Business loans offer startups a fixed repayment schedule with predictable monthly payments, providing financial stability and clear budgeting. Revenue-based financing adjusts repayments according to the company's monthly revenue, allowing flexibility during fluctuating income periods but potentially leading to higher total costs. Choosing between the two depends on the startup's cash flow consistency and willingness to trade fixed payments for adaptable repayment terms.

Table of Comparison

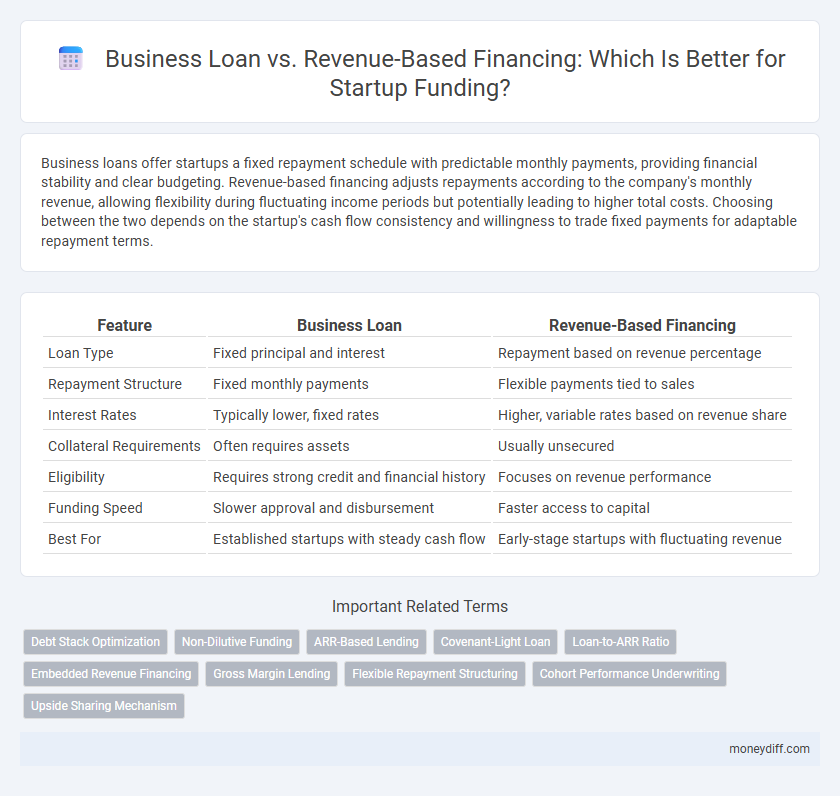

| Feature | Business Loan | Revenue-Based Financing |

|---|---|---|

| Loan Type | Fixed principal and interest | Repayment based on revenue percentage |

| Repayment Structure | Fixed monthly payments | Flexible payments tied to sales |

| Interest Rates | Typically lower, fixed rates | Higher, variable rates based on revenue share |

| Collateral Requirements | Often requires assets | Usually unsecured |

| Eligibility | Requires strong credit and financial history | Focuses on revenue performance |

| Funding Speed | Slower approval and disbursement | Faster access to capital |

| Best For | Established startups with steady cash flow | Early-stage startups with fluctuating revenue |

Understanding Business Loans: Traditional Funding Explained

Business loans offer startups a fixed amount of capital with predetermined repayment schedules and interest rates, typically requiring collateral and a solid credit history for approval. These loans provide predictable monthly payments, allowing startups to plan cash flow effectively while retaining full ownership and control of their business. Lenders assess creditworthiness, business plans, and financial statements to mitigate risk, making business loans a reliable but sometimes less flexible financing option compared to revenue-based financing.

What is Revenue-Based Financing?

Revenue-based financing is a flexible funding option where startups repay investors through a fixed percentage of their ongoing gross revenues until a predetermined amount is fully paid. Unlike traditional business loans that require fixed monthly payments and collateral, revenue-based financing adjusts repayment based on the company's revenue performance, reducing financial strain during slower periods. This model aligns investor returns with the startup's success and cash flow, making it suitable for companies with fluctuating or seasonal income.

Key Differences: Business Loans vs Revenue-Based Financing

Business loans provide a fixed principal amount with structured monthly repayments and often require collateral, making them suitable for startups with predictable cash flow and credit history. Revenue-based financing offers flexible repayments tied to a percentage of monthly revenue, aligning payment obligations with business performance but typically comes with higher overall costs. Key differences lie in repayment structure, risk allocation, eligibility criteria, and impact on startup cash flow management.

Eligibility Criteria for Startups

Startups seeking funding must consider eligibility criteria that vary between business loans and revenue-based financing. Traditional business loans often require strong credit scores, collateral, and a proven financial history, making them less accessible to early-stage startups. Revenue-based financing offers more flexible eligibility by focusing on consistent revenue streams and business growth potential, allowing startups with limited credit history to qualify more easily.

Repayment Structures Compared

Business loans typically require fixed monthly repayments with a set interest rate and term, providing predictable cash flow management for startups. Revenue-based financing adjusts repayments according to a percentage of monthly revenue, offering flexibility during fluctuating income periods but potentially higher overall costs. Startups must weigh the stability of fixed payments against the adaptability of revenue-share models to align with their financial projections and growth trajectory.

Impact on Cash Flow and Operations

Business loans typically require fixed monthly payments that can strain a startup's cash flow, especially during slower revenue periods, potentially limiting operational flexibility. Revenue-based financing adjusts repayments based on a percentage of monthly revenue, allowing startups to better align cash outflows with actual income and maintain smoother operations. This dynamic repayment model reduces financial pressure during low-revenue months and supports continuous operational scalability.

