Bank loans offer structured repayment plans, fixed interest rates, and regulatory protections, making them a reliable choice for funding pet expenses. Peer-to-peer lending provides faster access to funds with potentially lower rates and flexible terms, appealing to borrowers who prefer a less traditional process. Comparing both options helps pet owners select the best financing solution based on their credit profile and urgency of need.

Table of Comparison

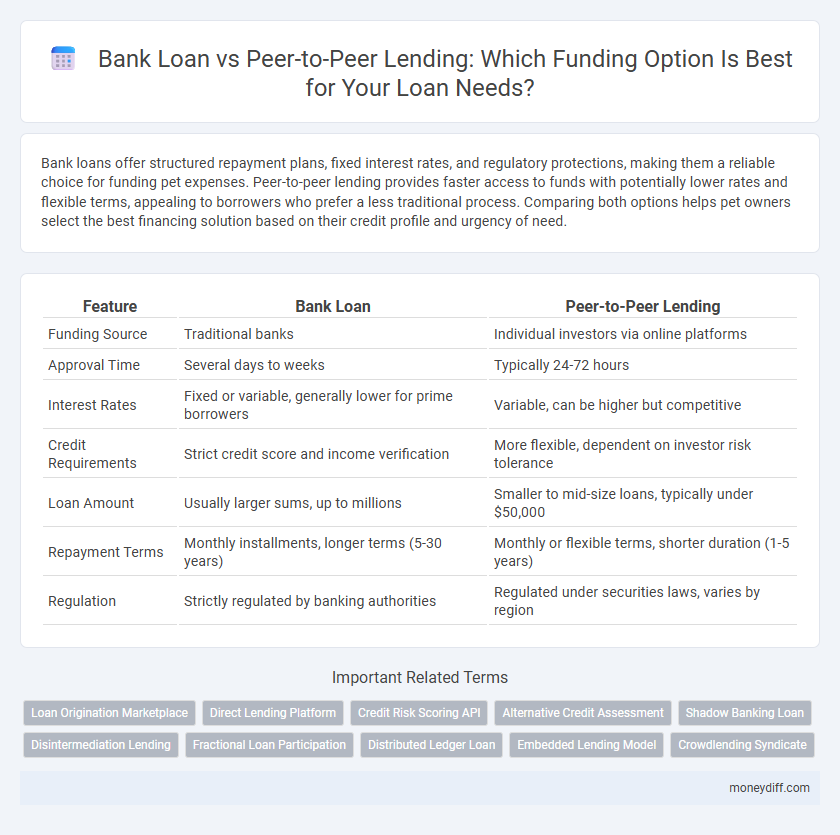

| Feature | Bank Loan | Peer-to-Peer Lending |

|---|---|---|

| Funding Source | Traditional banks | Individual investors via online platforms |

| Approval Time | Several days to weeks | Typically 24-72 hours |

| Interest Rates | Fixed or variable, generally lower for prime borrowers | Variable, can be higher but competitive |

| Credit Requirements | Strict credit score and income verification | More flexible, dependent on investor risk tolerance |

| Loan Amount | Usually larger sums, up to millions | Smaller to mid-size loans, typically under $50,000 |

| Repayment Terms | Monthly installments, longer terms (5-30 years) | Monthly or flexible terms, shorter duration (1-5 years) |

| Regulation | Strictly regulated by banking authorities | Regulated under securities laws, varies by region |

Understanding Bank Loans and Peer-to-Peer Lending

Bank loans typically involve borrowing from a financial institution with fixed interest rates, collateral requirements, and a structured repayment plan, offering reliability and regulatory protection. Peer-to-peer lending connects borrowers directly with individual investors via online platforms, often providing more flexible terms and faster approval but with varied interest rates based on creditworthiness. Understanding the differences in risk, approval process, and cost of capital is essential for selecting the appropriate funding source.

Key Differences Between Bank Loans and P2P Lending

Bank loans typically involve stringent credit assessments, fixed interest rates, and longer approval times, whereas peer-to-peer lending offers faster access to funds with variable rates set by individual investors. Bank loans usually require collateral and have standardized repayment terms, while P2P loans often provide more flexible conditions without the need for traditional collateral. The risk profile differs significantly, with banks mitigating risk through rigorous underwriting, whereas P2P platforms distribute risk across multiple investors.

Application Process: Traditional Banks vs P2P Platforms

Traditional bank loans require extensive documentation, credit checks, and often take several weeks for approval due to stringent underwriting processes. Peer-to-peer lending platforms offer a faster, more streamlined application with minimal paperwork and digital verification, resulting in quicker funding decisions. Borrowers benefit from P2P platforms' user-friendly interfaces and transparent criteria, contrasting with banks' rigid protocols and longer waiting periods.

Interest Rates: Bank Loans vs P2P Options

Bank loans typically offer lower interest rates due to regulated financial structures and established credit assessments, making them more cost-effective for borrowers with strong credit histories. Peer-to-peer lending platforms often present higher interest rates reflecting increased risk and less stringent credit requirements, attracting borrowers with limited access to traditional banking. Comparing effective annual interest rates reveals that bank loans prioritize stability, while P2P lending emphasizes accessibility and flexible funding options.

Eligibility Criteria Compared: Banks vs Peer Lenders

Bank loans often require stringent eligibility criteria, including a high credit score, stable income, and extensive documentation to qualify for funding; these institutions prioritize risk assessment and regulatory compliance. Peer-to-peer lending platforms typically have more flexible eligibility requirements, allowing borrowers with lower credit scores or limited credit history to access loans by connecting directly with individual investors. The difference in criteria affects approval speed and accessibility, with peer lenders often providing faster, more accessible options for underserved borrowers compared to traditional banks.

