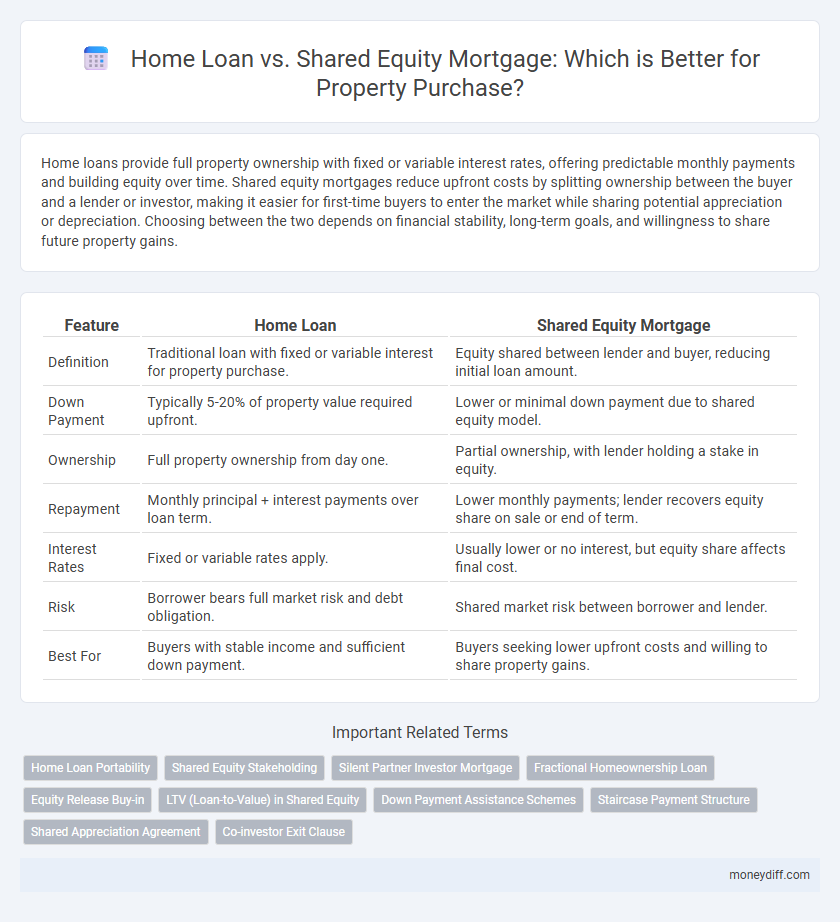

Home loans provide full property ownership with fixed or variable interest rates, offering predictable monthly payments and building equity over time. Shared equity mortgages reduce upfront costs by splitting ownership between the buyer and a lender or investor, making it easier for first-time buyers to enter the market while sharing potential appreciation or depreciation. Choosing between the two depends on financial stability, long-term goals, and willingness to share future property gains.

Table of Comparison

| Feature | Home Loan | Shared Equity Mortgage |

|---|---|---|

| Definition | Traditional loan with fixed or variable interest for property purchase. | Equity shared between lender and buyer, reducing initial loan amount. |

| Down Payment | Typically 5-20% of property value required upfront. | Lower or minimal down payment due to shared equity model. |

| Ownership | Full property ownership from day one. | Partial ownership, with lender holding a stake in equity. |

| Repayment | Monthly principal + interest payments over loan term. | Lower monthly payments; lender recovers equity share on sale or end of term. |

| Interest Rates | Fixed or variable rates apply. | Usually lower or no interest, but equity share affects final cost. |

| Risk | Borrower bears full market risk and debt obligation. | Shared market risk between borrower and lender. |

| Best For | Buyers with stable income and sufficient down payment. | Buyers seeking lower upfront costs and willing to share property gains. |

Understanding Home Loans: Basics and Benefits

Home loans typically offer fixed or variable interest rates, allowing borrowers to repay the mortgage over a set term while building equity in the property. Benefits include predictable monthly payments, potential tax deductions on mortgage interest, and complete ownership once the loan is paid off. Understanding key terms like principal, interest, amortization, and loan-to-value ratio helps borrowers make informed decisions when choosing the best financing option for property purchase.

What is a Shared Equity Mortgage?

A Shared Equity Mortgage allows homebuyers to purchase a property with a reduced loan amount by sharing ownership or future property appreciation with an investor or government entity. This type of mortgage differs from a traditional home loan by requiring the borrower to repay the loan plus a percentage of the property's value increase upon sale or after a set term. Shared Equity Mortgages can lower initial monthly payments and reduce barriers to entry for homeownership, especially in high-priced real estate markets.

Key Differences Between Home Loans and Shared Equity Mortgages

Home loans require borrowers to repay the full loan amount with interest over a fixed term, providing full ownership from the outset. Shared equity mortgages involve an investor or lender owning a percentage of the property, reducing initial borrowing costs but sharing future property appreciation or loss. While home loans offer predictable monthly payments, shared equity mortgages tie repayment amounts to the property's market value at sale or refinancing.

Eligibility Criteria for Home Loans vs Shared Equity Mortgages

Home loan eligibility criteria typically require a steady income, good credit score, and sufficient debt-to-income ratio to ensure repayment capability. Shared equity mortgages often have more flexible credit requirements but demand owner-occupancy and may limit eligibility to first-time homebuyers or specific income brackets. Lenders for home loans rely heavily on financial documentation, while shared equity schemes assess applicant eligibility based on partnership terms with the equity provider.

Upfront Costs: Comparing Down Payments and Fees

Home loans generally require a higher down payment, typically ranging from 5% to 20% of the property's purchase price, along with origination and appraisal fees that can increase upfront costs. Shared equity mortgages often feature lower initial payments since the lender or investor shares ownership, reducing the down payment burden but may involve legal fees and valuation costs tied to the shared equity agreement. Evaluating these upfront expenses is critical for buyers aiming to manage cash flow during property purchase.

