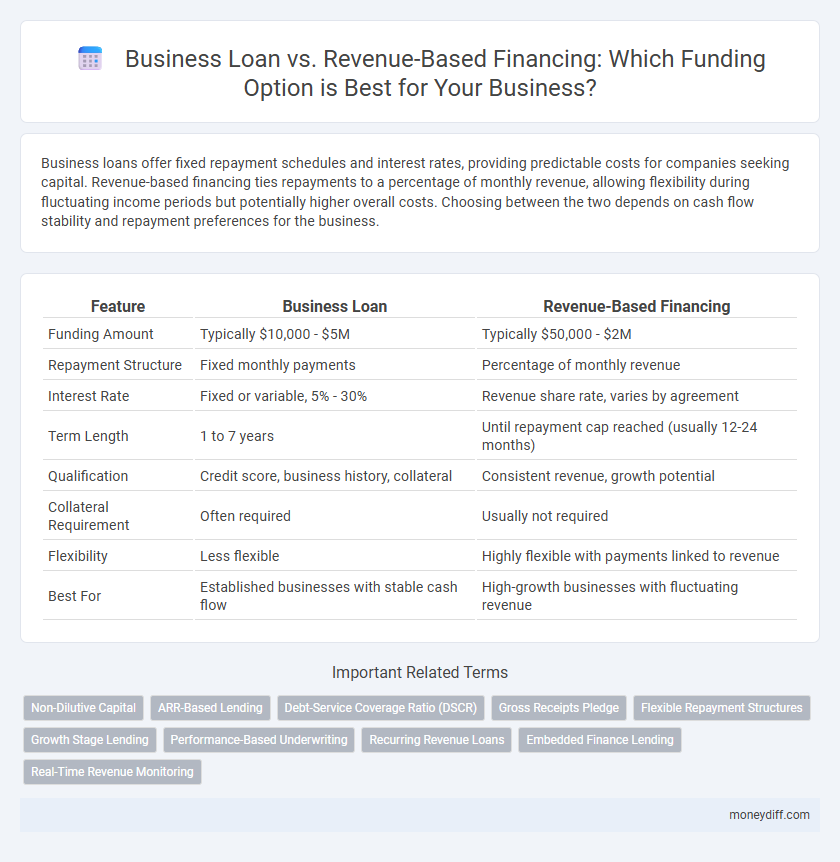

Business loans offer fixed repayment schedules and interest rates, providing predictable costs for companies seeking capital. Revenue-based financing ties repayments to a percentage of monthly revenue, allowing flexibility during fluctuating income periods but potentially higher overall costs. Choosing between the two depends on cash flow stability and repayment preferences for the business.

Table of Comparison

| Feature | Business Loan | Revenue-Based Financing |

|---|---|---|

| Funding Amount | Typically $10,000 - $5M | Typically $50,000 - $2M |

| Repayment Structure | Fixed monthly payments | Percentage of monthly revenue |

| Interest Rate | Fixed or variable, 5% - 30% | Revenue share rate, varies by agreement |

| Term Length | 1 to 7 years | Until repayment cap reached (usually 12-24 months) |

| Qualification | Credit score, business history, collateral | Consistent revenue, growth potential |

| Collateral Requirement | Often required | Usually not required |

| Flexibility | Less flexible | Highly flexible with payments linked to revenue |

| Best For | Established businesses with stable cash flow | High-growth businesses with fluctuating revenue |

Understanding Business Loans: Key Features and Terms

Business loans typically require fixed monthly repayments with set interest rates and defined loan terms, providing predictable cash flow management for companies. Revenue-based financing, by contrast, ties repayments to a percentage of monthly revenue, offering flexible payment schedules that adjust with business performance. Key terms to understand include interest rates, repayment schedules, collateral requirements for business loans, and revenue share percentages and caps for revenue-based financing.

What Is Revenue-Based Financing? A Comprehensive Overview

Revenue-based financing is a funding method where businesses repay lenders through a percentage of their ongoing gross revenues, offering flexibility compared to traditional business loans. Unlike fixed installment loans, repayment amounts fluctuate with the business's income, reducing financial strain during low revenue periods. This model suits companies with consistent revenue streams seeking capital without diluting equity or committing to fixed payments.

How Traditional Business Loans Work for Small Enterprises

Traditional business loans for small enterprises typically require fixed monthly repayments over a predetermined term, with interest rates based on the borrower's creditworthiness and collateral. These loans often involve a thorough application process, including financial statements and credit checks, to assess the risk and repayment capability of the business. Unlike revenue-based financing, traditional loans do not fluctuate with business income, making cash flow management crucial for timely repayment and financial stability.

Comparing Qualification Criteria: Business Loan vs Revenue-Based Financing

Business loans typically require strong credit scores, collateral, and detailed financial statements, emphasizing the borrower's repayment capacity and business stability. Revenue-based financing demands consistent and predictable revenue streams, focusing on the business's monthly or annual revenue rather than credit history or collateral. Entrepreneurs with limited assets or fluctuating income may find revenue-based financing more accessible due to its flexible qualification criteria.

Interest Rates and Repayment Structures: A Side-by-Side Analysis

Business loans typically feature fixed or variable interest rates with structured monthly repayments over a predetermined term, providing predictable cash flow management for companies. Revenue-based financing, however, ties repayment amounts directly to a percentage of monthly revenue, resulting in fluctuating payments that align with business performance and often involve higher effective interest rates due to risk premiums. This comparison highlights that business loans offer consistency in cost, while revenue-based financing provides flexibility in repayment schedules but may lead to greater overall cost depending on revenue variability.

Flexibility and Risk: Which Financing Option Suits Your Business?