Speed of Funding: Which is Faster?

Bank loans typically involve a rigorous approval process with extensive documentation and credit checks, resulting in funding timelines that can range from several days to weeks. Peer-to-peer lending platforms offer faster access to funds, often completing approval and disbursement within 24 to 48 hours due to streamlined online processes and automated credit assessments. Speed of funding depends heavily on individual borrower profiles, but peer-to-peer lending generally provides quicker turnaround compared to traditional bank loans.

Flexibility and Customization in Loan Terms

Bank loans typically offer less flexibility in repayment schedules and interest rates, as terms are standardized to meet regulatory requirements. Peer-to-peer lending platforms provide more customizable loan options, allowing borrowers to negotiate terms directly with individual investors. This flexibility can better accommodate unique financial situations and cash flow variations.

Risk Factors: Security and Borrower Protection

Bank loans typically offer higher security due to strict regulatory oversight and established borrower protection measures, including credit checks and legal recourse. Peer-to-peer lending exposes investors to greater risk because it operates with less stringent regulations and limited borrower verification, increasing the possibility of default. Collateral requirements and clear contract terms in bank loans further mitigate potential losses, unlike the more variable protections found in peer-to-peer platforms.

Costs and Fees Associated with Each Option

Bank loans often involve origination fees, monthly interest payments, and potential penalties for early repayment, with interest rates typically influenced by the borrower's credit score and financial history. Peer-to-peer lending platforms generally charge lower upfront fees and offer competitive interest rates based on borrower risk profiles, but may include platform service fees and higher rates for riskier borrowers. Comparing total borrowing costs requires analyzing annual percentage rates (APR), fees, and loan terms specific to each financing method.

Suitability: Which Funding Option Fits Your Needs?

Bank loans suit businesses seeking substantial capital with structured repayment terms and established credit histories, offering predictable interest rates and longer durations. Peer-to-peer lending fits startups or borrowers with less traditional credit profiles, providing flexible funding through individual investors often at competitive rates. Evaluating cash flow stability, creditworthiness, and funding speed determines which option aligns best with your financial needs.

Related Important Terms

Loan Origination Marketplace

Loan origination marketplaces streamline access to both bank loans and peer-to-peer lending by connecting borrowers with multiple funding sources through a single platform. These marketplaces enhance transparency, speed approval processes, and often provide competitive interest rates by leveraging digital underwriting and broad lender networks.

Direct Lending Platform

Direct lending platforms in peer-to-peer lending connect borrowers with individual investors, often offering faster approval and lower interest rates compared to traditional bank loans. While banks provide structured loan products with strict credit requirements, peer-to-peer platforms prioritize accessibility and transparency, enabling borrowers to secure funding without extensive collateral.

Credit Risk Scoring API

Bank loans rely heavily on traditional credit risk scoring APIs that analyze extensive financial histories and credit scores to assess borrower reliability, offering lenders robust risk evaluation frameworks. Peer-to-peer lending platforms utilize advanced, often AI-driven credit risk scoring APIs that integrate alternative data sources like social behavior and transaction patterns to provide more flexible and real-time risk assessments.

Alternative Credit Assessment

Peer-to-peer lending uses alternative credit assessment methods such as social media analysis, transaction history, and behavioral data to evaluate borrower risk, unlike traditional bank loans that rely heavily on credit scores and financial statements. This innovative approach broadens access to funding for borrowers with limited credit history or unconventional financial backgrounds.

Shadow Banking Loan

Shadow banking loans operate outside traditional regulatory frameworks, offering faster access to funds compared to conventional bank loans but often at higher interest rates and increased risk. Peer-to-peer lending, a key component of shadow banking, connects borrowers directly with individual lenders, bypassing banks and providing alternative funding options with flexible terms.

Disintermediation Lending

Bank loans involve traditional financial institutions acting as intermediaries between borrowers and lenders, while peer-to-peer lending eliminates this intermediary by directly connecting individuals seeking funds with investors through online platforms. Disintermediation lending reduces transaction costs, accelerates funding processes, and often offers more flexible terms compared to conventional bank loans.

Fractional Loan Participation

Fractional Loan Participation enables multiple investors to share risk by purchasing portions of a single bank loan, offering greater liquidity and diversification compared to traditional bank loans. Peer-to-peer lending platforms facilitate direct fractional investments from individual lenders, streamlining access to funding and bypassing institutional intermediaries.

Distributed Ledger Loan

Distributed ledger loan platforms leverage blockchain technology to offer transparent, secure peer-to-peer lending alternatives that reduce dependency on traditional bank loans by enabling direct interaction between borrowers and investors. This decentralized approach enhances trust, lowers transaction costs, and accelerates funding processes compared to conventional banking systems.

Embedded Lending Model

The embedded lending model integrates bank loans directly into digital platforms, enabling seamless access to traditional financing with established risk assessment methods, while peer-to-peer lending relies on decentralized online marketplaces connecting individual investors and borrowers with potentially faster approval but higher risk variability. This model enhances user experience by embedding loan options within non-financial apps, leveraging banks' regulatory compliance and credit expertise, contrasting with peer-to-peer's emphasis on community-driven funding and often higher-interest rates.

Crowdlending Syndicate

Crowdlending syndicates aggregate multiple investors to fund peer-to-peer loans, offering diversified risk and potentially lower interest rates compared to traditional bank loans. Unlike bank loans that require strict credit assessments and collateral, crowdlending syndicates provide faster access to capital with flexible terms, leveraging collective investor capital for small to medium-sized business financing.

Bank loan vs Peer-to-peer lending for funding. Infographic

moneydiff.com

moneydiff.com