Costs and Interest Rates: Which Is More Affordable?

Business loans typically offer fixed interest rates ranging between 6% and 13%, making monthly payments predictable but requiring solid credit history and collateral. Revenue-based financing costs fluctuate based on a percentage of monthly revenue, often between 2% and 10%, providing flexibility but potentially resulting in higher overall payments during high-revenue periods. Startups prioritizing affordability should evaluate their cash flow stability and long-term costs to determine whether fixed-rate business loans or variable revenue-based financing better aligns with their financial projections.

Pros and Cons: Business Loans

Business loans offer startups fixed interest rates and predictable repayment schedules, providing financial stability and easier cash flow management. However, they often require collateral and a strong credit history, which may limit accessibility for early-stage startups. Rigid repayment terms can strain startup resources, especially during periods of fluctuating revenue.

Pros and Cons: Revenue-Based Financing

Revenue-Based Financing (RBF) offers startups flexible repayment tied to monthly revenue, avoiding fixed loan payments and preserving cash flow during slow periods. However, this model often results in higher overall costs compared to traditional business loans, as payments can extend until a multiple of the financed amount is repaid. RBF also limits predictability in financial planning due to fluctuating payments aligned with revenue performance.

Choosing the Right Funding Option for Your Startup

Business loans provide startups with fixed repayment schedules and predictable interest rates, ideal for companies with steady cash flow and strong credit history. Revenue-based financing adjusts repayment amounts according to monthly revenue, offering flexibility without requiring fixed collateral, which benefits startups with fluctuating income streams. Evaluating your startup's cash flow stability, repayment capacity, and growth projections helps determine whether traditional business loans or revenue-based financing aligns best with your funding needs.

Related Important Terms

Debt Stack Optimization

Business loans offer fixed repayment schedules and interest rates ideal for startups seeking predictable debt servicing, while revenue-based financing adjusts repayments based on sales performance, enhancing cash flow flexibility. Optimizing the debt stack involves balancing these options to maintain manageable debt levels and align repayment terms with business revenue cycles.

Non-Dilutive Funding

Business loans offer startups fixed repayment terms and predictable interest rates, making them a traditional non-dilutive funding option with clear financial obligations. Revenue-based financing provides flexible repayments tied to monthly revenue, enabling startups to access non-dilutive capital without equity loss, ideal for businesses with variable cash flow.

ARR-Based Lending

ARR-based lending offers startups a flexible alternative to traditional business loans by leveraging Annual Recurring Revenue (ARR) as a key metric for loan eligibility and repayment terms. This approach aligns repayment schedules with revenue performance, reducing the risk of cash flow strain compared to fixed installment business loans.

Covenant-Light Loan

Covenant-light loans offer startups more flexibility by minimizing restrictive financial covenants compared to traditional business loans, enabling easier access to capital without stringent compliance burdens. Revenue-based financing provides repayment tied to monthly revenue, reducing fixed obligations but often carrying higher overall costs and less predictability than covenant-light business loans.

Loan-to-ARR Ratio

Business loans typically require a strict Loan-to-Annual Recurring Revenue (ARR) ratio, often capping at 1x to 2x ARR to ensure repayment ability, while revenue-based financing offers more flexibility by tying repayments directly to a percentage of monthly revenue without fixed installment constraints. Startups with unpredictable cash flow may benefit from revenue-based financing, as it aligns loan repayments with revenue fluctuations, reducing the risk of default compared to traditional business loans that demand consistent debt service coverage based on the Loan-to-ARR ratio.

Embedded Revenue Financing

Embedded Revenue Financing offers startups a flexible alternative to traditional business loans by linking repayments directly to revenue streams, reducing pressure during low-income periods. This approach enhances cash flow management and aligns lender returns with business performance, making it ideal for early-stage companies with variable earnings.

Gross Margin Lending

Gross Margin Lending offers startups a flexible financing option by advancing capital based on a percentage of future gross margin, contrasting with traditional business loans that require fixed repayments regardless of revenue fluctuations. This revenue-based financing method aligns repayment schedules with cash flow, reducing financial strain during growth phases and allowing startups to scale sustainably.

Flexible Repayment Structuring

Business loans typically require fixed monthly repayments regardless of revenue fluctuations, while revenue-based financing offers flexible repayment structures directly tied to a startup's actual earnings, allowing payments to scale with cash flow and ease financial strain during slower periods. This adaptability makes revenue-based financing a preferable option for startups seeking to align debt obligations with unpredictable revenue cycles and maintain operational liquidity.

Cohort Performance Underwriting

Cohort performance underwriting enables startups to secure funding by analyzing specific business metrics such as customer retention and revenue growth trends rather than relying solely on credit scores seen in traditional business loans. Revenue-based financing aligns repayment with a startup's cash flow, offering flexibility but often at higher cost, while conventional business loans provide fixed terms with potentially lower interest rates depending on the startup's creditworthiness and financial history evaluated through cohort data.

Upside Sharing Mechanism

Revenue-based financing offers startups an upside sharing mechanism where lenders receive a percentage of future revenue until a predetermined return is met, aligning investor interests with business growth. Business loans typically involve fixed repayments without profit sharing, providing predictable costs but less flexibility tied to revenue performance.

Business Loan vs Revenue-Based Financing for startups. Infographic

moneydiff.com

moneydiff.com