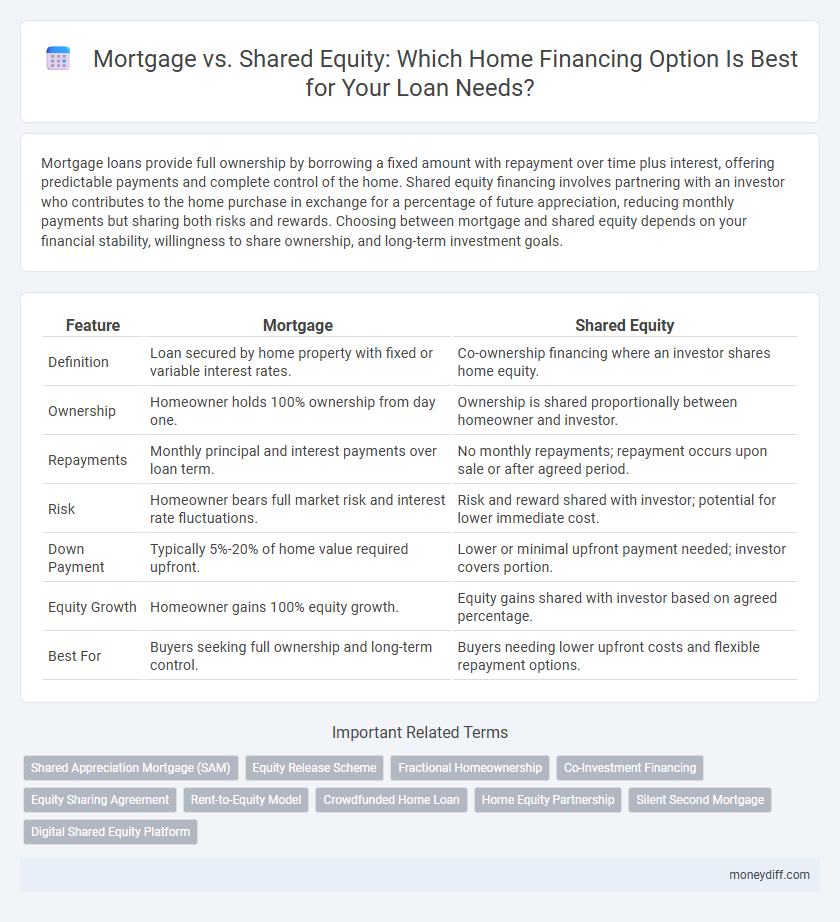

Mortgage loans provide full ownership by borrowing a fixed amount with repayment over time plus interest, offering predictable payments and complete control of the home. Shared equity financing involves partnering with an investor who contributes to the home purchase in exchange for a percentage of future appreciation, reducing monthly payments but sharing both risks and rewards. Choosing between mortgage and shared equity depends on your financial stability, willingness to share ownership, and long-term investment goals.

Table of Comparison

| Feature | Mortgage | Shared Equity |

|---|---|---|

| Definition | Loan secured by home property with fixed or variable interest rates. | Co-ownership financing where an investor shares home equity. |

| Ownership | Homeowner holds 100% ownership from day one. | Ownership is shared proportionally between homeowner and investor. |

| Repayments | Monthly principal and interest payments over loan term. | No monthly repayments; repayment occurs upon sale or after agreed period. |

| Risk | Homeowner bears full market risk and interest rate fluctuations. | Risk and reward shared with investor; potential for lower immediate cost. |

| Down Payment | Typically 5%-20% of home value required upfront. | Lower or minimal upfront payment needed; investor covers portion. |

| Equity Growth | Homeowner gains 100% equity growth. | Equity gains shared with investor based on agreed percentage. |

| Best For | Buyers seeking full ownership and long-term control. | Buyers needing lower upfront costs and flexible repayment options. |

Understanding Mortgage and Shared Equity: Key Differences

Mortgage loans require borrowers to repay the full loan amount with interest over a fixed term, providing full ownership of the property once paid off. Shared equity agreements involve a lender or investor sharing ownership of the home, reducing the borrower's upfront costs but requiring a portion of future home value appreciation. Understanding these differences helps homeowners choose between full repayment responsibility or shared financial risk and reward.

How Mortgages Work for Home Financing

Mortgages for home financing involve borrowing a specific loan amount secured by the property, requiring monthly principal and interest payments over a set term, typically 15 to 30 years. Interest rates can be fixed or variable, impacting the total repayment cost and monthly affordability. Lenders assess credit scores, debt-to-income ratios, and property value to determine eligibility and loan terms.

What Is Shared Equity in Property Purchase?

Shared equity in property purchase involves a homeowner partnering with an investor or housing provider who contributes a portion of the property's purchase price in exchange for a share of the property's future appreciation. This financing model reduces the initial mortgage amount, lowering monthly repayments and easing affordability challenges. Unlike traditional mortgages, shared equity arrangements balance risk and rewards between the homeowner and the investor, making homeownership more accessible.

Pros and Cons of Traditional Mortgages

Traditional mortgages offer fixed or variable interest rates allowing homeowners predictable monthly payments and full ownership once the loan is repaid. Downsides include strict qualification criteria, higher monthly obligations, and potential foreclosure risk if payments are missed. Borrowers benefit from building equity over time but face challenges like upfront costs and long-term debt commitments.

Shared Equity: Benefits and Drawbacks

Shared equity financing allows homebuyers to partner with investors or government programs, reducing initial mortgage payments and lowering down payment requirements. This arrangement offers financial flexibility and risk-sharing but can limit homeowners' equity growth and may require sharing a portion of future property value appreciation. Understanding these benefits and drawbacks is crucial when comparing shared equity with traditional mortgage loans for homeownership.