Business loans offer structured repayment schedules and fixed interest rates, providing predictability but less flexibility, making them suitable for businesses with steady cash flow. Revenue-based financing adjusts repayments according to a percentage of monthly revenue, offering greater flexibility and reduced risk during revenue fluctuations but can be costlier over time. Choosing between the two depends on your business's cash flow stability, risk tolerance, and funding needs for optimal financial management.

Impact on Cash Flow: Revenue-Based Financing vs Fixed Loan Payments

Revenue-Based Financing adjusts repayment amounts according to fluctuating business revenue, offering flexible cash flow management by aligning payments with income streams. Fixed loan payments require consistent monthly amounts regardless of revenue variability, which can strain cash flow during low-income periods. Businesses with unpredictable cash flow often benefit more from revenue-based financing due to its adaptability and reduced risk of payment default.

Access to Capital: Speed and Convenience Considerations

Business loans typically require extensive documentation and longer approval times, whereas revenue-based financing offers faster access to capital with minimal paperwork. Revenue-based financing repayments are tied directly to revenue performance, providing flexibility for businesses experiencing fluctuating cash flow. This convenience makes revenue-based financing an attractive option for startups and small businesses needing quick funding without rigid repayment schedules.

Costs and Long-Term Implications for Business Owners

Business loans typically involve fixed interest rates and set repayment schedules, which can result in predictable monthly costs but potential strain during low-revenue periods. Revenue-based financing adjusts repayments based on a percentage of monthly revenue, offering flexibility but possibly higher total cost over time if revenues grow. Business owners must weigh the certainty of fixed loan payments against the adaptable, yet potentially more expensive, nature of revenue-based financing to determine long-term financial sustainability.

Choosing the Right Financing Model: Factors to Evaluate

When choosing between a business loan and revenue-based financing, key factors to evaluate include cash flow stability, repayment flexibility, and cost of capital. Business loans typically require fixed monthly payments and may be suitable for companies with predictable income, while revenue-based financing adjusts repayments according to revenue fluctuations, benefiting businesses with variable sales. Assessing creditworthiness, growth projections, and risk tolerance helps determine the most effective financing structure for sustaining business operations and scaling growth.

Related Important Terms

Non-Dilutive Capital

Business loans provide non-dilutive capital by offering fixed repayment terms without equity loss, making them ideal for companies seeking predictable expenses. Revenue-based financing also delivers non-dilutive capital but aligns repayments with a percentage of ongoing revenue, offering flexible cash flow management without sacrificing ownership.

ARR-Based Lending

ARR-based lending offers a flexible alternative to traditional business loans by tying repayments directly to a company's Annual Recurring Revenue, allowing for scalable payment structures that adjust with business performance. Unlike fixed-term business loans with rigid schedules, revenue-based financing minimizes cash flow strain during slower periods, making it ideal for SaaS companies and subscription-based businesses seeking growth capital without diluting equity.

Debt-Service Coverage Ratio (DSCR)

Business loans typically require a Debt-Service Coverage Ratio (DSCR) of at least 1.25 to ensure borrowers generate sufficient cash flow to cover loan payments, while revenue-based financing offers more flexibility by tying repayments directly to a percentage of monthly revenue without strict DSCR thresholds. This makes revenue-based financing attractive for companies with fluctuating cash flows, whereas traditional business loans favor stable, predictable income streams for DSCR compliance.

Gross Receipts Pledge

Business loans typically require a fixed repayment schedule and may involve collateral beyond gross receipts, whereas revenue-based financing uses a gross receipts pledge, linking repayments directly to a percentage of a business's monthly revenue, providing flexibility during fluctuating income periods. The gross receipts pledge in revenue-based financing aligns lender returns with business performance, reducing the risk of default compared to traditional business loan structures.

Flexible Repayment Structures

Business loans typically offer fixed repayment schedules with set interest rates, providing predictable monthly payments but potentially less adaptability to cash flow fluctuations. Revenue-based financing allows repayments as a percentage of monthly revenue, offering dynamic, flexible repayment structures that adjust to business performance and help manage financial variability.

Growth Stage Lending

Business loans typically require fixed repayments and collateral, making them suitable for established companies with steady cash flow, while revenue-based financing offers flexible repayments tied to sales, benefiting growth-stage businesses seeking scalable funding without rigid debt obligations. Growth-stage lending prioritizes cash flow variability, with revenue-based financing adapting to fluctuating revenues, thereby supporting expansion without overwhelming financial strain.

Performance-Based Underwriting

Business loans typically rely on traditional underwriting methods, assessing credit scores and financial statements, while revenue-based financing employs performance-based underwriting by linking loan repayments directly to a company's monthly revenue, providing flexible cash flow management. This approach reduces risk for lenders by aligning loan terms with real-time business performance, favoring companies with fluctuating incomes over fixed repayment schedules.

Recurring Revenue Loans

Recurring revenue loans offer flexible repayment terms tied directly to consistent business income, making them ideal for companies with predictable cash flow. Unlike traditional business loans with fixed payments, revenue-based financing adjusts repayments based on monthly revenue, reducing financial strain during slower periods.

Embedded Finance Lending

Embedded finance lending integrates business loans and revenue-based financing to provide seamless capital access, leveraging real-time data analytics for tailored repayment plans aligned with cash flow patterns. This approach enhances funding flexibility for growing businesses by embedding loan options directly into platforms where financial transactions occur, optimizing borrower experience and risk assessment.

Real-Time Revenue Monitoring

Business loans typically offer fixed repayment schedules based on a lump sum, while revenue-based financing adjusts repayments according to real-time revenue performance, allowing for flexible cash flow management. Real-time revenue monitoring enables lenders and borrowers to dynamically align repayment amounts with actual business income, reducing the risk of default during fluctuating sales periods.

Business Loan vs Revenue-Based Financing for Loan Infographic

moneydiff.com

moneydiff.com