Monthly Payments: Loan Repayment vs Shared Ownership

Home loan monthly payments consist of principal and interest, often resulting in higher fixed monthly costs based on the full property value and interest rate. Shared equity mortgage payments are lower since borrowers pay interest only on the lender's share, reducing monthly financial obligations. This structure makes shared ownership a more affordable option for buyers seeking lower monthly repayments while sharing property equity with the lender.

Long-Term Financial Implications

Choosing between a home loan and a shared equity mortgage significantly impacts long-term financial outcomes. A traditional home loan requires full repayment with interest, increasing overall debt burden but allowing full property ownership and potential appreciation benefits. Shared equity mortgages reduce upfront costs by involving an investor who shares property appreciation or depreciation, potentially lowering monthly payments but also limiting future equity gains.

Impact on Property Ownership and Equity Growth

A home loan provides full ownership of the property and allows borrowers to build complete equity over time through principal repayments and property appreciation. In contrast, a shared equity mortgage involves co-ownership with an investor or institution, reducing the borrower's initial capital outlay but limiting equity growth as gains or losses are shared proportionally. Understanding the difference in equity accumulation and ownership rights is crucial when choosing between these financing options for property investment.

Flexibility and Exit Strategies

Home loans offer predictable fixed or variable interest rates with structured repayment schedules, allowing homeowners to fully own their property once the mortgage is paid off, providing straightforward exit strategies. Shared equity mortgages provide greater flexibility in initial payments and reduce loan amounts by sharing property ownership with an investor, but exit strategies can be complex as they require refinancing or buying out the investor's equity stake. Borrowers prioritize home loans for long-term stability and clear ownership, while shared equity suits those seeking lower upfront costs with potentially shared appreciation risks and benefits.

Which Option is Best for Different Buyer Profiles?

Home loans suit buyers with stable income and strong credit, offering full property ownership and potential tax benefits. Shared equity mortgages benefit first-time buyers or those with limited savings by reducing initial costs while sharing property value appreciation with an investor. Evaluating financial stability, ownership goals, and willingness to share equity helps determine the best option for each buyer profile.

Related Important Terms

Home Loan Portability

Home loan portability allows borrowers to transfer their existing loan balance and terms to a new property without incurring penalties, offering flexibility during relocation or property upgrades. Shared equity mortgages typically lack portability features, as they involve shared ownership with an investor, limiting the borrower's ability to easily move or refinance the loan.

Shared Equity Stakeholding

Shared Equity Stakeholding allows buyers to purchase property by partnering with investors who provide part of the home's value in exchange for a share of future appreciation, reducing the initial loan amount and monthly repayments. Unlike traditional home loans that require full principal repayment with interest, shared equity mortgages align lender and buyer interests by sharing property risks and rewards.

Silent Partner Investor Mortgage

A Silent Partner Investor Mortgage allows homeowners to access equity without monthly repayments by partnering with investors who share future property appreciation. This approach differs from traditional home loans by reducing borrower debt burden while enabling investors to earn returns based on property value increases.

Fractional Homeownership Loan

Fractional Homeownership Loans, also known as shared equity mortgages, enable buyers to purchase a portion of a property while sharing future appreciation or depreciation with an investor, reducing initial down payment and monthly payments compared to traditional home loans. This structure provides greater affordability and access to property ownership by splitting equity and risks, making it ideal for first-time buyers or those with limited capital.

Equity Release Buy-in

Home loans provide full ownership through traditional financing with fixed or variable interest rates, while shared equity mortgages involve partial property ownership where buyers co-invest with lenders or investors, enabling equity release buy-in by reducing upfront costs. This shared equity approach increases accessibility for buyers by leveraging the co-investor's capital, but requires sharing future property appreciation and potential resale proceeds.

LTV (Loan-to-Value) in Shared Equity

Shared Equity Mortgages typically offer lower Loan-to-Value (LTV) ratios compared to traditional Home Loans, often ranging between 50% to 70%, as lenders share ownership risk with buyers. This reduced LTV requirement enables buyers to access property with smaller upfront mortgages while co-investing equity with the lender or a third party.

Down Payment Assistance Schemes

Home Loan options typically require a substantial down payment, often 20% of the property price, posing a barrier for many buyers. Shared Equity Mortgage programs reduce upfront costs by partnering with government or private investors who contribute to the down payment in exchange for a share of future property appreciation, effectively easing entry into homeownership through targeted Down Payment Assistance Schemes.

Staircase Payment Structure

Home loans typically require fixed monthly repayments based on the full loan amount, offering predictable cash flow, while shared equity mortgages use a staircase payment structure allowing gradual increases in property ownership through scheduled repayments. This staircase approach reduces initial payment burden and aligns equity growth with the borrower's financial capacity over time.

Shared Appreciation Agreement

A Shared Appreciation Agreement (SAA) offers a unique home financing option where the lender shares in the property's future value increase instead of charging traditional interest, often making it more affordable than a standard home loan. This model reduces upfront payments and monthly costs but requires homeowners to share a portion of the home's appreciation upon sale or refinancing, aligning lender and borrower interests in property value growth.

Co-investor Exit Clause

A Home Loan typically requires full repayment upon sale or refinance, whereas a Shared Equity Mortgage includes a co-investor exit clause that allows the investor to sell their stake independently, often subject to specific notice periods and valuation methods. This clause provides flexibility in managing ownership shares and can impact the timing and financial outcomes of property sales.

Home Loan vs Shared Equity Mortgage for property purchase Infographic

moneydiff.com

moneydiff.com