Financial Requirements: Mortgage vs Shared Equity

Mortgage financing typically requires a substantial down payment, proof of steady income, and a good credit score to qualify for competitive interest rates. Shared equity agreements often have lower upfront financial requirements since the investor contributes part of the home's purchase price, reducing the borrower's initial capital outlay. However, homeowners must consider ongoing equity repayment terms and potential profit-sharing from future property appreciation.

Impact on Homeownership and Equity Accumulation

Mortgage loans provide full ownership with monthly payments that build equity directly, enabling homeowners to benefit from property appreciation and leverage tax deductions on interest. Shared equity arrangements reduce upfront costs by partnering with an investor, but equity accumulation is shared, limiting individual financial gains and complicating resale decisions. Choosing between these financing options significantly affects long-term wealth building and control over the property.

Eligibility Criteria: Which Option Suits You?

Mortgage eligibility typically requires a stable income, good credit score, and a down payment around 20%, suiting those with consistent financial history and sufficient savings. Shared equity programs often target first-time homebuyers or low-to-moderate income earners, requiring less upfront cash but shared ownership with an investor or government entity. Evaluating personal financial stability and long-term goals helps determine if traditional mortgage financing or shared equity aligns better with your homeownership plans.

Repayment Structures: Monthly Payments vs Profit Sharing

Mortgage repayment structures involve fixed monthly payments over a set loan term, providing predictable budgeting and gradual equity build-up. Shared equity agreements replace monthly repayments with profit sharing, where repayment occurs through a percentage of the home's appreciation upon sale or refinancing, aligning costs with property value growth. Homebuyers seeking stable cash flow may prefer mortgages, while those willing to share future equity gains might opt for shared equity financing.

Choosing the Best Fit: Mortgage or Shared Equity for Your Goals

Evaluating mortgage loans versus shared equity arrangements depends on your financial goals, risk tolerance, and homeownership timeline. Mortgages provide full ownership with fixed or variable interest rates and tax-deductible payments, ideal for long-term stability and equity building. Shared equity agreements offer reduced upfront costs and shared appreciation but require profit sharing upon sale, better suited for buyers needing lower entry barriers or flexible financial strategies.

Related Important Terms

Shared Appreciation Mortgage (SAM)

Shared Appreciation Mortgage (SAM) allows borrowers to access lower initial interest rates by agreeing to share a portion of the property's appreciation with the lender upon sale or refinancing, contrasting with traditional mortgage loans that have fixed or variable interest rates and full ownership equity retention. SAM offers a strategic option for homeowners seeking to minimize monthly payments while leveraging potential home value gains with partnering investors.

Equity Release Scheme

Mortgage loans offer full property ownership with fixed or variable interest rates, requiring monthly repayments based on the loan amount and term, while Shared Equity schemes provide partial home financing by sharing property ownership with investors or lenders, reducing initial borrowing costs. Equity Release Schemes enable homeowners aged 55 and over to access home equity as tax-free cash or lump sum without monthly repayments, though they reduce the inheritable estate value and may affect future mortgage options.

Fractional Homeownership

Fractional homeownership allows buyers to purchase a percentage of a property, reducing upfront mortgage debt and monthly payments compared to traditional full mortgages, while shared equity agreements split home appreciation with investors. This financing model benefits homeowners seeking lower entry costs and flexible repayment options without assuming full loan liabilities.

Co-Investment Financing

Co-investment financing through shared equity allows homebuyers to partner with investors, reducing the initial mortgage burden and enhancing affordability by splitting ownership equity. Unlike traditional mortgages that require full loan repayment with interest, shared equity agreements align repayment with property value changes, offering flexible exit strategies and potentially lower monthly costs.

Equity Sharing Agreement

Equity Sharing Agreements enable co-owners to finance a home by splitting ownership stakes, reducing upfront mortgage costs while sharing future property appreciation or depreciation. This alternative to traditional mortgages balances lower monthly payments with shared risks and benefits tied to the property's market value fluctuations.

Rent-to-Equity Model

The rent-to-equity model allows homebuyers to accumulate equity through monthly rent payments that partially contribute to ownership, differing from traditional mortgage loans requiring upfront down payments and full credit qualification. Shared equity agreements reduce financial burden by partnering with investors who share in property appreciation, offering an alternative path to homeownership compared to standard mortgage structures.

Crowdfunded Home Loan

Crowdfunded home loans leverage collective investment to provide mortgage alternatives, reducing reliance on traditional lenders and potentially lowering interest rates. Shared equity agreements in crowdfunded financing allow investors and homeowners to share property appreciation, aligning financial incentives and spreading risk more effectively.

Home Equity Partnership

Home Equity Partnership offers a flexible alternative to traditional mortgage loans by allowing homeowners to share property equity with investors in exchange for partial home ownership, reducing monthly payments and the need for large down payments. Unlike a mortgage, this shared equity model aligns investor returns with property value appreciation, providing risk mitigation for borrowers and potential profit for equity partners.

Silent Second Mortgage

Silent second mortgages provide a zero or low-interest secondary loan that complements the primary mortgage without monthly payments, allowing homeowners to access additional funds for down payments or renovations. This option contrasts with shared equity financing, where lenders receive a percentage of future home appreciation instead of direct loan repayment.

Digital Shared Equity Platform

Digital Shared Equity Platforms offer a modern alternative to traditional mortgages by allowing homeowners to access funding without increasing monthly debt obligations, leveraging technology to simplify equity sharing agreements. These platforms provide transparent, flexible financing options that align investor returns with home value appreciation, reducing risks associated with conventional mortgage interest rates and loan terms.

Mortgage vs Shared equity for home financing. Infographic

moneydiff.com

moneydiff.com