Installment loans require fixed, regular payments over a set period, providing predictable repayment schedules and clear timelines for loan payoff. Revenue-based financing adjusts repayments according to the borrower's revenue, allowing flexible payments that fluctuate with business performance and reduce pressure during slower periods. Choosing between these options depends on cash flow stability, with installment loans offering certainty and revenue-based financing providing adaptability for variable incomes.

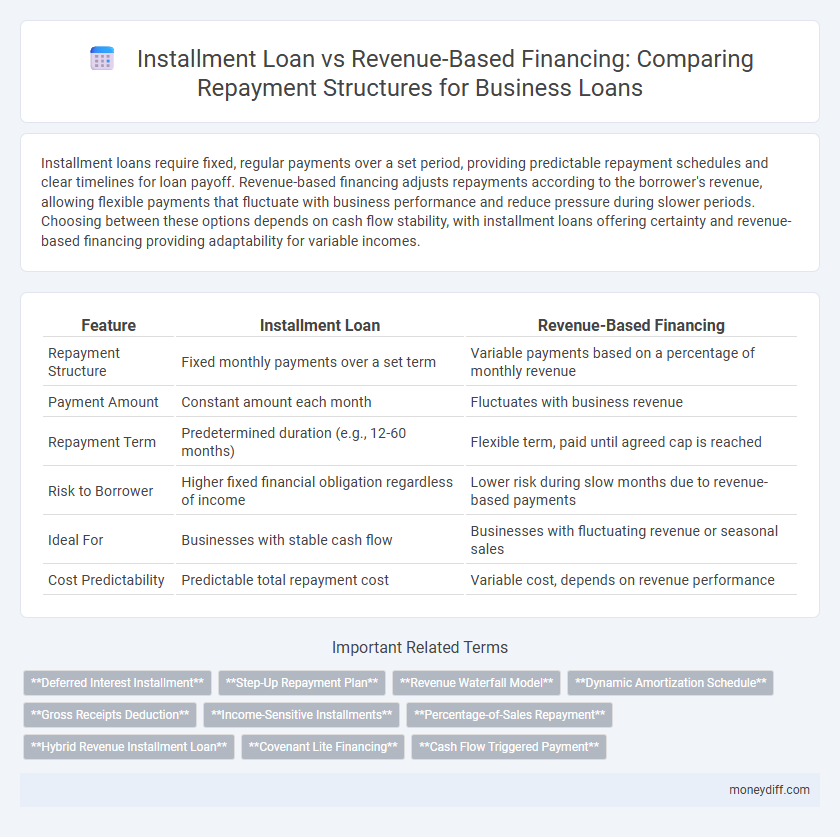

Table of Comparison

| Feature | Installment Loan | Revenue-Based Financing |

|---|---|---|

| Repayment Structure | Fixed monthly payments over a set term | Variable payments based on a percentage of monthly revenue |

| Payment Amount | Constant amount each month | Fluctuates with business revenue |

| Repayment Term | Predetermined duration (e.g., 12-60 months) | Flexible term, paid until agreed cap is reached |

| Risk to Borrower | Higher fixed financial obligation regardless of income | Lower risk during slow months due to revenue-based payments |

| Ideal For | Businesses with stable cash flow | Businesses with fluctuating revenue or seasonal sales |

| Cost Predictability | Predictable total repayment cost | Variable cost, depends on revenue performance |

Key Differences Between Installment Loans and Revenue-Based Financing

Installment loans require fixed monthly payments over a predetermined term, providing predictable repayment schedules and interest rates, ideal for businesses with steady cash flow. Revenue-based financing ties repayments to a percentage of monthly revenue, offering flexibility and aligning payments with business performance but potentially leading to variable payment amounts and longer repayment periods. Choosing between these depends on cash flow stability, repayment predictability, and the business's ability to handle variable versus fixed repayment obligations.

How Repayment Structures Impact Cash Flow

Installment loans require fixed monthly payments over a set term, providing predictable cash flow but increasing pressure during low-revenue periods. Revenue-based financing adjusts repayment amounts according to a percentage of monthly revenue, aligning payments with business performance and easing cash flow volatility. Choosing the right structure depends on balancing repayment certainty with flexibility to maintain healthy operational cash flow.

Understanding Installment Loan Repayment Schedules

Installment loan repayment schedules consist of fixed payments made at regular intervals, typically monthly, combining principal and interest to ensure full repayment by the end of the loan term. These predictable payments aid borrowers in budgeting and planning cash flow effectively. Unlike revenue-based financing which fluctuates with business income, installment loans provide stable, time-bound obligations that enhance financial clarity.

Revenue-Based Financing: Flexible Payments Explained

Revenue-based financing offers flexible repayment terms directly tied to the borrower's revenue, allowing payments to fluctuate based on monthly income rather than fixed amounts. Unlike installment loans with predetermined monthly payments, revenue-based financing adjusts repayment amounts, reducing financial strain during slower revenue periods. This structure benefits businesses with variable cash flow by aligning debt servicing with business performance, improving liquidity management and reducing default risk.

Predictability vs Flexibility: Choosing the Right Repayment Model

Installment loans offer predictable fixed payments over a set term, making budgeting and cash flow management easier for borrowers. Revenue-based financing provides flexibility by tying repayments to a percentage of monthly revenue, which can fluctuate with business performance. Choosing between these models depends on whether a business prioritizes consistent repayment amounts or adaptable payments aligned with its revenue cycle.

