generally 7% - 30% | Varies; often competitive based on market demand |

| Risk | Higher for lender due to smaller scale | Shared risk among many investors |

| Repayment Terms | Short to medium-term (6 months to 3 years) | Flexible; set by crowdfunding platform |

| Purpose | Small business, personal use, education | Business growth, startups, large personal loans |

| Regulation | Regulated by local microfinance laws | Regulated under securities and lending laws |

Understanding Microloans: Definition and Key Features

Microloans are small, short-term loans designed to support entrepreneurs and small businesses, typically ranging from $100 to $50,000, with flexible repayment terms and lower interest rates compared to traditional loans. Key features include quick approval processes, minimal collateral requirements, and a focus on improving financial inclusion for underserved communities. Crowdsourced lending, in contrast, pools funds from multiple individual investors but often involves larger amounts and longer repayment periods.

What Is Crowdsourced Lending? An Overview

Crowdsourced lending is a financing method where multiple individual investors contribute small amounts of capital to fund a single borrower's loan request through online platforms. Unlike microloans, which are often provided by nonprofit organizations or specialized lenders to support small businesses or individuals with limited credit history, crowdsourced lending leverages a broad pool of private investors seeking diversified investment opportunities. This peer-to-peer lending approach can offer competitive interest rates and faster approval times, making it an appealing alternative for borrowers who may not qualify for traditional bank loans.

Eligibility Criteria: Microloans vs Crowdsourced Loans

Microloan eligibility typically requires borrowers to demonstrate low income or limited credit history, aiming to support underserved individuals or small businesses. Crowdsourced lending often demands a basic credit check and transparent financial information to attract multiple individual investors willing to fund the loan. Both options prioritize borrower credibility, but microloans emphasize social impact, while crowdsourced lending focuses on peer-based risk assessment.

Application Process Comparison: Speed and Simplicity

Microloans typically offer a faster and simpler application process due to minimal documentation and streamlined approval criteria designed for individual borrowers. Crowdsourced lending involves a more complex procedure, often requiring detailed credit assessments and longer periods to attract sufficient lenders from the platform community. Microloan platforms prioritize quick disbursal, while crowdsourced lending emphasizes transparency and investor engagement, impacting the overall speed and ease of application.

Interest Rates and Fees: Which Option Costs Less?

Microloans typically offer lower interest rates and minimal fees compared to crowdsourced lending, which can involve higher costs due to platform fees and variable interest rates driven by investor demand. Microloan programs often receive government or nonprofit support, allowing them to provide affordable financing specifically targeting underserved borrowers. Crowdsourced lending, while accessible, tends to have fluctuating fees and interest rates that may increase the overall cost of borrowing.

Loan Amounts and Repayment Terms Compared

Microloans typically offer smaller loan amounts, often ranging from $100 to $50,000, with shorter repayment terms of 6 to 24 months. Crowdsourced lending platforms provide a broader spectrum of loan amounts, from a few thousand dollars to several hundred thousand, accommodating longer repayment periods that can extend up to 60 months or more. Borrowers seeking smaller, quick-turnaround loans may prefer microloans, while those needing larger sums with flexible repayment plans often consider crowdsourced lending options.

Risk Factors: Borrower and Lender Perspectives

Microloans present high risk for lenders due to limited borrower credit history and smaller collateral, increasing chances of default. Crowdsourced lending distributes risk across multiple individual lenders, reducing exposure but potentially diluting returns. Borrowers in microloan programs face stringent repayment terms, while crowdsourced lending often offers more flexible conditions tailored to diverse financial profiles.

Impact on Credit Score: Microloans vs Crowdsourced Lending

Microloans typically provide small, short-term credit solutions that often report payments to major credit bureaus, helping borrowers build or improve their credit scores through consistent repayment. Crowdsourced lending platforms may vary in reporting practices, with some not reporting to credit bureaus, which can limit positive credit score impact despite offering accessible funding. Borrowers seeking credit score benefits should verify the lending service's credit reporting policies to ensure their repayments contribute effectively to credit history development.