Impact on Business Growth: Installment vs Revenue-Based Repayment

Installment loans require fixed monthly payments regardless of business revenue, providing predictable cash flow but potentially straining growth during slower periods. Revenue-based financing adjusts repayments according to a percentage of monthly revenue, aligning payment obligations with business performance and supporting flexible growth. Businesses with fluctuating income may benefit more from revenue-based repayment as it reduces financial pressure and preserves capital for expansion.

Assessing Your Business’s Suitability for Each Repayment Structure

Assessing your business's suitability for installment loans versus revenue-based financing involves evaluating cash flow stability and repayment flexibility. Installment loans require fixed monthly payments, making them ideal for businesses with predictable revenues and steady cash flow. Revenue-based financing offers variable payments tied to sales performance, benefiting businesses with fluctuating income or seasonal sales cycles seeking adaptable repayment options.

Cost Comparison: Installment Loans vs Revenue-Based Financing

Installment loans feature fixed monthly payments and predetermined interest rates, making cost prediction straightforward but potentially costly if business revenue fluctuates. Revenue-based financing ties repayments directly to a percentage of monthly revenue, offering flexibility during low-income periods but often results in higher overall repayment amounts due to variable payment rates. Comparing total cost of capital, businesses with steady cash flow benefit more from installment loans, while those with unpredictable revenue streams may find revenue-based financing more manageable despite increased expense.

Managing Risk with Different Repayment Options

Installment loans provide fixed monthly payments over a set term, which helps borrowers predict cash flow but increases the risk of default during revenue shortfalls. Revenue-based financing adjusts repayments according to a percentage of monthly revenue, allowing flexibility and reducing strain during low-income periods but potentially extending the repayment duration. Choosing between these structures depends on a business's revenue consistency and risk tolerance, with revenue-based financing better suited for fluctuating income and installment loans favoring stable earnings.

Decision Factors: Selecting the Best Repayment Structure for Your Needs

Choosing between installment loans and revenue-based financing depends primarily on cash flow stability and repayment flexibility. Installment loans require fixed monthly payments over a set term, making them suitable for businesses with predictable income, while revenue-based financing adjusts payments based on a percentage of monthly revenue, offering flexibility for fluctuating earnings. Assessing your business's cash flow consistency, growth projections, and risk tolerance ensures the repayment structure aligns with financial capabilities and strategic goals.

Related Important Terms

Deferred Interest Installment

Deferred interest installment loans allow borrowers to postpone interest payments for a specified period, reducing initial cash flow burdens compared to revenue-based financing, where repayments fluctuate with revenue percentages. This repayment structure in installment loans offers predictable payment schedules and potentially lower overall costs if the loan is paid off before deferred interest accrues.

Step-Up Repayment Plan

A Step-Up Repayment Plan in installment loans allows borrowers to start with lower payments that gradually increase over time, aligning with anticipated income growth and easing early financial burdens. In contrast, revenue-based financing adjusts repayments directly with business revenue, offering flexibility but lacking the structured payment increases typical of step-up plans.

Revenue Waterfall Model

The Revenue Waterfall Model in revenue-based financing prioritizes repayment as a percentage of monthly revenue, aligning borrower payments with cash flow variability, whereas installment loans require fixed, scheduled payments regardless of revenue fluctuations. This dynamic allows businesses with irregular income to manage repayments more flexibly under revenue-based financing compared to the rigid amortization structure of installment loans.

Dynamic Amortization Schedule

Installment loans feature a fixed repayment schedule with predetermined principal and interest payments, while revenue-based financing employs a dynamic amortization schedule that adjusts payments based on the borrower's fluctuating revenue streams. This flexibility in revenue-based financing allows for variable payment amounts, reducing financial strain during lower income periods and accelerating repayment during higher revenue phases.

Gross Receipts Deduction

Gross receipts deduction in revenue-based financing links repayment amounts directly to a fixed percentage of a borrower's gross revenues, providing flexible payments aligned with business performance. In contrast, installment loans require fixed repayment amounts regardless of gross receipts, potentially straining cash flow during periods of lower revenue.

Income-Sensitive Installments

Income-sensitive installments in installment loans adjust repayment amounts based on a borrower's income, providing predictable payment schedules while reducing financial strain during low-income periods. Revenue-based financing ties repayments directly to business revenue, causing variable installments that align with cash flow fluctuations but may lead to less payment predictability.

Percentage-of-Sales Repayment

Percentage-of-sales repayment in revenue-based financing ties loan repayment directly to a fixed percentage of the borrower's gross revenue, providing flexible cash flow management compared to installment loans that require fixed monthly payments regardless of business performance. This structure allows businesses to align repayments with actual sales cycles, reducing the risk of default during lower revenue periods often associated with traditional installment loan obligations.

Hybrid Revenue Installment Loan

Hybrid Revenue Installment Loans combine fixed installment payments with revenue-based financing features, allowing repayments to adjust based on business cash flow while maintaining predictable minimum payment schedules. This repayment structure offers flexibility for borrowers by blending steady loan amortization with variable payments tied to revenue performance, reducing financial strain during slower periods.

Covenant Lite Financing

Covenant Lite Financing in installment loans typically involves fewer restrictions and financial covenants, offering borrowers more flexibility in repayment schedules compared to traditional loans. Revenue-Based Financing ties repayments directly to revenue performance, avoiding fixed installments but often includes tighter covenants to protect investors due to variable cash flow exposure.

Cash Flow Triggered Payment

Installment loans require fixed, regular payments regardless of business performance, while revenue-based financing aligns repayments directly with cash flow, adjusting payment amounts based on a percentage of monthly revenue. This cash flow-triggered payment structure offers flexibility by reducing financial strain during periods of lower income and accelerating repayment when revenue increases.

Installment Loan vs Revenue-Based Financing for repayment structure. Infographic

moneydiff.com

moneydiff.com