Suitability for Small Businesses and Entrepreneurs

Microloans offer small businesses and entrepreneurs targeted financing with lower borrowing amounts and flexible terms, making them ideal for startups and ventures with limited credit history. Crowdsourced lending provides access to a broader investor pool, enabling higher loan amounts and potentially faster funding, suited for businesses aiming to scale quickly. Both options support small business growth, but microloans prioritize accessibility and manageable repayment, while crowdsourced lending emphasizes capital volume and speed.

Choosing the Right Lending Platform for Your Needs

Microloans offer small, short-term financing typically provided by nonprofit organizations or community lenders, ideal for individuals or small businesses seeking quick access to funds with potentially lower interest rates. Crowdsourced lending pools funds from multiple individual investors online, allowing borrowers to access larger amounts with flexible terms and a broader range of credit options. Selecting the right platform depends on factors like loan size, interest rates, repayment flexibility, and the borrower's credit profile to ensure the best fit for financial needs.

Related Important Terms

Peer-to-Peer (P2P) Microfinancing

Peer-to-peer (P2P) microfinancing leverages direct connections between individual lenders and borrowers, offering flexible microloans with lower interest rates compared to traditional crowdsourced lending platforms that pool funds from multiple investors. This targeted approach enables faster access to capital for small entrepreneurs while maintaining personalized risk assessment and repayment tracking.

Hyperlocal Crowdlending

Hyperlocal crowdlending leverages community trust and localized networks to provide microloans with lower interest rates and faster approval times compared to traditional microloan platforms. This method enhances financial inclusion by connecting borrowers directly with local lenders, reducing reliance on centralized institutions and enabling tailored loan terms based on regional economic conditions.

Social Lending Circles

Microloans typically provide small, short-term loans to individuals with limited credit history, while crowdsourced lending leverages collective contributions from social networks to fund loans, often organized through Social Lending Circles that promote trust and financial inclusion. Social Lending Circles enable borrowers to access funds through community-based peer groups, reducing reliance on traditional credit systems and fostering collaborative repayment structures.

Instant Nano-Loans

Microloans provide instant nano-loans with minimal approval time and typically target individuals or small businesses, offering quick access to funds often under $1,000. Crowdsourced lending pools small investments from multiple lenders, enabling diverse funding sources but generally involves longer processing times compared to the rapid disbursement of microloan platforms.

Blockchain-Backed Microloans

Blockchain-backed microloans offer enhanced transparency and security compared to traditional crowdsourced lending by leveraging decentralized ledgers to verify transactions and reduce fraud. This technology enables faster loan approvals and lower interest rates, making microloans more accessible and affordable for underserved communities.

AI-driven Borrower Profiling

AI-driven borrower profiling in microloans leverages machine learning algorithms to analyze alternative data sources, enabling precise credit risk assessment for individuals with limited credit history. Crowdsourced lending platforms utilize AI to match borrower profiles with appropriate investors by evaluating behavioral patterns and financial health, enhancing loan approval efficiency and reducing default rates.

Impact-Driven Microcredit

Impact-driven microcredit through microloans provides targeted financial support to underserved entrepreneurs, fostering local economic growth and poverty alleviation with lower default risks. Crowdsourced lending pools funds from multiple individual investors, increasing access to capital but often lacking the tailored social impact focus and personalized borrower support found in microloan programs.

Decentralized Crowdsourced Lending

Decentralized crowdsourced lending leverages blockchain technology to connect multiple lenders and borrowers directly, ensuring transparency and reducing reliance on traditional financial institutions. Unlike microloans typically offered by local lenders or NGOs, decentralized platforms enable peer-to-peer funding at a global scale, facilitating faster approval and lower interest rates through smart contracts.

Smart Contract Loan Disbursement

Microloan platforms leveraging smart contract loan disbursement automate fund release upon meeting predefined criteria, enhancing transparency and reducing processing time. Crowdsourced lending benefits from blockchain-enabled smart contracts by ensuring secure, decentralized management of multiple investor contributions and real-time repayment tracking.

Community-Pooled Lending Funds

Community-pooled lending funds in microloans provide borrowers access to small, affordable loans funded collectively by local members, enhancing financial inclusion for underserved individuals. Crowdsourced lending aggregates investments from a broad online network, offering diverse funding sources but potentially higher interest rates due to platform fees and investor risk tolerance.

Microloan vs Crowdsourced Lending for loan. Infographic

moneydiff.com

moneydiff.com